Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

BLACK FRIDAY SALE 70% OFF QuickBooks for 3 months* Ends 11/30

Buy nowGood day, sdlumber.

You can mark the products and services as taxable. This way, you don't have to manually check the Tax box in your invoices or estimates.

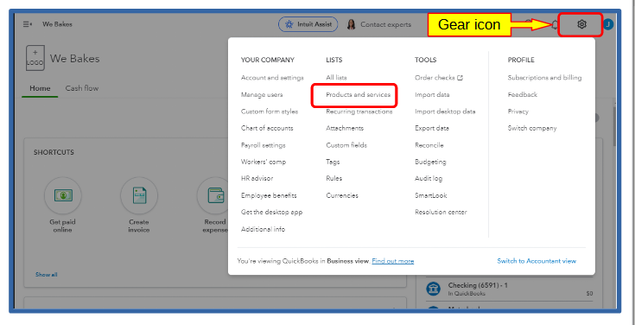

Here's how you can make the item as taxable:

You can open this article to get more information: Sales tax in QuickBooks Online.

I'm just a post away if you have any additional questions about sales tax in QuickBooks Online. Thanks.

What is Gear?

What is List?

Can you post a screenshot of what you're saying to do.

When I put the line items in, I have to enter the line "Tax" after each line. If I do not, for instance if there are 10 lines on the invoice and I enter the "Tax" line at the end, the last item is the only line that is taxed. The other 9 entries are not taxed. We have to calculate tax on our calculator and write it in on the last line. Really stupid... but there are no clear directions on how to remedy this.

Let me provide you with clear guidance on how to apply tax to each line item on an invoice, @itskiki.

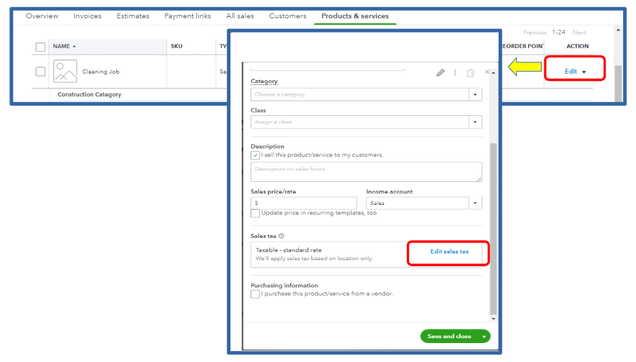

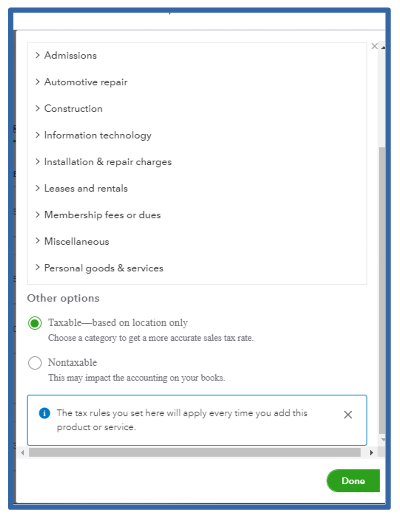

When you add or create your products and services to QuickBooks Online, make sure to set them as taxable or nontaxable during the setup. This way, the tax rules you set will automatically apply each time you use these items.

However, if a product or service should be taxable and isn’t set as such, you’ll need to manually edit the items and switch their tax status from nontaxable to taxable so when you create an invoice it will automatically apply on the Tax box.

Here's how:

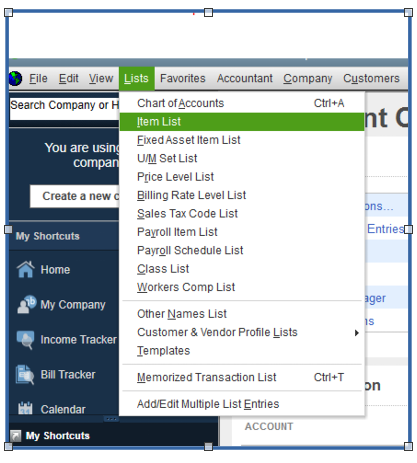

If you're a QuickBooks Desktop user, here's how to manually change the tax status:

If you want to learn how to set up, edit, or deactivate sales tax rates, you can read and review this article for guidance and information: Set up your sales tax in QuickBooks Online.

If you need further assistance setting up taxes, don't hesitate to comment below. The Community is always here to help you. Have a great day!

Quick question: every single item in our inventory is taxable. There are hundreds of items. Is there a way to mass-assign them all as taxable at the 6% tax rate?

Thanks again for all your help!

OK, OK, Thank you for the screenshot. As I stated in the beginning, I have absolutely no idea what I'm doing. I think I'm on the wrong product forum. My Quickbooks looks nothing like your screen. I'll attach what mine looks like. Thanks, though, for your time and attention!

Hi there, @itskiki. I can help simplify your invoice processing by allowing you to apply tax rates in one go, skipping the need to check each line item individually. With my assistance, you can save time and streamline your workflow.

Please know that the steps provided by my colleague are for QuickBooks Online users. Based on your screenshot, it appears that you're using QuickBooks Desktop. Let's create a sales item at a rate of 6%, then batch assign a tax code for each one of your items. Doing so will save you the trouble of manually assigning each line item to taxable.

Let's begin by creating a sales tax item. Here are the steps:

Now, let's assign a tax code to your items/inventory. Please follow these steps:

When you create an invoice, select the tax items you've created before to apply the rate of 6%. You can follow these steps:

In addition, you can generate a report that will provide a glimpse into your future sales and inventory status.

You can guarantee that with all the information and steps provided, the items will automatically classified as taxable. If you need additional help, you can always return here. Have a good one!

WOW!!! AMAZING rockstar support!!! I really appreciate you going above-and-beyond!!! Thank you, thank you, thank you... we cannot thank you enough!!!

Good morning, @itskiki.

Thanks for reaching back out and let us know that those steps worked for you business.

I'm glad we were able help you resolve your issue.

Feel free to come back if you have any other concerns. Have a wonderful day!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here