Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI just created a new company in Quickbooks Destop.

I entered my opening balance for my CC and it shows as negative equity??? Is this correct???

Thank you!

Let me provide some information about opening balance, @Charries.

A Negative equity in Credit Card account can be caused by an incorrect opening balance or transactions that are older than the opening balance. When you create a new account in QuickBooks, you pick a day to start tracking transactions. Then, you enter the balance of your real-life bank account for whatever day you choose. This amount and the start date set the account's opening balance.

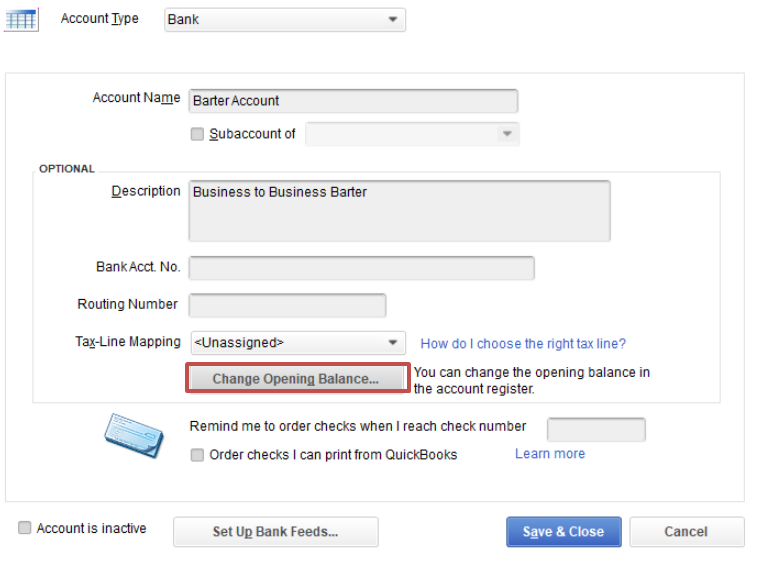

To fix this, let's start by reviewing and updating the opening balance entry in the Chart of Accounts.

I've also added this article to learn more about opening balances: Enter opening balances for accounts in QuickBooks Desktop.

For future reference, you may consider checking out this article: Reconcile an account. This helps match your bank and credit card statements in QuickBooks.

If I can be of any additional assistance, please don't hesitate to let me know. I'll get back to you as soon as possible. Stay safe.

@Charries I believe what you are talking about is the negative balance in your Equity account (most likely Opening Balance Equity with a new file) that offsets the positive credit card balance. A balance sheet must always "balance". The top half (Assets) is everything your business "owns". The bottom half (Liabilities and Equity) is everything your business "owes". Equity is the owners' "value" in the business - the difference between what you own and what you owe. When you enter a credit card balance, you owe the money, so it will reduce the owners' value, therefore creating negative equity. Does that help?

I wonder why it's recorded as Opening Balance Equity for a Credit card when you first attach it to Quickbooks. That seems strange to me as far as the Balance sheet goes as CC's are a liability. Curious.

@Mary4booksbybrooks The bank only downloads a certain number of transactions (or transactions for a certain number of months) when you first attach it to QB. So the starting balance, for which it is not sending in transactions, goes to Opening Balance Equity. This is a clearing account. You will need to reclass it to wherever it belongs. For example, the bank gives me detailed transactions for 03/01-05/31, but my balance on 02/28 was $500. The offset for that $500 balance will show up in OBE. If I have already recorded the transactions manually for 01/01-02/28, then I would delete that OBE entry because I don't need it. But if I had not done so, I would need to find the transactions (and the opening balance at 12/31 of the prior year) and record those transactions, INSTEAD of the OBE entry. The opening balance at the end of the prior year correctly belongs in Retained Earnings or Owner's Capital because those expenses (theoretically) had already been recorded in the prior tax year. Hope that helps.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here