Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHi. Is it possible to record sales commissions received without using an invoice or sales receipt? Would it be correct to debit Undeposited Funds and credit Sales Commission Income, then make the deposit into checking? Would it be helpful to create a receivable account for sales commissions? I am the bookkeeper for a small sole proprietorship that receives commissions from selling products and signing up customers. I do not need to track the customers signed up or even the specific products that earned the commission, just the revenue itself. The commission is recorded online in detail through the company that I purchase inventory from. It builds up and I make a transfer to my business checking account. Thanks in advance!

Solved! Go to Solution.

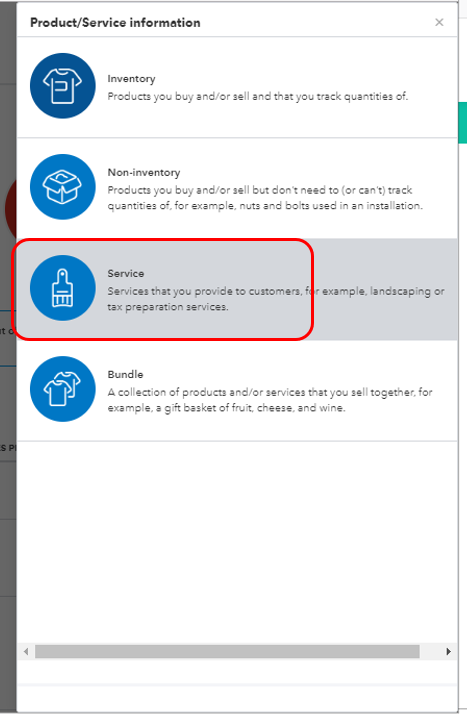

I would create a service item called commission earned, select your commission income account on the item screen

use that item on a sales receipt when you get the commission and then deposit the funds (you can use a generic customer, or create that company as a customer <- if there is any chance other companies will be paying you in the future this is the better option.

that will give you better income reporting.

I would create a service item called commission earned, select your commission income account on the item screen

use that item on a sales receipt when you get the commission and then deposit the funds (you can use a generic customer, or create that company as a customer <- if there is any chance other companies will be paying you in the future this is the better option.

that will give you better income reporting.

I record commission checks received by doing the invoice/receive deposit. This is okay as well? TIA

Would the created Service Item be a Non Tax item?

Do you have a video, or know of a video, that walks me through this process?

Good day, FlexMgt.

While we can't provide you a video that will walk you through the process, I can provide you the steps on how to create the service item commission and record this sale in QuickBooks Online.

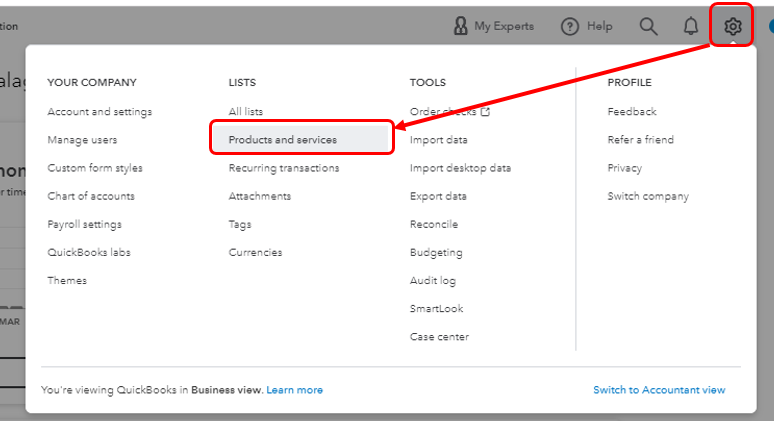

Here's how to create a service item:

Once done, as referenced by our Community backer Rustler, you can set up your customers so that you can keep track of those commissions, use the item on your sales receipt and deposit the funds.

In case you need more help with tracking and recording your sales commission, the following pointers are good references:

Track sales commissions in QuickBooks Online.

Turn on class tracking in QuickBooks Online.

If you have any questions or need anything clarified, don't hesitate to reply to this post! All of us are eager to help set you up for success!

This is for Rustler, you seem to have answers close to what I am looking for. I took over books for a retired hay farmer who solely deals in farm equipment sales. Most sales are simple, he purchases equipment and sells for a profit. However, he also has arrangements with farmers and other equipment dealers to sell on commission. Now those before me had their own way of recording things and the one I took over for could not remember how they entered the transactions. Everything I picked apart and backed into made no sense and everything I tried would not work and show what I needed on reports. So, history showed that commission sales were processed through the bank deposit screen, splitting the amounts into a liability code and the commission code (sorry screen shot will not work) line 1 is Misc Vendor : from account Payable on Commission Sales (liability account) : then the $10K/ line 2 from account Commission on Equipment Sales : $2k. This is fine for the sales tax due on it (and I confirmed with the owner he does pay the sales tax even though he never takes physical possession of the equipment) does not show on any report and it seems to have been tracked on an Excel spread sheet. After many videos and reading many many posts, I have tried the following. On the Sales Receipt I created an account that is for the Liability amount (over the code we use for the owners inventory) that is paid to the equipment owner and I have made the commissions amount taxable so I can generate the proper sales tax on the receipt. In testing, the Liability amount no longer shows on the P&L, the commissions shows on the P&L and the sales tax is reported properly and shows on the report. I appears everywhere I believe it should and the only part left is to ensure the Liability account is cleared out as I balance the check book. I am just hoping I am on the right track so I can close up the year.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here