Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

CYBER MONDAY SALE 70% OFF QuickBooks for 3 months* Ends 12/5

Buy nowI am using QBO.

My client has 3 PayPal foreign bank accounts listed in the Chart of Accounts (PP AUD, PP EUR, PP GBP). The Quickbooks balance on the chart of accounts screen shows 0.00 for each account.

The Balance Sheet shows small amounts for each account. The transactions in those balances stem from 2017. I need to zero out all 3 accounts but am unsure as to how to do it. Thanks for your help!

Solved! Go to Solution.

Let's get these balances zeroed out so you can get back to working order, @maryg2.

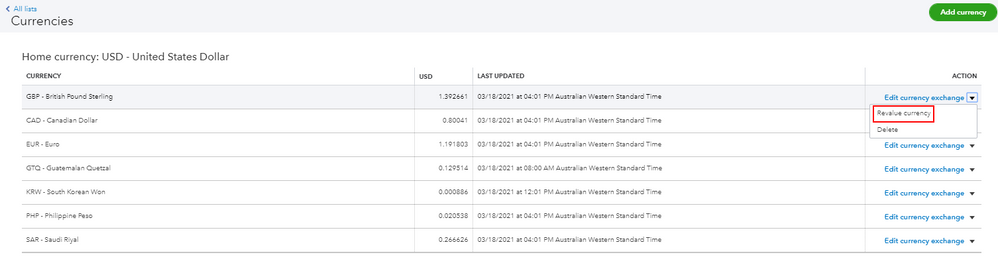

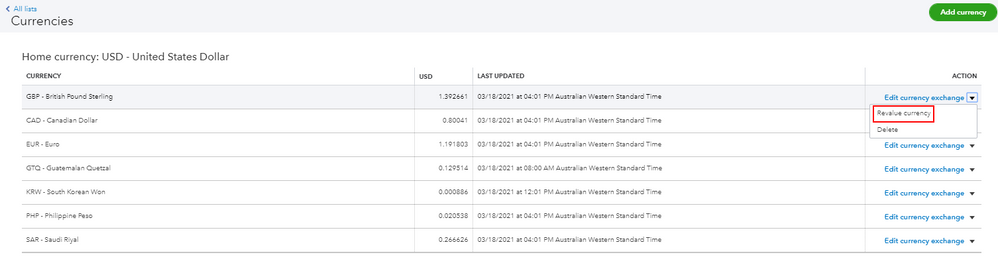

You'll want to create home currency adjustments to zeroed out the small amounts showing on your balance sheet report. The home currency adjustments change the home currency value of your foreign balances, recalculating them based on a new rate. These adjustments affect your balance sheet accounts.

Here's how to create home currency adjustments:

I'm adding this article for more details: Enter home currency adjustments for your foreign balances.

Moving forward, you'll want to perform this every month to make sure the Chart of Accounts (COA) balance and the conversion amount balance on the Balance Sheet will match the actual bank. Not doing this will show a difference in the balances between the Balance Sheet and COA.

You might also want to check out this article to learn more about multi-currency in QuickBooks: Multi-currency FAQ.

Keep in touch if you need any more assistance with this, or there's something else I can do for you. I've got your back. Have a good day.

Let's get these balances zeroed out so you can get back to working order, @maryg2.

You'll want to create home currency adjustments to zeroed out the small amounts showing on your balance sheet report. The home currency adjustments change the home currency value of your foreign balances, recalculating them based on a new rate. These adjustments affect your balance sheet accounts.

Here's how to create home currency adjustments:

I'm adding this article for more details: Enter home currency adjustments for your foreign balances.

Moving forward, you'll want to perform this every month to make sure the Chart of Accounts (COA) balance and the conversion amount balance on the Balance Sheet will match the actual bank. Not doing this will show a difference in the balances between the Balance Sheet and COA.

You might also want to check out this article to learn more about multi-currency in QuickBooks: Multi-currency FAQ.

Keep in touch if you need any more assistance with this, or there's something else I can do for you. I've got your back. Have a good day.

Thank you for the quick and correct answer to my question. I appreciate it so much! You saved me a lot of time!

Hello. I am using QB Pro Desktop. I recently closed our Euro account that we have had since 2013 or so. The Euro account is reconciled to zero, but the balance sheet is showing ~34K balance. Do you have any ideas on how to clear this out without claiming it as a loss?

Thank you,

Rachel

Hi there, rdenker28.

I'll share a way on how you can handle it without claiming it as a loss.

You can create a journal entry to get this done. Here's how:

Note: I would suggest reaching out to your accountant to guide you with the correct accounts to debit and credit. If you're looking for an accountant, you can find one by clicking on this link: Find an accountant.

For additional information and tips, you can read through this article: Create a journal entry in QuickBooks Desktop.

Feel free to visit this guide when reconciling your account:

If you have additional questions, please let me know by posting another one below. I'm here to assist you more, rdenker28. Take care and stay safe always.

I have exactly the same problem. We closed our USD bank account, USD balance is zero, and our book has a 67k balance in CAD (home currency in CAD).

Did you find a way to solve your problem and do you mind sharing it with me? Thank you!

Hello,

I have not figured it out. For now, I entered it as an expense. This doesn't really work since it is a cumulative amount over many years. Please let me know if you have done any more research or have found anything out!

Regards,

Rachel C. Denker

Hi Rachel,

I think I've figured out a way to do it.

You may need to reverse your expense entry to return to the start point.

When your foreign bank is at zero, and you have a balance in home currency, you can do a fx revaluation to fix it.

Go to Settings - Currencies - at the drop down Revalue currencies. Because foreign bank is 0, and 0 times any fx rates would return a 0 home currency. My accounts seems to look ok after I did it this way.

Hope it helps.

Jessie

I am in the current Enterprise version, but I believe it is the same

From the top Menus:

Company > Manage Currency > Home Currency Adjustment

Then enter the date you are trying to reconcile to and enter the Currency

click "Calculate Adjstement"

Make any adjustmetns to its calculation and then "Save & Close"

Alternatively, you can make your own General Journal entry and make sure you've selected the "Home Currency Adjustment" check box.

The Alternate approach works great! I had a similar issue with Foreign Currency AP accounts where all suppliers had been Paid, and the AP screens showed 0.00 but the balance sheet still showed small amounts. the Home Currency Adjustment Check box on the JE did the trick. to move the amounts off to Exchange Gains and Losses.

I am a bit surprised that the Standard AP process didn't charge these values off to Exchange Gain/loss when they first happened... perhaps because i needed to make a deposit payment ahead of receiving the invoice/product. Hum?

i want assistance on how to adjust individual foreign suppliers balance as the valuation only change figure for the main account foreign payables account and don't change individual foreign suppliers, even after revaluation they still have wrong home currency values

Hi, RWMUCHIRI. I appreciate you for joining the thread.

When performing home currency adjustments for Accounts Payable (A/P) in QuickBooks Online (QBO), Journal Entries (JE) are created that don’t directly adjust the home currency values at the supplier level. Instead, these entries provide essential information for accurately reporting Unrealized gains or losses on financial statements. To resolve the adjustment not reflecting at the supplier level, you might need to create a separate JE. Let me add further details how QBO handles these adjustments and guide you on the actions we can take to resolve this.

The effects of a home currency adjustment are represented as unrealized gains or losses in A/P (or Accounts Receivable). In other account types, such as bank accounts, these adjustments can be seen as realized gains or losses. Since making home currency adjustments for supplier levels requires creating JEs and selecting the correct accounts, I recommend collaborating with your accountant.

If you don't have an accountant yet, our ProAdvisor service can connect you with a local expert. Many ProAdvisors offer free consultations, providing an excellent opportunity to get professional advice tailored to your needs. Enter your zip code at this link: Find an Accountant.

I'm also adding this article about the frequently asked questions about home currency adjustments in QBO as additional guide: Frequently asked questions about Home currency adjustments.

For future reference, I'm adding this article about running financial reports in QBO to verify that the home currency adjustments have been applied correctly: Run a report in QuickBooks Online.

If you have further questions about how home currency adjustments work in QBO, don't hesitate to respond to this thread. We are dedicated to providing ongoing support.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here