Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHI , I am using QBs Desktop pro plus 2021 (upgraded yearly). We use to use QBs payroll system. We switched to an outsource payroll company. By the previous accountant I was asked to put all the payroll taxes EE and ER into the payroll tax liability account, which I have. But because the outsource company takes a lump sum to cover the expense, the account is in the negative. I would like to fix that so it show zero - at least for the year end if not weekly. I do an ACH to the payroll company weekly. Should I invoice the payroll taxes and then "pay" them?

Thanks for dropping by, HOw to clear a depost from serva. Let's get your liabilities zeroed out.

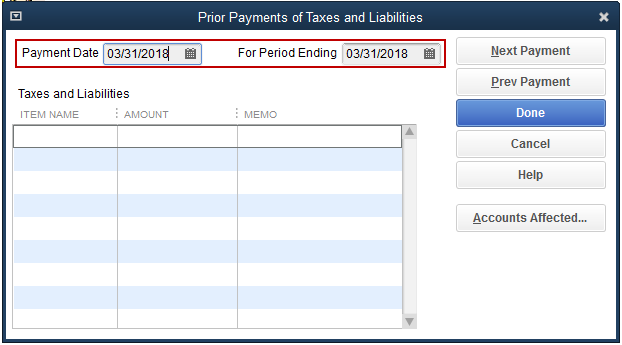

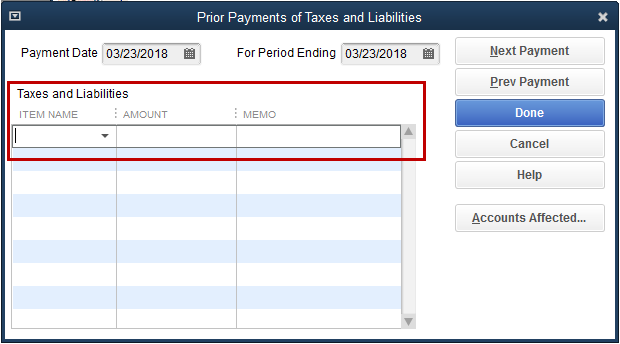

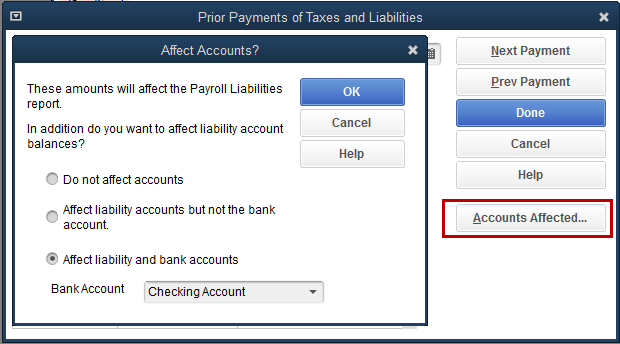

If you already paid those payroll taxes outside QuickBooks, you can use the Enter Prior Payments feature in QuickBooks Desktop to record the payments. Here's how:

However, if you haven't paid the taxes yet, you can write a check and choose the correct Liability Account. To know more about this process, you can read through this article: Enter historical tax payments in Desktop payroll. This will provide you other ways on how to record tax payments as well as a link to access your historical payroll data.

I want to be your main point of contact, so please let me know if you have any other concerns or questions. Please know I'm ready to assist further. Have a good one.

Hi, HOw to clear a depost from serva.

Hope you're doing great. I wanted to see how everything is going about your payroll tax liabilities. Was it resolved? Do you need any additional help or clarification? If you do, just let me know. I'd be happy to help you at anytime.

Looking forward to your reply. Have a pleasant day ahead!

When I attempt to follow the directions, my system does not look anything like what you have shown in your reply. So, when I start to enter the date on what shows for me, the second screen ask me when I would like to begin QBs payroll --- I do not want QBs payroll, the past person was not making payments to the Federal or Local governments. So to prevent this from happing again, when I took over, we hired and outsource payroll company. (I also had to clear up all payment and fillings that were not done). QBs would not let me see any past payroll reports or fillings once payroll was canceled with QBs-- had I know I would have printed everything out. So I am not happy with QBs payroll.

I will have to come up with another way. I do not need the amount to come out of the checking account, as the payroll taxes have been paid. That is why there is a negative amount in the Payroll Liab. account.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here