Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI received Accountant's copy from a couple of clients and have discovered that they have made payments to folks that should be receiving 1099s. These people were entered as "other names" rather than vendors. Is there a way I can print out a list that would have the Others along with any payments received? Or, do I have to go through each one individually to see if any payments were made to them during the year.

Thank you.

Lynda

Solved! Go to Solution.

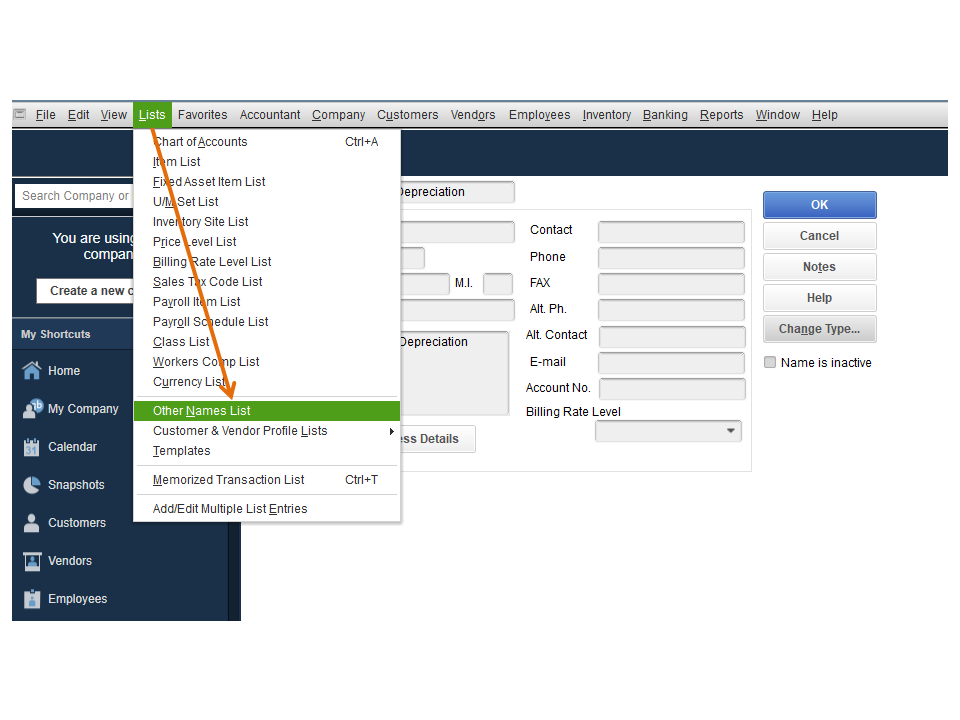

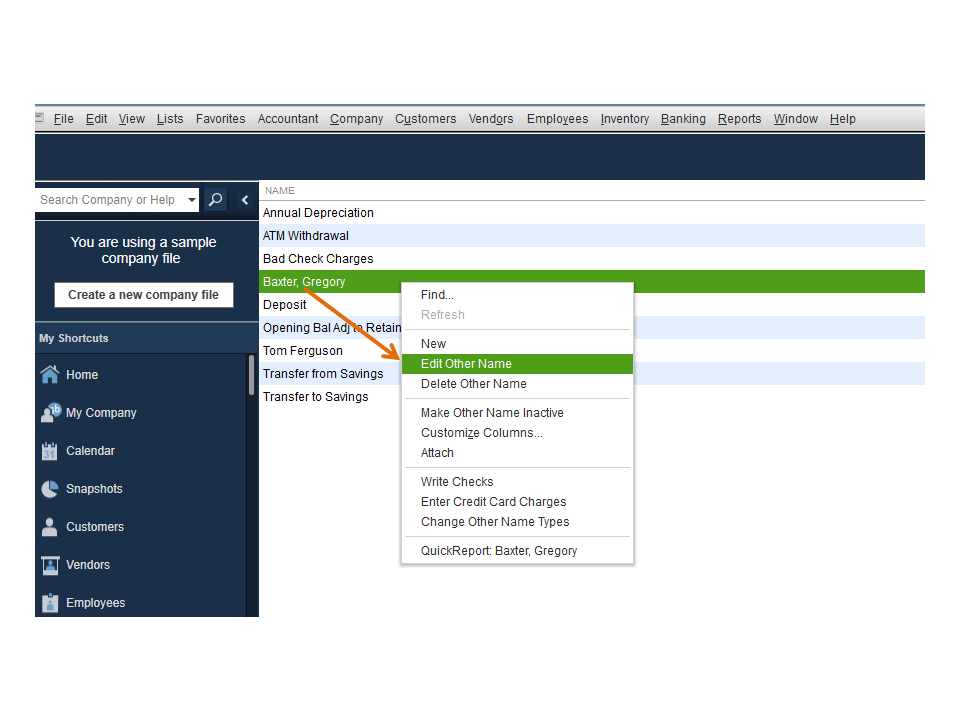

I found if you select

Lists

Other Names List

Activities

Change Other Names Type

You will be able to change those to "Vendor". They will then be able to be marked as a vendor eligible for a 1099.

I used the Add/Edit multiple List Entries to update any 1099 information requires (FEIN)

Thanks,

I dont have the answer to this, but have the exact same situation. Hoping by commenting I will be notified when other answers appear.

Thanks,

Thanks for visiting the Community, @lyndaj. I understand you want to print a list of people who are receiving 1099's.

We can pull up a 1099 report, and ensure that the Vendor eligible for 1099 box is unchecked. This way, it will show all of the vendors or other name even if they did not reach the IRS threshold. Here's how:

Then, start viewing the report by going to the Vendors menu, then select Print/E-file 1099s. Select 1099 Detail Report.

From there, you can go to the Print drop-down, and then choose Report. Select the print setting you want. Click Print, and then follow the on-screen prompts to continue.

For more details about 1099, I recommend checking these articles:

Comment down below if you have any other questions about the 1099 Detail report. I'll be happy to help you out.

This report only applies to "Vendor". I need to see those not selected as "Vendor"; but in the "Other Names List" with payments

I found if you select

Lists

Other Names List

Activities

Change Other Names Type

You will be able to change those to "Vendor". They will then be able to be marked as a vendor eligible for a 1099.

I used the Add/Edit multiple List Entries to update any 1099 information requires (FEIN)

Thanks,

Hello @slwhagenhoff1! Thanks for coming to the Community with your question and solution! I'm happy you figure out what you needed and that others with the same issue can try your steps as well.

If for any reason you need any additional help or have another question, please feel free to reply to this post. All of us here in the Community are eager to help!

By changing the other name to a vendor type, will those changes be saved in an accountant's copy, and then transfer back to the client in a file transfer? I don't want to have to do the work twice - once on our end, and then again on the client's end.

Thank you!

Thanks for following this thread, Pam2467.

Yes, the changes saved from the accountant’s copy are saved. Also, they’re carried over the client file transfer.

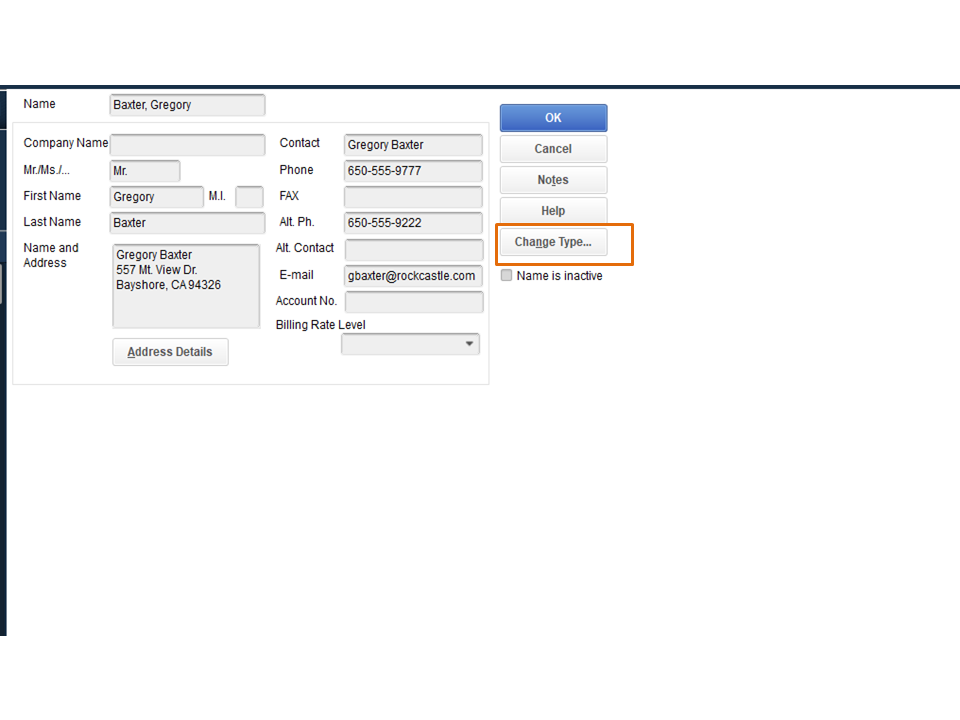

Here's how to update the name type:

Then, save your changes and corrections. Next, import the file (.QBY) so your client can apply the changes to the company file.

For more information about updating name types in QBDT, see the following guide: Change vendor, customer, or employee name type.

Let me share this article for an overview of the accountant’s workflow. It provides information of the process that you can and unable to accomplish using the accountant’s copy: QuickBooks Accountant's Copy.

Stay in touch if you have any clarifications or other concerns. I’ll be around to answer them for you. Enjoy the rest of the day.

We do accrual accounting. I need to enter the bill in prior year and then pay. The payment is for reimbursement so not vendor/no 1099.

Let me help you reimburse your vendor, @Jay Jay7.

There are numerous ways to reimburse a bill, depending on the situation. Happy to share detailed information for you to guide you accordingly.

You will need to record a deposit if a vendor sends you a refund check for a paid bill. Let me demonstrate:

After that, record a Bill Credit for the refunded amount:

Once done, let's link the deposit to the Bill Credit. Go as follows:

Check out this link to learn about the different ways to record vendor reimbursement: Record a vendor refund in QuickBooks Desktop.

On top of that, I recommend consulting with an accountant. They can provide additional guidance and may have another option to meet your company's needs.

Let me add the reference about Accounts Payable workflows in QuickBooks Desktop to better guide you.

If you have other questions, please feel free to keep in touch. We'll respond as soon as we can.

The following popup response to apply a 1099 to "other names" at this time resolved my mattr.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here