Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHello,

We are a cash basis company and utilize only cash basis reports. Partial income (9.14%) is shown on the P&L as well as a partial sales tax liability (9.14%) on the balance sheet for each invoice created for a specific customer regardless of payment. All other customers are showing correctly on the balance sheet and P&L. For example, $100k in field work is invoiced as well as $9k for sales tax in January. QuickBooks is then recognizing $9,140 as income and $822.60 as due to the Dept of Rev in January. It is considering 9.14% of each line as paid in January even though the invoice shows unpaid with the full balance due. How do I get this to stop? I only want to recognize revenue/liability if the invoice is paid since we are cash basis. Thanks in advance.

Product: Enterprise Solutions 21.0

Thanks for sharing details, @Construction999.

Let me share some insights on why it appears that reports are calculating partial income and sales tax without applied payments.

When you pull up detailed reports in QuickBooks, their default is accrual basis. Also, summary reports can be on a cash or accrual basis, the keyword to identify is having the word Summary in their titles.

In this case, let's make sure that you've set the company's preferences on a cash basis so it could generate the cash base report you want.

Here's how:

Once done, rerun the Profit and Loss report to see the difference. I'll add this reference to learn more about this setup: Differentiate Cash and Accrual basis.

Additionally, you can modify detailed reports in QuickBooks, simply click the Customize button on a report window. For detailed insights on how to filter and add columns to a report, you can check this reference: Customize reports in QuickBooks Desktop.

Please leave me a comment below if you have other concerns with cash and accrual-based reports. I'll answer them for you. Take care!

Thank you for your message. As I posted in the initial post, all reports are already generating on a cash basis. The error I mentioned occurs when the reports are under cash basis. Partial income and sales tax liability are shown on the balance sheet and P&L even though no payments have been applied to the invoice. Please assist.

Thanks for sharing this concern with the Quickbooks Community, @Construction999,

What's happening in your end is rather unusual. In this case, let's diagnose if the problem is caused by minor issues in the program.

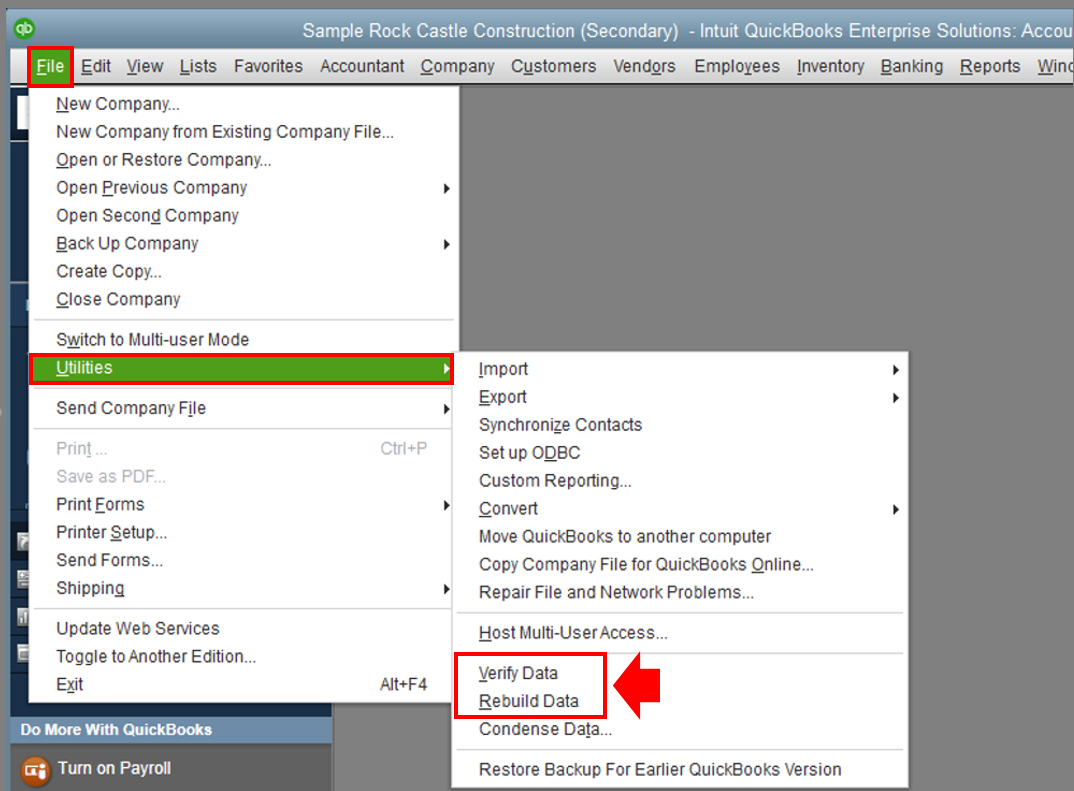

Run the Verify/Rebuild Utility to check any data issues within the company file. This built-in tool automatically fixes minor program data issues like the one you experience when running cash basis reports.

Here are the steps to do it:

For your reference, see the following link to learn more about this tool: Resolving Potential Data Issues

Once done, try running the report again and see if it resolves the problem.

However, if you get the same result after doing so, I recommend reaching out to our Support Team. They can initiate a viewing session with you and help diagnose the company file to verify what causes the problem.

To get our support, follow the steps below:

Refer to this article to learn more about our contact options and support availability: Contact QuickBooks Desktop support

Also, kindly update me with the result in this thread. I want to make sure this reporting concern is resolved so you're able to view reports with accurate data in it.

RE: QuickBooks is then recognizing $9,140 as income and $822.60 as due to the Dept of Rev in January. It is considering 9.14% of each line as paid in January even though the invoice shows unpaid with the full balance due. How do I get this to stop?

Are there any negative line items on the invoice? If so, they can cause this if they are not Discount type items.

This is because negative lines (that are not discounts) are considered returns that "pay" the invoice, just as if you'd created a credit memo for them and applied it to the invoice.

Thanks BigRedConsulting! Support just identified the negative line item as the source of the error. Retention is shown on the invoice. Do you know how to do a negative line item on the invoice without it affecting the reports?

We identified the negative retention line item as the source of the error. Is there a way to keep the negative line item without the system realizing income or sales tax liability on the statements?

Can you describe the case in more detail? What is the nature of the retention that reduces the invoice amount?

Retention is something stated in the contract between my company and the customer. Let's say we have completed $100k worth of work with a sales tax of 9%. The invoice would be as follows:

Gross Invoice $100,000

Retention <$10,000>

Sales Tax $9,000

Net amount= $99,000

Retention will be paid at a later time. The customer does not want to pay sales tax on the retention value at the end of the project, so we collect and remit sales tax in full when the net amount is paid. Sales tax would not calculate correctly without the negative line item on the invoice. Does this help?

Hello! Did you ever get this figured out? I'm having the same issue with retention.

Hello, @icjerk.

Can you tell me more about the retentions that you're referring to? That will surely help us provide an accurate solution to the concern that you're having.

You can click the Reply button below to add more details.

I'm looking forward to hearing from you soon! Take care, and have a wonderful day!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here