Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowThanks for posting here, @dreamerdad,

I can share some insights about the billable time tracking in QuickBooks Online. Regarding your first question, yes, your vendors can enter their time using the Timesheet feature in QBO. This means that you need to add them as Time Tracking users in the company file.

Here's how you can add a time tracking user in QuickBooks Online:

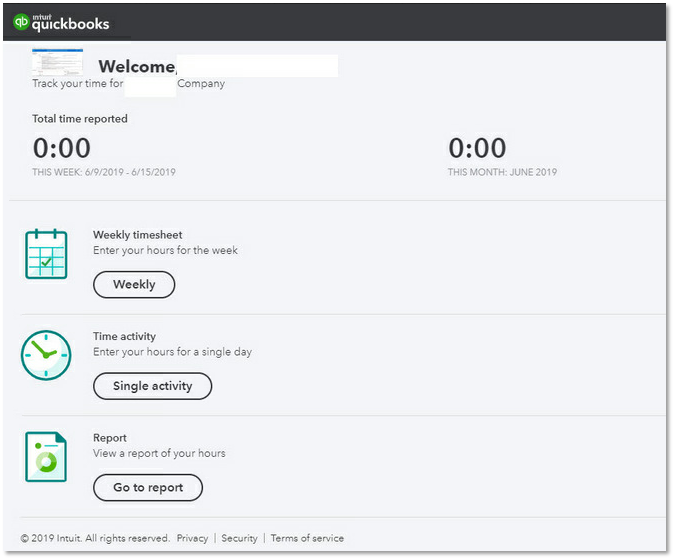

Once added, the user can now enter hours in a timesheet:

I'll be adding some related links to help you further with this:

Then, you can approve time within the company file just like what you do with payroll time. Also, for the third and fourth concern, the system will not automatically generate transactions from approved or billable time.

The system will only generate entries automatically if you have set up recurring transactions. Every transactions related to time and billable expenses has to be entered manually in the program. This ensures the program will not create entries accidentally and mess up your accounting.

But don't worry, we have a list of third-party apps that is QBO compatible to perform the data transfer for you. These apps will help you back up your data for conversion or restoration.

You can also consider checking out for third-party apps that handles this type of data entry. Visit our applications website here: https://apps.intuit.com/app/apps/home.

We also have another channel called Intuit Developers. There you can find engineers who can recommend third-party applications for you to use. Here's the link to the website: Intuit Developers Community.

Please let me know the result after trying out the steps. I want to make sure this time tracking user issue is resolved and I'll be right here if you need further help.

Jen_D - Thank you so much. This is exactly the solution I was wanting to go with, however, my understanding is that it will not work for 1099 vendors. Please see below.

Hello @dreamerdad,

You're on the right track, vendors with payments tracked for 1099 is unable to be invited as one of your time-tracking users. Since the option is not possible, I'd recommend letting our product developers know about your request by send feedback.

This way, they may consider integrating user access for billable vendors and 1099 payments. You can let them know by following the steps below:

Need help performing any tasks related to your account and company settings, click here to access and browse all articles for QuickBooks products. This reference contains most resources with steps on how you can manage your vendor's activity and other expense transactions, to name a few.

Don't hesitate to post again here if you have other questions or concerns with QuickBooks tasks and navigations. I'm always around happy to help. Stay safe and have a good one!

I submitted feedback a few months ago and was just wondering if there is any update on this? Will this be added to the QB roadmap by chance?

QuickBooks is constantly changing and evolving based largely on the suggestions and requests of users, like yourself, dreamerdad.

I appreciate you sending your product suggestion to our engineers. At this time, there's no specific time frame when this feature will be added in QuickBooks Online (QBO). You'll want to check for a third-party application that can help you invite vendors with payments tracked for 1099 as one of your time-tracking users. You can check out the apps that are compatible with QuickBooks at this link: https://quickbooks.intuit.com/app/apps/home/. We can also do it in QBO by following the steps below:

Any questions about integrating the app into your Online account are best handled by the third-party app provider. Feel free to visit our Expenses and vendors page for more insights about managing your vendor transactions.

I'm just one post away if you need a hand with running your financial reports or any QBO related. I'll be here to answer them. Have a great day ahead.

Thank you!

I notice that the Projects functionality allows us to see time tracking expenses related to vendors. I'm a bit confused since my understanding is that QB time tracking does not work in relation to 1099 vendors. Would this Projects reporting therefore work only work in relation to non-1099 vendors? It seems very unusable if so since most time tracking in relation to vendors would be in relation to 1099 vendors. No?

Hi there, @dreamerdad.

Thanks for following up with us.

In QuickBooks Time, you can track time for 1099s. All you'll need to do is ensure you have that feature turned on. I've covered some steps below to turn it on.

That should do it. Please let me know if you have any additional questions or concerns. Take care!

Tori - Thank you. I just want to make sure I will be able to see everything in Quickbooks Online also.

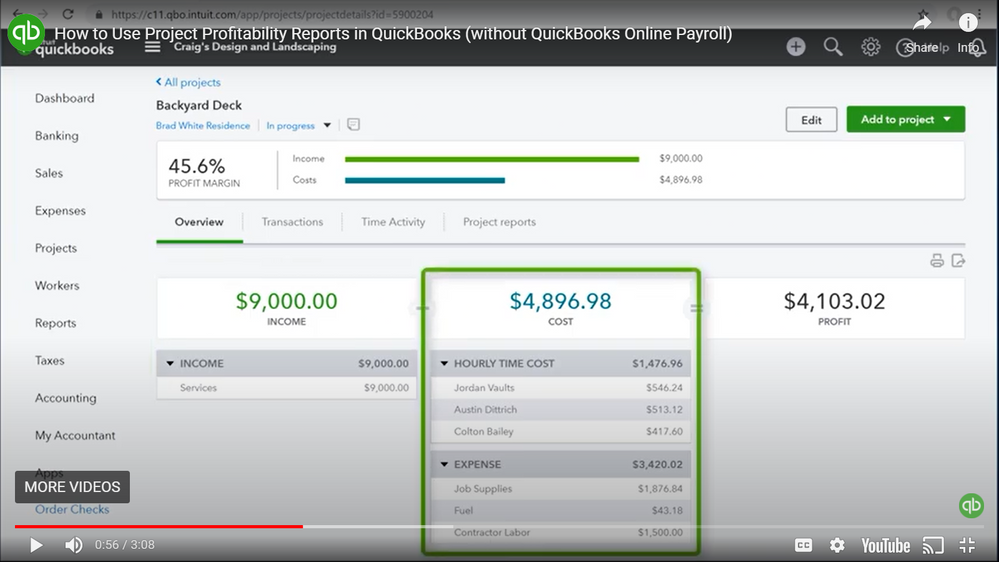

The reason is that my goal is to be able to calculate profitability for each project such that profitability reflects income from the client for the project and expenses in the form of time billed by vendors and in the form of other non-time related material vendor expenses. The Projects reporting tool allows me to have that wholistic view that encompasses all expenses related to the projects, broken down down exactly as I need them broken down, but only if I am able to see time tracking related expenses for 1099 vendors in the Project profitability reports.

My guess is that I will not be able to see time tracked by vendors in the Project profitability report. Is that correct? I say this because when I try to send an invite to a 1099 contractor so they can track their time via Quickbooks Time Tracking, I am not able to do so as shown below.

With that being said, if I add them via the external tsheets app as you are suggesting, can you clarify whether I will be also be able to see 1099 vendor time in the primary Quickbooks Online user interface in the Project profitability reports as shown below?

Thanks!

I appreciate those details, dreamerdad.

I have some info for you regarding your last question about tracking billable time for 1099 vendors.

When time is tracked for a 1099 contractor in QuickBooks Time and exports:

Please feel free to reach back out if you have any other questions. I’ll be here to help in any way that I can.

Morgan - Belated thanks for your reply and apologies for not replying sooner..

Can you clarify why the project profitability report would not report time cost by design? For us, that is typically a big part of the project cost. Also, I notice in the demo video QuickBooks shows time cost does appear to show up in the dashboard as shown below. Has this changed recently by chance?

I’ve got the information you need, @dreamerdad.

The Project profitability report is essentially a profit and loss report for the project. I understand that time cost is part of your project cost. QuickBooks uses separate reports to provide you a better presentation of your business.

You may consider running the Time cost by employee or vendor report to see your time costs info. Just make sure the hourly costs for each employee/vendor are set up. Then, follow the steps below.

Also, QuickBooks is always looking for opportunities to improve. By this, the program constantly changes its interface to make users’ experience better.

You can read these resources to learn more about projects:

If you have more questions or concerns about the project feature, just leave a message. I’ll be here. Thanks again for reaching out!

Madelyn - Belated thanks. Unfortunately, I'm still a bit confused. Can you clarify whether time costs are included in the project profitability report as it appears they are in the screenshot below and at the help doc here:

It seems from the video in this help doc and in the screenshot below that time costs *are* included in the project profitabity report which would be great if so since time costs are, in most cases, my largest type of project cost. But you said "QuickBooks uses separate reports to provide you a better presentation of your business."

Does this mean Quickbooks does not include time costs in the project profitability report as shown below? Can you clarify?

More broadly, I will say that anything you can do to more seamlessly integrate time tracking/reporting into Quickbooks projects would be much appreciated. I do find the integration with Tsheets and the fact that it is not fully "baked into" the Quickbooks UI to be a bit confusing. I also find it is not as helpful as it could be in relation to tracking time in relation to 1099 contractors. I hope this feedback is helpful!

Thanks!

Hugh

Thanks for getting back to us, dreamerdad. I can see how important it is to track your hourly costs in the project. I'm here to help you with that.

Hourly time costs are included in the Project Profitability report and can be viewed on the Overview tab. To do this, I'd recommend switching to Hourly Cost.

Here's how:

For your visual reference, I've attached a screenshot below.

For more details about tracking hourly costs in QuickBooks Online, please see this article: Profitability by Project.

Additionally, I've included these resources that'll help you learn more about creating and managing projects in QuickBooks Online. By browsing these articles, you'll be able to easily navigate the feature:

Please let me know if there’s anything else I can do to help in managing your projects, dreamerdad. I’m always around to further assist you. Keep safe always!

Thanks! So just to circle back to my original question related to this. Back in Oct of last year, @MorganB mentioned (above) that (if I understood Morgan correctly) time tracked in relation to 1099 contractors using Quickbooks Time does not show up in the Project Profitability report and that that report does not include time cost by definition. Can you clarify whether this remains the case? That is, if a 1099 contractor tracks time using Quickbooks Time in relation to a Project, will the cost associated with that time be reflected in the Project Profitability report? Ultimately I just need Quickbooks to help me better track project profitability on projects where a key expense affecting profitability is 1099 contractor time.

I can clarify things out for you on how transaction are tracked on your project profitability, dreamerdad.

QuickBooks automatically connects the billable expense and invoice to your project. Hence, you need to create an invoice from the billable time to track project profitability.

I'm adding a sample screenshot of the billable time of a contractor below.

When you go to the Project Reports and view the Project Profitability, the time entry won't show up on the report. You need to create an invoice first so QuickBooks can tell how much you're making for the project.

Check out these articles as a guide toward tracking billable hours.

Let me know if there's anything else you need by commenting below. I'm always around to help manage your project profitability.

This is what I do: I create my subs names in QBO as Vendor BUT also as an Employee, ONLY for TIME Tracking/Billing purposes. My sub clocks in/out of the projects so I can see time spent and create invoice. But I obviously pay him thru Vendor.

I FEEL YOU! This is what Ive done:

Go to the Subs vendor profile and there is a box on the right and it says "Track for 1099"...thats just for tax purposes. And what the Time Tracking is saying is if that box is checked, you cannot also track them using Time. SO, Unclick that box in their profile and just have your Accountant issue them a 1099 at the end of the year. And now you can TIME Track them for job costing purposes.

I am now trying to integrate Quickbooks Time with my QB Online account and I keep seeing a message that I need to contact support but when I click support I am redirected to a non-support page as shown here: https://www.loom.com/share/d9362290d29441589acb0ab4cc635cc8 I tried the chat icon and see a message saying no one is available to assist. When I have called the sales # in the past it has taken me 20 mins to connect with someone in sales who can answer my questions. My experience in general with QB Time is that it provides a very clunky user experience and syncing my QB Online account with QB Time is complicated. I'd really love to use it but it is just way too complicated.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here