Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hi,

I would like to know what is the best way to invoice clients for software licenses (like QBO :P).

How can we accelerate the process with 50 current license to accrure each month ?

Context:

- Knowing that the license is for a specific period, lets say 1 year, and that we have to recognize a portion of revenue from this license sold each month.

- I can set a service linked to an unrecognized revenue account ( liability account)

- Can we automate revenue recognition based on a << service date period fiel>> in QBO ? Or should I track the revenue recognition in an excel file ?

Ex : we sell 1 licence for 100 CAD for the following period :January 01 2020 to December 31 2020

Hi there, @Benji09.

Thank you for posting to the Community.

We can accelerate the process by dividing it. Instead of creating one transactions for whole year we can divide it, then we need to create recurring transaction per month. This allow your customers the options to choose when and how much to pay.

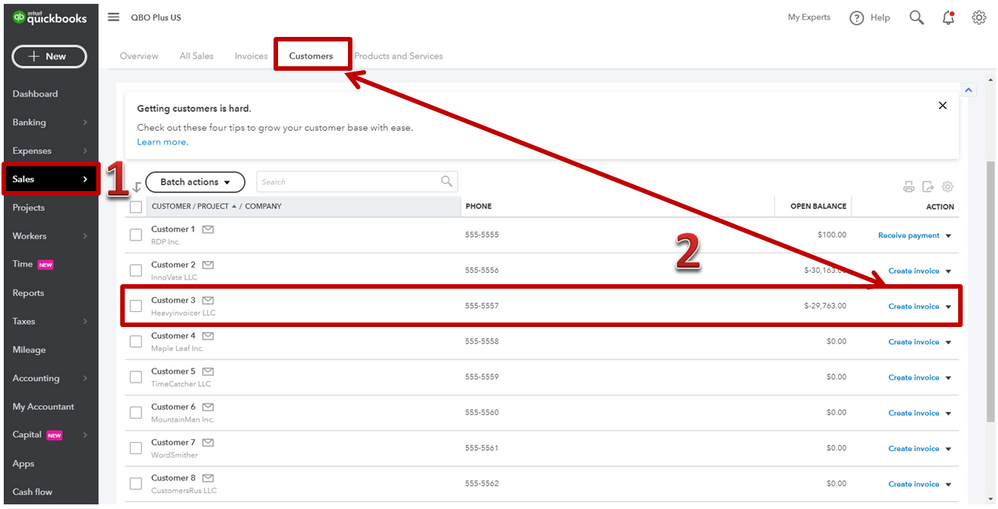

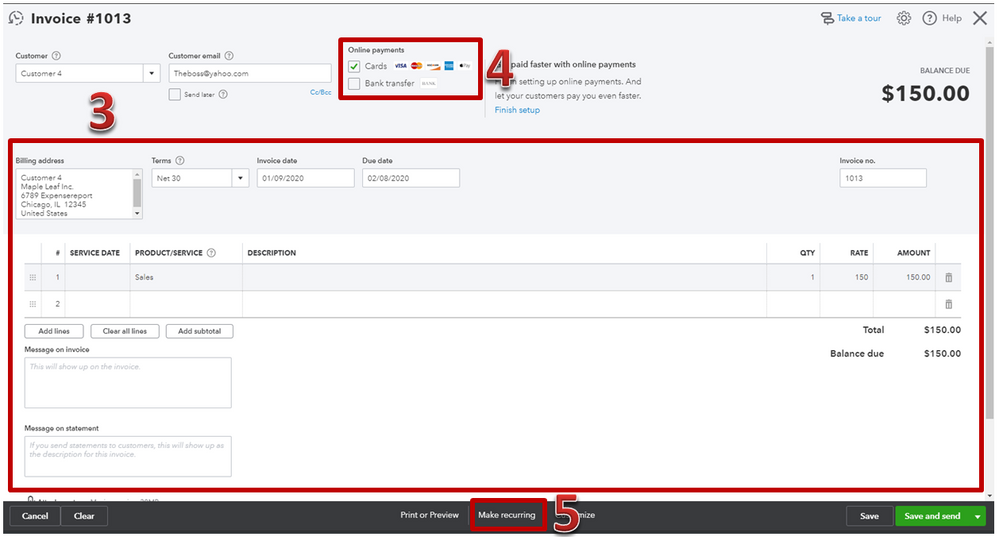

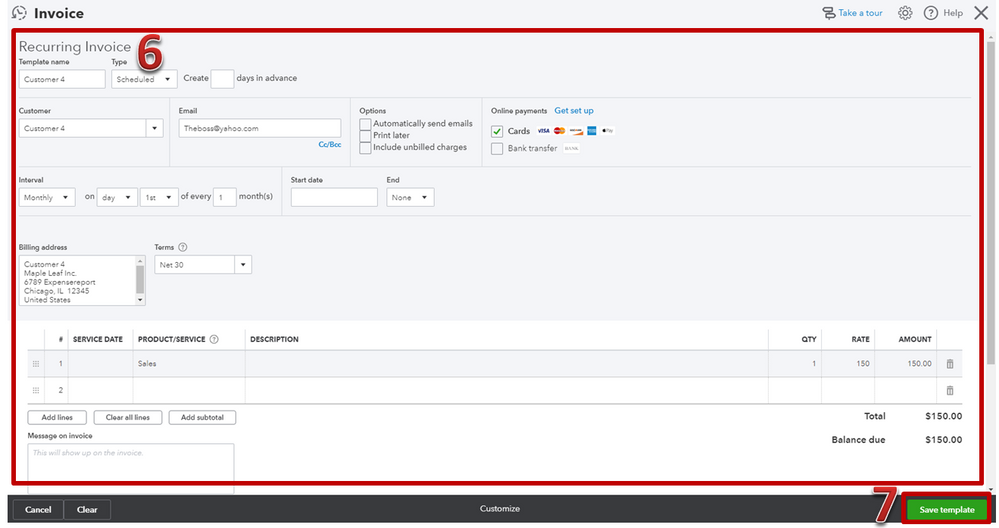

To create recurring transaction here's how:

Once finished, you'll be able to view the recurring invoice on Recurring Transactions.

I've attached additional article to help you guide on how to set schedule for recurring transactions:

I'm just a post away if you should have any questions. Have a lovely day.

Thanks for your answer!

So if I understand I will only send one invoice to the clients with service item linked to deferred revenue liability account.

And at the en of each month an automated invoice will be created with two service items :

- 1 item to the portion from deferred revenue

- 1 item to recognize the portion of the monthly revenue

So the total of each recurring invoice will be 0$.

Looks fine to me !

Suggestion to QBO DEV : a period field with starting and ending date would be amazing to automate revenue recognition and immobilization amortization I guess ?!

You're on the right track, @Benji09!

I'll also take note of your request and submit it directly to our developers so they'll know of your need to customize a certain field for preferred dates.

I've got you these articles for future updates about the features of our product:

Keep me posted in the comment section down below if you have any other questions. I'm always around happy to lend a helping hand.

as another option, consider a recurring billing app and sync it with your QBO

Hope it helps.

Hi there,

Thanks it helps me for another matter but in this case the client pays the whole amount upfront. So one bill and monthly automated adjusting entries to recognize revenue I guess.

Hi @Benjie09.

You have to create a prepayment for your customers and manually enter the payment.

Let's start creating an account for posting the deposit you receive from your customer. Let me walk you through the steps.

Here's how:

Next, create the item you’ll use to invoice customers for the deposits. To add a Service item, please follow these steps:

Once done, you can start with invoicing the customer for the initial payment. This allows the deposit to be shown deducted from the final invoice total, where the customer can see they are receiving that credit.

When you create a Bank Deposit, you use the Accounts Receivable with the name of the customer, and then you can apply this to the invoice through Receive Payment.

Let me know if you have follow-up questions about customer prepayments. I'm here to help.

Hi,

Could you please write the same instruction for the case if the services are rendered prior to invoicing. For example, we provide services in June, and issue the invoice on the 1 day of July. We use the ship date (June), but in reports this revenue goes to July.

How can we manage to book the income in PL in June and what would be the date of AR?

Hi there, @vshulakova.

You can change the invoice date to June so that the Profit and Loss report will be corrected. I'd be glad to show you the way.

Here's how:

Moreover, you can also use a sales receipt transaction if you haven't created an invoice. You can also customize the template before sending it. For more information about this process, please check out this article: Customize invoices, estimates, and sales receipts in QuickBooks Online.

I'd like to share this reference whenever you're going to customize your report in QuickBooks: Customize reports in QuickBooks Online. This also contains a sub-article about the popular custom reports in QuickBooks.

I'll be a few clicks away if you have other concerns or questions. Take care and have a beautiful day.

@MarsStephanieL , many thanks for your prompt reply!

But in case, if I have to issue an invoice on the 1 day of the next month under Contract? If I cannot change the date of invoice?

Thanks for coming back, vshulakova.

If you're asking if you can change the invoice date when you issue an invoice using the first day of next month which is August, then the answer is yes.

For the steps on how to change your invoice date, you can refer to the steps previously shared above.

In addition to the articles shared by my colleague MarsStephanieL, I'm leaving you this article about other way to edit transactions like invoice in QBO: Find, review, and edit transactions in account registers.

Drop me a reply if you have additional questions. I'd be more than happy to help, Keep safe and have a wonderful day ahead!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here