Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowIf my work truck is in the shop and I rent a vehicle to perform my work, how do I categorize that expense? If I put it under travel, doesn’t that presume that I need to be a certain distance away from my tax home to qualify? The vehicle repair occurred local to my tax home and so did the necessary rental expense. Please advise.

Solved! Go to Solution.

You can create in the chart of accounts an expense account named vehicle rental and use that

or

since the rental was associated with the truck repair, use vehicle repair expense

You can create in the chart of accounts an expense account named vehicle rental and use that

or

since the rental was associated with the truck repair, use vehicle repair expense

Where can I find this chart of accounts?

Hello Cat1112,

Thank you for joining the conversation. I'd like to share insights about creating an account.

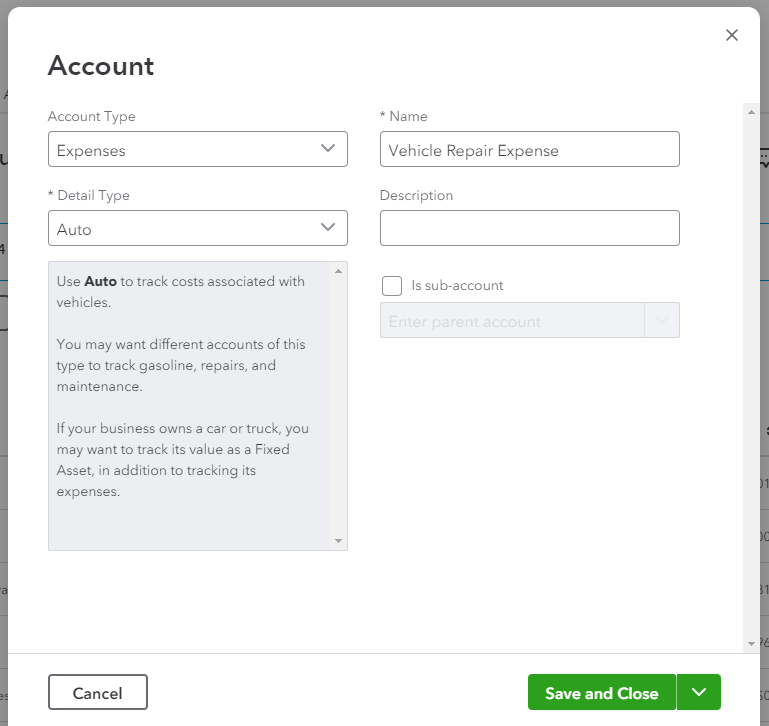

While we don't have a vehicle repair expense Detail Type in the Chart of Accounts, you may want to use a different one that is closed to it. For example, you can use the Auto detail type under the Expense account type. Then, just name the account as Vehicle Repair Expense.

To ensure you have the appropriate setup for your specific needs, it's always advisable to consult with an accountant. They can provide expert guidance and help you make the right decisions for your account setup. I'm also adding this article for additional reference: Learn about the chart of accounts in QuickBooks Online.

You can always go back to this thread if you have other questions about creating an account for your vehicle repairs. I'll be happy to lend a hand.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here