Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Using 2020 QuickBooks Desktop Premier Contractor Edition

When doing a P&L by job, I realized that the income received from a job was exactly $100,000 too low. Could not understand since bank account has been reconciled. Deposit clearly shows correctly. After a lot of investigating it was discovered that although an invoice for this particular customer was entered, and paid, and marked paid properly, and the deposit recorded properly, the amount shown in the P&L for income is exactly $100,000 off. It does not matter if I run the report in accrual method or cash. The results are the same.

The total amount of the invoice was $166,250. The invoice DID have one line item of $100,000. But still, when the customer sent payment, the payment clearly reflects it being applied to the correct invoice for the full amount of the invoice of $166,250.00

Where did the $100,000 go ? Why is it not reflected in the job P&L report.? I also did a search for the invoice, and it comes up with 4 line item amounts totaling only $66,250. But when I pull up the invoice itself, it is cearly for the full $166,250.

Sorry if I am repeating myself, but I have done everything I can think of and have come up with no explanation.

Any ideas? I spent a good amount of my afternoon trying to figure this out.

I appreciate the detailed information you've shared, pjmitchell55.

Please allow me to help share additional information about running the Profit and Loss Detail report in QuickBooks Desktop (QBDT).

The Profit and Loss report summarizes your income and expenses for the year to know whether you're operating at a profit or loss. However, you can create/run a report which shows payments in QBDT. As of now, you can start opening the Transaction List by Customer report and make the necessary customization. Here's how:

Also, let's make sure it was properly deposit to the correct bank account. To learn more about running and customizing reports in QBDT, you may check these articles:

Don't hesitate to leave a comment below if you have any other questions about the report. Have a good one.

Thank you, however this does not explain what I am asking. I want to know specifically why a deposit that in every other way appears to have been done correctly does NOT show up in P&L reports (does not matter if run in accrual or cash method).

I very clearly see the payment made, and applied correctly to the correcty invoice. I very clearly see the deposit made for the full amount. But when I run the P&L it is $100,000 under the correct amount. I do see a line item in the invoice for $100,000. But the invoice as a whole was paid and applied correctly.

I run customized reports frequently. THIS is a complete mystery and makes me concerned about what else is not appearing correctly in P&L reports and why it could be happening.

Welcome back to the Community, pjmitchell55.

I appreciate adding more details about the issue. This gives me a clearer view of what happened to the report.

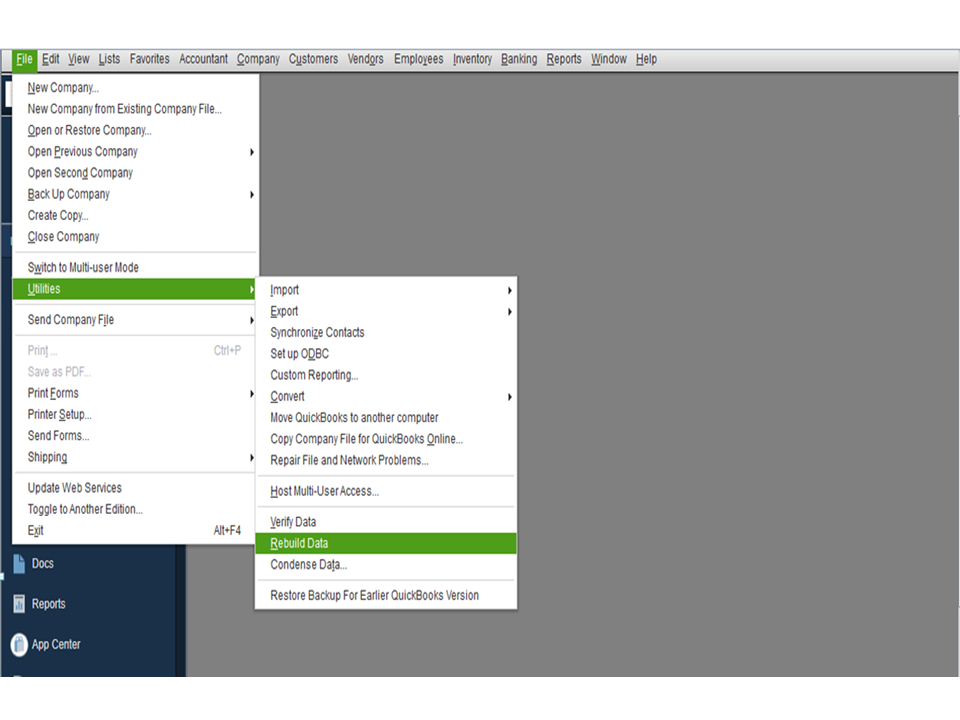

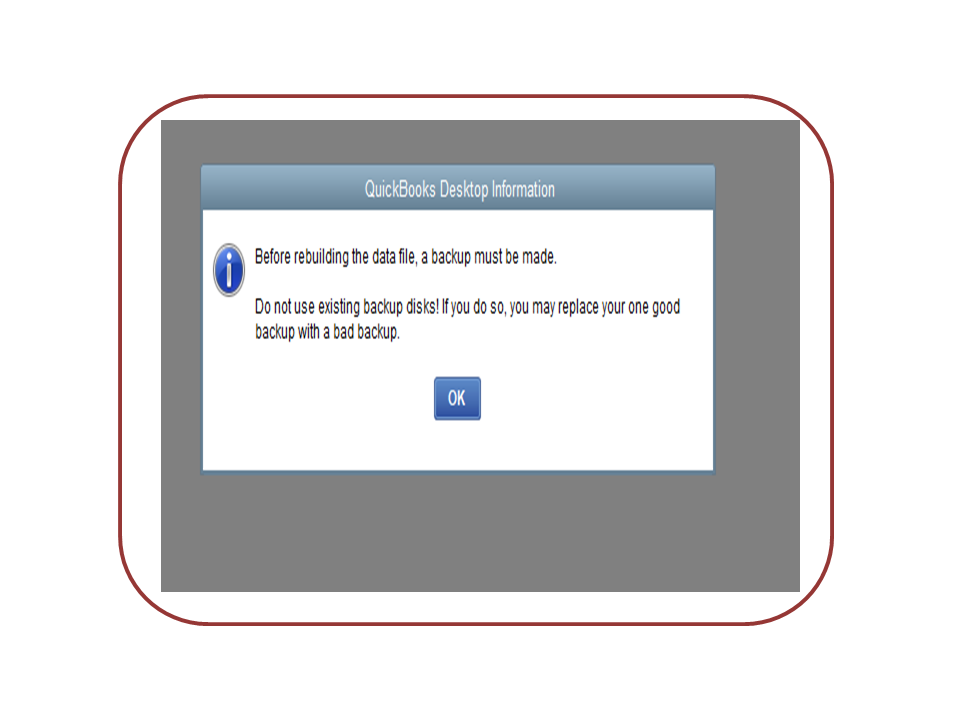

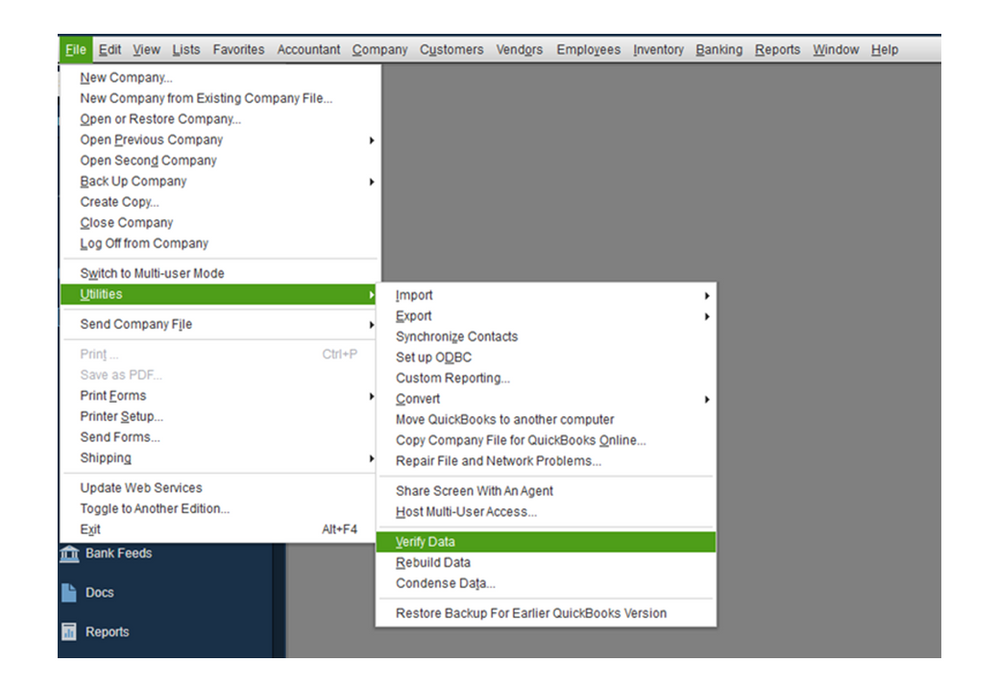

Based on the information shared, we’ll have to run the Verify and Rebuild Data Utilities. These are built-in tools used to validate whether your file is still in good shape and fixes common errors.

To begin, run the rebuild tool after creating a backup of the company file to resolves data integrity issues. Verifying the file identifies the most commonly occurring data issues.

If it finds an issue, check the damaged transaction/s shown in the QBWin.log and apply the solution. For detailed instructions, follow the instructions in this article and go to the Apply the appropriate fix on the transaction/s. section: Fix damaged transactions in QuickBooks Desktop.

Additionally, this guide provides an overview of how to resolve data issues: Fix data damage on your QuickBooks Desktop company file.

Please let me know if there's anything else you need. I'll be here to keep helping. Take care and have a good one.

Thanks for the response. I ran the Rebuild & Verify data utilities. Nothing changed unfortunately. I am at a loss. I'll keep exploring why the P&L report is not including that $100K when all looks ok. Sigh.

HA! I figured it out - just wanted to update. I looked at the invoice and the line item for $100k. I checked the item list for that item and realized the associated account was "contstruction in progress" instead of "construction INCOME" !!. I changed it and the report is right now.

Hi there, pjmitchell55.

Thanks for dropping by the Community and providing an update. I'm happy to see that you were able to find that discrepancy!

If you have any other questions, feel free to post here anytime. Thanks for your time and have a lovely day.

I can't seem to get an answer as to why when I run a cash report, it's correct on the P&L but when I run an accrual report it shows very little income. I have a lot of invoices that were billed for work done and we are awaiting payment. Those invoices should show up on the accrual method but they do not. If I put in May, for instance, it shows only outstanding for May and not total outstanding for the year??? It was showing correctly in the past. what has changed? how do I fix this so the accrual report is correct

Hello there, @Carolexx.

Please allow me to help share additional information about running the Profit and Loss Detail report in QuickBooks Desktop (QBDT).

The Profit and Loss report summarizes your income and expenses for the year to know whether you're operating at a profit or loss. However, you can create/run a report which shows payments in QBDT. As of now, you can start opening the Transaction List by Customer report and make the necessary customization. Here's how:

Also, let's make sure it was properly deposited to the correct bank account. To learn more about running and customizing reports in QBDT, you may check these articles:

Don't hesitate to leave a comment below if you have any other questions about the report. Have a good one.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here