Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Solved! Go to Solution.

The reply is an answer to missing info on the 1099's but not the answer I needed. In my case I had several months worth of rent payments showing on the 1099 and then missing the rest of the year. I actually found the answer in digging a little deeper. My remaining payments did not show on the 1099 because I changed the method of payment from a check to a credit card.

Hi there, @HWETN.

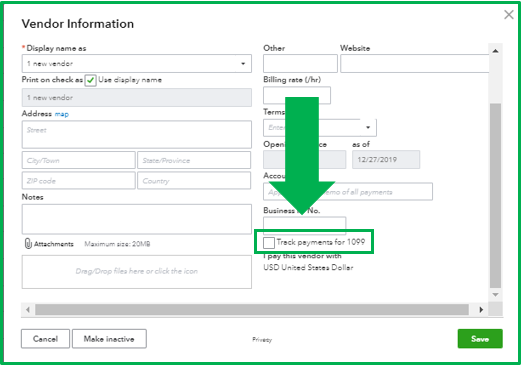

Let's make sure to track the payments for your landlord to show the expense on your 1099 report. Here's how.

In your QuickBooks Online (QBO):

You can also read this article for more details (Read Run a report that lists your 1099 vendors section): Create a 1099 report for vendors and vendor payments.

In case your vendor is missing from your 1099 summary report, you can refer to his article for the details: Vendor missing from 1099 Summary Report or 1099 Efile Service.

You can also visit our Income and expenses page in case you want to learn some tips on managing your expenses in QBO.

I'm always here to help if you have other concerns in entering expense in your QBO account. Have a great day!

The reply is an answer to missing info on the 1099's but not the answer I needed. In my case I had several months worth of rent payments showing on the 1099 and then missing the rest of the year. I actually found the answer in digging a little deeper. My remaining payments did not show on the 1099 because I changed the method of payment from a check to a credit card.

How did you come up with an easy solution? We did the same, and it isn't pulling up. What is the easiest way to resolve this? Create a JE or change the payment method temporarily.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here