Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowThere is no field for entering an opening balance when setting up the chart of accounts. Pray Tell, how is this missing as this is a Bookkeeping 101 item required to set up the books. I tried making journal entries but ran into the next road block. There is no field there for tags so they don't show on my reports or are mixed up.

I realize the MO is to force us to upgrade but to not provide the most basic account tools is a sham. Not sure I will go from the 30 day trial to a purchase.

I'm ready to help you how to view the balances under the Chart of Accounts page, @lvloatreasurer.

To view the opening balances for your accounts, you can go to the Chart of Accounts in QuickBooks Online and select the account you want to view. From there, you can view the account history and find the opening balance entry.

Here's how:

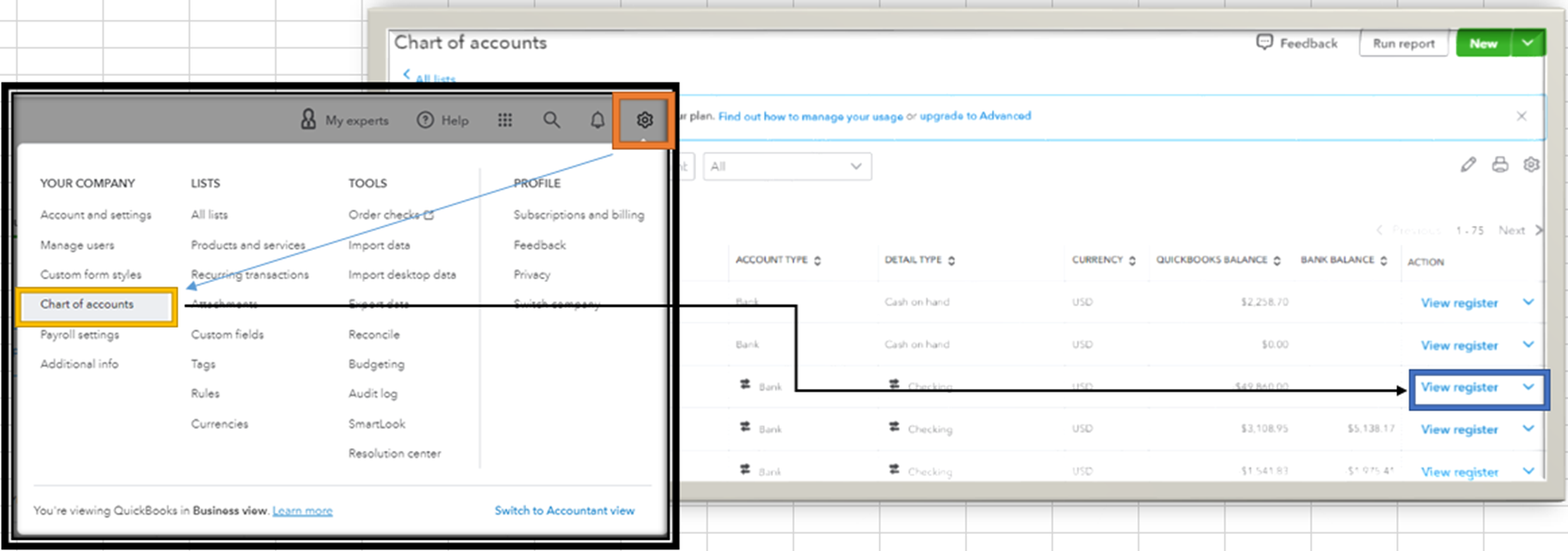

1. Go to the Gear icon and click the Chart of Accounts.

2. Click the View Register.

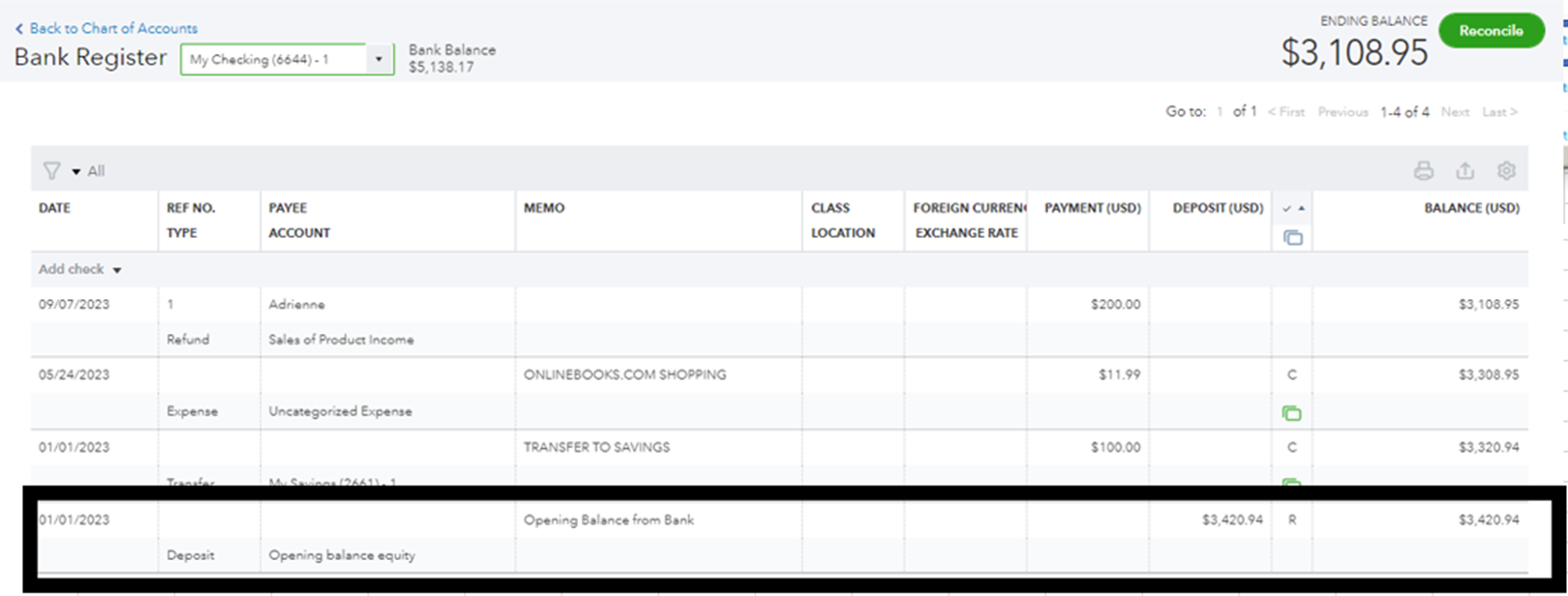

3. Scroll down and review the opening balances below.

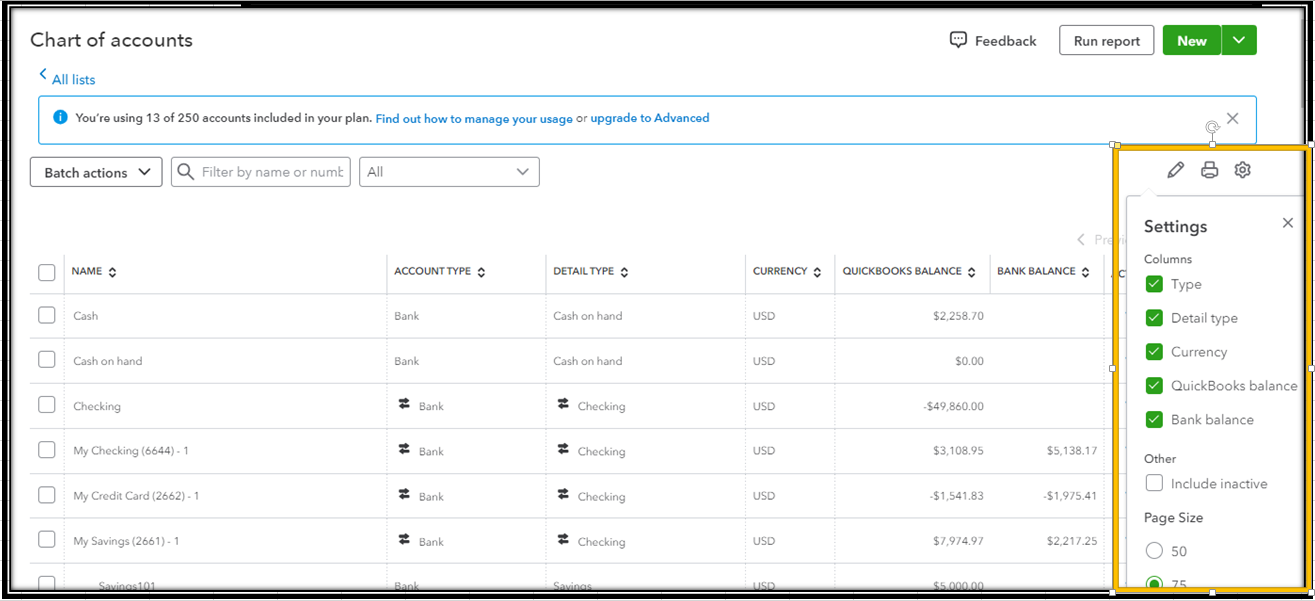

Furthermore, by adding columns, QuickBooks will display details like bank balance and QuickBooks balance within the Chart of Accounts screen. It can provide you with a quick overview of the financial status of your accounts at a glance.

Here's how:

Next, if you need to set up new accounts, here's an article for your reference: Add an account to your chart of accounts in QuickBooks Online.

I'm also adding these resources for managing your QuickBooks transactions and reconciling them: Reconcile an account in QuickBooks Online.

Please let me know if you have other concerns with your banking accounts. I'll guide you along the way.

This only applies to Bank and Equity accounts.

How about expense and revenue accounts which also need an opening balance to get the books started?

So simple but absolutely necessary. How can it possibly be missing?

Any accountants out there have an answer?

Hi there, @lvloatreasurer.

I understand how efficient it would be if both expense and revenue accounts had an opening balance. Expense and revenue accounts represent costs and income that are incurred during the accounting period. Opening balances should be entered for equity, asset, and liability accounts, as they represent the initial investment, value of assets, and amount of debt at the start of the accounting period.

There's still a way of adding an opening balance to expense and income accounts. This method is by creating a journal entry and adding an opening balance equity account. However, it's best to reach out to your accountant to ensure you are debiting/crediting these to the correct accounts. You can follow the steps in this article: What to do if you didn't enter an opening balance in QuickBooks Online.

Furthermore, you can also check this article about reconciling an account in QuickBooks Online.

Let me know if you have any other concerns about the chart of accounts. I'd be glad to assist. Have a great day!

"How about expense and revenue accounts which also need an opening balance to get the books started?

So simple but absolutely necessary. How can it possibly be missing?

Any accountants out there have an answer?"

It's never (as far as I know) been an option to enter opening balances for items of income and expense, even in QB Desktop. I think QBO does this more as a preventative measure than anything. It's not a necessary option because you can create journal entries, $0 bills, or $0 invoices, to perform the same function as an Opening Balance box. The easiest is to create journal entries: for revenue items, debit OBE and credit revenue. For expense items, debit expense and credit OBE.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here