Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hello, svirani.

I hope you're doing a fine day today. I'll help you continue and handle the bill for the travel expenses.

Since you've already transferred the loan amount, then there's no need to use a vendor credit. You'll want to directly pay the bill for the travel expenses in Company A.

First delete the vendor credit:

Next, mark the bill as paid:

When you're ready to repay the loan, you can follow Step 3 in this article: Set up a loan in QuickBooks Online.

Need help managing your company financials? Our articles can point you in the right direction. They have guides and detailed information when handling customers, vendors, expenses, income, reports, etc.. Give them a shot here.

I'll lend a hand again if you have more questions for QuickBooks Online. Just reply here and I'll lay down the details and steps for you.

Hi James

Thankyou for your reply. I have ongoing certain transactions which are always paid by company B as loan to our company A. We dont transfer the loan amt right away. And we would like to see in Company A all of our expenses even if its not paid to the vendor directly. here in this example 5k was back from June as travel expense but paid now in oct so for june, july, august and sep financials will have that amt under loan as due to company B and we want to see it that way. To be more accurate we did a transfer in oct for multiple loans towards Company B together for instance 50k and remember all of these expense for 50 k is been recorded as bill with whatever kind of expense it is(Travel, repairs etc;) in company A and on the same time all bills will equally have vendor credit transaction for each of those bills Company A (when i enter vendor credit i pick account type as Due to Company B), So when we did transfer of 50 k towards diff bills, how can i record this entry. Do i need to do pay bill and select all the bills that totals up to 50k and mark them as paid. or no need to clear those bills as paid and just concentrate on ur loan amt getting reduced with the transfer amount? Currently i just added a bank transfer transaction of 50k towards acct type due to Company B and results are correct my only concerned is the bills that i entered is not marked as paid

Due to Company B is setup as a loan account

Thanks for adding more details about your concern, Angel Virani.

Based on the information provided, we’ll have to create a journal entry. Then, write a check for the expenses and deposit the payments. Since there were transactions recorded, I suggest voiding/deleting them before performing the resolution steps. This is to help start on a clean slate.

I suggest consulting with an accountant to avoid throwing off your records. Also, verify with them the category type to use for the debit and credit. When you’re ready, here's an article that will walk you through the step by step process: Void or delete transactions in QuickBooks Online.

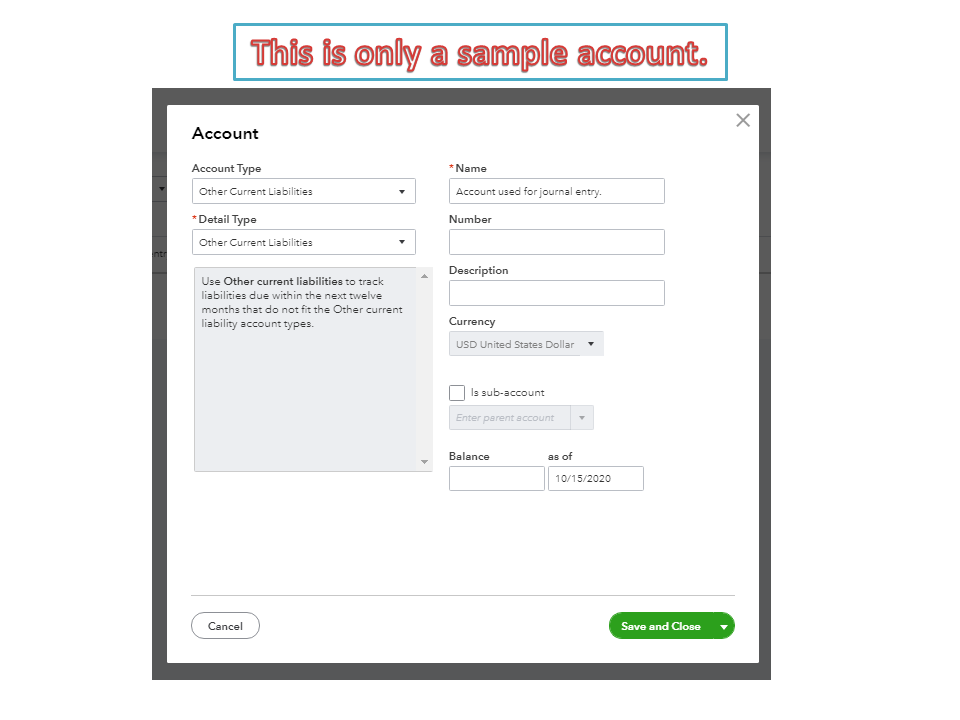

Next, add the expense and liability accounts in your company. I’m here to guide you through the steps.

Follow the same procedure to add the expense account. For more insights into this process, see the following guide: Add an account to your chart of accounts in QuickBooks Online.

Then, create a journal entry each time there’s an expense paid by company B. Use the liability account in the Credits column and expense for the Debits side.

When company A pays company B, you can either write a check or expense (liability account) to track the entry. For the payment received (company B), enter a deposit to the Equity account.

You'll have to create an expense or check to the Equity account every time business B pays expenses to business A. By the time the latter makes a payment, deposit it back to the Equity account. This process will keep your records in tiptop shape.

For additional resources, here's a link that provides a breakdown of articles to easily manage expenses and vendor transactions: Self-help guide.

Reach out to me if you have any clarifications or other concerns. I’m here to help. Have a good one.

Hi Rasa-Lila

Thankyou for your reply. I will definitely follow the journal entry concept going forward but i have transactions from last 3 months recorded differently as bill and vendor credit for different type of expenses all together. Company A wants to see all their expenses in financials with loan balances taken from other company, bills payables, vendor expense etc;

Briefly let me mention multiple expense of company A paid by company B as loan but Company A never paid them right away. for example lets consider one transaction for travel expense of 500 paid by company B as loan to company A, steps followed below

+ new bill - Entered bill with account type as travel expense for 500

+ vendor credit- Entered a vendor credit with account type as due to Company B(current liability as loan acct) for 500

P&L look perfect with travel expense amount 500

Balance sheet looks perfect with other current liability -due to Company B as 500

few month later company A transfer 500 to Company B (bank transfer) to record this i entered a transfer in bank register with account type as due to company B for 500

Balance sheet reflected due to company B as zero, which was perfect

Concern was how to clear a bill (500)or mark as paid?

Finally i followed below to take care of that

+ pay bill

selected the bill for 500 and under vendor credit tab added 500 and payment was zero

uncheck print later and instead added a reference as bank transfer and payment date and still have bank account selected

click save

the bill was now clear or marked as paid without actually paying anything from bank account

Please let me know what would be pros and cons in terms of expert advise for this solution.

Thanks in advance!

Hi Rasa-Lila

Thankyou for your reply. I will definitely follow the journal entry concept going forward but i have transactions from last 3 months recorded differently as bill and vendor credit for different type of expenses all together. Company A wants to see all their expenses in financials with loan balances taken from other company, bills payables, vendor expense etc;

Briefly let me mention multiple expense of company A paid by company B as loan but Company A never paid them right away. for example lets consider one transaction for travel expense of 500 paid by company B as loan to company A, steps followed below

+ new bill - Entered bill with account type as travel expense for 500

+ vendor credit- Entered a vendor credit with account type as due to Company B(current liability as loan acct) for 500

P&L look perfect with travel expense amount 500

Balance sheet looks perfect with other current liability -due to Company B as 500

few month later company A transfer 500 to Company B (bank transfer) to record this i entered a transfer in bank register with account type as due to company B for 500

Balance sheet reflected due to company B as zero, which was perfect

Concern was how to clear a bill (500)or mark as paid?

Finally i followed below to take care of that

+ pay bill

selected the bill for 500 and under vendor credit tab added 500 and payment was zero

uncheck print later and instead added a reference as bank transfer and payment date and still have bank account selected

click save

the bill was now clear or marked as paid without actually paying anything from bank account

Please let me know what would be pros and cons in terms of expert advise for this solution.

Thanks in advance!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here