Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowIt's nice to have you here today, bluemarble41075.

When you enter a vendor credit, it leaves an open balance to your account. This means that you need to link the credit to a transaction or future bills to offset the balance.

Otherwise, you'll need to delete the Vendor Credit and just simply create a Bank deposit to record deposit of your vendor's check.

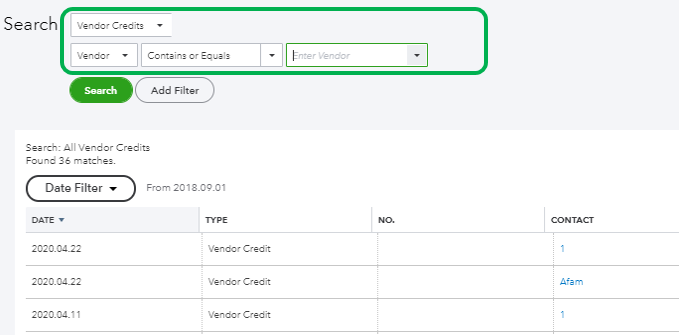

First, let's locate the Vendor credit through the Advance Search feature.

Here's how to record a Bank deposit:

Learn more about recording bank deposits through this article: How to Record Bank Deposits in QuickBooks Online.

Get back to me if you have other concerns. I'll be around to answer them all for you. Keep safe and have a good one!

No do not delete the vendor credit, @Charies_M is wrong

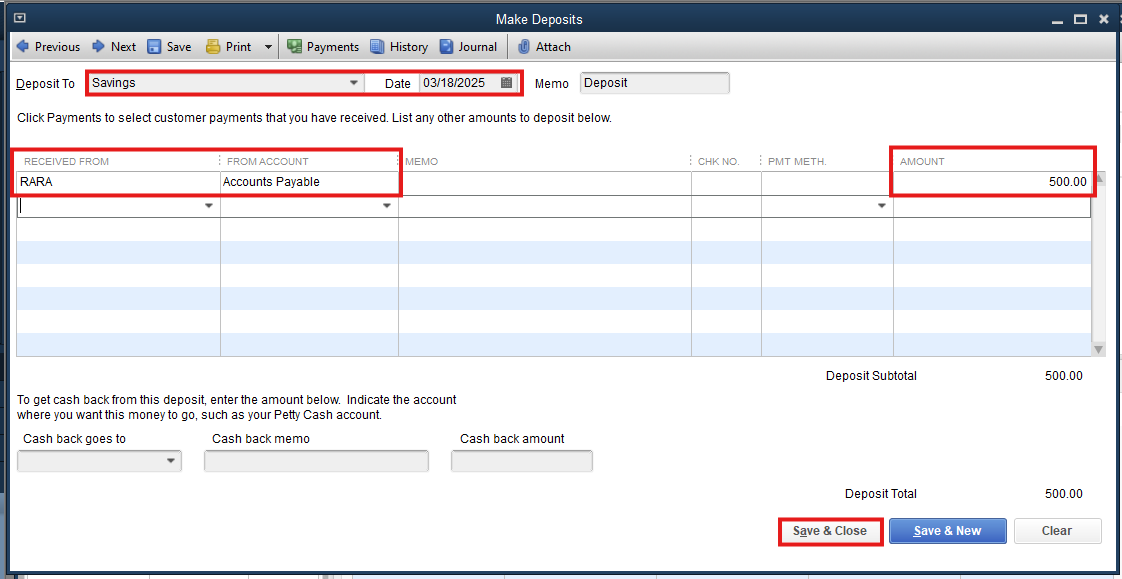

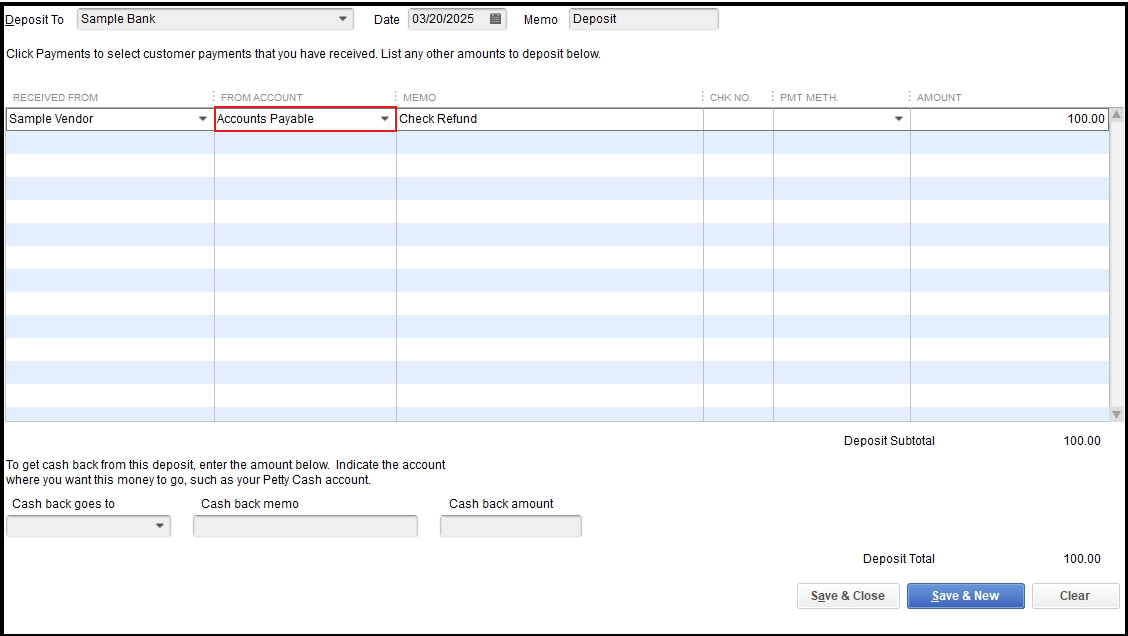

deposit the refund check and use accounts payable, vendor name as the source for the deposit

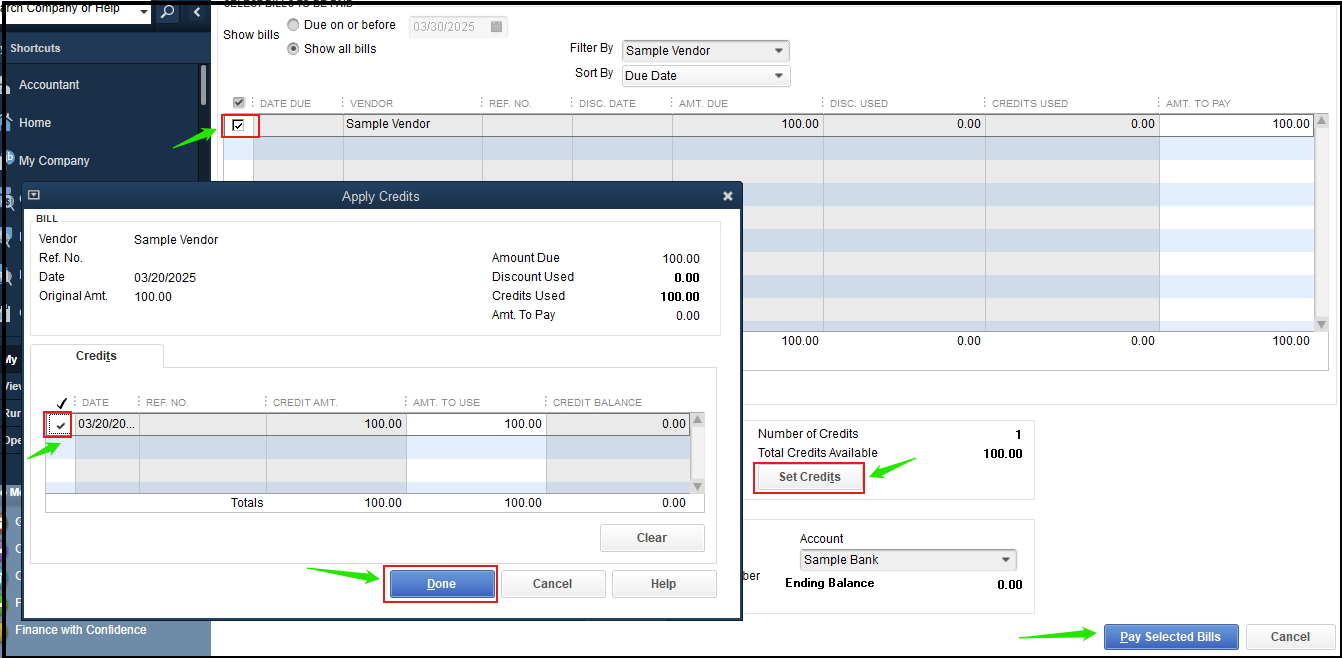

then open bill pay and pay the "bill" the deposit created with the credits, save

Can you list the steps to complete this task in Enterprise Desktop? I do not use the online QB.

Hi there, @Dr251.

I can certainly provide you with the steps for the correct workflow of balancing the vendor credit. You'll only need to create a bank deposit from Accounts Payable account.

If you've already entered a vendor credit, we'll proceed with recording the vendor refund check deposit. Here's a more detailed steps:

By doing this steps, you'll be able to balance the vendor refund status after depositing the check from the Accounts Payable account to your bank account. You can refer to this article for more information about this process: Record a vendor refund in QuickBooks Desktop.

Always remember to reconcile your account to ensure they match your bank statement and avoid discrepancies. It's important to review your accounts in QuickBooks to make sure they align with your actual bank especially when handling refunds.

You can always leave a reply if you have additional concerns besides recording a vendor refund in QuickBooks Desktop. I'm always here to guide you with anything you need.

Thank you kindly for your assistance.

My problem arises at step #6.

The Credit memo is coded on the Items Tab which ties to a COGS account (Construction Materials).

(I read "If the original credit was applied to a different expense account, then that account should be selected") When I just enter it to Accounts Payable, complete the rest of the information, save and close, go back to the Vendor, I still see the open credits on the open balance report.....perhaps I have something set up wrong, I'm confused.

You're doing well on following the steps outlined above, @Dr251. The reason why you're still seeing open credits on your balance report is that the deposit hasn't been linked to the credit memo yet. Let me walk you through linking those transactions.

While a credit memo creates a negative balance in your vendor account, the deposit does the opposite. We can link those two transactions by creating a bill payment.

To link the deposit with the Bill Credit, please follow these steps:

Following these steps should resolve the open credit on your report. For more detailed guidance, you can refer to this article: Record a vendor refund in QuickBooks Desktop.

Additionally, You can utilize this article when you customize the data, add or delete columns, add or remove information on the header/footer, and even personalize the font and style of the report in QuickBooks Desktop: Customize reports in QuickBooks Desktop.

Feel free to leave a reply if you need further assistance recording a vendor refund in QuickBooks Desktop. The Community is here to help you.

Stop after Step #1. After I go to Vendors, Pay Bills.

I do not have the option to "choose the deposit" from the vendor on that Pay Bills screen.

I only see the open invoices for my vendors.

If I had an open invoice for that Vendor, I could check that invoice, then go down to Set Credits and select the open credit and that would clear the open invoice to the amount of the available credit.

But on that screen, as I stated, I only see Open Vendor Invoices, no deposits are reflected on that screen.

Thank you for your detailed response and for walking us through the steps you've encountered. I'm here to help clarify the situation and guide you through the process, DR251.

I have carefully read the entire thread, and based on your explanation, it appears the issue arises from how QuickBooks Enterprise Desktop handles deposits and bill payments. In QuickBooks, deposits typically do not appear in the Pay Bills screen, as this screen is reserved primarily for managing vendor bills and applying credits or payments to those bills.

The check deposit from your vendor hasn't been linked to the bill credit properly, which is why the credits still appear as open on the balance report.

To ensure the check deposit from the vendor is reflected in the Pay Bills page, we can use the Accounts Payable account when recording the refund deposit from the vendor. Once done, we can apply the credit bill against the check deposit.

Here’s how to do it:

Record the Deposit:

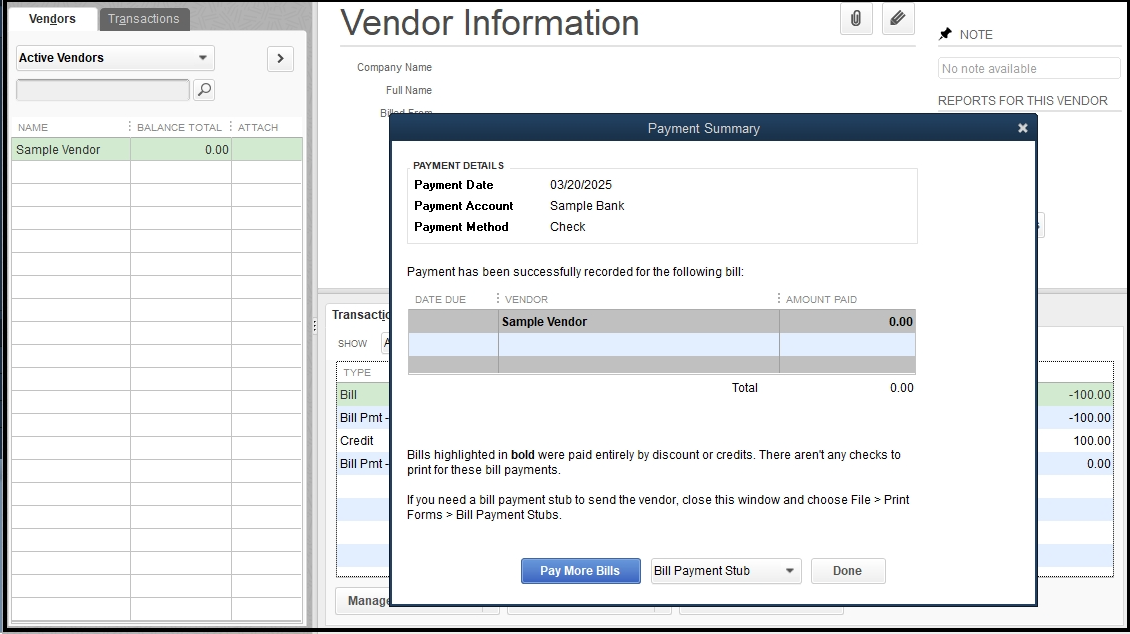

Link the Deposit to the Vendor Credit:

After completing these steps, the open credits should no longer appear on the open balance report for that vendor.

I recommend consulting your accountant before making any adjustments to your accounting principles. Their expertise can provide valuable insights tailored to your specific business circumstances.

Furthermore, you can check this article to ensure your records match your bank statement and avoid discrepancies or errors: Reconcile an account in QuickBooks Desktop.

Thank you for your patience and cooperation throughout this process. We appreciate your diligence in managing your transactions. Feel free to reach out if there's anything else we can assist you with, DR251.

JorgetteG,

Thank you for your assistance. I am happy to report that following your steps solved my issue.

I followed them to the letter, and it worked. I have successfully cleared the credits from

my vendor reports as well as see the deposit in the bank account. I do have several credits from 2022 that remain on this vendors account, but I will request our accountant to GE those out so I do not create an entry that may adversely effect a previous tax return. Again, thank you!!!! I printed the steps to save for the next time!

I'm happy the steps my colleague provided worked for you, @Dr251.

Thanks for keeping us updated. It's customers like you that make the Community so beneficial to all of our users.

Please know you can reach out to the QuickBooks Community any time you need a helping hand. Take care!

Nice! Bottom line.....use the "Accounts Payable" account in the deposit. Then it will show up in the Pay Bills section!.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here