Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowCredit cash for the amount of the purchase and debit a fixed asset account.

So just to confirm, I wrote a check for the cash paid for the vehicle purchase and then posted it against Asset I set up for the vehicle purchase, is that correct and all that's needed to record the expense & the asset?

Hey there, @lauriedtriano.

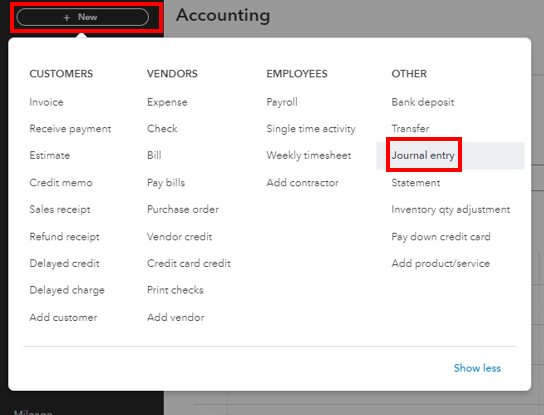

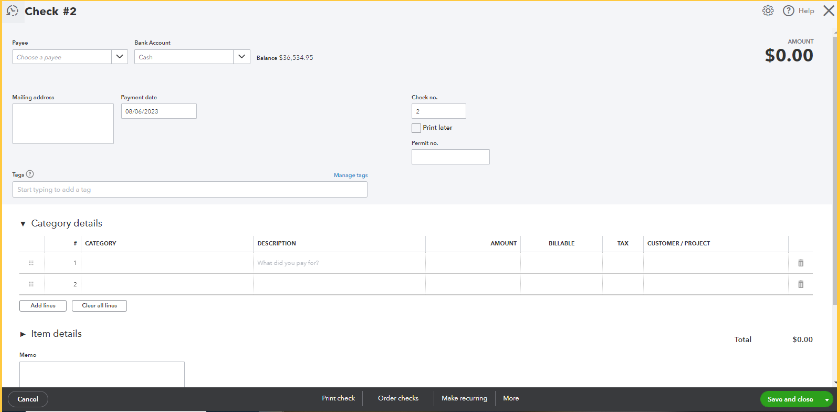

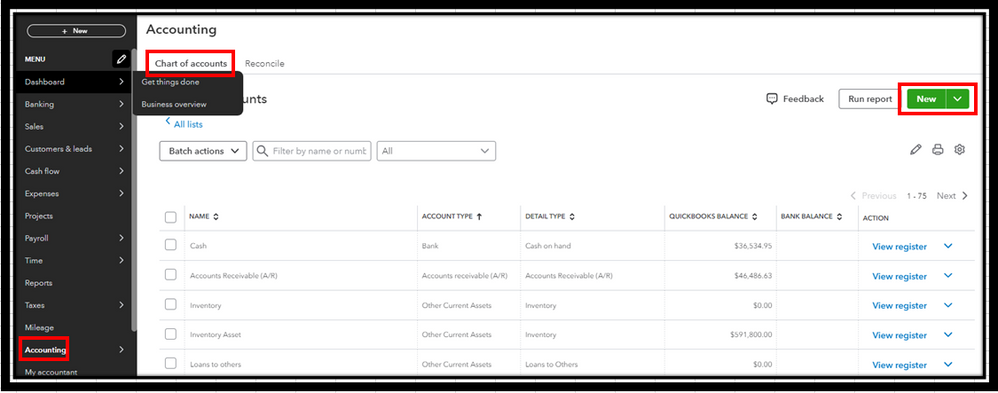

There are multiple ways to record your vehicle expense. One way is to record the expense by creating a check. Let me guide you how:

You can view the Transaction Journal by opening the check and clicking on More. This way, you can verify that the expense was recorded under the corrects accounts.

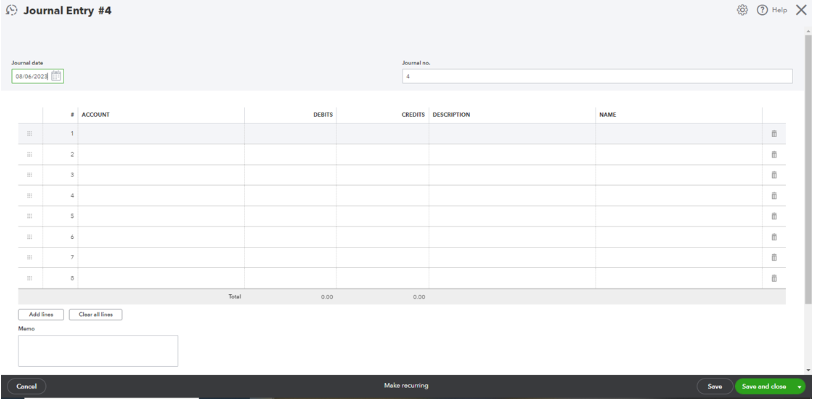

Another way to record the expense is by creating a Journal Entry as suggested by @QBsguru.

If you have other questions, feel free to comment below.

I have a similar situation, wondering if you wouldn't mind verifying I do this correctly. I have the amount I paid for a truck as a withdrawal in my bank feed, ( I withdrew the amount, and paid the seller cash) Do I create a bill for a fixed asset, being the truck, and then pay the bill with the bank feed transaction?

Let's find out the best way on how to record the transaction, Lady J Livestock.

With Journal Entry, you can transfer money between income and expense account. At the same time, you can transfer money from an asset, liability, or equity to an income or expense account. Since this is a loan that is a part of the purchase price, you can create a Journal Entry.

However, I suggest reaching out to your accountant for the specific accounts to use. They're more likely capable of knowing what accounts are affected.

For future reference, you can run reports in QuickBooks Online to give you different aspects of your business. Run Reports In QuickBooks Online.

Please let me know if you need anything else. I'd be glad to help.

Using QB desktop and I use turbo tax desktop

I purchased a vehicle, paid in full and may take 179 for this vehicle. When categorizing the bank feed should i use the accumulated depreciation or an expense account like auto/truck expenses?

Hi there, @quinn1.

I can share some details about the two accounts you've mentioned in categorizing the purchased vehicle in QuickBooks Desktop.

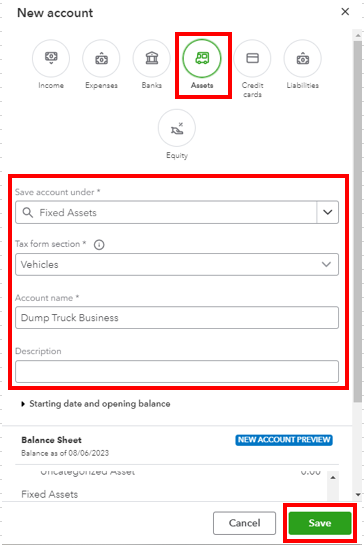

You can categorize the vehicle into an Asset account. A Fixed Asset is anything purchased for long-term use. These are usually equipments, machineries, land, and cars. I'd highly recommend consulting with your accountant to make sure that this is recorded properly to avoid getting errors in the future.

I've added these articles about creating an account and managing fixed assets:

Feel free if to comment below if you have other questions. I'd be happy to assist you further. Take care.

Hi,

I have a dump truck business which is an LLC.

When purchasing my truck in February (started operations in June), I used cash from personal funds for the purchase.

The $ shows being deducted from my personal Checking Account, but, not the business.

How do I reflect this in Quickbooks? I tried to do it, but, only the $31,500 is showing up under Retained Earnings, clearly wrong and it isn't showing up as a fixed asset.

Thank you!

I understand your concern regarding the transaction in Quickbooks for your dump truck business, SmallsHauls. Let me guide you to properly reflect this in your accounting records.

In QuickBooks Online (QBO), we can create a journal entry to record the business expense you made with personal funds. I'll guide you on how to do it.

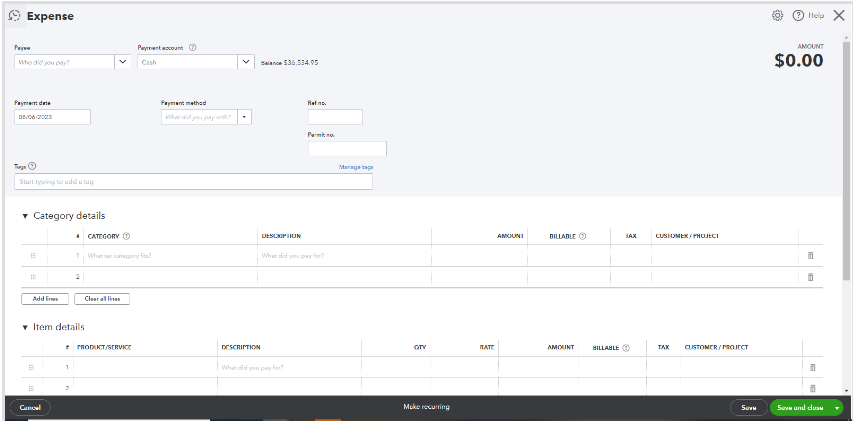

Next, decide how you want to reimburse the fund. You can either record it as a check or create an expense.

Here's how:

To record the reimbursement as an expense:

Additionally, you'll have to create an asset account to show the retained earnings as a fixed asset.

I'd also recommend working with your accountant to help record the retained earnings as an asset. They'll also guide you with the appropriate account to use. It's to ensure that your books are accurate.

If you have any further questions or need additional assistance, feel free to ask. God bless your dump truck business, SmallsHauls.

purchase of a motor vechicle by cash transfer

i need to account for the GST, Stamp duty etc and the payment by cash

how do i account for this in a journal entry

We're happy to have you here in the thread, @ABS Booking.

We appreciate you reaching out in the Community space and allowing us to assist with your query. We'll gladly write down the steps on how to enter journal entries inside QuickBooks Online (QBO):

You can check this page for more details: Create journal entries in QuickBooks Online.

Regarding how to account for the purchases, it's best to reach out to your accountant so they can give you the best possible way to handle it. If you don't have an accountant, I can help you find one. Feel free to visit this page to find an accountant for your business: Find a QuickBooks ProAdvisor.

Furthermore, here are some articles to help you manage journal entries, and ensure your data stays accurate inside QBO:

@ABS Booking, please let us know if you need further assistance with this or have any additional QuickBooks-related concerns. We'll make sure to get back to you as soon as possible. Take care, and have a nice day!

I bought a van using my business checking account (I paid with a check). How do I enter this in QBO? I see the check cashed that is in my bank registry. How do I categorize this and where does the purchase go under?

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here