Glad to have you here, laura-lauraelylc. I'm here to lend a hand.

In QuickBooks Self- Employed, there are two options on how to handle the refund. You may tag it as Personal or Exclude it.

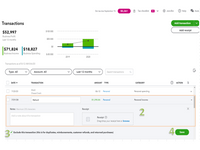

To exclude transactions:

- Go to the Transactions menu on the left panel and find the refund you're working on.

- Then, click the right arrow under the ACTION column.

- Tick the Exclude this transaction (this is for duplicates, reimbursements, customer refunds, and returned purchases) box.

- Click Save.

Also, I recommend seeking expert advice from an accountant to ensure your books will be accurate.

These articles provide an overview on how to classify transactions and how they show up on the financial reports:

Feel free to comment below if you need more help about managing refunds @laura-lauraelylc. I've got your back.