Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowUsing memorized invoices, what is the most efficient procedure to record a net check from a property management company that retains a balance to pay repair expenses?

I use Class: Property, Customer:Bldg, Customer:Job: Prop Mgt Co, cash basis tax reporting, and a manual checkbook.

I incorrectly set up automatic memorized monthly invoicing to track rent receivable from prop mgt firm using Items such as mgt fee, plumbing repairs, electrical repairs, as negative offsets in the invoice to get to the net deposit, but that created P&L reporting problems. If I only collected 9 months of rent, paid 9 mgt fees, the P&L still showed a full 12 months of mgt fees (don't understand why, but this appears to be an incorrect method anyway).

Wasn't tracking the cash balance held by the managment company. Use a $200 ZBA, or ZBA and Petty Cash account for this property?

Example: $800 rent, $80 mgt fee, $20 (haha) repair expense, $200 balance retained by property mgt co.

Solved! Go to Solution.

Hello there, @deenerneener.

I appreciate you providing detailed information. I'm here to share some more insights and answer your inquiries about property management and repair cost.

That should answer your questions, @deenerneener. If there's anything else I can do for you, just let me know. I'm still here to help you more.

Thanks for reaching out back to me, @deenerneener.

I can share the reason why the negative amount posts in both an income and expense line item on a P&L (cash basis) report.

The posting account of the invoice depends on how the items were set up. You can verify and update the posting accounts by following these steps:

To learn more about items, you can refer to this article: Add, edit, and delete items. Once you update the posting accounts, automatically the P&L report should be corrected, deenerneener.

Keep me posted if you have additional concerns about reports and items. I'm still here to offer more help. Wishing you and your business continued success!

A warm welcome to the Community, deenerneener.

I'm here to lend a hand in deducting management and repair cost in QuickBooks Desktop.

In order to correct your memorized invoices, you can create a credit memo for the repair and management fees then link the credit to offset the invoice net deposit. This will correct your P&L report as well.

Here's how:

You can get insights in this article: https://quickbooks.intuit.com/community/Help-Articles/Record-a-credit-memo-or-refund-in-QuickBooks-D....

Also, you may find this article helpful: Remove or unapply a credit from an invoice or bill.

Let me know how it goes by leaving a reply below. I'll be around to help.

Thank you for the warm welcome, Credit Memo links, and detailed response RoseMarjorieA.

In the original invoice, I entered $800 for Rent income, and -$80 for Mgt Fee expense netting to $720 deposit. This creates an $80 Rent income and $80 Mgt Fee expense every month in the P&L even after entering a Credit Memo and applying it to an invoice. Entering a Credit Memo added an additional $80 to both the Rent income and Mgt expense line items as well in the P&L.

The negative Mgt Fee expense entered on the invoice is the culprit. Deleted them from the invoices.

Think I figured out how to set up and efficiently account for receiving a net check, and monitoring the petty cash held by the prop mgt company, using the example details below.

$800 rent,

$80 mgt fee,

$20 (haha) repair expense,

$200 balance retained by property mgt co.

(1) Create memorized, Prop Mgt Co_customer rent receivable using rent income item for $800.

(2) Record a GROSS rent payment $800 by the Prop Mgt customer and post against receivable.

(3) Create a Petty Cash bank account. Deposit $800 gross check to Petty Cash bank account.

(4) Create Prop Mgt Co_vendor. Use Petty Cash bank account register and pay $80 mgt fee and $20 repair fee to Prop Mgt Co_vendor.

(5) Use Petty Cash bank account register and transfer net check amount, $700, to actual bank account register using same deposit date.

(6) If ending Petty Cash balance reported by Prop Mgt Co differs from Petty Cash account, verify and enter additional payment to Prop Mgt Co_vendor so ending balance matches Prop Mgt Co reported ending Petty Cash balance, $200. If not, call and yell at them. : )

Any corrections/suggestions much appreciated.

@deenerneener wrote:

Using memorized invoices, what is the most efficient procedure to record a net check from a property management company that retains a balance to pay repair expenses?

I use Class: Property, Customer:Bldg, Customer:Job: Prop Mgt Co, cash basis tax reporting, and a manual checkbook.

I incorrectly set up automatic memorized monthly invoicing to track rent receivable from prop mgt firm using Items such as mgt fee, plumbing repairs, electrical repairs, as negative offsets in the invoice to get to the net deposit, but that created P&L reporting problems. If I only collected 9 months of rent, paid 9 mgt fees, the P&L still showed a full 12 months of mgt fees (don't understand why, but this appears to be an incorrect method anyway).

The issue is not the memorized invoice, that is fine, the issue is that you are using it for months that you should not. Rather than set it to enter automatically, set the memorized invoice to be scheduled, then you will see it in reminders, either use it or skip it as required.

Wasn't tracking the cash balance held by the management company. Use a $200 ZBA, or ZBA and Petty Cash account for this property?

Yes, this should be set up as a cash type bank account name it for the management company-escrow or something

Example: $800 rent, $80 mgt fee, $20 (haha) repair expense, $200 balance retained by property mgt co.

If they are holding 200 in escrow, and the expense was 20 for that month, then all they should hold back on that transaction is 20 - so I do not understand how this is working for you

Basically the invoice should look something like

rent, 800

fee expense, -80

plumbing exp, -20

net payment, 700

all they do is spend the 20 from escrow, report it to you, and hold back that 20, but from your view of things, the hold back is invisible, there was a 20 expense is all you enter. That assumes the escrow account they have has in fact 200 in it

Thank you for your feedback Rustler. Using a negative amount in the invoice created P&L problems for me where the $80 mgt fee showed up in both gross income and mgt fee lines, in every month where there was an accrual but no actual payment, even with using cash basis reporting.

Since I wasn't using a Petty Cash account, I wasn't able to systematically track whether the mgt company took funds without reporting the expense.

Adding the Prop Mgt Co as a vendor enables 1099 tracking too, whereas only having them as a customer for the receivable would not. Not certain of the risks or complications this might lead to having them as both a customer and vendor. Please review the proposed solution in previous post and let me know if you have any suggestions. Thank you.

Going back and deleting the deposits to adjust the invoices, re-depositing to Petty Cash, paying the vendor, and transferring deposit to real bank account is tough, but hopefully this is the correct approach.

$800 rent,

$80 mgt fee,

$20 (haha) repair expense,

$200 balance retained by property mgt co.

(1) Create memorized, Prop Mgt Co_customer rent receivable using rent income item for $800.

(2) Record a GROSS rent payment $800 by the Prop Mgt customer and post against the invoice depositing and deposit to Undeposited Funds on the Customer Payments window.

(3) Create a Petty Cash bank account. In the Banking Deposit window, select the pmt, then deposit to Deposit $800 gross check to Petty Cash bank account, select your bank account on the Cash Back Goes To box and enter the net check amount, $700 ($800-$80-$20).

(4) Create Prop Mgt Co_vendor. Use Petty Cash bank account register and pay $80 mgt fee and $20 repair fee to Prop Mgt Co_vendor, which nets out the $100 deposit and leaves the $200 petty cash balance (assuming it started with $200).

(5) If ending Petty Cash balance reported by Prop Mgt Co differs from Petty Cash account, verify and enter additional payment to Prop Mgt Co_vendor so ending balance matches Prop Mgt Co reported ending Petty Cash balance, $200.

Questions:

(1) Is the approach descibed above the best and most efficient method to account for a net check received from a property management company (or other similar business situations)?

(2) Any cautions/suggestions about having one company as both as customer and vendor (_c and _v)?

(3) Why does a negative amount entered in an invoice shows up on a cash basis P&L when there has been no pmt applied to the invoice? Mgt fee appears in both the Rent income line and Mgt Fee expense line on the cash basis P&L. Maybe this is an improper way to use invoices.

Hello there, @deenerneener.

I appreciate you providing detailed information. I'm here to share some more insights and answer your inquiries about property management and repair cost.

That should answer your questions, @deenerneener. If there's anything else I can do for you, just let me know. I'm still here to help you more.

Thank you @HoneyLynn_G. Not entirely clear why a negative amount on an invoice posts in BOTH an income and expense line item on a P&L report on a cash basis report, netting to 0, but that appears as an improper way to handle the transaction anyway.

Thanks for reaching out back to me, @deenerneener.

I can share the reason why the negative amount posts in both an income and expense line item on a P&L (cash basis) report.

The posting account of the invoice depends on how the items were set up. You can verify and update the posting accounts by following these steps:

To learn more about items, you can refer to this article: Add, edit, and delete items. Once you update the posting accounts, automatically the P&L report should be corrected, deenerneener.

Keep me posted if you have additional concerns about reports and items. I'm still here to offer more help. Wishing you and your business continued success!

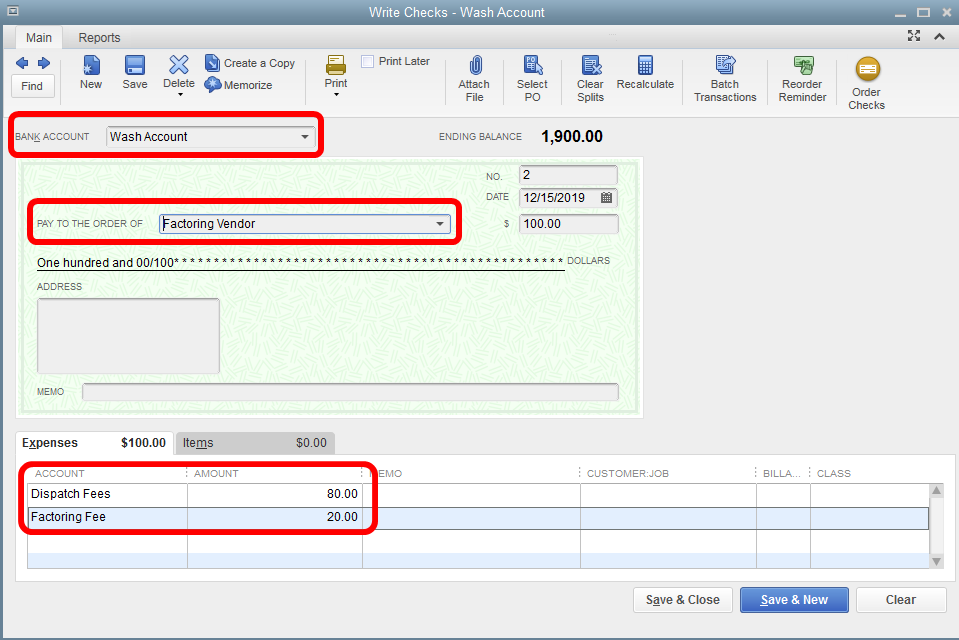

I have a similar problem and need help. I have a trucking company and we pay a dispatcher (dispatch fees) and a factoring company (factoring fees) for their services and these “expenses” are automatically deducted from invoice total. Example, the total invoice for “x” delivery is $1000, however, it is the factoring company processes the payment and automatically deducts the “fees,” therefore, actual payment to us (ach) is the $1000 minus the $80 dispatch fees and $20 factoring fee—net deposit: $900. I need to make the invoice match the deposit amount but still reflect the pmt made to dispatch and factoring. Help please

Hi there, @Garritt,

It's nice to have you as part of the discussion. I can provide you the steps to record the invoice payment less fees in QuickBooks Desktop.

There are a few steps you need to do to make sure your bank statement matches your data in QuickBooks. Here are the steps I've outlined for you:

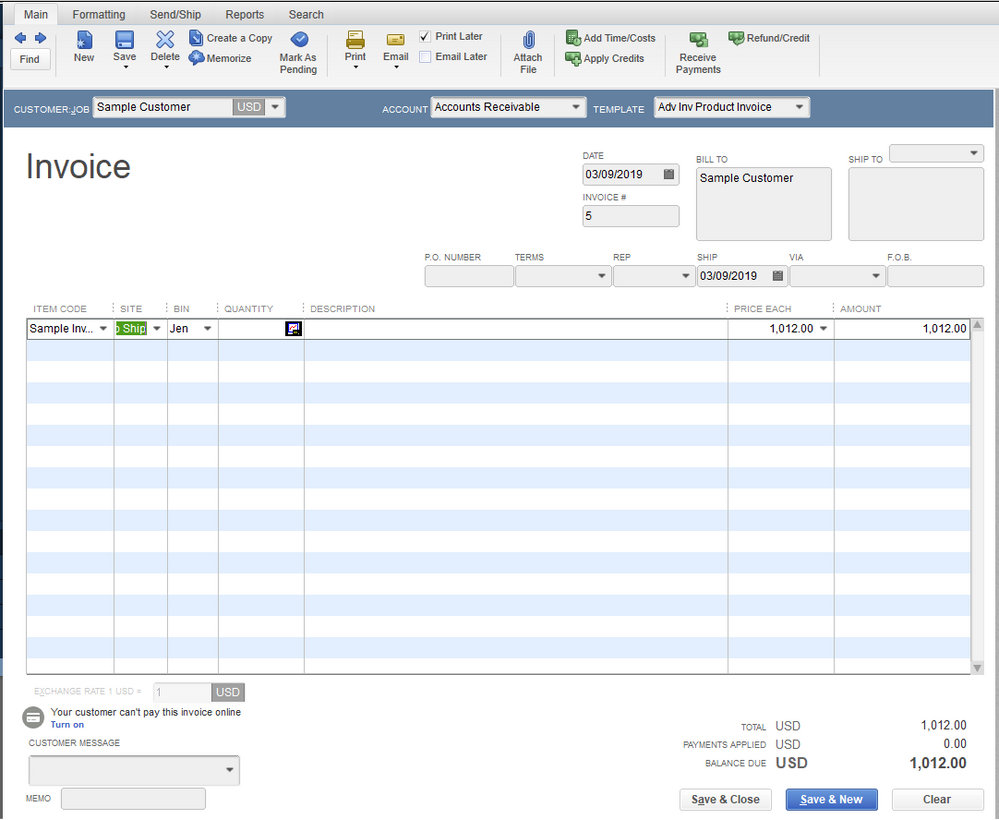

Step 1: Create the customer invoice.

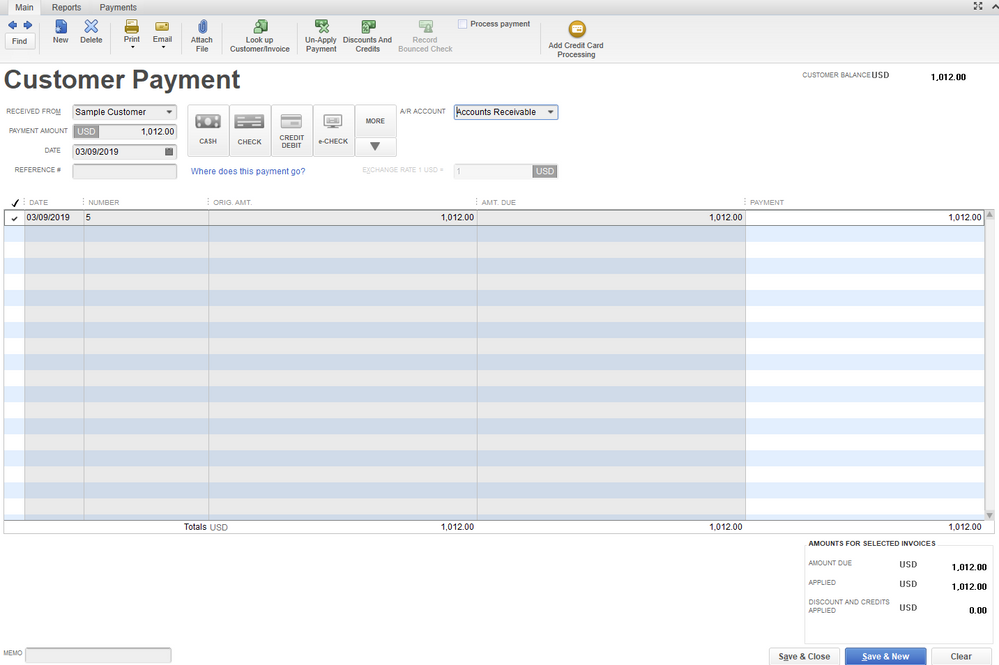

Step 2: Receive the full invoice payment to remove the A/R balance.

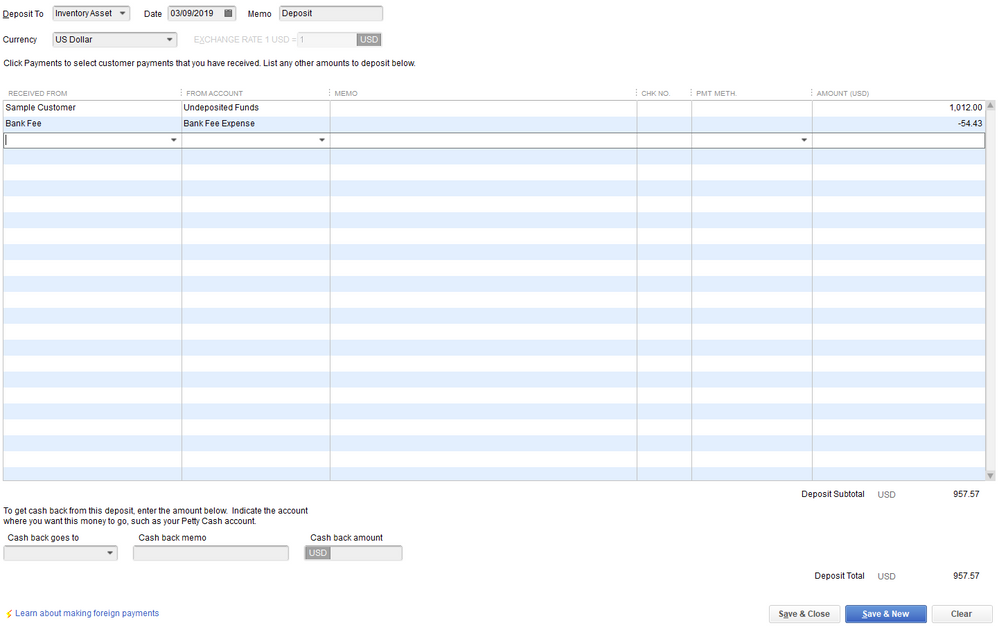

Step 3: Enter a Bank Deposit for the bank fee to relieve the balance from Undeposited Funds account. (See sample screenshot)

I'm confident those steps will help you match your bank statement with the deposit you created in QuickBooks. That should get you on the right track @Garritt. Please let me know if you need further assistance with recording the fees. I'm here to help you anytime. Have a great day!

Hi again — I followed your advice, however, when I went to check to see how the amounts were posted, I noticed that both the factoring and dispatch fees are being applied as deposits and not expenses. If

when I run the “expenses by vendor” report it doesn’t show i

those expenses because they are not set up,as vendors. They show up as deposits (in deposit detail report). Should I be setting them up as vendors and then invoicing them so that these “deposits” can be applied to them and be posted as the payments they were.? If so, how will it capture those payments as expenses—which will be deductible as “cost of doing business” or “expense”? Please advise. Thanks.

Thanks for coming back to the Community and for keeping us updated, Garritt.

Allow me to help make sure the transactions are posted correctly on your reports.

Since we enter the dispatch and factoring fees as negative amounts on the deposit, they are expenses for you. However, they'll show as a deposit on the reports since they were included on that transaction.

There's another way to enter this in QuickBooks Desktop. We can use a Wash account to move funds from one account to another. This will ensure the fees show as expenses on your reports.

Follow the steps provided by my colleague above on how to create an invoice and receive payment. Once done, please follow the steps I've outlined below:

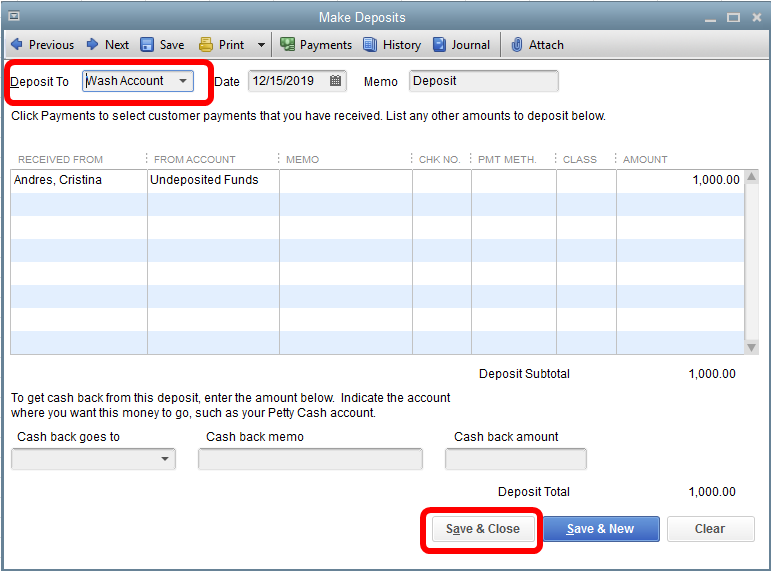

First, deposit the $1000 payment to your Wash account.

Next, write a check for the fees.

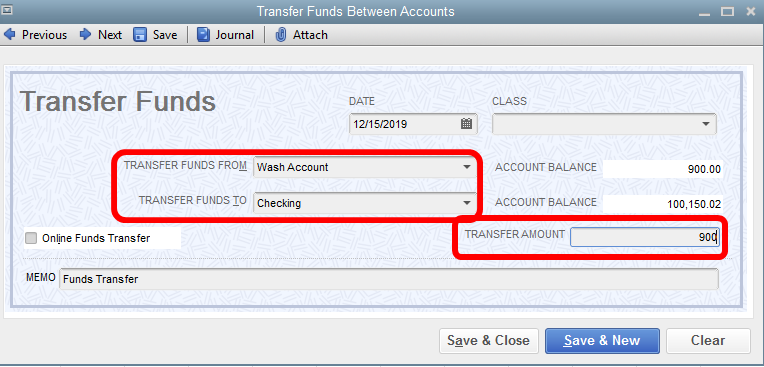

Lastly, transfer the funds from Wash account to the account you want to use.

You can now run the Profit and Los Detail report to review how the transactions are posted. Please make sure that the Wash account has a zero balance.

Following these steps should get you back in line. Please keep me posted and reach out to me if there is anything else you need about QuickBooks Desktop. I'd be happy to help. Have a lovely day!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here