Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I will start with, we bill opposite way most companies do. We bill in advance for our time. One month prior to the services being rendered. That being said built into some of those invoices are regular monthly "add-on" expenses that pass through to our clients in addition to their "retainer" service hours. That goes out a month a head. Then in the month we get the bill for that item, I mark it as billable, because it is and has been billed. but is there then an easy way to mark that billable expense on the invoice after the fact as "billed"? We are accumulating "billable" expenses that aren't clearing out. Is there a journal I can do? Also, we have a similar problem with time. We want to import the time logs from teamwork so we can start to see project profitability in real-time. But I because we bill for that time in advance there seems to be no way to clear it out later. Any suggestions are greatly appreciated. SIDE NOTE for Quickbooks online: It would be awesome if Quickbooks would create some sort of reconciliation feature for time and billable expenses that would help to easily clear out these items. If I could check off which prior billed expense they are tied to it would clear out easily.

Hi mharan,

You'll want to uncheck the Billable box on your timesheet so it won't open every time you create an invoice.

Here's how:

Whereas for the time and billable expenses reconciliation feature, I'll make sure to pass this along to our product team to let them know of your business needs.

In case you want to know the reports available in QuickBooks Online (QBO), please check this article: Run Reports in QuickBooks Online.

yes, I understand that I could choose non-billable. But it is in-fact a billable item that was billed prior to. I need to link it to the invoice that I previously sent, or clear it out some how. All while it remaining billable. Your solution would not solve the problem and would not allow us to see the cost accounting.

Hi mharan!

I'd like to step in and clarify the workflow of the billable expenses in QuickBooks in relation to your scenario. I can tell that you really have a unique way because you invoice first before accumulating billable expenses.

We're unable to do this reverse process in QuickBooks. What we normally do when we receive an advanced payment is we deposit the amount to a business account and track it in a liability account. When it's time to invoice the customer, we take that amount as payment to the invoices. We don't record advanced invoicing since there isn't sale happening yet.

In your case, the only way to clear the billable expenses is to recreate your invoices. However, I would highly suggest consulting an accountant so they can give you the best advice for this setup. But technically, that's what we can do to link the uncleared billables to the invoices. You can do the same thing for your time logs.

As for having an option to reconcile time entries and billable expenses against invoices or sales transactions, I think this would be uneccessary if we do the usual process. However, I will also bring up this idea to our product engineers and share with them how transactions flow in your business. That way, they can consider creating options for business that operates like yours.

Lastly, feel free to check out our blogs to stay current with the latest updates in QuickBooks.

If you have other questions, please don't hesitate to comment below.

I am also needing to do this option as well. I have outstanding Purchase Orders (billable) that I have already invoiced to the customer. The vendors have already been paid as well. I am needing to attach the correct PO to the invoice that has already billed to clear the billable list up. Is there a way to do this?

I am also needing to clear out billable Purchase Orders that were created after invoiced. Is there a way to attach PO's to billed invoices?

Thanks for sharing your input, @SN07.

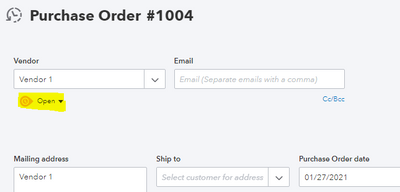

The only way to clear out these open purchase orders (PO) you've created after being invoiced to customers is to change the status to Closed.

Here's how:

You can also attach a screenshot of the PO to the customer's invoice. Refer to this article for more info: Attachments in QuickBooks Online.

Moving forward, I'd suggest creating the purchase order first before you enter a bill and invoicing it to the customer. Creating a purchase is always the first step in a business transaction. Check out this link for more info: Add purchase orders to expenses, bills, or checks in QuickBooks Online.

Feel free to visit again if you have more suggestions or concerns. We're always here to help. Have a great day.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here