Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Alright, I don't know why I'm stuck on this, but I need some help.

With everything going on at the moment, we are allowing some tenants to apply part of their security deposits to their current month rent invoices. Which means we have the following:

Tenant: John Doe

Account: Security Deposit - Balance $2000.

Invoice #101: John Doe - $1000

John Doe pays (through Quickbooks payments) $500 on Invoice #101, so the invoice has a $500 remaining balance. I want to pay that balance of the invoice with $500 from the Security Deposit account. What's the best way?

Option 1: Journal entry. Debit Security Deposit $500. Credit Rental Income $500. Issue a Credit Memo to John Doe for $500. Invoice is paid, but Rental Income account incorrectly shows double rent income.

Option 2: Journal entry. Debit Security Deposit $500. Credit Rental Income $500. Update Invoice #101 with a line item for 'Rent credited from Security Deposit' of amount $-500.

Option 3: ????

I'm self-taught and clearly missing some conceptual understanding here - how do experienced people handle this sort of situation?

Many thanks!!!

Solved! Go to Solution.

Welcome to our growing family in the Community, JustinRSD.

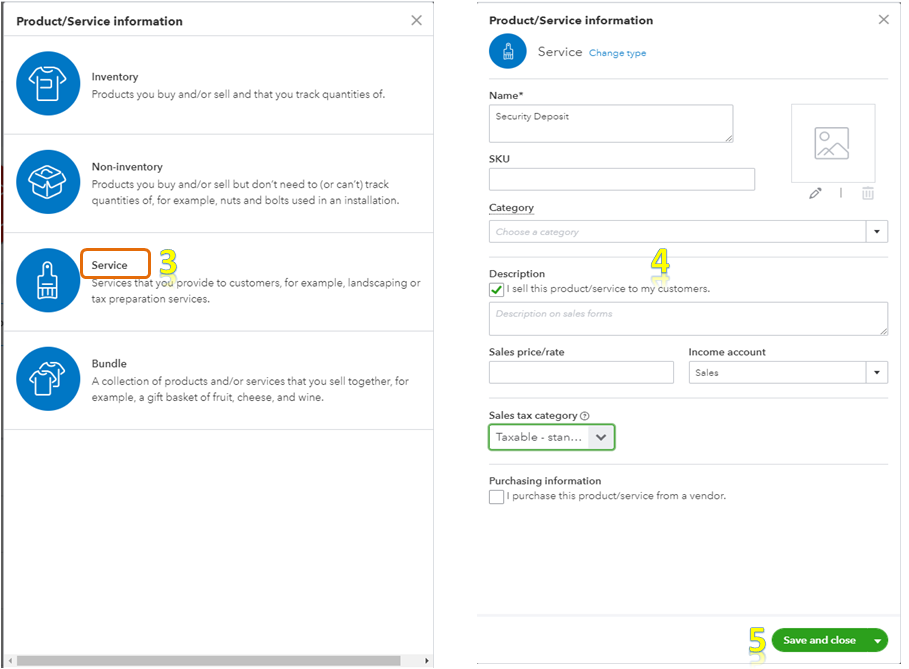

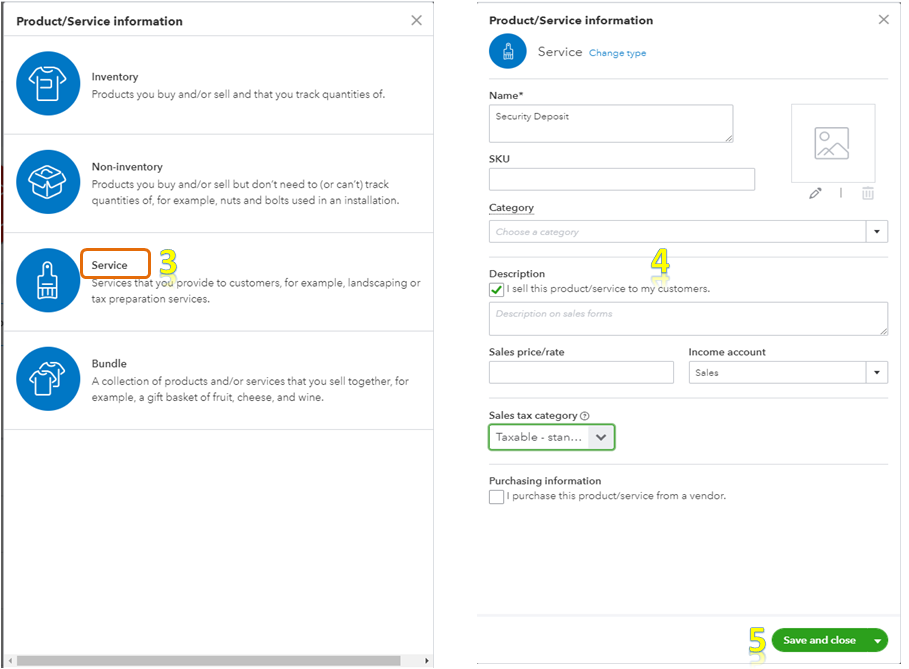

I appreciate the steps you've tried to sort this out. Let me help you on how to handle the security deposit to an open invoice in QuickBooks Online. Let's create a service item named Security Deposit and have that item linked to the Security Deposit liability account.

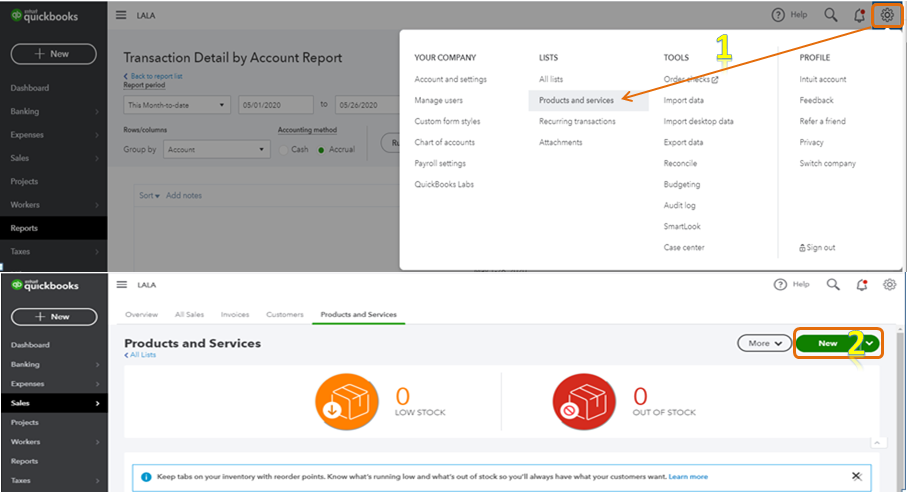

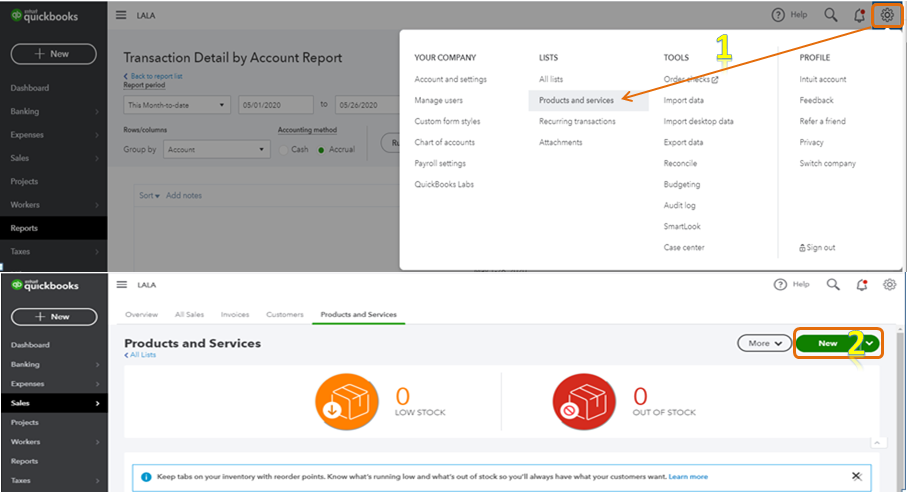

To create a service item:

Once done, put that item on the Credit Memo for the tenant, enter the amount of the deposit, and then in Receive payments apply the Credit Memo to the invoice.

Following the instructions above, you'll surely apply a part of their security deposits to their current month's rent invoices.

I've added these links to learn more about adding a product/service items and applying credit memo in QBO:

If you have any other concerns, please tag me directly. I'll be sure to get back to you.

Welcome to our growing family in the Community, JustinRSD.

I appreciate the steps you've tried to sort this out. Let me help you on how to handle the security deposit to an open invoice in QuickBooks Online. Let's create a service item named Security Deposit and have that item linked to the Security Deposit liability account.

To create a service item:

Once done, put that item on the Credit Memo for the tenant, enter the amount of the deposit, and then in Receive payments apply the Credit Memo to the invoice.

Following the instructions above, you'll surely apply a part of their security deposits to their current month's rent invoices.

I've added these links to learn more about adding a product/service items and applying credit memo in QBO:

If you have any other concerns, please tag me directly. I'll be sure to get back to you.

Really appreciate your time and answer @GlinetteC - the results in exactly what I need. Based on it, I dove into some of the training content on Credit Memos and think I now understand their affect on everything. New tool in my bookkeeping tool belt! Thanks!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here