Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

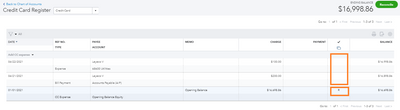

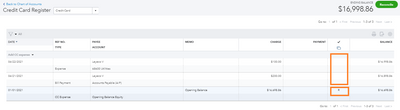

Buy nowHello, I'm trying to reconcile my credit card account for the first time and noticed that my opening balance was incorrect. I followed the steps to manually enter an opening balance of zero (the card had no balance when we opened the business). I tried to reconcile again, but the amount was still wrong. I ran a report and can now see there is another transaction (listed as a Credit Card Expense) showing an opening balance of $16,698.86. I believe this was the balance on the card when I imported all of my transactions into QBO. All of the other transactions look correct, but that particular transaction is causing the credit card balance to be about 30K, when it's actually closer to 15K.

Can I edit or remove that transaction so it stops doubling my balance without messing anything else up? If edit, can you please provide steps to change it to be my opening balance entry? Or how I can just zero it out since it's not an actual expense or charge? I've attached screenshots. Thank you so much.

Solved! Go to Solution.

Thank you for sharing your concern in such great detail, @XL_Velo.

When you reconcile an account for the first time, there's only one entry that's already reconciled. It's the opening balance entry. No other transactions should be reconciled. For credit card accounts, opening balances are entered as credit card expenses. Since this is a liability you owe to the credit card provider, it will show as a charge in the Chart of Accounts.

To check:

On the other hand, if this amount isn't included in your credit card statement, you have the option to delete it.

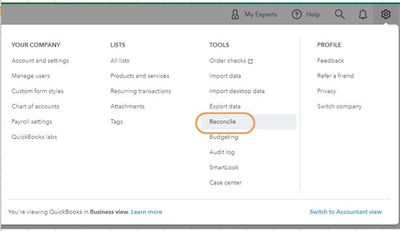

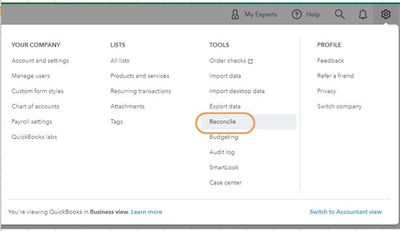

Once done, follow these steps to start reconciling:

To learn more about the reconciliation workflow in QuickBooks, you can refer to the articles below. It contains complete information to keep your accounts accurate:

Please let me know how it goes. I'm determined to help you fix this beginning balance issue. Have a good one!

Thank you for sharing your concern in such great detail, @XL_Velo.

When you reconcile an account for the first time, there's only one entry that's already reconciled. It's the opening balance entry. No other transactions should be reconciled. For credit card accounts, opening balances are entered as credit card expenses. Since this is a liability you owe to the credit card provider, it will show as a charge in the Chart of Accounts.

To check:

On the other hand, if this amount isn't included in your credit card statement, you have the option to delete it.

Once done, follow these steps to start reconciling:

To learn more about the reconciliation workflow in QuickBooks, you can refer to the articles below. It contains complete information to keep your accounts accurate:

Please let me know how it goes. I'm determined to help you fix this beginning balance issue. Have a good one!

Thank you, this worked and my balances matched. I have a follow-up question though. We have some personal charges on that same credit card account that I wanted to exclude, but per this article (listed as #1 below), excluding the personal transactions would make it hard to reconcile your account, so I followed the suggested steps in article (#2 below) to make an equity account for those transactions.

Upon trying to reconcile the first month, the difference is exactly the amount of the transactions that I categorized into the equity account. I can't move onto the next month now because the ending balance doesn't match. It seems the end result of excluding them or categorizing them into the equity account is the same. How do I fix this and get to $0?

Thank you again.

I appreciate your prompt reply, @XL_Velo.

I want to make sure I’ll be able to provide you the right information to get you on the right track. Can share with me the article you’re referring to? Any additional information can help us narrow things down.

Additionally, to ensure the accuracy of your accounts, I recommend working with your accountant for guidance. They’ll be able to provide you their expert advice on how to categorize those transactions to the correct account.

If you’re not affiliated with one, you can visit our ProAdvisor page and we’ll help you find one from there.

Once you’re all set, you might want to check this article for guidance in reconciling your accounts. This provides complete details in matching your bank balance and QuickBooks balance efficiently: Reconcile an Account in QuickBooks Online.

In case you have any other follow-up questions about reconciling your QuickBooks, you can always get back to me in this thread. I’ll be around ready to help you. Have a good one!

Oh my gosh, I forgot the include the articles!

Please let me know how to categorize or exclude these in a way that will allow me to reconcile the account. Thank you.

Thanks for getting back to us, @XL_Velo.

Based on the information you've provided, you should be able to exclude or remove the personal charges on your credit card after adding the transactions to the equity account you've created outlined in this article.

Since the issue persists, I highly suggest contacting our Support team. They have tools such as screen-sharing (remote access) that can pull up your account in a secure environment and check the cause of this odd behavior. They can also perform some troubleshooting steps if necessary.

Here's how to reach them:

I'm also adding this article that tackles reconciling your account in QBO for future reference: Reconcile an account in QuickBooks Online.

Please let me know how it goes or if you have any additional concerns. I want to make sure everything is taken care of for you. I'm always here to assist. Have a great day!

Hi @FritzF I haven't had a chance to call support yet, so I started reconciling a different account. The new account I'm working on also has items classified as personal charges, but I'm not running into the same issue (the personal charges show up and they are able to be reconciled).

I'm curious if the issue with the first account is that it's a credit card account?

Let's find out what causes the issue so we can fix your reconciliation, XL_Velo.

It's possible that transactions that were included in the reconciliation were mixed up with personal and credit card account. You'll have to make sure to drill down each transaction manually to ensure that all the same accounts have been grouped together.

In addition, double-check if the beginning balance is correct. This should match what's on your bank statement for the same start day. For more information, please check this article handy: Fix issues for accounts you've reconciled in the past in QuickBooks Online.

For your reference, you'll want to print the reconciliation report in case you need a copy and for future reference: How do I view, print, or export a reconciliation report?

Please let me know if you need further assistance with your reconciliation. I'll be here to help.

Hi @MariaSoledadG it doesn't seem like you read my prior question with Fritz as the answer you provided doesn't really match the issue. The opening balance issue was already resolved, but it brought to light a different issue that he was not able to resolve:

We have some personal charges on a credit card account that I wanted to exclude, but per this article (listed as #1 below), excluding the personal transactions would make it hard to reconcile your account, so I followed the suggested steps in article (#2 below) to make an equity account for those transactions.

Upon trying to reconcile the first month, the difference is exactly the amount of the transactions that I categorized into the equity account. I can't move onto the next month now because the ending balance doesn't match. It seems the end result of excluding them or categorizing them into the equity account is the same. How do I fix this and get to $0?

Please let me know how to categorize or exclude these in a way that will allow me to reconcile the account. This issue is happening only with the credit card account and not with the bank accounts, so I'm wondering if the solution does not work for CC?

Thank you.

Hello XL_Velo!

I'm joining so I can help you in fixing the credit card transaction issue.

It seems that you created the same transactions in QuickBooks Online. If so, make sure to match them to the downloaded personal transaction so it won't cause discrepancies. Follow the steps in this article: Categorize and match online bank transactions in QuickBooks Online.

It also depends on how these transactions appear on the statement. If the credit card statement doesn't include the personal charges, then it's best to exclude them in QuickBooks Online.

Let me know if you need more help by leaving a comment again here. Take care!

Hmm, these replies seem to be getting more off base...the transactions were not created in QBO. I have bank feeds set up so the charges appear on my statement and only once in QB.

There are personal charges on the account that I want to exclude, but then I would not be able to reconcile, so I followed the advice of the two QB articles below and put them into an owners equity account. The result of doing this is the same as if I excluded them. They do not show up on the the reconciliation report, and I cannot get my balance to zero because of this. The charges exist in QBO and on my bank statement. Is there a way to categorize these transactions that will allow me to remove them for accounting/tax/business purposes, and allow me to reconcile the account?

Allow me to chime in the discussion about reconciliation process, @XL_Velo.

I appreciate the time you've spent to get back in the community and performing the steps to make this transaction show on the reconciliation page. Since you've already followed the steps in the article about categorizing it to the Owner's Equity account using a check. I suggest checking the Bank Register to ensure that the transactions are Cleared so that they will appear on the reconciliation page.

Here's how to verify the transaction:

Once done, you can now continue your reconciliation process. I've included this article to know the next steps you can perform: Reconcile an account in QuickBooks Online.

Feel free to let me know how it goes so that I'll be able to help you further just in case you've bumped into any issues. Take care!

Thank you! This helped me realize that the charges were no longer showing in the CC register, but in the 'personal charges' account that I created. I guess now I can just reconcile the charges that are mission from the CC register separately and both accounts will show zero. Thanks again! (and if something is wrong with what I just said about reconciling in two accounts, please let me know lol).

Thank you! This helped me realize that the charges are now showing in the 'personal charges' account that I created versus the credit card account, so I guess I can just reconcile that account separately to bring both to zero off the same bank statement. Thanks again!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here