Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHi @HollyJ,

Let me help you out with your concern about the Resolve difference feature in QuickBooks Online (QBO).

An alternative way I can suggest is to add this processing fee when you create an invoice. This way, you no longer need to resolve the difference later.

You'll need to create an expense account and a service item to record the fees.

Create the expense account first:

Then, create the service item second:

You can then include this service item in your invoices.

If you want to continue using the Resolve difference feature, I suggest you open your browser's private window. It isolates the cache, which is the common factor of a browser's unusual behavior.

If that works, go back to your regular browser, then clear its cache. Otherwise, open an alternative browser that's available for you.

Check out this article: Categorize and match online bank transactions in QuickBooks Online. It has the steps on how you can add, match, and review bank transactions.

Let me know if you have other concerns with your online bank transactions in QBO. I'll handle them for you.

Ryan, thanks for responding.

A couple things—I can't know how a customer is going to pay for an invoice when I create it. Some customers pay by check, some by Paypal & some by credit card. All of those methods mean different processing fees that I can't calculate up front. So it's impossible to determine any applicable payment processing fees when I create the invoice. Consequently, your first suggestion doesn't solve my problem.

Second, I cleared my cache & attempted to resolve the transaction again this morning again as you suggested. But (see attached screenshot) it still gave me the same error msg saying that I need to resolve the difference between my invoice total and my payment total even though, with the resolving transaction of the processing fees, they do, in fact, match.

Do I need to do something special with the payment processing fees prior to adding them as a resolving transaction? I tried separately adding them as an expense prior to matching the payment to the invoice, but that didn't work either.

Otherwise, what is it that I don't understand about how to use QB's resolving transaction feature? Can you speak to how that specific feature works instead of giving me workarounds?

We're scaling up and will face this bookkeeping issue more and more often in the future. I want to streamline this process now, not have our work multiply unnecessarily when QB has a feature that should make it easy.

Thanks.

I'll help match your transactions in QuickBooks, @HollyJ.

First, thanks for following the suggestions given by my peer above. I've got other solutions you can perform to get around the matching issue you're having.

Yes, you can't calculate those processing fees directly since you received those payments from third-party merchant services, like PayPal, etc. There are bank service fees that the credit card company will deduct from the payment. Thus, the payment amount that shows on the bank register won't match the deposit amount in QuickBooks Online.

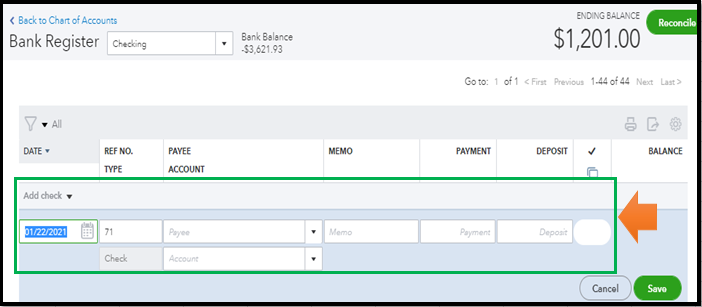

In this case, you can enter the bank service fee amount directly into the register. This way, the register balance matches the bank statement balance.

Here's how:

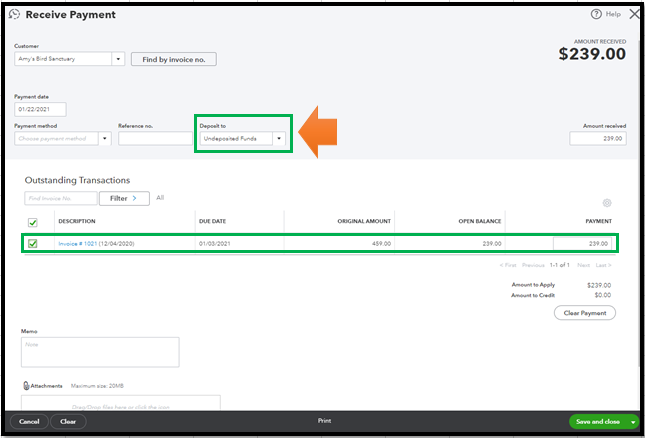

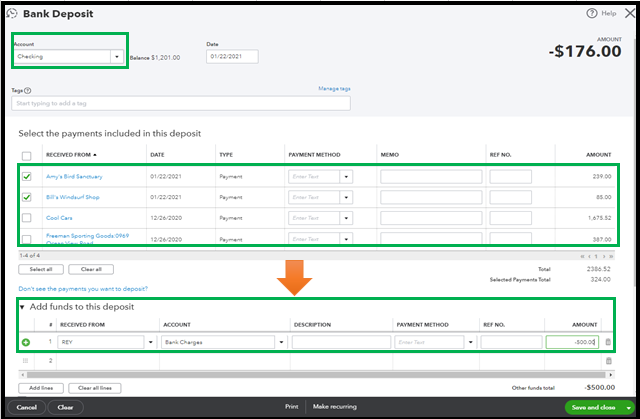

After that, you can now enter the fee as a negative amount on the Bank Deposits screen when depositing a payment.

To do that:

Then, it's time to create a bank deposit:

For more details, please refer to this handy article: Enter a bank service fee while using a third-party merchant service.

Next, you can do the usual matching process.

Also, QuickBooks will create an adjustment or journal entry when you use the Resolve difference feature. You usually do this when you're matching the same transactions, but their amounts don't quite add up.

When you're all set, you can begin your usual reconciliation. This way, you can ensure your books are accurate.

I'm still around to help if you need more banking insights. I'd be glad to extend a helping hand. Have a great day!

Thanks ReyJohn_D. I appreciate your help.

But I already understand how to make sure that the processing fees and the deposit are both showing up in my account via the method that you suggested.

What I'm trying to understand is how to use QB's Resolving Transactions feature when matching an invoice, instead of having to do this in the roundabout ways that you and your colleagues have suggested. None of the answers I've received have specifically explained how to use the Resolving Transactions feature that I'm having trouble with when I try to match an invoice to a payment and add an accounting of the payment processing fees via QB's Resolving Transactions feature.

As our transactions multiply, using QB's Resolving Transactions feature would be the cleanest way to solve my problem. So I'd really appreciate it if someone could reply to me specifically explaining to me what I'm doing wrong in using your Resolving Transactions feature instead of explaining workarounds that don't involve QB's Resolving Transactions feature.

You're most welcome, @HollyJ!

I've got some insights about the Resolve difference feature in QuickBooks Online (QBO).

There may be times when a bank item amount (payments/bank fees) doesn't quite match the transaction you entered (invoice). When you go to the Banking page, they don't add up even though they're the same entries.

In this case, you can use the Resolve difference feature to match them and fix the payment differences until it equals to zero.

Let me guide you on how to perform this task:

In case you run into some problems when reconciling your accounts, you can refer to this handy article to resolve them: Fix reconciliation issues in QuickBooks Online.

You can get back to me anytime if you have questions about handling your transactions. I'm still around to help you.

Perfect. Except as I've mentioned, that's exactly what I'm doing.

But when I do, even though the difference is $0, QB keeps giving me an error msg that says I still need to resolve the difference. (see attached screenshot)

Is this a glitch? And if so, how do I get it fixed?

Thank you for posting back and sharing a screenshot, @HollyJ.

I appreciate all the steps you've performed to resolve the payment differences, and I want to make sure this is taken care of.

At this time, I suggest reaching out to our QuickBooks Support Team so they can investigate why you're still receiving the error even though the difference is already $0 and provide additional troubleshooting steps to get this fix. They can also create an investigation ticket if other users are experiencing the same.

To reach them, click the ? Help button at the top right corner of your QuickBooks Online and select Contact Us to talk or chat with a live agent.

Just in case you want to learn more about matching transactions, feel free to check out this article for more guidance: Categorize and match online bank transactions in QuickBooks Online.

Please touch base with me here for all of your QuickBooks needs, I'm always happy to help.

Mark_R, thanks very much for your response.

Unfortunately, we've already tried resolving this issue via QB's support chat, and it was one of the most frustrating customer service experiences we've ever had. My partner was on a 2-hr chat with one of your reps the other day who could not help her because he wasn't familiar with QB's Resolving Transactions feature and apparently neither was his supervisor. I've uploaded the transcript of that chat so you can see why we're very hesitant to go thru that process again because it was so time consuming and, ultimately, completely unhelpful.

Can get me in touch with someone at QB who's familiar enough with this feature to actually help us?

This is not the kind of service we want you to have, HollyJ.

As much as I want to assist you with this, our QuickBooks Online support has better access. They can work with you remotely, and also report this error to our product engineers. The resolve transaction/resolve difference should work when trying to match the transactions.

I recommend reaching out to them again.

Here's an article with a video tutorial for your reference: Categorize and match online bank transactions in QuickBooks Online. See more video tutorials about QuickBooks here.

If there's anything else that I can help you with, let me know in the comments.

Thanks very much, Mary.

We'll reach out to them again. Can you suggest any terminology we could use that might expedite us getting assistance with it from them instead of wasting more time with someone who isn't familiar with the feature?

Thanks for getting back to us, @HollyJ.

You can use the Resolve Payment Difference as terminology when you contacted our support team. This way, they'll have an idea about your concern and look into this further.

Also, you'll have an option to request a callback and speak with a live representative. Just follow the steps below and they'll call you within 5 minutes after you've confirmed it.

To reach us on time, our Live Help is available from 6:00 AM to 6:00 PM on weekdays and 6:00 AM until 3:00 PM on Saturdays.

I'm also adding this article to further guide you in managing the growth of your business using QuickBooks: Help Articles. It includes topics about account management, banking, and expenses, to name a few. You can click the + More topics button to view other selections.

Please know that you're always welcome to comment below if you have other inquiries about managing a QuickBooks account. I'm just around to help. Take care always.

Hi @HollyJ

Did you fix the problem? I have exactly in the same situation and getting the same error message. How did you fix the problem?

Regards

Derko.

Hi Holly,

We are also having exactly the same issue. It's as if QuickBooks has never heard of businesses being charged credit card fees before! I have been trying for 3 hours to reconcile one transaction. We are new to QuickBooks (came from Xero) and nobody knows what I'm talking about. I have called and was told they can't teach us how to use the product. When I asked where I should learn...do they have a help center, video tutorials, anything? I was told that most of their customers have been using QuickBooks for years. In Xero, you just apply the deposit to all the invoices it paid for, then click the "adjustment" button when they don't equal the right amount, and you apply the balance to the "bank services" account. It is SO simple! How is this possible that we have baffled QuickBooks to the point that they are trying to find time-consuming work-arounds for us? And THANK YOU for posting this thread. I will be eternally grateful if someone can tell us how to do this in a normal way!

Hi @HollyJ,

faced the same issue and finally found a solution. The key is to have the Difference field in CERO. The validation is on that field. I had an invoice for $400 with a payment of $300 and the were $100 of bank fees and commissions.

1- In the Match Transaction page I selected the invoice I wanted to match the payment to. The app completes the PAYMENT column with the payment, $300. Change it manually to $400, as you want to pay the full invoice.

2- Clicked on Resolve Difference, selected the Category as Bank Fees and complete the amount column to $ -100.

3- The app calculates the Difference as $0. If you press SAVE you are good to go.

What is confusing is that when you click the invoice, it autocompletes with the PAYED AMOUNT, so you can never get a difference of $0.

All the best,

Martin

Did you ever find an answer to this? I'm also having the same problem!

Thanks for joining us here today, @klangefeld.

I have some information about the Resolve Difference feature. While this option will help resolved your transaction fees, you'll want to contact our Customer Care Support. This way, we can add your account to the list of affected users. You will be notified via email on the updates of the resolution status.

Here's how to reach out:

Meanwhile, you can add the fees to the transactions manually as a workaround. Just edit the transaction and enter the fees as a line item. See attached screenshot below.

Also, you can add the fee during reconciliation. See this guide for details: Reconcile in QuickBooks Online.

Feel free to browse this link in case you need help with bank-related tasks. It has our general banking topics with articles: Find help with bank feeds and reconciling accounts.

Reach out to me again if you still have questions or concerns with invoices or fees. I'll be right here for you. Take care and have a nice day ahead.

Thank you sooo much! I was having this issue also and couldn't get any help from QBO support. Seems like a simple fix, but certainly not logical. I've use QB desktop for years and am having a horrible time converting to Online. Thanks for your help on this one!

Why can't the resolve transaction feature make it part of the deposit rather than creating another expense. This is causing lots of issues when trying to reconcile the account at the end of the month.

Can you change the "Resolve difference" feature to add a transaction to the deposit instead of creating a whole new journal entry? Its causing issues when I go to reconcile the account because I have transactions that don't match up with the bank statements.

Hello RDAccount,

Being able to add a column on the invoice form would be a great feature.

While this option is unavailable, I suggest sharing this idea with our developer's team. Here's how:

Moreover, you can check this artile as your guide about managing bank entries: Banking.

I'm always around whenever you have banking concerns.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here