Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Something changed with the look and operation of my quickbooks online yesterday. I am not able to print the monthly (Usually shows January thru December in order on one page to print) taxable and non-taxable totals and sales tax due.....please help.

I'm here to help, duckgrovecity.

The Sales Tax Liability report has only updated the columns to include the Non-Taxable and Gross Amount. To verify, are you trying to group the report by month? If so, you'll want to run a different report.

You can use the Taxable Sales Detail and customize the report to include the Tax Amount and Taxable Amount.

Here's how:

Once you have the details you need, you can click the Print icon.

Here's a sample screenshot of what it looks like:

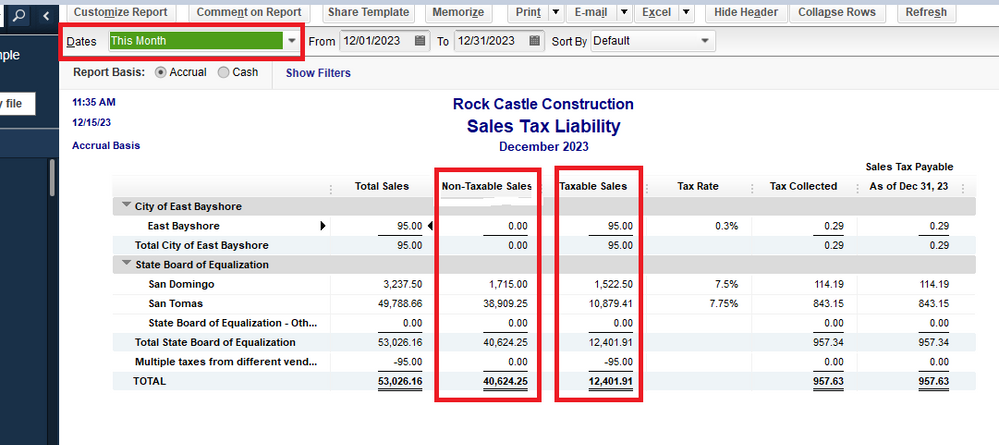

For the Sales Tax Liability report, you can see the same figures in this sample screenshot:

I'm adding this article for more information on how to customize a report: Customize reports in QuickBooks Online.

Please let me know if you need more help with the Sales Tax report in QuickBooks. I'll be happy to lend a hand. Take care and stay safe.

But why is it not showing me non-taxable also, because when I report my sales to the county I also have to give them a total sales. Is there anyway you could screen share with me and make sure my settings are correct? I think I have clicked something incorrect in sales tax and it has just thrown everything off. I'm very sorry to bother you, but my husband is in hospice and his illness has caused me to become very behind and I'm trying to play catch up....Thank you so much for your help.

Hello there, duckgrovecity.

I can get you the right support that has the resources to check your account and sales tax setup in a secure environment. You'll want to reach out to our Customer Support Team. They'll surely sort things out with you and give you direct and detailed steps on how to fix the issue you're currently experiencing.

Here's how to contact us:

You can also check out this article that lists all our support hours and types.

I'll be attaching an article that will help you manage your sales tax setup while waiting to get connected with our Phone Support.

Reach out to the Community if there's anything else that you need help with. You take care and have a great day!

Can you show me how to run a monthly report on my non taxable customers? I need to know the total amount so I can put that on my monthly sales taxes.

Let me show you how to view your non-taxable customers, lisa565.

We can run and customize the Taxable Sales Detail report to see all customers with non-taxable sales in QuickBooks Online.

Here's how:

For more details about the process, you can check out this article: Create a Non-Taxable Sales Report in QuickBooks Online.

Once done customizing, you may want to consider memorizing the report. Doing so helps you save the current customized settings in QuickBooks Online.

Stay in touch with us if you have other questions about running reports. We'd be glad to answer them for you.

I'm sorry, but this new format will NOT work, at least for the state of Colorado. We have to report sales by jurisdiction, and the workaround you are suggesting does not do that for us.

We need to be able to have those columns back, which include gross sales, non taxable, taxable, and tax amount columns, BY JURISDICTION.

Why was this changed anyway? There was nothing wrong with the old format.

Michelle

This does not bring me the non taxable sales. Please help.

Thanks for reaching out to the Community, Marciab.

You can customize and run your Taxable Sales Detail report to see a list of non-taxable customers and their sales. Detailed steps for this process can be found in CharleneMae_F's post.

You'll additionally be able to find many useful resources about using QuickBooks in our help article archives.

Please feel welcome to send a reply if there's any questions. Have an awesome day!

I used to get my reports showing the full gross amount and then a column for the taxable amount. Now the column for gross is ONLY showing the taxable amount. This is a problem. When I go to the PA state website to file my sales tax each month I am asked to record the gross AND taxable amounts (we are a janitorial company and have some non taxed accounts, like churches and federal buildings) so I need to report all revenue (gross sales) as well as only the taxable amounts. The report is not showing both figures but showing the taxable and gross numbers as the same. It was fine up until this month. Not sure what changed and why, but I had to go into a different report just to get the right gross amount.

Nice to have you join this thread, WandaA.

Let’s log in to your QuickBooks Online (QBO) account on a private window (incognito) and open your report from there. This way, we can check if this issue is caused by stored cache files.

QBO uses data cache to swiftly load the page faster. When piled up, this causes issues that affect the performance of your account.

Using an incognito window doesn’t store any cache files. Thus, it’s a great tool in identifying the issue easily. To start, you can use these keyboard shortcuts in opening a private window:

If the data shows correctly in your report, I’d recommend clearing your regular browser's cache. This will delete all saved data files from your browser and refresh the system. If the issue persists, try using other supported browsers. That way, we can check if this is a browser-integrated issue.

If this is not the case, I recommend contacting our Support team. They have the proper tools to securely check your account and review the settings of your report.

Let me also share this link that you can utilize in personalizing your reports seamlessly: Customize reports in QuickBooks Online.

Keep me in the loop if you need further assistance managing your reports. I’ll be around ready to help you. Have a good one and keep safe!

QB Online Sales Tax Liability are not valuable for filing taxes in Texas!! I have been calling, chatting, and emailing on this issue for almost a year and it's still not resolve.

PLEASE FIX THIS ISSUE!!!!!!!!!!!!!!!!!!

PLEASE FIX THIS ISSUE!!!!!!!!!!!!!!!!!!

PLEASE FIX THIS ISSUE!!!!!!!!!!!!!!!!!!

PLEASE FIX THIS ISSUE!!!!!!!!!!!!!!!!!!

PLEASE FIX THIS ISSUE!!!!!!!!!!!!!!!!!!

PLEASE FIX THIS ISSUE!!!!!!!!!!!!!!!!!!

Liability report does not total the columns. Business owners who file taxes need to know: GROSS SALES, TAXABLE SALES, NON-TAXABLE SALES all in one report.

Quick zoom on columns does not take you to corresponding numbers-- it dumps you to all data. There's no way to drill down to specific transactions based on the total from the report.

Sales tax liability reports should match P&L sales information-- this is also not working. Yes I'm on the same dates and yes both are on "cash basis".

"Sales tax liability report" does not match the "Pay Sales Tax" report-- both give you different numbers, and changing dates and accounting methods (cash vs accrual) also does not fix the issue. Additionally, neither of these match the P&L either. Additionally, columns are not totaled on either of these reports so it requires a lot of manual calculating just to get the totals to file reports!

When dealing with custom rates, they do not display correctly on the Sales Tax Liability report. For example, when selling wholesale and getting a resale form on file, we don't charge sales tax. I have setup the customer account to be non-taxable, and double checked the invoice as well. Even though it's not charging them sales tax, it will display under the "taxable sales" on the Liability Report.

I own 4 companies and have been a QB Desktop user for about 15 years. I do every single part of our accounting, including sales tax, P&L, and balance sheets. I know QB Desktop and accounting methods like the back of my hand and I am extremely familiar with how sales tax and liability reports should look and work. However, QB Online does NOT work properly when it comes to sales tax.

I have spoken to at least 8 people at QB over the course of a year, and while they admit there are some issues with sales tax on the QB side, they are not fixing the issue. Multiple case numbers, support calls, and remote sessions to get nowhere and I am extremely frustrated! I have two CPA's also and their office has looked at this as well and determined it's definitely on the QB engineering side.

Below is how a liability report should look (at least for me in Texas based on my location). If anyone reading

this knows how to fix this in QB Online please reach out to me!

| Gross Sales | Taxable Sales | Non-Taxable Sales | Total | |

| Taxable 8.25% | 50,000.00 | 50,000.00 | 0 | 50,000.00 |

| Resale form 0% | 25,000.00 | 0 | 25,000.00 | 25,000.00 |

| Out of state 0% | 5,000.00 | 0 | 5,000.00 | 5,000.00 |

| Total | 80,000.00 | 50,000.00 | 30,000.00 | 80,000.00 |

Can someone PLEASE help me resolve this and get this escalated and fixed at Intuit!

This is not the impression we wish to leave you with,km12345.

The Sales Tax Liability report should also include the non-taxable amount. The first column shows the gross amount, next is the non-taxable, the taxable, and the tax amount. In addition, if the items on a transaction are all non-taxable, they won't be added to this report. In the Sales Tax Liability report, only the invoices with taxable and non-taxable items will show under Gross Sales in QuickBooks Online (QBO). However, if the invoices have only the non-taxable items, they will not show in the Gross sales section. This causes the gross amount doesn't equal the total sales for that period(tax and nontax).On the other hand, your P&L report is based on the transactions you entered in QuickBooks

The Sales Tax Liability report displays the following information:

You can use the Profit and Loss Detail report, and add the TAXABLE AMOUNT column to show how much sales are only taxable. That amount should match the taxable sales amount in your Sales Tax Liability report. You can adjust the date range of your P&L report or change the Accounting Method used to see if you get the same result. The new sales tax system is irreversible once you switch from the old one. You can use custom rates on your transactions if you need to track special taxes manually. Pulling up the sales tax liability report in QuickBooks Online will only provide the taxable sales of your transactions.

You can refer to these resources below to know more about the available reports in QuickBooks Online as well as how to customize them.

Should you need more help with running your sales tax reports, feel free to add a comment below. I'm always open to help you out. Take care.

Thanks for the reply but part of the information you stated is wrong:

1 - Non-taxable amounts DO show up on the Sales Tax Liability report. For example, I have 2 custom rates setup for 0%: "out of state" and "resale form on file". Both of these categories generate invoices where ALL of the line items on the invoice are non-taxable and thus show up on a Sales Tax Liability Report. The idea of the report is to be used when filing your taxes, so it has to show both taxable and non-taxable information, as that's information all states require from the business owner when filing and paying taxes.

2 - Additionally to #1, the Liability Report should also TOTAL the columns for you and it does not. It never has in QB online, but it does in other versions, for example Pro and Enterprise. The total is also what the owner uses to file and pay taxes to their state, so if it's totaled in other versions of QB then why is not totaled in the Online version? Makes zero sense.

3 - The P&L generated based on the same accounting method (cash basis) for the same given timeframe should yield the EXACT same information as what a Sales Tax Liability Report shows. Both reports are generating income taken in during a specific time frame. I understand the P&L is an "income" statement and does not show liabilities, however the "income" should be the same as the Liability Report--- both reports are based on income.

4 - If the taxable rate is setup at 8.25% and I look at it to verify the same, then the Sales Tax Liability Report should accurately reflect the same amount due as if I were to manually calculate it. I can pull that report, look at taxable sales and multiple that number by 0.0825 and the number I manually calculate should match what's due on the liability report---- it does NOT match.

As I have stated in the previous post, I am extremely versed on accounting principles, income statements, and sales tax reporting. Additionally, I have been through multiple sales tax audits in Texas so I'm well aware of the nexus laws for collecting and remitting sales tax in my state. My point here is that all of the links you listed below DO NOT HELP, as does the community forum and any other 'self-guided' help sections that Intuit offers--- the issue is not on my end, the issue is on the engineering side of Intuit. My point of leaving all of the comments is in hopes that someone higher up at Intuit will see my comment and take the time to truly fix the software issue. As a business owner I am paying top level for an accounting software service that does not properly work and has not worked for over a year! Due to the business type, I have to be online and I cannot move to the desktop version to resolve the issues unfortunately.

You are welcome to private message me if you think you can help or resolve this, but I have little hope until bigger issues are resolved at Intuit.

Good Evening! Is there a similar report in QB Desktop ?

Thank you,

Denise

It's a pleasure to have you here, @Denise1985.

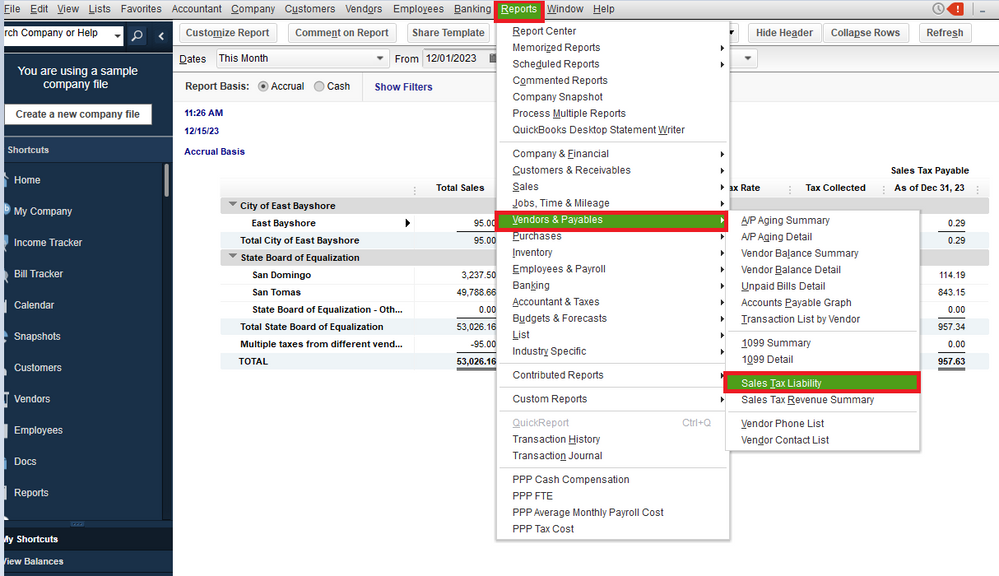

Yes, there's a similar Sales Tax Liability report in QuickBooks Desktop showing the taxable and non-taxable amounts. Simply follow the steps below to generate the said statement.

In addition to that, let me share relevant articles you can review to help manage your reports in QuickBooks:

Keep in touch if you have other questions about generating reports in QuickBooks Desktop. I'll be happy to lend a helping hand. Stay safe and have a wonderful day!

The work around for the Sales Tax Liability Report to find Non-Taxable Invoices is time consuming (using the Sales by Customer Type to determine total sales and then manually look for Non-Taxable Invoices). It works but it is manual.

Why doesn't the Sales Tax Liability Report provide a gross total that includes invoices that are completely non-taxable? (it only includes invoices that have a mix of taxable and non-taxable items.) Also why are there no totals by reporting entity? For example, in Colorado, sales taxes need to be reported both to the sale but also to specify municipalities.

I agree with earlier comments, this report is not very useful.

This process still doesn't work as the report still shows "no data" for 1st quarter 2022.

Thank you for bringing this to our attention, @cc66. I’ll point you in the right direction for help.

Currently, we haven’t received a similar issue about no data in the sales tax liability report in QuickBooks Online (QBO). That being said, I suggest contacting our Technical Support team.

They can pull up your account in a secure environment. Also, our phone representatives have tools that can access your account to reinvestigate the issue and can provide fixes immediately. Reaching out to them can also trigger a further investigation into this matter.

Here’s how to get in touch with them:

Please ensure to review their support hours to know when agents are available. This way, you can contact them at a time that is convenient for you.

You can always hit the Reply button if you have further questions in mind regarding QuickBooks. I’ll make sure to get back to you as soon as I can. Stay safe!

That report is not available in my quick books online

Hi rosesexcavating8!

There are reports for QuickBooks Online in the previous replies. However, I can still show you how to run a sales tax report.

You can pull up the Sales Tax Liability report to show the much sales tax you've collected and how much you owe to tax agencies. Follow these steps:

You can also run the Sales by Product/Service Detail report to see all the list of transactions and if they are taxable or not. Search and select this report on the Reports menu. Click the little gear icon and make sure to check the Tax Name, Tax Amount, Taxable, and Taxable Amount.

I added this link if you need detailed steps on how to pull up, customize, and save reports in QuickBooks Online: Run reports in QuickBooks Online.

You're more than welcome to post here again if you have other concerns regarding taxes. Let me know what else you need to do and I'll be glad to work with you again.

We are having a problem were taxable products sold to tax exempt clients won't show in the non taxable column.. it puts the sale transaction under taxable amount...

Although the actual taxes total collected is accurate but to file for NY we need to buy in the gross revenue that is non taxable and taxeble..

This is a mess

Instead of clicking on Reports, click on Taxes then Sales Tax. Follow the steps to set up the Sales Tax Manager. Inside that, you can click reports and run the Sales Tax liability Report just like the Desktop Version.

Did you get an answer for this question? I talked to two people at QBO and none of them can tell me how to print a report that list the total sales, including sales tax that was invoiced in certain time frame. I am looking to print a report that shows total sales for one month that includes the sales tax.

I appreciate what you've done so far. Let me help you generate a report that lists the total sales, including sales tax, over a specific period and then print it in QuickBooks Online (QBO).

Let's run the Sales by Customer Detail report wherein you can see your desired details on a specific report:

In a Modern View:

Additionally, let's memorize this report so you can save its current customization for future needs: Memorize reports in QBO.

Moreover, if you want to send your memorized report through an email on a recurring schedule, use this article as a reference: Set schedule and email information for a memorized report.

Feel free to comment below if you need anything else regarding printing a report that lists the total sales for a month, including sales tax. Take care.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here