Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowGood day, sb-alehzayis,

You have the option to apply the discount to a specific line or to all items on the invoice. You may choose between these two options as they have different calculations.

I've added screenshots below to see the difference.

Check out the Sales and customers page to learn all your company's income and customers. It includes subtopics to help you manage and handle your revenue.

Should you need anything else, please let me know. I'm always around here in the Intuit Community to help you out.

Hey there, sb-alehzayis.

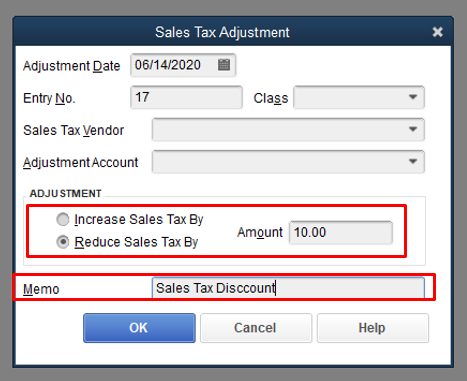

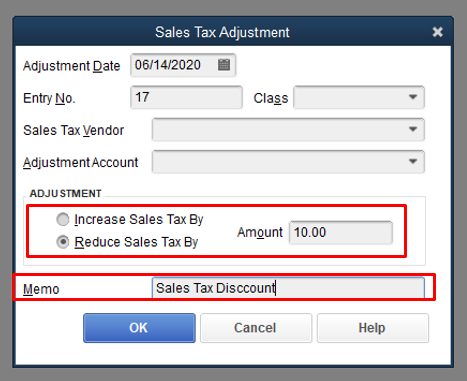

I can help you reflect the discount in the sales tax liability in QuickBooks Desktop. You can process a sales tax adjustment to reflect the transaction.

Here's how:

To know more sales tax adjustment process, you can go through this article: Process sales tax adjustment.

Additionally, you can take a look at these pointers to help guide you more in managing sales tax in QuickBooks:

Show multiple sales tax items on an invoice

Feel free to drop me a reply below if you have any other sales tax concerns. I'll be more than willing to lend you a hand.

I've got the steps you need, sb-alehzayis.

You can add a discount item by following the steps below. Note: QuickBooks calculates percentages only on the line, make sure to create a subtotal item before adding the discount item.

Once done, you can apply this discount to your items. I've got this article for more information: Add, edit and delete items.

Please don't hesitate to reach out to us if you need more help with QuickBooks Desktop items. Thanks.

Thank you!

If I have several items on an invoice, will the discount be applied only to the item immediately before the discount, or will it be applied to all items above it?

Thank you!

Will the discount be applied only to the item immediately preceding it, or will it be applied to all items preceding it on the invoice?

Good day, sb-alehzayis,

You have the option to apply the discount to a specific line or to all items on the invoice. You may choose between these two options as they have different calculations.

I've added screenshots below to see the difference.

Check out the Sales and customers page to learn all your company's income and customers. It includes subtopics to help you manage and handle your revenue.

Should you need anything else, please let me know. I'm always around here in the Intuit Community to help you out.

Thanks, but no matter what I do the discount item applies only to preceding line in invoice. You are saying "You have the option to apply the discount to a specific line or to all items on the invoice. You may choose between these two options" and I see how it works on your screenshoots. But how do I choose in QuickBooks Desktop those options: to apply to all lines or to particular one? I don't see such options available to choose from. Thank you!

Let me share with you additional insights on how you can apply discounts in your invoice, @ubcgroupusa.

You're actually correct, the discount only applies to the preceding line in invoice. You can follow the steps provided by my colleague above if you want to apply discount to a specific line item.

Although, you also have the option to add a discount to all items on the invoice. All we need to do is to add a subtotal after the last line item, then enter the discount after the subtotal. This way, it will calculate the discounts to all of the line item on the invoice. Let me provide you the steps on how to create a subtotal.

You can now create an invoice and enter all the items, then add the subtotal after last item. Once done, you can now add the discount after the subtotal. Please see the screen shot below:

In addition, you can print or email the invoice after creating it. Simply click the Print icon or the Email icon.

You can also run the Open Invoices report to check your customer balances. Just to go Reports and select Customers & Receivables, then click Open Invoices.

Feel free to go back to this thread if you need anything else. QucikBooks Community is open 24/7 to provide additional assistance.

This OK, but really awkward, especially if I want to apply differing discounts to different items on the invoice. Is it really not possible to just have a column for discount percentage that can be entered on each line item?

Seems like a pretty simple thing.

This is really awkward, especially if I want to use different discounts on different items.

Why not just have a "Discount" column on the invoice, where a percentage can be entered for each line item?

Seems pretty simple.

This is really awkward, especially if I want to use different discounts on different items.

Why not just have a "Discount" column on the invoice, where a percentage can be entered for each line item?

Seems pretty simple.

Glad that you’ve finally visited the Community, @byomtov.

Thank you for getting in touch about this. I agree having a discount column is more manageable.

You can still apply a discount to a specific line or to all items on the invoice. However, the discount feature can only be added to another line item. To have a discount column is currently unavailable.

You can visit our QuickBooks Help articles to get more information about organizing accounts. It contains different topics and tips for running your business.

You can reach us anytime in case you have questions in mind or need assistance. Thanks.

Thanks, Madelyn.

I do understand how to do it, I think. If I understand correctly I have to add an extra line to the invoice for each item I want to discount. So if I am selling Item, with a 10% discount, and item 2 with a 20% discount, I need five lines on the invoice:

Item 1

Discount on item 1

Item 2

Discount on item 2

Total

Is that right?

I was just suggesting that this is awkward and it would be much quicker, and clearer to the customer, to be able to put the discount % on the same line as the item.

I hope that's a feature you consider adding.

Thank you, Madelyn,

I do understand, I think.

As I understand it if I have two items, with a 10% discount on one and 20% on the other, I need five lines on the invoice:

Item 1

Discount on Item 1

Item 2

Discount on Item 2

Total

It would be simpler, and clearer to the customer, if the discount for each item appeared on the same line as the item, quantity,price, etc.

I hope you will consider this improvement.

Thanks for getting back to us, byomtov.

Yes, you are right. At this time, you'll have to add an extra line to the invoice for each item you want to have the discount for as a workaround.

I know it's ideal to have the discount column on an Invoice. Please keep in mind that our goal here is to help our users save time and keeping things simple when doing tasks in QuickBooks. For now, we can take this as a product suggestion.

Please let us know if you have any other related QuickBooks concerns. We're always here to help.

Yes, you can do that...but not without buying a calculation add-on like FormCalc SST for QuickBooks, or CCRQInvoice. (Google to find their Web sites.)

The two products work differently, but I believe both would support having a Discount column so that the discount percentage can be different on each Item line if you wish. They should also let you do away with the need to have a subtotal line(s) for discounting blocks of Items.

Seeing that this conversation is continuing, I will add another question.

Is there any way to have a discount reflect in the Sales Tax Liability?

For example if Item's original price was $100, yet we discounted it by 10%, that means we only sold it for $90.

However, when we calculate our quarterly sales tax liability - the missing $10 is not reflected in the total at all. Meaning, according to the report, we sold that item for $100 even though we only sold it for $90.

That was really the intent with my original question - how do I apply a discount to a specific item so the discount is reflected in our sales tax liability?

Hey there, sb-alehzayis.

I can help you reflect the discount in the sales tax liability in QuickBooks Desktop. You can process a sales tax adjustment to reflect the transaction.

Here's how:

To know more sales tax adjustment process, you can go through this article: Process sales tax adjustment.

Additionally, you can take a look at these pointers to help guide you more in managing sales tax in QuickBooks:

Show multiple sales tax items on an invoice

Feel free to drop me a reply below if you have any other sales tax concerns. I'll be more than willing to lend you a hand.

Thank you very much! That is most helpful!

Hello, sb-alehzayis.

I'm glad I came across your post and was able to address your concern.

If you ever have any other questions we can help you with, feel free to drop by the Community. Have a good one.

Its 2022, for us in the Wholesale Trade we still cannot add discounts to specific line items. It is a very necessary function for us but Quickbooks seems to keep overlooking this. We need this both on Desktop and Quickbooks Online.

Thanks for joining this thread, lesedimagowe.

I understand the importance of adding discounts to specific line items. While this function works in QuickBooks Online, you can send feedback to apply this on the Desktop version.

Here's how:

I'm adding these two articles as a reference on how discounts work on both programs.

Don't hesitate to create a new post if you have other QuickBooks concerns. I'm always around here in the Community Forum to help you.

In the desktop editions you can calculate per-item discounts with the FormCalc SST for QuickBooks add-on, or possibly also with the CCRQInvoice add-on (I'm less familiar with it).

In general this would involve adding a couple custom columns to your invoices (or sales receipts or...whereever you want to calculate discounts). Then in day-to-day usage you would enter a discount amount on each line, and the add-on would calculate a new Rate (price) on each line. With FormCalc SST you could see what the discounted Amount is before saving the invoice. (CCRQInvoice is more of a batch product--does the same things but not in real time.)

In either case, you could also set aside a customer custom field in the invoice header to use as a default discount rate for each customer...so the add-on would use the default discount on Item lines where you hadn't entered a different/specific discount.

Hi there, nain040903.

It's our priority to provide the help you need.

To ensure that we're able to do so, I'd recommend adding more details about your concern. This helps us share the steps to resolve this.

I hope you can respond to me on this thread so we can work on your concern together. Please know I'm ready to assist further. Have a good one.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here