Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

CYBER MONDAY SALE 70% OFF QuickBooks for 3 months* Ends 12/5

Buy nowI have been trying to find a way to monitor cash flow both monthly and annually for real estate properties. Principal payments are being tracked as a decrease to the long term liability account. Interest is tracked as an expense.

I believe that is the usual arrangement, but it makes tracking actual cash flow difficult. That is, for each property, I would like a single report showing how much was received in rent/lease/payments vs how much was paid out in expenses/principal. Basically, I want to be able to quickly see which properties are cash flow positive each month (as well as annually), on a single report. I know I can work this out from the P/L and the balance sheet, but it would be much easier if there was a way to automate that process.

The Statement of Cash Flows is close, but not exactly what I'm looking for because it includes the initial increase to the long term liability account when the mortgage is taken out. I also don't see a way to split this out by property (job).

Am I overlooking the report to do this?

Solved! Go to Solution.

You can customize the report to add the Customer:Job, J_P_A,

When you run the Custom Transaction Detail report, you have the option to add a name column and filter it to the Customer:Job.

Here's how:

Please see this sample screenshot below:

You can also use the article on how to customize reports in QuickBooks Desktop.

Let me know if there's anything else you need about QuickBooks Desktop reports. Thanks.

Good morning, @J_P_A. Thanks for reaching out to the Community.

You can use the Custom Summary and Custom Transaction Detail reports to create specialized reports in QuickBooks. These reports use different combinations from the Display and Filters tab in the Modify Report window. You could build a Custom Report, but just remember that this may be subject to accounting and programming limitations, your permissions in the data file, and how you have the transactions documented in your books.

I recommend running a Custom Transaction Detail report. This report lists individual transactions, showing each account involved in a transaction on a separate line. Here's how to run this report:

Here's an article for more information on Custom Reports in QuickBooks.

Let me know if this works for you. I'm always here to lend a helping hand. Happy Friday!

Awesome!

I assign transactions to each property using a Customer:Job. I don't see a way to add that column to this report. Am I just missing it? I think that would be necessary for me to be able to sort transactions based on each property.

Is there another (preferred) way to associate transactions with a particular property?

You can customize the report to add the Customer:Job, J_P_A,

When you run the Custom Transaction Detail report, you have the option to add a name column and filter it to the Customer:Job.

Here's how:

Please see this sample screenshot below:

You can also use the article on how to customize reports in QuickBooks Desktop.

Let me know if there's anything else you need about QuickBooks Desktop reports. Thanks.

Perfect! Thanks so much for the help! It seems obvious now :-)

Is this available in QBO?

Yes, the same report is available in QuickBooks Online (QBO), @aiwapro.

Let me help you pull up the report you need so you can monitor your cash flow and manage your transactions accordingly.

In QBO, you can find a variety of financial reports that can give you snapshots of different areas of your business. You can pull up the Transaction Detail by Account report and customize it so you can focus on the details you needed the most. It has a Name column and you're able to filter it to include the Customer:Job info. To do this, here's how:

Once you're done, you can memorize the said report to save its current customization settings. You can learn more about this process by checking out this article: Memorize reports in QuickBooks Online.

Also, you may want to checkout one of our Help articles as your reference to see the complete list of reports available for your version of QBO: Reports included in your QuickBooks Online subscription.

Please let me know if you have other reporting concerns or questions about managing transactions in QBO. I'm always ready to help. Take care, and I wish you continued success, @aiwapro.

I really need a report showing all my cash going in and coming out during the month. I use CASH Basis accounting on QBO. This includes:

Income:

Service income

Fuel surcharge income

Payments:

Interest on loans

Loan payments

Payroll

Admin expenses

Utilities

etc.

I can't find a report that shows me this info.

Can you please help??

I'll make sure you pull up the report you need, Sandy.

Based on your needed data, you might want to pull up two separate reports, the Profit and Loss and Transaction Detail by Account. I'll guide you in customizing them according to the information you need.

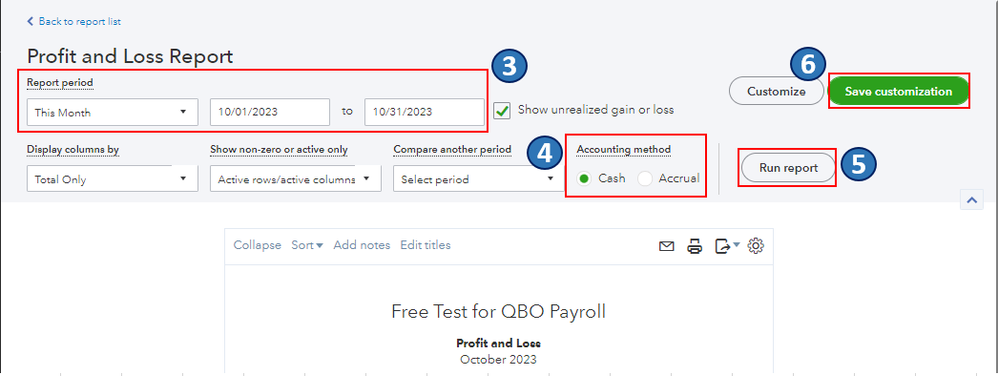

Let's start by pulling up the Profit and Loss report to see your monthly cash going in and coming out of your business. It summarizes the total income and expenses of your business. To do this, here's how:

If you need data for additional accounts such as Interest on Loans, Admin Expenses, or any other specific accounts, I recommend pulling up the Transaction Detail by Account report.

Once you have customized your reports to your desired settings, you may want to save these customizations for future use. Please see this article to guide you through the process: Memorize reports in QuickBooks Online.

If you have other reporting questions or concerns about managing income and expenses in QuickBooks, please don't hesitate to leave a reply below. I'm always ready to provide a prompt response to ensure your goals are achieved.

Hi,

I have all of my rental properties separated by Class and all transactions are added with a Class assignment. When I run this report all of my income shows as a negative number and all expenses as positives. Am I entering something incorrectly? Thanks!

I appreciate you for joining the thread and sharing your concerns. I understand how confusing it can be to have your income show as a negative number and all expenses as positive when you run a P&L report in QuickBooks Online. Let me share my thoughts on this and help you clear things up.

Expenses are reported as positive numbers in double-entry accounting. The Net Income section assumes that Total Income (credit) minus Total Expenses (debit) yields total profit.

If you see a negative under exchange gain or loss, it means a negative expense in that account is income, and a negative exchange gain or loss indicates that you made money on the exchange rate.

If you are referring to another specific issue, I'd appreciate it if you could provide us with more details. You can also attach a screenshot to help us better understand the problem and find the best possible solution. Our goal is to align with you and supply the most accurate explanation and resolution.

I'm leaving you these articles you can use to learn more specific ways to customize your reports:

I'd be happy to hear any updates from you soon, as I want to ensure this is resolved for you. Don't hesitate to reach us again. Have a great day ahead!

@J_P_A I am looking for this same type of report. Did you have any success creating one?

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here