Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

BLACK FRIDAY SALE 70% OFF QuickBooks for 3 months* Ends 11/30

Buy nowSolved! Go to Solution.

Thanks for visiting the Community today, kelekonagreen.

QuickBooks Online creates specific default accounts when you set up your company. The Sales tax Payable account is automatically added once the Automated Sales Tax feature is turned on. This is where the sales tax for every transaction is reported since the option to map it is unavailable.

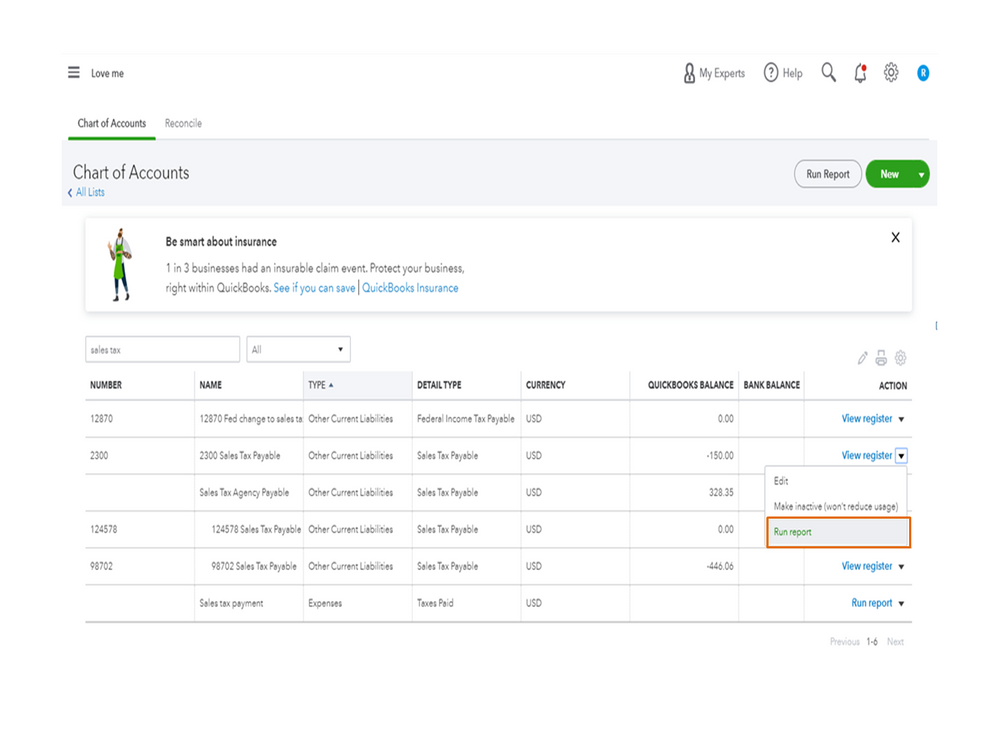

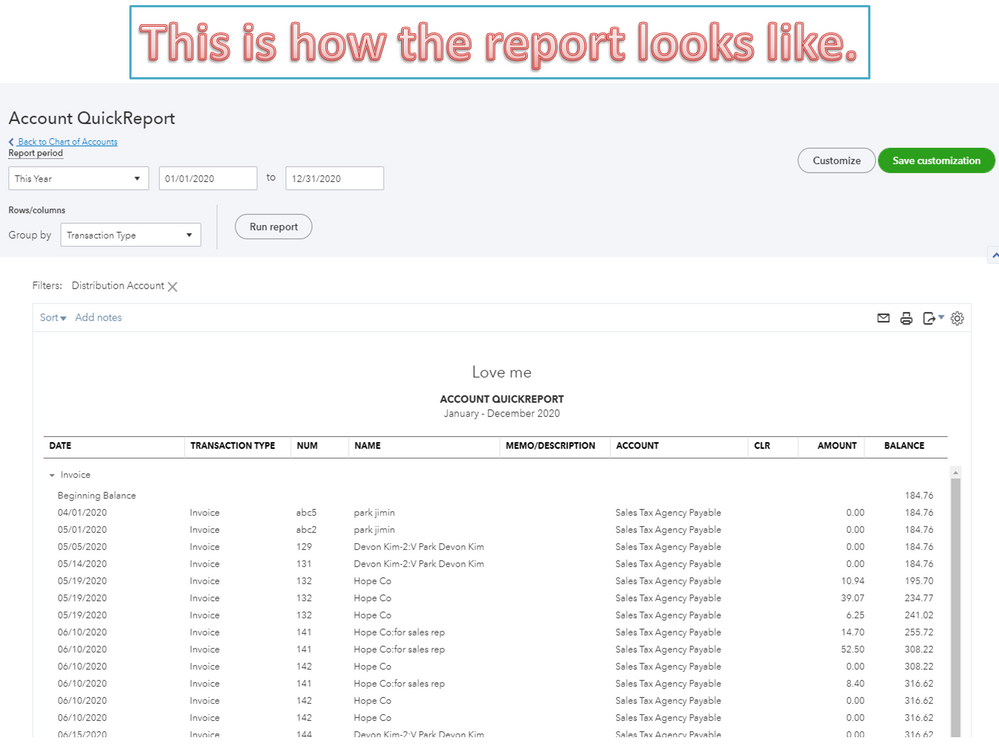

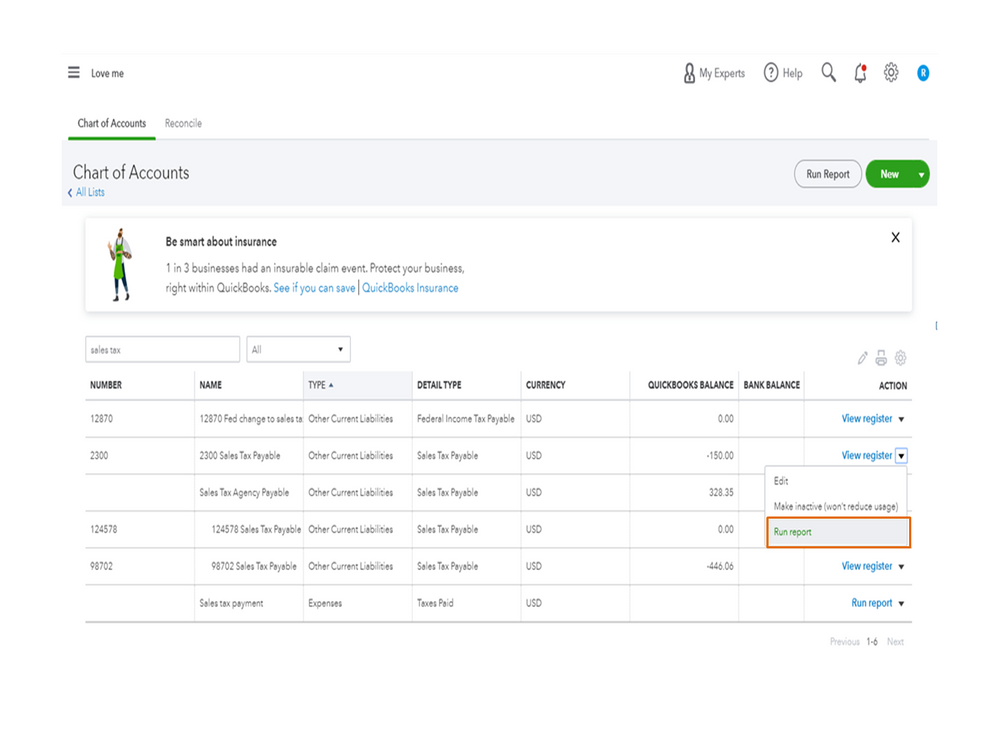

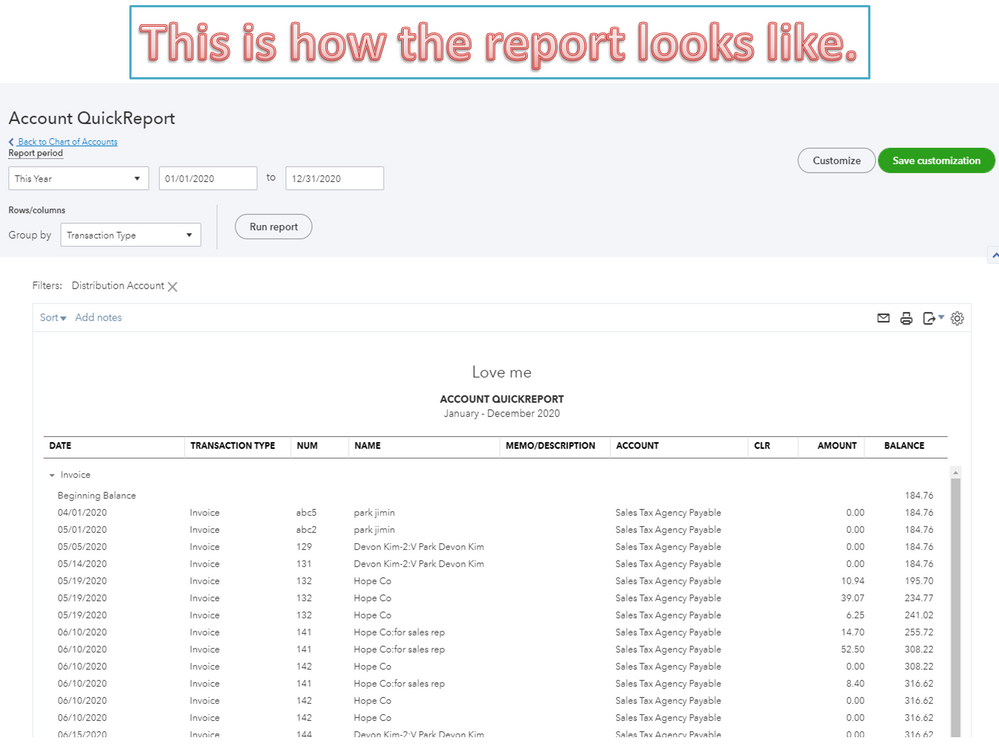

If you wish to check transactions, run an Account QuickReport to view them. You can also drill down each one to see the items used.

Here’s how:

For additional resources, these guides provide detailed information on the accounts that can be deleted and merged in QBO. Aside from that, you'll see complete instructions on how to check for sales tax owed.

I'll be around if you have any other questions or concerns about QuickBooks. Click the Reply button to leave a comment. I’ll pop right back in to answer them for you. Enjoy your day.

Let me ease your confusion, Kelekonagreen.

When you turn on the Automated Sales tax feature, our program will create the agency automatically. It's the tax agency where you pay your sales tax, and it's not set up as a vendor. That's why you're unable to see it on the AP reports.

The payment is handled differently. You don't have to create any bills since they're created automatically. You have to go to the Sales Tax page to check if there's a due payment. Here's how:

On that page, you can file the sales tax return and record the sales tax payment.

If you have other questions, please feel free to get back to us. We'll reply as soon as we can.

Thanks for visiting the Community today, kelekonagreen.

QuickBooks Online creates specific default accounts when you set up your company. The Sales tax Payable account is automatically added once the Automated Sales Tax feature is turned on. This is where the sales tax for every transaction is reported since the option to map it is unavailable.

If you wish to check transactions, run an Account QuickReport to view them. You can also drill down each one to see the items used.

Here’s how:

For additional resources, these guides provide detailed information on the accounts that can be deleted and merged in QBO. Aside from that, you'll see complete instructions on how to check for sales tax owed.

I'll be around if you have any other questions or concerns about QuickBooks. Click the Reply button to leave a comment. I’ll pop right back in to answer them for you. Enjoy your day.

Perfect! I found what I needed and made the changes. Thank you so much for your help.

I'm sorry. One more quick question on this. So when i enter a sales invoice and charges sales tax it posts the tax to an pre-setup Sales Tax Payable account in QB. I think i have that part figured out. The follow up is does it create a vendor AP account as well? I already have an account for the entity which i need to remit the sales tax to. If it doesn't then am I stuck just entering a payment to the entity as a manual check out of the bank account? Or is there some other method?

Thank you for getting back to us, @kelekonagreen.

When you create a company, the QBO system automatically creates specific accounts by default as mentioned above. Yes, one of them is the A/P account. Our general recommendation is to maintain one A/P account. This way, you're able to organize your books and business expenses accordingly. You can refer to these articles for the complete details:

Manage default and special accounts in your chart of accounts

Furthermore, there's no need to manually enter a payment to the entity account as a manual check since your vendor expenses are already recorded to the default A/P account. Then, when you already have multiple A/P accounts, you can consider merging them. However, I'd recommend consulting your accountant before doing so to keep your books accurate.

In case you have to group or divide your open payables, you can use location tracking to group them. I'd recommend checking out this article's Use location tracking to group payables section for the complete details: How to group Accounts Payable account types.

Additionally, you can pull up the Accounts Payable Ageing Detail and Summary reports. This way, you're able to effectively monitor your unpaid bills that are grouped by days past due. Just go to the What you owe section from the Reports menu's Standard tab.

Please know that you're always welcome to comment below if you have other concerns or follow-up inquiries about managing your default accounts and expense transactions in QBO. I'm just around to help. Take care always.

I understand most everything you said but I don't think I have some of those options. I'm working with QB Plus on the desktop app. I have entered an invoice and charged the sales tax. It booked the tax owed to the automatic payable account as you state. However, it is not tied to a vendor account as a payable. If I run the AP Aging report you suggest it doesn't show up in either detail or summary. The automatic GL payable account is set as an Other Current Liability type of account. I'm thinking that's why it doesn't show up on the aging. So the payment for the sales tax to the taxing entity is handled how? It won't show up on the Pay Bills to be paid so wondering how you go about cutting a check to the tax entity?

Let me ease your confusion, Kelekonagreen.

When you turn on the Automated Sales tax feature, our program will create the agency automatically. It's the tax agency where you pay your sales tax, and it's not set up as a vendor. That's why you're unable to see it on the AP reports.

The payment is handled differently. You don't have to create any bills since they're created automatically. You have to go to the Sales Tax page to check if there's a due payment. Here's how:

On that page, you can file the sales tax return and record the sales tax payment.

If you have other questions, please feel free to get back to us. We'll reply as soon as we can.

Great! I think I got it now. Appreciate your help.

OK. So does the machine pick a random gl account# (from wherever??) or do we get to input the gl account# that we would like to post all the sales tax to in the company setup? If so where is this done please.

Let me provide some information about the set up of GL account number for sales tax in QuickBooks, @1935 1462 9520 719.

When you use the Automated Sales tax feature, QuickBooks Online will add the Sales tax payable account. This is where all sales tax for every transaction is recorded. If you want to use account numbers in QuickBooks, you'll just have to turn on the feature.

Here's how:

For more details, feel free to check out this article: Use account numbers in your chart of accounts.

Additionally, I'll be adding this resource on how you can use the automated sales tax: Set up and use automated sales tax in QuickBooks Online.

I'll look forward to your reply if you need clarification. I'll make sure to get back to your right away. Have a blissful day.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here