Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI am having a problem with accounting when it comes to Square and being able to zero out (maybe that is not the right term) my Undeposited Funds line in the register. I use the Sync with Square app and it works OK, all the funds go into Undeposited Funds, and once those sales are matched and the deposit is made to my bank account, they basically zero out (it shows them with a C or R depending on if I have reconciled or not). However, the cash sales made with Square do not do this, and as we make only one or two deposits a week, those deposits don't match 1:1 with the cash sales in the Undeposited Funds, so I'm showing a dollar amount there as unaccounted for that is actually totally accounted for.

I saw in another thread to delete these as they are probably duplicates (and they do seem to show in the checking register with the deposited Square funds ...), but I'm not sure that's the right move ... I'm fairly new to this and don't want to mess anything up, but also really need to figure this out ASAP as it's driving me a little nuts.

Any thoughts on how to solve this?

Hello Briana,

We can create a lump sum deposit (for your cash sales transactions) that matches the one that flows from your bank.

From there, you should be able to match deposit from your bank to the one that's in QuickBooks.

You can also provide additional details such as screenshots if you need further assistance with this.

Thank you, James.

If I do this, will it show additional funds in the account register for my bank account in Quickbooks (in this case checking). Because the cash has been actually deposited into my actual checking account, and the Quickbooks account register and the actual bank balance are matched up. So I don't want to do anything to disturb that.

For example, lets say that I made a bank deposit on Thursday for $100, and that deposit is made up of 50 cash sales of $2 each from the previous Thursday through Wednesday. The $100 is in my bank account (on Quickbooks and in real life), but is also still showing in Undeposited Funds. If I follow your steps, will I reconcile / zero out my Undeposited Funds account register without adding new funds to my Quickbooks Checking account register?

Thank you for the clarification.

Follow up: I took your advice, following the steps you laid forth, and it did not do at all what I need it to do.

To reiterate:

1. Sync with Square drops money into Undeposited Funds when it syncs each night (regardless of settings).

2. When the credit card sales are credited to my checking account, I am able to match them in bulk and they are accepted into my Account Register on the Checking account line

3. The problem is with cash sales. Cash is deposited physically in my bank account as lump deposits and those deposits recognized in my Account Register on the Checking Account line. However, each individual cash sale is still hanging out on the Undeposited Funds line of my Account Register.

If I follow your advice, step by step, the money is then deposited into the Checking line of my Account Register - causing a huge discrepancy, because that money is already in my bank account, and in the checking line of the Account Register.

Additionally, even though I balance my drawer every evening, and make deposits based on that, the amount Square is importing that's just hanging out in the Quickbooks purgatory of Undeposited Funds does not match the actual cash we deposited / balanced with the cash drawer.

Can you help me?

Obviously I don't want to put screen shots of my register on the internet.

Hi there, briana_tt.

Allow me to step in and guide you through process of handling downloaded transactions in QuickBooks Online (QBO).

If you're adding transactions from your bank into QBO, you'll want to undo your transactions first from the Banking tab before creating a deposit. This is to prevent any additional funds to reflect on your bank account in QuickBooks.

Here's how to Unmatch transactions:

This time, you can now create a deposit and match it with the transactions that you've previously undo from the For Review tab.

In case you need assistance in doing this, you can reach out to our QuickBooks Care Team. They'll be able to initiate a screen sharing and guide you through the whole process.

Here's how you can reach them:

Keep me posted on how things go and if you have additional questions about this. I'll be here for further assistance.

Thank you for your reply. That's not at all what I have clearly written I am trying to do.

The problem is the following:

1. SQUARE (my POS system) syncs with QuickBooks

2. ALL THE TRANSACTIONS from Square filter into the Undeposited Funds line on my Chart of Accounts.

3. When Square deposits the credit card payments to my (physical) bank and I match those transactions, I no longer need to worry about those credit card transactions within the Undeposited Funds line on my Chart of Accounts as intake of funds and subsequent deposit cancel each other out.

4. HOWEVER. The cash sales that sync into QuickBooks via the Sync with Square interface are just hanging out in the Undeposited Funds line DESPITE the fact that there have been physical deposits made to the (physical bank).

5. I don't want to create a deposit because that makes it appear on the Checking line of my Chart of Accounts like I am adding new money to the checking account, which I am not.

All I want to know is how to zero out the Undeposited Funds line on the Chart of Accounts without creating a redundant deposit.

I believe I have laid out the problem quite clearly and none of the answer address the problem. This is incredibly frustrating and disappointing.

Hi there, @briana_tt.

Thank you for the quick response. Allow me to help share some insights about recording the cash sales without making deposits.

You can manually change the Deposit to account in each cash payments to zero out the Undeposited Funds.

Here's how:

Additionally, you can change the default bank that is linked to the Sync with Square app so that the transactions will not flow to the Undeposited Funds.

Here's how:

I've added an article for additional reference:

As always, you can also reach out to our Customer Care agents if you need additional help. They have the tools that can help you get this fix quickly.

Here's how you can reach them:

That should do it.

Keep me posted how it goes. I'll be happy to help you further with clearing the Undeposited Funds account. Have a great weekend.

Hi MaryGrace. I'm sorry, but this does not help because it doesn't at all answer the problem I have posed.

The question is: How do I remove the cash sales (that have actually been deposited) from the Undeposited Funds line of my Accounts Register WITHOUT adding them to my QuickBooks Checking line in my Accounts Register?

If I follow the steps you have laid out - which I have just tried - then the $3 does indeed leave Undeposited Funds, but it MOVES it into my Checking Accounts Register, and this is a thing I have stated multiple times that I 100% DO NOT want to happen, as these funds are already in the Checking Accounts Register as part of that $200 deposit.

Following your steps creates a huge discrepancy in my Checking Accounts register and will throw off all my reconciliations.

Let me lay out my problem again using the following example:

I have received $3 in Cash from a customer, and recorded it in my Square POS.

Square and QB have synced and that money is appearing in Undeposited Funds.

I have gone to my bank and made a deposit in the amount of $200, which is comprised of multiple small sales that I have received and recognized through Square (which has synced with QB).

Thus the $3 is in my QB Checking Accounts Register (as part of that $200 cash deposit) and that has, additionally, been reconciled.

Yet that $3 still appears in Undeposited Funds.

(Additionally, the Sync With Square settings are already set to deposit to the correct bank account so I have no idea why they are appearing into Undeposited Funds.)

Greetings, briana_tt.

I'd like to add to this discussion and ensure your cash sales are recorded properly in QuickBooks.

Before we begin, I know you've already explained this multiple times, but I just want to confirm a few more things to make sure I provide you with the right solution. Just a heads up, I'll be using your example to make sure we're on the same page.

Based on what you've mentioned, I understand that the lump sum deposit ($200) is already in your QB account register. However, how was it added? Did your POS system (Square) record a deposit when it synced? Or, did you add it from the Banking page when it was downloaded to QuickBooks?

If it's the first scenario, then you could delete the cash sales in the Undeposited Funds account, since they're just duplicate transactions at this moment. However, if it's the latter, then I would recommend that we follow my colleague's Charies_M suggestion and undo the added deposit.

Although, instead of creating a deposit, I'd suggest that you match them to the lump sum deposit. Doing this will remove them from the Undeposited Funds account and put them in your Checking Accounts register. I've attached a screenshot below to show you how it would look like.

Keep me posted with the results on your end, I want to make sure you're taken care of. Thanks for again reaching out, I'll be standing by for your response.

Thank you for your reply, Aldrin.

To answer your question, Square put all the cash transactions into the Undeposited Funds upon Sync. The ones in the Checking line, the lump deposits (there is no way for Square to make a lump cash deposit), we added by me (and then reconciled when reconciling my monthly statement).

To make sure I understand your directions:

I should go back into my Checking Account Register and remove the bank deposits (even those that have been reconciled) from the Checking Account register.

Then I should go into Banking (where these bank deposits will now be hanging out) and I should match them with the cash sales that are currently in Undeposited Funds and if I do that the Undeposited Funds will balance out (as long as everything matches properly).

Moving forward, I will not ADD cash deposits, but I will instead MATCH them, and I should not have this problem in the future.

Is that correct? Thank you!

Hi there, @briana_tt.

Allow me to chime in the conversation and answer your question in behalf of my colleague @AldrinS.

Yes, you're on the right track. Since you added the deposits from the Banking page, you'll just have to remove the deposits on your checking account and match the sales on the Undeposited funds.

As always, you can contact us whenever you need help in going through the steps of matching your transaction in QuickBooks.

Here's how you can get their contact information:

Should you have any questions about matching your transactions, don't hesitate to post them below. Have a good one.

Hi Briana,

I am having the exact same issue now, and have hundreds of transactions sitting in undeposited funds that should not be. I think this is 100% the exact same issue you were exploring. Did you ever resolve? If so could we touch base. That would be so greatly appreciated. THANK YOU!

Thanks for joining this conversation, @LaChelleH.

Just to verify, did you also add the transaction from the Banking page when it was downloaded to QuickBooks? If so, I highly suggest following the steps provided by my colleague @Charies_M to undo the added deposit. Here's how:

1. From the left menu, select Banking.

2. On the Banking page, select the In QuickBooks tab. Make sure the correct bank or credit card account is selected.

3. Locate and check the downloaded transaction to unmatch on the Reviewed tab.

4. Click Undo under the Action column or at the top.

Then, Match them instead of creating a deposit. This will remove them from the Undeposited Funds account and put them in your Checking Accounts register moving forward.

For additional information, check out these articles:

That should point you in the right direction. Please let me know how everything goes or if I can be of additional assistance. I'll be here to help. Take care and have a good one.

I know that this is an old thread, but what I've been doing is on Deposit to my checking account, I mark it as a transfer from Undeposited Funds. That draws down the Undeposited Funds with the money you Deposited. That works to the account balance, but it DOES NOT clear out the transactions like Square does for your Credit Card transactions automatically.

I haven't found any way to actually take the Transfer and match it to specific Square transactions. As a consequence, there are thousands of transactions which are never going to be matched, though the account balance will decrease.

Hello there, MrTizzy.

The transactions from Sync with Square App are automatically deposited to the Undeposited Funds account. Then, from your Undeposited Funds account, you'll have to deposit them to your checking account.

Also, the possible reason why there are transactions that are not matched in the Sync with Square app is that there could be a square fee added in it.

When depositing from Undeposited Funds to your checking account, please make sure to add a line item which is the square fee. Also, please make sure to make this amount as negative. This way, the real amount of the transactions will be matched with the Square transactions.

You can also see this article in case you have further questions with sync with square app.

The Community team is always here to help if you need anything else. Have a good one!

Hello!

Thank you for trying to assist me. Unfortunately when I follow your steps, the transactions that are sitting in my undeposited funds account do not come up which is very odd because they automatically come in from the banking page (I don't know how else they got there).

At the moment my checking account balance is correct, which means all transactions are recorded CORRECTLY, but I have a huge balance in my undeposited funds account on the balance sheet, which doesn't actually exist. So I need to get rid of those as soon as possible. They are all from square credit card payments. When I attempt to delete them it gives me this warming "Something's not quite right. This transaction has been deposited. If you want to change or delete it, you must edit the deposit it appears on and remove it first." In other words, the funds are clearly in my checking account already if the balance is reconciling, so they don't need to be redeposited they just need to be removed from the "undeposited funds".

Thanks for getting back to us in the Community, @LaChelleH.

Since your checking account is already correct, I highly suggest contacting our Phone Support team so they can investigate why the undeposited funds account still has a balance. They have tools such as screen-sharing (remote access) that can pull up and check your account in a secure environment.

Here's how to reach them:

1. Click the Help (question mark) icon at the top.

2. Select Contact Us at the bottom to connect with our support.

You can always check out the article provided by my colleague above for future reference.

Please let me know how the call goes by leaving a comment below. I want to make sure this is taken care of for you. I'll be here should you need anything else.

I have the exact same issue. We own a café that does many transactions every day, and deposits the cash at the bank each night. I probably have thousands of undeposited items made up from a square invoice and a square payment. It overstated the income and throws off the profit and loss statement. To match literally dozens of transactions (every sale at the cash register) to every cash deposit is going to be like doing a bank reconciliation every day. I read somewhere a few weeks ago that this was a known issue and there was a beta patch that grouped those transactions into one single cash deposit. I can’t seem to find it now, and don’t remember if it was on the Square side or the QuickBooks side.

Thanks for joining this thread, @CurtF.

The posting account of your Square transactions depends on the setting up preference and process. So we can conduct further investigation and update your settings, please reach out to our support team.

They have the necessary tools to help process your request and correct the posting account of your transactions.

Check out this link to get their contact details: Contact the QuickBooks Online Customer Support team.

Keep me posted on how it goes or if there's anything else you need. I'm still here to offer more help. Have a wonderful weekend!

I can picture-out and explain what happened in your case, Zowie.

When you created your sales transactions or receiving payments, they were initially deposited to the Undeposited Funds account.

Without knowing these transactions exist, you might have created separate bank deposits without associating the said income transactions. Then, you matched it to the downloaded ones. Hence, we have pending transactions under the Undeposited Funds accounts.

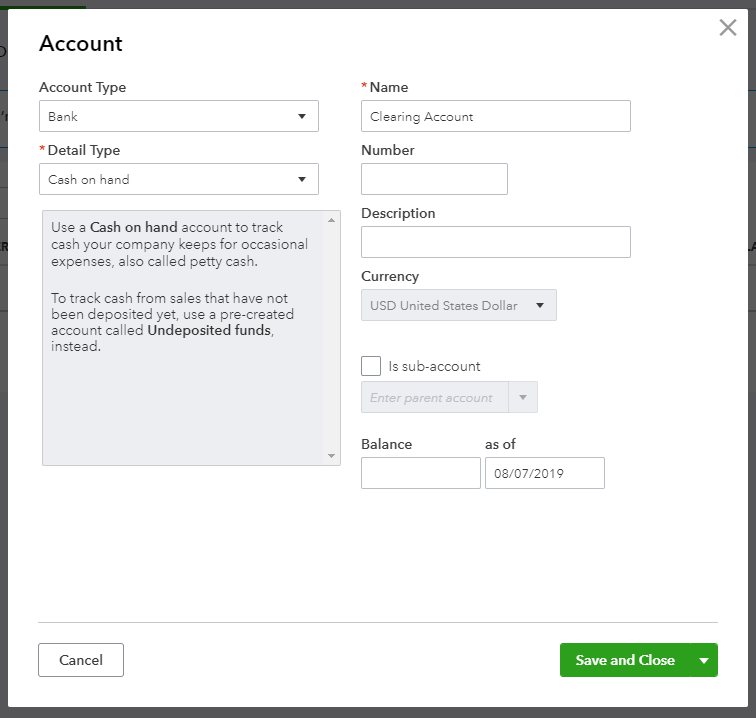

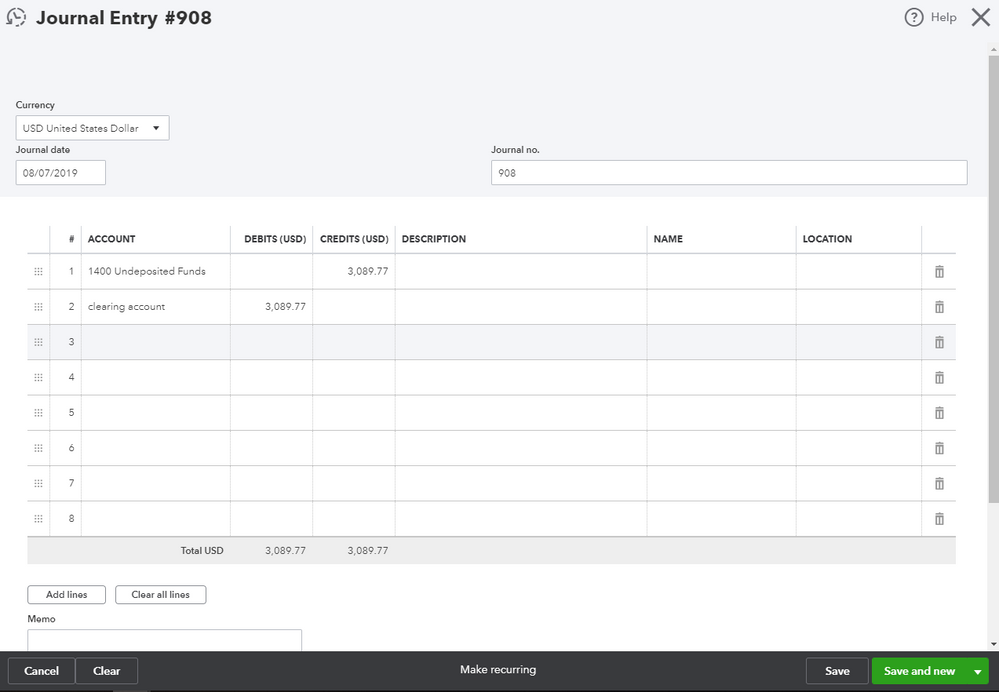

I can only think of a way to clear the Undeposited Funds account. We can create a clearing account and a journal entry to do this. However, it would require the approval of your accountant to avoid future issues.

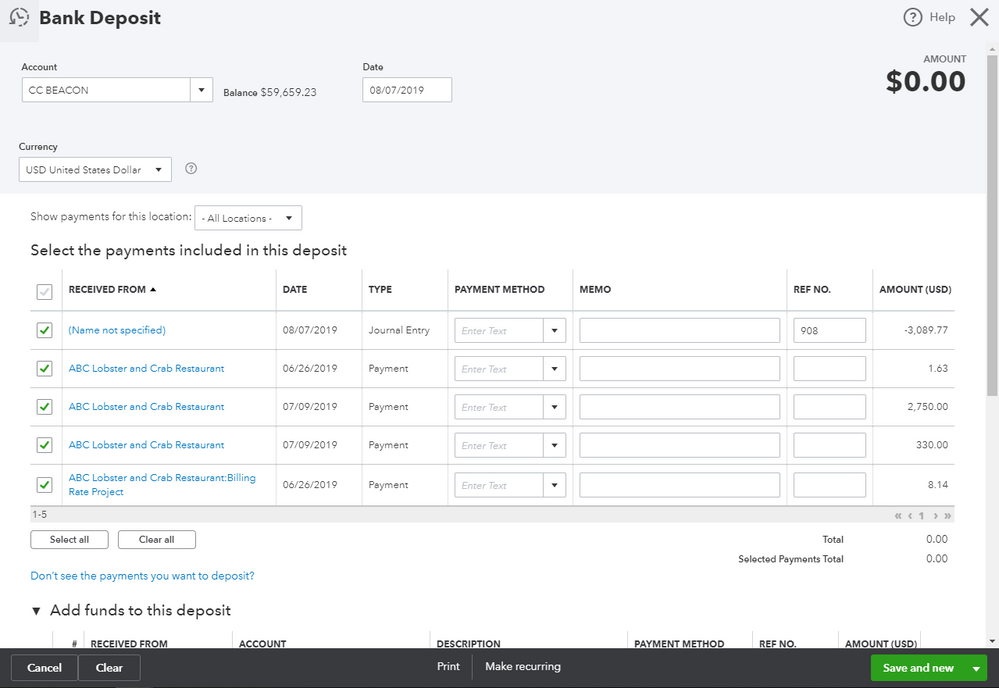

Once your accountant agrees with this process, here's how to clear the Undeposited Funds account:

Set Up a clearing account

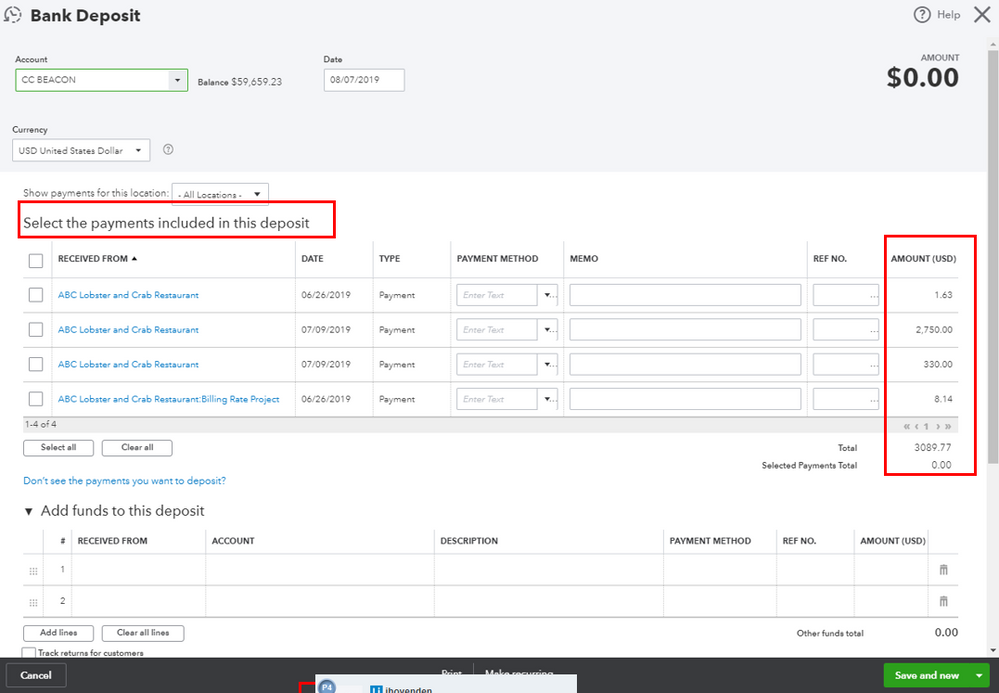

Get the total amount in the Undeposited Funds account

Create a journal entry

Create a bank deposit

Here's a few tips to avoid this problem in the future:

Though this is quite a long process, keep in mind that I'm here if you need more help.

Thanks for this process James. I think there may be a couple additional things at play here:

Thanks for the detailed information, MrTizzy.

To start, the steps provided by my colleague above should help clear the balance in your Undeposited Funds account. However, I suggest consulting your accountant for further assistance when creating a journal entry.

Regarding your suspicion that this was a reporting bug in Square integration, I checked if there's an ongoing issue about this, but there isn't currently one. To verify this matter, I highly recommend contacting our Phone Support team, so they can check your account using their screen-sharing (remote access) tool in a secure environment. They can also open an investigation to send to our Product Engineers, and take a look at this and fix it for you.

Here's how to reach them:

I want to make sure everything is taken care of for you, so please let me know if you have other issues in the comment below. I'll be here to help.

Is there a way to match the small cash sales to the lump deposit with like a batch action? I have thousands of dollars of unmatched small cash transactions and dread having to manually select each one to match a lump deposit.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here