Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

BLACK FRIDAY SALE 70% OFF QuickBooks for 3 months* Ends 11/30

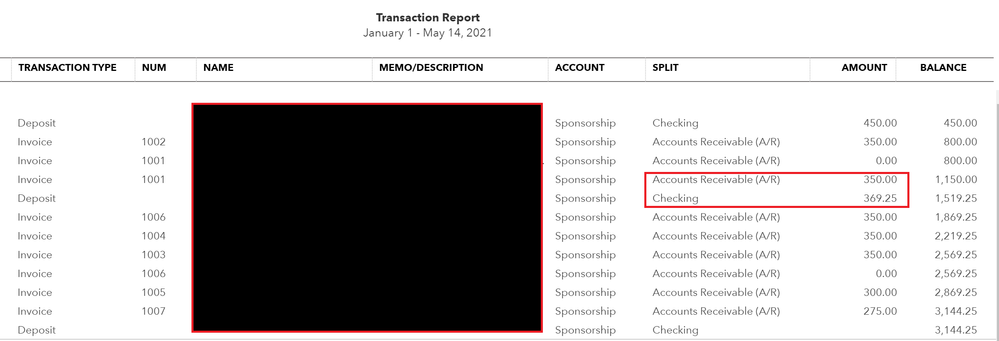

Buy nowHello. I'm having some trouble with getting the P&L statement to reflect the correct totals that were charged for invoices paid through Quickbooks online. I have several transactions that show the invoice number and each of those invoices has a total that does not included the taxes that were charged. I do have an example of one invoice the shows the actual correct total deposited into my checking account, but it appears to be a duplicate charge since both the total without tax is present and so is the deposit that has the correct amount with tax (see red box on screenshot).

Solved! Go to Solution.

I recognize the importance of having accurate books for your business, @bjazz.

I appreciate you for providing screenshots and all the steps you've done in resolving your duplicate transactions in QuickBooks Online. I'm here to help you determine where the 04/28/21 deposit comes from.

You'll want to access the Audit Log report to determine the transaction source. Let me guide you how:

Once you confirmed that the transaction is duplicate, then you'll want to delete it. Moreover, as my peer mentioned above, you can communicate with your account to check if you should be deleting the deposit. This way, your books are accurate.

If you're unable to delete it, please call our QuickBooks Specialist. They have can help you remove the transaction.

Here's how:

Make sure to call them within business hours to ensure we can cater to your concern immediately.

Lastly, feel free to visit these articles below about how to reconcile accounts, handle your banking transactions, and other related topics.

Let me know in the comment section if you have a follow-up question about your transactions. I'm happy to serve you. Keep safe.

Good day, bjazz.

Let me help with your question about running reports in QBO.

Can you tell us which part of the Profit and Loss Statement was zoomed in to get the transaction report or list of invoices and deposits? Please note that sales taxes are not reported in your Profit and Loss because they're part of your liabilities. They will be shown in your Balance Sheet instead.

I'd also like to ask how the Deposit recorded was recorded? Did you click the Receive payment option or did you make a bank deposit? If so, this can be the reason why both the invoice (without tax) and the deposit (with tax) are shown separately in your report.

If that's the case, I'd recommend reaching out to your accountant and check if you should be deleting the deposit. Although, you can also change the account used to Accounts Receivable. Then, follow the steps in this article on how to link them together: How To Link A Deposit To An Invoice.

Let me also share these articles for additional details about running reports in QBO:

Please add a reply below to add more details. I'll jump right back to help you again.

Hi bjazz,

Hope you’re doing great. I wanted to see how everything is going about the different totals in your Profit and Loss statement. Was it resolved? Do you need any additional help or clarification? If you do, just let me know. I’d be happy to help you at any time.

Looking forward to your reply. Have a pleasant day ahead!

Hi JenoP. Thanks for reaching out and my apologies for the delayed reply. The placed I started with was the Sponsorship link on the P and L statement (box in red). From there it took me to the screen that has the breakdown I had in the first screenshot you saw in the initial post.

As for the Deposit that is a duplicate of the invoice transaction, I'm trying to figure that part out as well. I believe the deposit was received initially via invoice through Quickbooks and then auto-deposited into my checking account. I made no manual deposits for any transactions included. Once this happened, I had the option to match the transaction to a deposit that was in linked to my checking account so I selected that option. I did this for the remaining invoices that are also included in the first screenshot and it seems to have worked properly with none of those being duplicated. However, this single transaction has a duplicate for some reason. .

I do believe the deposit with tax is showing up accidentally but I'm not sure why. I have checked my categorized transactions but don't see a duplicate there so I'm not sure where it originates. However, I also followed the steps in the link you included about linking a deposit to an invoice (thank you for sharing that) and was able to see both transactions in the Chart of Accounts section (see screenshot below).

After seeing this, I was able to link the transaction to the deposit similar to how it shows up for the other sponsorships that were paid using the Quickbooks invoices. However, this still didn't completely fix the problem since that duplicate deposit remains (see screenshot below).

It looks like deleting the transaction on 04/28/21 would be the next logical step, but I'm not sure if that's best. Any other suggestions how to determine where the 04/28/21 deposit comes from and if it's able to be deleted for this issue?

I recognize the importance of having accurate books for your business, @bjazz.

I appreciate you for providing screenshots and all the steps you've done in resolving your duplicate transactions in QuickBooks Online. I'm here to help you determine where the 04/28/21 deposit comes from.

You'll want to access the Audit Log report to determine the transaction source. Let me guide you how:

Once you confirmed that the transaction is duplicate, then you'll want to delete it. Moreover, as my peer mentioned above, you can communicate with your account to check if you should be deleting the deposit. This way, your books are accurate.

If you're unable to delete it, please call our QuickBooks Specialist. They have can help you remove the transaction.

Here's how:

Make sure to call them within business hours to ensure we can cater to your concern immediately.

Lastly, feel free to visit these articles below about how to reconcile accounts, handle your banking transactions, and other related topics.

Let me know in the comment section if you have a follow-up question about your transactions. I'm happy to serve you. Keep safe.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here