Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI am so confused. I have setup my credit card as a feed to download transactions, which I reconcile monthly. However, all my payments are setup as a vendor. Should I have the payment name set as "other" so that it doesn't show as a vendor? I thought the point of setting up the credit card as a credit card feed to is to not have to enter bills and pay them. I tried to zero down the vendor account, and when I did, it increased the balance I am carrying to a super high amount (over what I have as a credit limit). How can I rectify this?

Solved! Go to Solution.

Thanks for following up this thread, @RBlazer.

A credit card account is a liability type by nature. Therefore, the CREDIT side will increase its balance and the DEBIT side will reduce its balance. When you pay your credit card company, that payment will post to the DEBIT side. This means you're reducing your credit card balance or the amount you owe to the credit card company.

When you receive credits or refunds from your vendor, these will show under the Payments columns. You can categorize them using the expense transaction you use for your purchases. Then, add the vendor's name who gave the credits.

If you pay your credit card charges in QuickBooks Desktop, you can pay them by writing a check. However, we recommend paying the credit card at the end of a reconcile.

Here's the detailed steps on how to pay credit card charges before reconciliation:

If you'd like to record your credit card payment after reconciliation, refer to this article to the Pay credit card charges after reconciliation: Set up, use, and pay credit card accounts.

Once done, you can match them with the downloaded transaction in the bank feeds.

Should you have any further questions about categorizing credit card transactions, I'm always here to help you.

Let me help you record the credit card payment, RBlazer.

You're right about setting it up as a vendor.

With regards to the payments, you'll have to write a check to cover the payment. Then, use the credit card account in the Account field, not an expense account.

You can also refer to this article for more information: Set up, use, and pay credit card accounts.

Feel free to get in touch with us if you have other concerns. We're right here to help you. Take care!

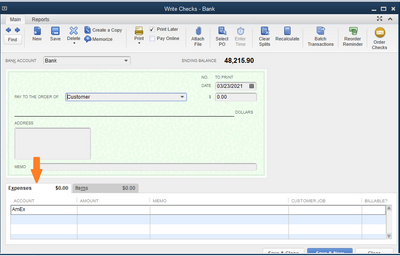

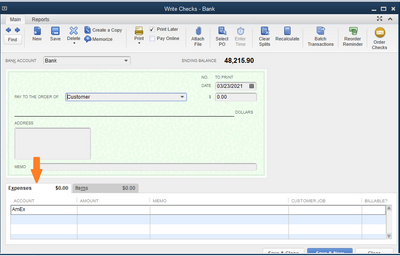

So this “check” that I’d need to write is just to clear out the vendor? All the payments were imported through the feed as a “credit card credit”. Should I go back and correct those “credit card credits” to the “checks” and then delete the credits after? And when you said I should enter the credit card as an account and not as an expense, do you mean under the “items” tab instead of the “expense” tab (see screenshot)? Lots of confusion here and thank you for the guidance.

Thanks for following up this thread, @RBlazer.

A credit card account is a liability type by nature. Therefore, the CREDIT side will increase its balance and the DEBIT side will reduce its balance. When you pay your credit card company, that payment will post to the DEBIT side. This means you're reducing your credit card balance or the amount you owe to the credit card company.

When you receive credits or refunds from your vendor, these will show under the Payments columns. You can categorize them using the expense transaction you use for your purchases. Then, add the vendor's name who gave the credits.

If you pay your credit card charges in QuickBooks Desktop, you can pay them by writing a check. However, we recommend paying the credit card at the end of a reconcile.

Here's the detailed steps on how to pay credit card charges before reconciliation:

If you'd like to record your credit card payment after reconciliation, refer to this article to the Pay credit card charges after reconciliation: Set up, use, and pay credit card accounts.

Once done, you can match them with the downloaded transaction in the bank feeds.

Should you have any further questions about categorizing credit card transactions, I'm always here to help you.

So this worked out. I was able delete all the payments listed as credits and "write" checks for payment. I had AP listed as the account and when I flipped it to the CC account (and removed the name), the outstanding vendor balance went to zero. Also, I figured out how to account for personal funds paying on the credit card as Owner Equity. I am a single-member LLC, so I know I can do this.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here