Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHanding WIP in QuickBooks Online can be done manually, andy37.

QBO’s project feature is currently unable to cater WIP accounting needs. This is why your costs are eventually recorded as expenses.

You’ll need to create an Asset Account to track all WIP costs. Once the project is sold and complete, you can then transfer the costs from Asset to the Expense account. You might want to seek assistance from an accountant to set this up properly.

Also, I’ll take note of this preference and will let our developers know about the request.

Share those questions in mind by posting them here. We'll be happy to look into it and take care of it.

I have this problem too. What is the point of having the fancy project add on if I can't actually track my progress? I had to get the project add on so that I can create subcontractors (vendors) and allocate their expenses to the Project...but it seems like a giant waste if I'm unable to actually see those expenses until I move the entire pile from the WIP account to an Expense account when the project is sold. Is there a way to make the WIP expenses show up as expenses towards the project but not expenses on the P&L? How are other contractors doing this?

Thanks for joining the Community, bsimmons64.

I can certainly understand how an ability to run a profit & loss report that doesn't show your project expenses could be useful to yourself and others. I've submitted a suggestion about this to our developers as of today.

If you'd like to submit your own feature requests, you can do so while signed in.

Here's how:

Your feedback's definitely valuable to Intuit. It goes to our Product Development Team for review and will be considered in future updates. Feature requests can be tracked through our Customer Feedback website.

Currently, the best method for tracking Work in Progress (WIP) costs is as my colleague, MikiD, mentioned. If you need assistance setting everything up properly, you'll want to get in touch with your accounting professional. In the event you're ever looking for one, there's an awesome tool on our website called Find an Accountant. All ProAdvisors that can be found there are QuickBooks-certified.

If there's anything else I can help with, please feel more than welcome to post a reply anytime. Enjoy the rest of your day!

Has any progress been made on this request? Currently, I have to run a transaction list on my WIP account, add a customer field, dump it into Excel, categorize my expenses manually, then create a pivot table and my own P&L. That's insane.

It seems like an easy fix to allow some sub-categorization in the entry tables utilizing the Lists to feed Projects.

Cheers!

Thank you for visiting us today, @madametat2.

I recognize that this is part of your daily responsibilities. I'm here to express how to provide feedback and how to see product request updates will be available in QuickBooks Online.

Since this feature is unavailable in QuickBooks Online, we can submit feedback to our developer to run a profit & loss report without the project expenses showing. Furthermore, if you want to share your ideas, we'd be delighted to hear from you.

Here's how:

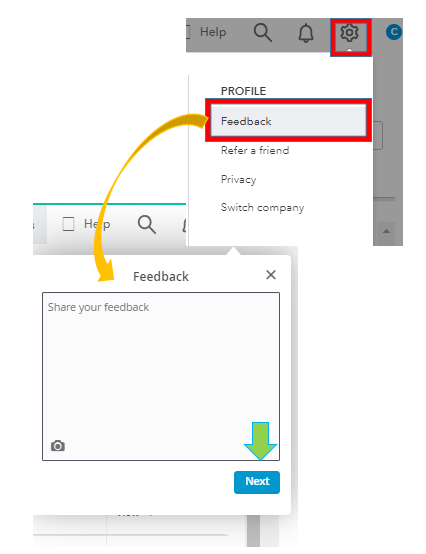

1. Select the Gear icon.

2. Select the type of feedback you want.

3. Leave your feedback or product suggestions in the box below.

4. Then, to submit feedback, click Next.

Once done, I'm excited to share the website where you can find similar suggestions and consider voting on other ideas you like. Go to the QuickBooks Online Features Requests page and search for ideas similar to yours using keywords.

I recommend keeping an eye on our blog to stay up to date on all the latest QuickBooks feature releases.

For your convenience, I've also included an article about the How Do I Questions in QuickBooks: Help Articles.

You are welcome to return to the Community at any time. I'll do everything to lead you in the right direction. Have a wonderful day.

All you costs that are going to the WIP need to be entered as items. Make sure every item has a customer name attached to it. You map your items to the WIP account (current asset account). To see where you're at, use the item profitablity report.

If you're doing progress billing, you'll have to modify the date of that report to do your journal entries to move costs over to cogs.

Hope this helps.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here