Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowHi,

I have a client that is a licensed real estate agent. Besides the services he provides as a real estate agent, he also engages in purchasing properties to flip and resale.

How can I properly record expenses spent towards the property so that it won't affect the P & L?

What he spends on the property is a capital expenditure that decreases his income only once the property is sold.

Any ideas?

WIP (work in Progress) Fixed Asset account, more precisely you want to post ALL flip costs to the increasing basis of the Fixed Asset. Purchase of Fixed Assets is never on the P&L. When sold th egain, either sort (less than a year) or long will appear on the P&L.

Let me provide you some information about WIP accounts, Y10 Tax.

QuickBooks Online (QBO) creates specific accounts by default and the Work in Progress (WIP)account isn't currently not one of them.

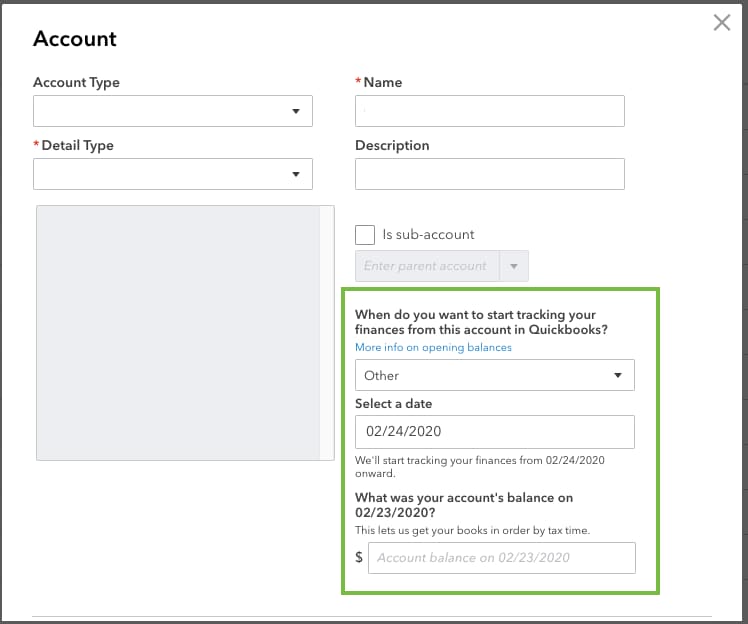

If you've entered WIP information in QBO, you may want to consider recording them in a separate account. To add a new account (WIP) to your chart of account, follow the steps below:

However, I still recommend reaching out to our accountant for other ways on how to record them.

For reference, please visit these help articles if you have questions about QBO.

Post a comment below if you have any other concerns about the process, Remember, I'm always right here to help you.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here