Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowWe overpaid on a vehicle loan. The financial institution refunded the amount in check form and that check was included with other checks in a deposit. It is showing as part of a preencoded deposit that I now need to match, however, I'm not sure of the process.

Thank you in advance

Barb

Hi there, @alicensetochill4461.

Thanks for taking the time to reach out to the QuickBooks Community for support. I hope you're enjoying the day so far.

For this one, you can manually record all the checks and send them to the Undeposited Funds account. From there, you can then manually create a deposit that includes those funds. Then, match the deposit that came from your bank. I've included some steps below to help walk you through the process.

To create a check:

Now that you've created the checks, you can use the guided steps included in Record and make deposits in QuickBooks Online to complete the process.

Please know that it's always best to consult with your accountant before making any changes to your account. If you don't have an accounting professional, don't sweat it. You can find one here in our Resource Center.

I'm only a reply if you have any questions or concerns. Take care, and have a good one!

I'm not sure if I explained it correctly... my preencoded deposit consists of 4 checks: 1 is for the refunded amount for the overpayment of a paid-off vehicle loan and the other 3 checks are for payments of invoices that I normally match to the invoice as a banking transaction. I'm not writing a check - this is a check that we received as an overpayment that we made on a vehicle loan, but I have nothing to match it with - if that makes sense.

Both the vehicle and the loan are also in our chart of accounts...

Thanks for following up with the Community, alicensetochill4461. I appreciate your detailed information.

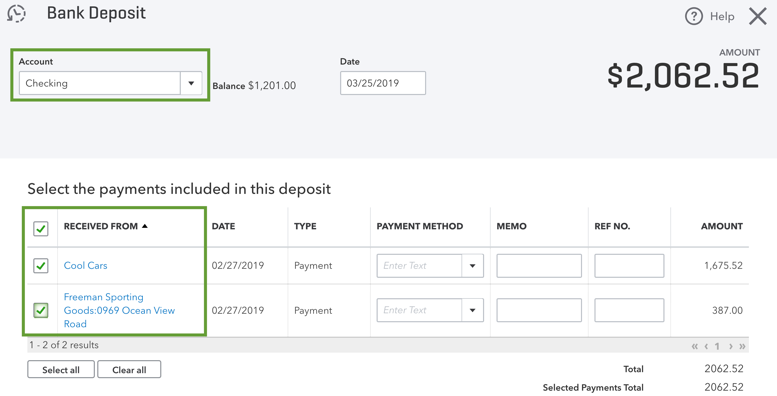

When you deposit funds into a bank account, your financial institution will usually record everything as a single record with one total. If you enter those same payments as individual records in QuickBooks, they won't match the way your bank recorded the deposit.

In these scenarios, you can combine transactions so your records match their real-life deposits. The first step is to put your transactions into the Undeposited Funds account. Next, you'll be able to combine transactions with a deposit.

Here's how:

Now you'll be able to proceed with categorizing and matching.

If you're still not certain how to go about accounting for your invoice payments and the refund you received, I'd recommend working with an accounting professional. If you're in need of one, there's an awesome tool on our website called Find a ProAdvisor. All ProAdvisors listed there are QuickBooks-certified and able to provide helpful insights for driving your business's success.

I've also included a couple detailed resources about working with deposits and loans which may come in handy moving forward:

I'll be here to help if there's any additional questions. Have a wonderful day!

I think the QB "employees" responding to your post may be bots. It's like they didn't even read your question.

In order to get all four checks into one single deposit you need to get all of those checks into undeposited funds. However, and this is the problem, the only way to do that is to use "Receive payments" on an invoice (which you did for three of them), create a sales receipt, or make a journal entry for the loan overpayment refund. If you overpaid the loan, you should have a negative balance for the loan equal to the deposit. If that's the case, the easiest thing to do is to make a journal entry: debit undeposited funds and credit the loan payable. Then, you can combine all four checks into one deposit. If the refund on the loan is for overpayment of something other than just the principal, you will need to split the credit portion of the journal entry into its proper accounts - i.e. interest, fees, etc. Hope that helps.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here