Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

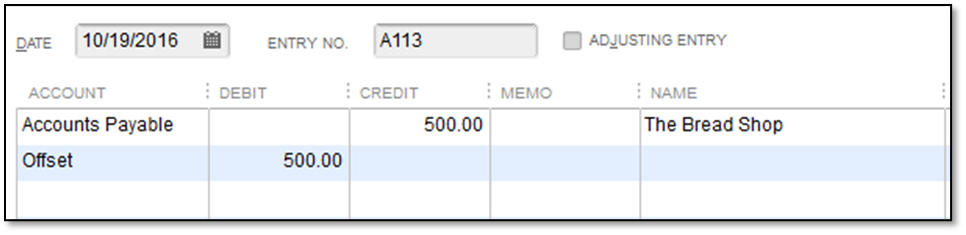

Buy nowHello, we have some old general journal entries on our AP report that I need to find a way to clear out without deleting. I have attached a screen shot to show that they net to $0.00 however, is there a way to apply these entries to each other so this vendor does not show up at all on the AP report as showing a $0.00 balance.

Thanks!

Solved! Go to Solution.

To clear these from the report, use the Pay Bills feature to apply them to each other. One of them will appear as a Bill to pay and the other will be available as a credit, which can be applied to the bill.

First, select the item that appears in the pay bills table, then click the Set Credits button to apply the funds from the other Journal to it.

Let me help you clear out the vendor balances in the QuickBooks Desktop report, jolenehawes.

You may have small balances that are the result of an error, an overpayment, or an underpayment. Often it would cost more time and materials to collect or pay the amount due than it would be to clear it from your accounts.

We can create a General Journal Entry to write off the amount in the Accounts Payable.

For vendors with overpayment:

For vendors with underpayment:

Then, apply the journal entry to the existing debit/credit:

To learn more about this one, check out this article: Write off customer and vendor balances. Another option is to create a bill to clear the balances. When you pay bills, don’t write a check. If you do, the bills remain open and unpaid which leads to inaccurate financial reports. Follow the steps in this article to pay a bill properly: Pay bills in QuickBooks Desktop.

Feel free to visit this page to learn the A/P workflows in QBDT: Accounts Payable workflows in QuickBooks Desktop.

Should you need further assistance with this? Or do you have any additional QuickBooks-related concerns? Feel free to get back to me anytime. It'll be my pleasure to help you again. Take care, and have a great day!

@RCV RE: We can create a General Journal Entry to write off the amount in the Accounts Payable.

Uh, did you read the OP's question? Or look at their screenshot? It seems not. Is it really that hard to actually answer the user's question?

To clear these from the report, use the Pay Bills feature to apply them to each other. One of them will appear as a Bill to pay and the other will be available as a credit, which can be applied to the bill.

First, select the item that appears in the pay bills table, then click the Set Credits button to apply the funds from the other Journal to it.

Thank you! I had to change the A/P account to an seperate holding accounting that a previous employee set up but once I changed that, I was able to clear them as you suggested. Thank you very much!

Thank you. This absolutely works! The journal entries no longer appear on the AP report.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here