Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hi there, customerservice9.

Welcome to the Online Community. I can provide some information about tracking per diem in QBO.

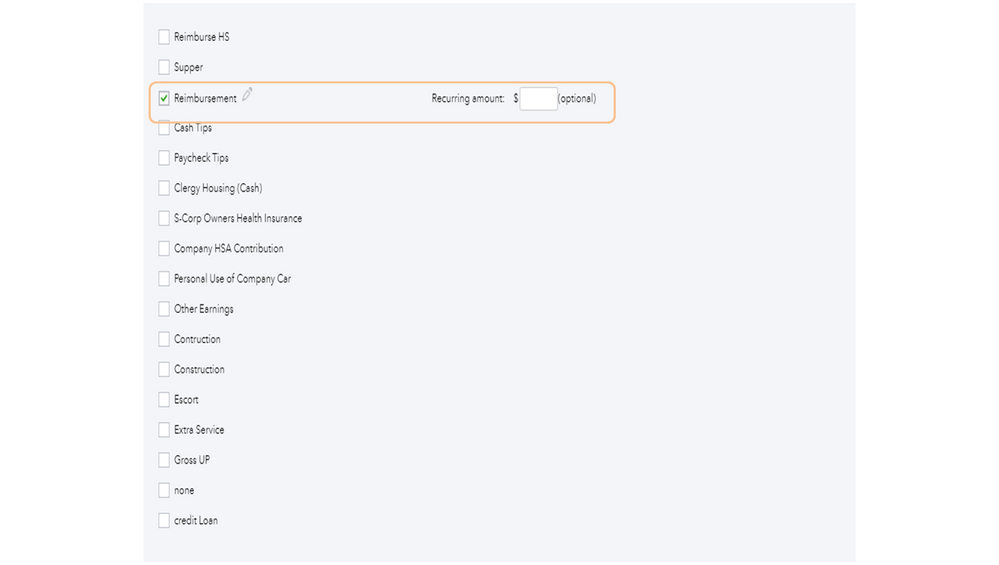

When using a timesheet, you can only track the service worked on a (customer/job). To record the per diem, let’s create a payroll item and then add the amount to the paycheck.

The Reimbursement field will show in the Enter Employee Pay Details page. From there, type in the correct amount.

For more information, check out the Reimburse an employee article. It provides detailed information about recording non-taxable payments as well as steps to record it in QBO.

If there’s anything else I can help you with, post a comment below. I’ll be right here to assist further. Have a great rest of the day.

Per Diem for Labor or Travel?

What about taking that per diem expense form the payroll and assigning to a customer/project so that it is included in the costs when running a P and L for a certain job?

..

Is this typing in a fixed dollar amount for each employee each timesheet period? No source or calculations?

Sorry I am trying to reply to the post above but it is not letting me.

Hi Cheryl - To me or someone above?

Did you ever get an answer here? I'm having the same issue. I can pay per-diem on the paycheck but I want to link it to a project. We have T&M projects so I need the per-diem to show in the project as billable.

Great to see you here, @emcoy1985.

I'm to share some information about linking per-diem into projects in QuickBooks Online (QBO).

Tying up the per diem into projects is unavailable in QBO. However, we can create a service item for the per diem and post it as a payroll expense.

Once done, enter the timesheet and tag the project, then select the per diem service item and the rate, and also check the billable box. Please see the screenshot below for visual preferences.

Furthermore, I'm attaching this article that can guide you in filing your taxes seamlessly: Pay and file payroll taxes and forms in Online Payroll.

Additionally, you can run payroll reports to view useful information about your business and employees.

In case you have additional questions about setting up per diem, please let us know by getting back to this thread. We're always here to help. Take care!

@emcoy1985 Seems there is some confusion here between Per Diem Labor vs. Per Diem Travel Reimbursement and this may be based on the industry. You mention T&M contracts. Are these Govt contracts?

Construction jobs. Per-diem for travel to out of state jobs. I must see the per-diem expense in the job/project. Some are government and some are not.

I have the field set up in payroll and can pay the employees. But after that, how do I think that payment (that is also included on their timesheet) into the Project?

Per diem for travel.

I create a paycheck. One of the fields is per-diem. How do I link the per-diem travel expense that is paid through payroll, to the actual project to show as an expense for the Project?

Unfortunately this did not work for me. It calculated it as hours worked and added an hour (because I put 1) to my employee's payroll time.

Hello, @CBergie.

Before we get some solutions to the issue, may I know how to set up or record the per diem? May I also know what are the process you've done so far? This will help me locate the main issue and provide accurate solutions to your concern.

Any further details will be much appreciated. I'll be waiting for your response.

We are a small company, but pay our employees per diem. It would be nice when you enter time, that there would be a place where you could enter daily per diem so that it is attached to the "job" or "sub-company." I tried one of the options above, trying to enter it into the timesheet, but for per diem it adds actual time to the employee's pay. For example if I enter per diem and put a 1 under the date, it will add 1 hour to the employee's time. I simply want the option to enter per diem somewhere and it show up not only on the employee's paycheck, but on the invoice for the company

Thanks for getting back into this forum, CBergie. Let me share insights when tracking per diem in QuickBooks Online.

When entering per diem using a timesheet, you can only track the service hours spent on a customer/job. To best pay your employees per diem, you can add them to their payroll. This way, you'll be able to keep track of your payroll taxes. To do this:

Once done, the pay type created will show on the Enter Employee Pay Details page. From there, type in the correct amount. Then, if you've already run their payroll, you can generate an unscheduled payroll to pay your employee per diem.

You can also read this resource that provides detailed information about recording non-taxable payments in QBO: Reimburse an employee.

Moreover, you can run payroll reports to get a closer look at your business finances.

If you have additional queries or other QuickBooks concerns, please don't hesitate to leave a reply below. We'll always be around, willing to help you further.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here