Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowDear QB community,

I fixed ( changed , deleted ) multiple reconciliation from bank register ! the beginning balance of the last month has changed because of the discrepancy report ! how can i get back to the correct beginning balance ! is there any way to avoid this report . I use online Quickbook. thank you for your help

Hello there, @amanihaddad.

Let me share some information so you'd be able rectify the incorrect beginning balance in your account.

The incorrect beginning balance of your previously-reconciled accounts depends on the total amount of all reconciled transactions, regardless of its date. You can review your bank's beginning balance last month and make sure that it matches your bank statement:

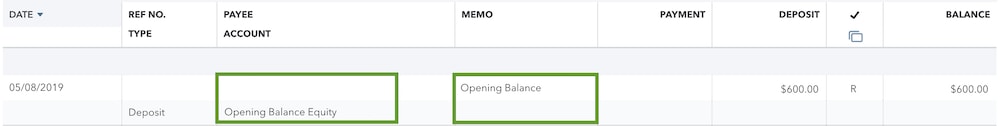

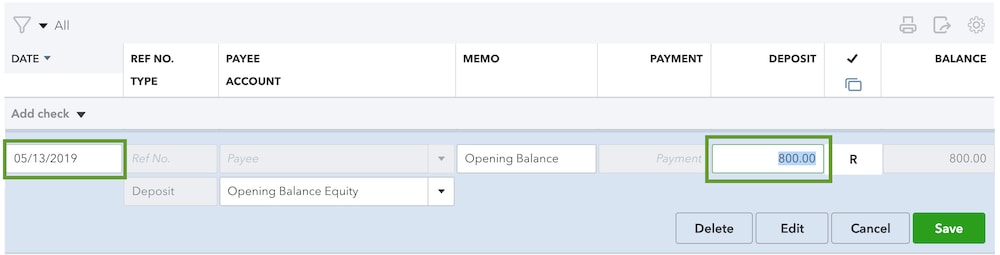

If the opening balance in QuickBooks doesn't match your bank records, you can update it.

You can undo initially reconciliation then, reconcile it again. However, if the balances match, you entered the opening balance correctly. You can proceed to Step 3 in this article: Fix issues the first time you reconcile an account in QuickBooks Online.

Also, you can browse this article to learn more about how you can manually undo your reconciled transaction: Undo and remove transactions from reconciliations in QuickBooks Online.

Lastly, I'd recommend consulting with an accountant so you'd be guided when reconciling your account.

Always feel free to leave a comment below if you have other concerns or questions. I am always here ready to help.

Thank you for the quick response.

I am reconciling December 31. the ending balance and cleared balance match . the payment, deposits ,and beginning balance are correct. all transactions reconciled. but , I still have difference. I checked all transactions in register . there is nothing missing or uncleared / unchecked ! Is it okay if I click on finish now and ignore this difference.

Thank you ,

I appreciate adding more details about the issue, amanihaddad.

Let’s perform another step to find the discrepancy. This way, you can finish your reconciling the account.

Before you continue with the reconciliation process, open any Discrepancy Report. This can help decide if and how to make changes to the account.

For detailed instructions, perform Step 4 in the following article: Fix issues for accounts you've reconciled in the past in QuickBooks Online.

Also, you can run a Reconciliation Report to view previous reconciliations. From there, you’ll see if everything has balanced out and check what transactions were recorded.

Once you’re able to find the difference, you can start reconciling the account. For additional resources, these articles contain solutions on how to resolve reconciliation discrepancies.

Please let me know if I can be of further assistance. I’ll be glad to lend a helping hand. Have a good one.

Thank you very much for the videos and detailed information.

finally, there is no discrepancy report. However, I still have a difference , it is a small amount. the cleared balance and statement ending balance match. the payments and beginning balance are correct. I reviewed all transactions . all is reconciled.

My problem was just solved. Thank you & please have a great day.

Hi:

My bank balance has been incorrect since December 2019. I never knew why and when I contact QB, they couldn't figure it out either. I finally found a journal entry from 12/27/2019. The account says Reconciliation Discrepancies-1. The amount is $565,298.05. If I delete the journal entry, my balance is correct.

I don't remember creating this journal entry. Is it possible that it was auto-generated? If so, why?

Let's resolve the bank balance discrepancy, @Hollyg123.

One of your account's users may have created this journal entry. If you don't have this amount from your bank statement, then you can delete it.

Here's how:

You can refer to this article for more information about reversing a journal entry or deleting it entirely: Reverse or delete a journal entry in QuickBooks Online.

Here’s more information on how to enter an opening balance after you already created an account: What to do if you didn't enter an opening balance in QuickBooks Online.

I'm always here if you need further help with your bank balance and or anything else by leaving a reply below. Keep safe and have a great rest of the day!

Thank you. This is helpful. Is there a way to see who made the journal entry? (I had a couple of short-term bookkeepers "helping")

I'm happy to know that the solution shared by my peer above helped you, @Hollyg123.

Yes, I'd be glad to assist you in checking which user made the journal entry. To do so, you can run the Audit Log report to view all the activities created in QuickBooks. Here's how:

I'm adding this article for more guidance: Use the audit log in QuickBooks Online.

As always, you can visit our QuickBooks Community help website if you need tips and related articles in the future.

The Community forum is always open to help you again if you have any other questions about QuickBooks. Wishing you all the best, @Hollyg123.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here