Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

My balance sheet is showing a small ($40) balance for Accounts Receivable for the cash basis report. It does not show a balance when run on accrual basis. I have no open invoices that would account for this.

I did a little digging and was able to figure out that this was due to two separate sales of an inventory item that was sold at "no charge" along with some other items for which there was a charge. To further complicate the problem, these two invoices are five years old. We used QB Desktop then converted to Online and then back to desktop and I think the problem occured when we switched from QB Online to QB Desktop Pro.

The Balance sheet from two years ago (before converting back to Desktop) has no AR balance, last year (after converting to Desktop) AR had a very small balance but was missed because of a customer who had an actual small credit pending. This year I would like to correct it, how is the best way to do this? Thanks

Let's get this fixed, Intune.

The Balance Sheet report on a cash basis shouldn't show Accounts Receivable balances. The reason is that the account tracks open invoices.

We have three steps to resolve your concern. The first is to identify the root cause transaction. It's a good thing you're able to dig deeper and saw the sales transactions. Next, we'll have to fix them manually. Lastly, we'll have to take some preventive changes to your procedures.

I'll share the article for the steps to guide you: Resolve AR and AP balances on the cash basis Balance Sheet.

You can get back to this thread if you need more help. We're just one comment away. Take care!

So I followed the steps in the linked article but I have some complicating circumstances. I had deleted the problematic transactions as described in step 5 at the end of the article. However I could not reenter them because the transactions were created when we were using QB Online and now we have converted to desktop and the sales tax set-up is different. QBD will not allow the memorized transaction to be saved because of this. I also checked the balance sheet record from when we made the switch from Online to Desktop over a year ago and we did not have an AR balance then so this has happened after the switch. Is there anything else that can be done?

Thanks for choosing QuickBooks Desktop as your accounting partner, @InTune.

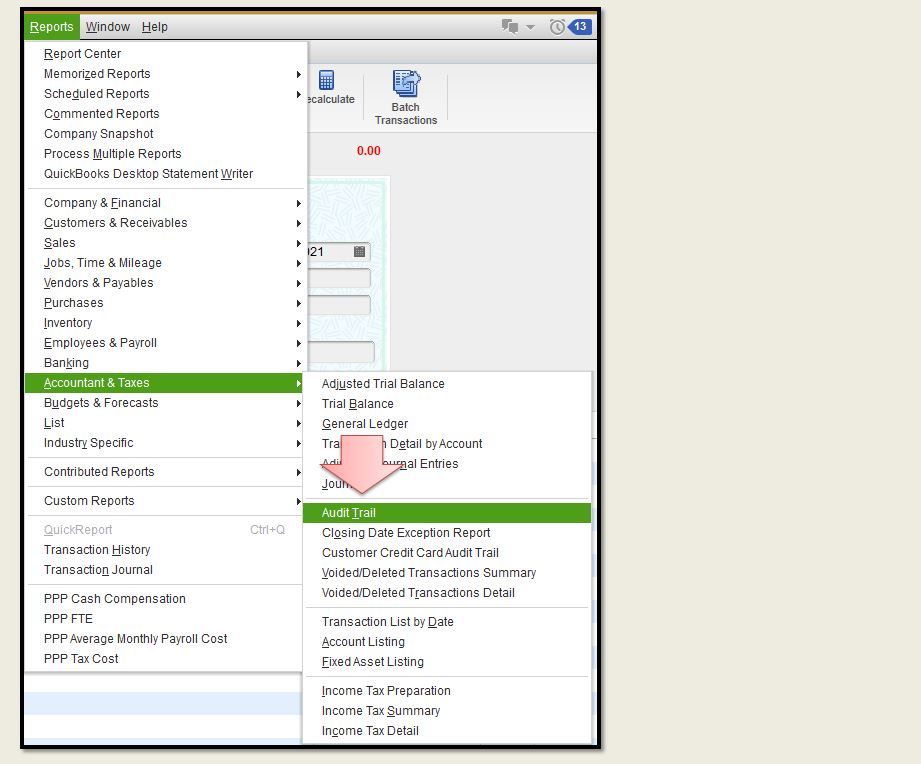

Also, I appreciate you providing details of your concern. This helps me to come up with steps to help you fix your issue. To start, let's run the Audit trail to get the details of the deleted transactions and manually reenter them. To do so, follow these easy steps:

For more info, refer to this article: Resolve AR and AP balances on the cash basis Balance Sheet.

Then, if you need to create new rates on sales tax so they will match the set up in QBO, please head to the Setup sales tax page for the detailed instructions.

Also, I encourage you to visit our QBDT Help page, so you can browse articles or even questions of other QuickBooks users that were answered by QuickBooks experts. This will help you earn more QuickBooks knowledge that can help you with your accounting tasks.

If you need further assistance about fixing your A/R balance in the Balance Sheet report, post a reply below. I'm always here to help. Have a good one.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here