Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

It's a pleasure to have you here, @Denise1985.

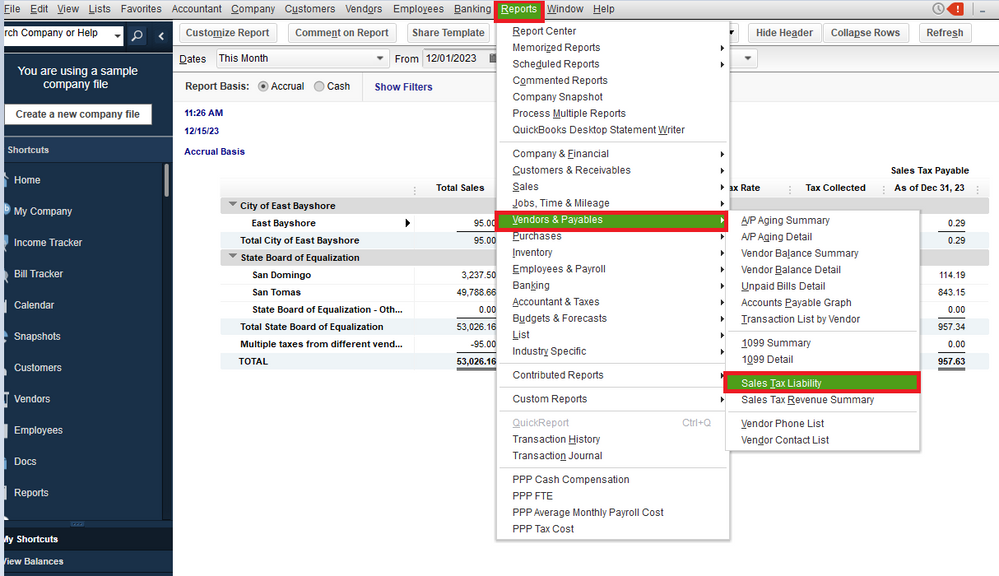

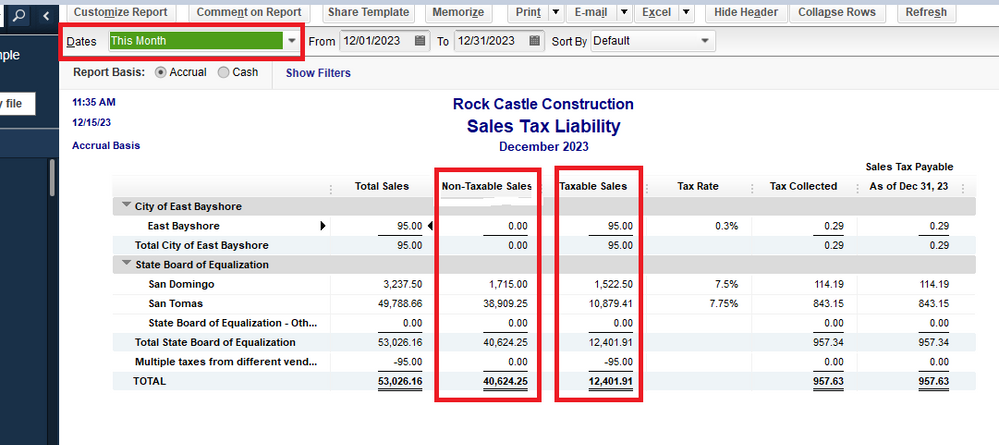

Yes, there's a similar Sales Tax Liability report in QuickBooks Desktop showing the taxable and non-taxable amounts. Simply follow the steps below to generate the said statement.

In addition to that, let me share relevant articles you can review to help manage your reports in QuickBooks:

Keep in touch if you have other questions about generating reports in QuickBooks Desktop. I'll be happy to lend a helping hand. Stay safe and have a wonderful day!

The work around for the Sales Tax Liability Report to find Non-Taxable Invoices is time consuming (using the Sales by Customer Type to determine total sales and then manually look for Non-Taxable Invoices). It works but it is manual.

Why doesn't the Sales Tax Liability Report provide a gross total that includes invoices that are completely non-taxable? (it only includes invoices that have a mix of taxable and non-taxable items.) Also why are there no totals by reporting entity? For example, in Colorado, sales taxes need to be reported both to the sale but also to specify municipalities.

I agree with earlier comments, this report is not very useful.

This process still doesn't work as the report still shows "no data" for 1st quarter 2022.

Thank you for bringing this to our attention, @cc66. I’ll point you in the right direction for help.

Currently, we haven’t received a similar issue about no data in the sales tax liability report in QuickBooks Online (QBO). That being said, I suggest contacting our Technical Support team.

They can pull up your account in a secure environment. Also, our phone representatives have tools that can access your account to reinvestigate the issue and can provide fixes immediately. Reaching out to them can also trigger a further investigation into this matter.

Here’s how to get in touch with them:

Please ensure to review their support hours to know when agents are available. This way, you can contact them at a time that is convenient for you.

You can always hit the Reply button if you have further questions in mind regarding QuickBooks. I’ll make sure to get back to you as soon as I can. Stay safe!

That report is not available in my quick books online

Hi rosesexcavating8!

There are reports for QuickBooks Online in the previous replies. However, I can still show you how to run a sales tax report.

You can pull up the Sales Tax Liability report to show the much sales tax you've collected and how much you owe to tax agencies. Follow these steps:

You can also run the Sales by Product/Service Detail report to see all the list of transactions and if they are taxable or not. Search and select this report on the Reports menu. Click the little gear icon and make sure to check the Tax Name, Tax Amount, Taxable, and Taxable Amount.

I added this link if you need detailed steps on how to pull up, customize, and save reports in QuickBooks Online: Run reports in QuickBooks Online.

You're more than welcome to post here again if you have other concerns regarding taxes. Let me know what else you need to do and I'll be glad to work with you again.

We are having a problem were taxable products sold to tax exempt clients won't show in the non taxable column.. it puts the sale transaction under taxable amount...

Although the actual taxes total collected is accurate but to file for NY we need to buy in the gross revenue that is non taxable and taxeble..

This is a mess

Instead of clicking on Reports, click on Taxes then Sales Tax. Follow the steps to set up the Sales Tax Manager. Inside that, you can click reports and run the Sales Tax liability Report just like the Desktop Version.

Did you get an answer for this question? I talked to two people at QBO and none of them can tell me how to print a report that list the total sales, including sales tax that was invoiced in certain time frame. I am looking to print a report that shows total sales for one month that includes the sales tax.

I appreciate what you've done so far. Let me help you generate a report that lists the total sales, including sales tax, over a specific period and then print it in QuickBooks Online (QBO).

Let's run the Sales by Customer Detail report wherein you can see your desired details on a specific report:

In a Modern View:

Additionally, let's memorize this report so you can save its current customization for future needs: Memorize reports in QBO.

Moreover, if you want to send your memorized report through an email on a recurring schedule, use this article as a reference: Set schedule and email information for a memorized report.

Feel free to comment below if you need anything else regarding printing a report that lists the total sales for a month, including sales tax. Take care.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here