Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI am using QB Pro 2013 Desktop for bookkeeping and reporting purposes, I record everything at the end of the month. My question is regarding setting up my Inventory and Sales Account. I know that it should be done through Items & Services and Sales Receipt, but which account should I link my inventory to, Other Current Asset? And which Account should I link my Sales to, Income or again to Current Asset?

When I enter my inventory purchases into the system then how do I track it against the sales I make out of the purchased inventory, when I make sales for sure I add benefit on the top of purchased prices. If I record inventory and sales under Other Current Asset, it only reflects balance sheet, and if I record sales as income it reflects P&L and Inventory stays unchanged on my P&L. How should I track these two properfly and which accounts should these be associated with? Thank you for your answer.

(Title has been edited by moderator for clarity)

Solved! Go to Solution.

You may want to be familiar with these basic steps related to Inventory questions:

1) To turn on Inventory: Go to Edit menu at the top > select Preferences > choose Inventory & Items > Company Preferences > checkbox "Inventory & Purchase Orders are active" > click OK.

2) Create Inventory Items: Go to Lists menu at the top > Items List > Select Item tab at the bottom > click Item (or drop-down arrow) and select New > Type = Inventory Part and create a new item.

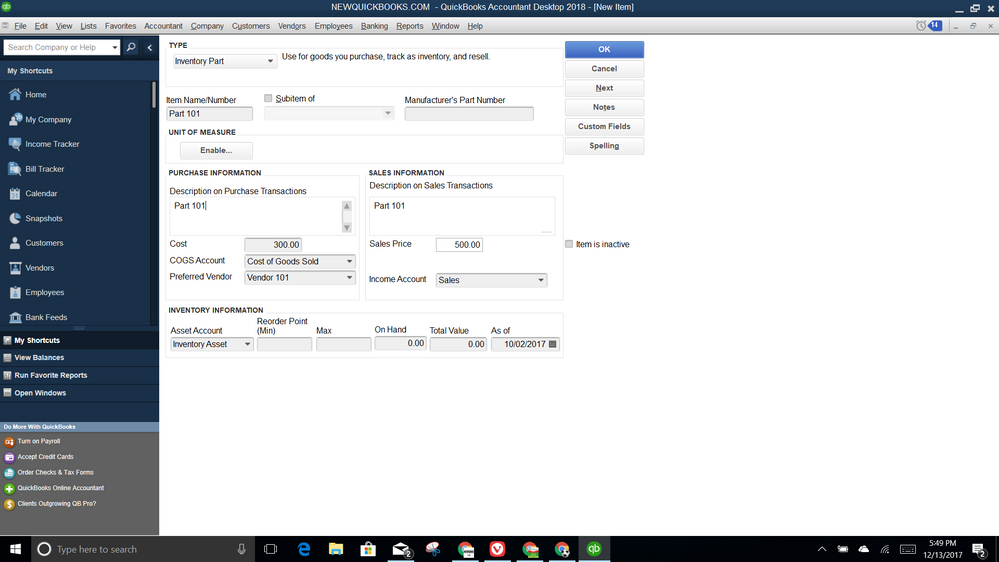

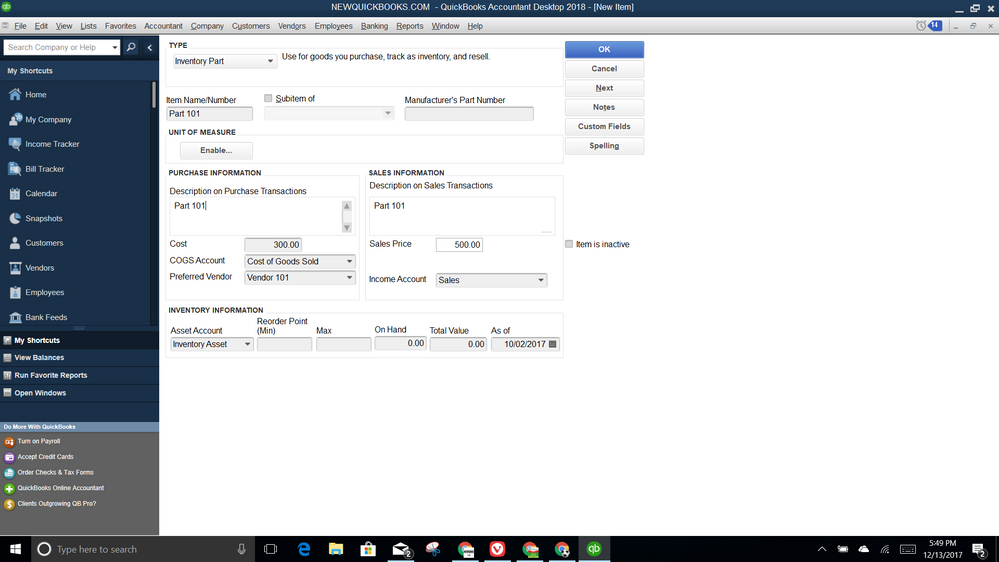

These three fields are important to set up inventory items. See screenshot sample below.

For COGS Account field = Cost of Goods Sold account type from the Chart of accounts

For Income Account field = Income account type from the Chart of Accounts

For Asset Account field = Inventory Asset account which is part of the Other Current Asset on the Chart of Accounts

You do not want to put in On Hand/Total Value info here.

3) For adding purchased Inventory items: Use Enter Bills under Vendor menu at the top or Write Checks menu under Banking at the top. Always use ITEMS tab, never Expenses tab.

4) For selling Inventory items: Create Invoice (or Sales Receipt). Use ITEM Code in the sales form. This will also automatically post COGS to P&L by reducing inventory counts.

If you need more info, you can always click HELP menu at the top and select QuickBooks Desktop Help and type INVENTORY HELP in the search field. If interested, you can also watch my famous how to inventory video tutorials on YouTube.

Hope this helps!

+

What do you think if I link both my Sales and Purchase to COGS?

Inventory and assembly items have three accounts

expense = COGS

income = your sales income account

asset = inventory asset

do not ever link income and expense to one account, improper accounting.

You may want to be familiar with these basic steps related to Inventory questions:

1) To turn on Inventory: Go to Edit menu at the top > select Preferences > choose Inventory & Items > Company Preferences > checkbox "Inventory & Purchase Orders are active" > click OK.

2) Create Inventory Items: Go to Lists menu at the top > Items List > Select Item tab at the bottom > click Item (or drop-down arrow) and select New > Type = Inventory Part and create a new item.

These three fields are important to set up inventory items. See screenshot sample below.

For COGS Account field = Cost of Goods Sold account type from the Chart of accounts

For Income Account field = Income account type from the Chart of Accounts

For Asset Account field = Inventory Asset account which is part of the Other Current Asset on the Chart of Accounts

You do not want to put in On Hand/Total Value info here.

3) For adding purchased Inventory items: Use Enter Bills under Vendor menu at the top or Write Checks menu under Banking at the top. Always use ITEMS tab, never Expenses tab.

4) For selling Inventory items: Create Invoice (or Sales Receipt). Use ITEM Code in the sales form. This will also automatically post COGS to P&L by reducing inventory counts.

If you need more info, you can always click HELP menu at the top and select QuickBooks Desktop Help and type INVENTORY HELP in the search field. If interested, you can also watch my famous how to inventory video tutorials on YouTube.

Hope this helps!

+

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here