Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

BLACK FRIDAY SALE 70% OFF QuickBooks for 3 months* Ends 11/30

Buy nowHi @micheline-hoarep , is it grant funds? What's the reason of payment? Comment back, cheers.

@micheline-hoarep wrote:

We receive payments on behalf of our client. If the person sending us the check does not include any money for us, we deposit the check and write a new check to send to our clients.

Set up a liability account and a service item that links to it

use that service item on a sales receipt when it is received

use that same item on an expense form when making the payment

Can you show us an expanse of how it’s done. I get the first part but I am confused about how the payments is issued using the same account.

Thanks for joining this thread, @AmmarS.

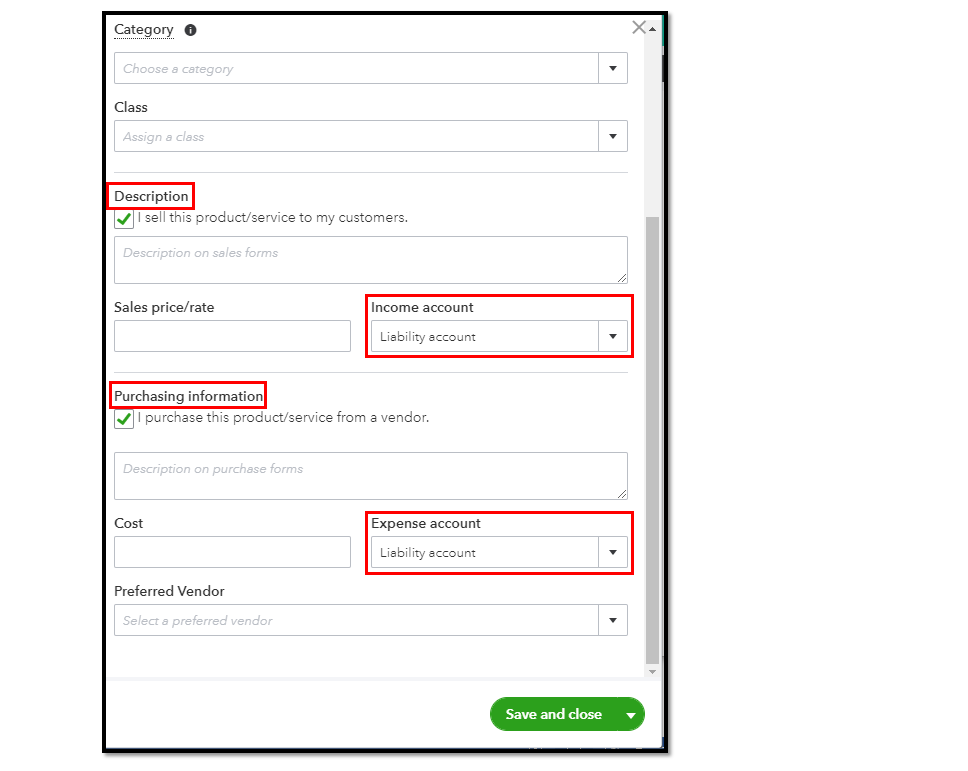

I'm here to provide additional info about the previous response provided by Rustler. To issue the payment under the same account, you'll have to ensure that the service item created is assigned to the Liability account on both Income and Expense account fields. Let me guide you how:

This way, the expense or sales transactions entered will be directed to the liability account.

Community articles are also a great help to guide you with your QuickBooks tasks. You can either save them or bookmark them for future use. To do so, just type the keyword of your concern

in the search bar or select any of the categories displayed.

Keep me posted if you need further assistance processing payments using the same accounts. I'll be on the lookout for your response. Take care always.

I have a SMLLC and my work comes from one company. When I can't do a phone sale to get payment for materials I pay for them with my business card. I send pictures of the receipts to the company's book keeper and I enter them in on my invoice for reimbursement. My one Client that I work for sends me a check with services and reimbursable expenses in one lump sum. At first it wasn't that much. This year it is when I received my 1099 I did the math and the materials I've been reimbursed for are over a 1/3 of my income. I list these in other expenses and label them as reimbursable expenses and match them with a receipt. They are billable income from the invoices. My company has made very little profit until this year. I will see my CPA eventually but until then should I be categorizing this differently to show a difference in earned and reimbursed income?

I followed the instructions above but got the message of “something’s not quite right” and couldn’t save.

Thanks for becoming a part of the Community and getting involved with this thread, Kay63. I appreciate you performing DivinaMercy_N's steps to create or edit a service item.

Since you're receiving a "something's not quite right" message when you're trying to create/edit your item, I'd recommend checking your browser. It's possible this could have something to do with temporary internet files. Browsing applications store these types of records, but sometimes they can cause issues with certain webpages. You can open a private window and check to see if you receive the message when trying to create/edit an item.

Here's how to access incognito mode in some of the most commonly used web browsers:

If you don't see the message while browsing privately, and are able to create/save service items, it's safe to say this problem's being caused by your browser. It can be fixed by clearing cached data and Intuit-specific cookies.

In the event you continue encountering the message while browsing in incognito mode, you'll initially want to try switching to another browsing application.

Here's a list of supported browsers:

QuickBooks supports the current and two previous versions of browsers. If you find that you're using an unsupported version, make sure to update it to its latest release. Steps for doing so can be found on the particular company's website.

In the event you've found no problems that could be causing this with your browser, you'll want to check the operating system and internet speed you're working with.

Here's our recommended operating systems and internet speeds:

If you meet each of our system requirements, but are still encountering pages the message when trying to create/save service items, I'd recommend using a different device and/or internet connection. If it continues happening on other devices and internet connections, you'll want to get in touch with our Customer Care team. They'll be able to pull up the account in a secure environment, conduct further research, and create an investigation ticket if necessary.

They can be reached while you're signed in.

Here's how:

Be sure to review their support hours so you'll know when agents are available.

I've also included a detailed resource about system requirements for QuickBooks which may come in handy moving forward: System requirements

I'll be here to help if there's any additional questions. Have a wonderful Tuesday!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here