You’re on the right path, @pettyc. It'll be my pleasure to guide you in saving your previous reconciliation reports as pdf in QuickBooks Desktop.

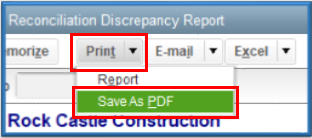

After selecting the Statement Ending Date and reviewing the report, you can go at the top menu and click the Print dropdown. From there, choose Save As PDF. Here’s a snippet for your reference:

For more insights, refer to this article: Get reports for previous reconciliations in QuickBooks Desktop.

If you’re unable to see those tabs, this means you’re experiencing data integrity issue. To fix this, there are a few basic troubleshooting steps we can perform. Let’s start with verifying and rebuilding your data. This process scans your company files for errors or data damage.

Here’s how:

- Go to the File then Utilities. Select Verify Data.

- Wait for it to load.

- Click File again, Utilities, then Rebuild Data.

- Press OK when you get the message "Rebuild has completed".

For other damage troubleshooting steps for Windows, feel free to check out this article: Verify and Rebuild Data in QuickBooks Desktop

If you get the same result after running those troubleshooting steps, I suggest using QuickBooks File Doctor. To begin, download and install the most recent version (1.4.0.0) of QuickBooks Tool Hub. Then let’s install the program by opening the downloaded file (QuickBooksToolHub.exe) and follow the on-screen instructions.

To open the tool hub, double-click the icon on your Windows desktop. We recommend running QuickBooks File Doctor on Windows 10, 64-bit.Then, run the Quick Fix my File utility by following these steps:

- Select the Company File Issues tab from the tool hub.

- Click Quick Fix my File from the drop-down menu.

- Tap OK to launch QuickBooks.

If the issue persists, you’ll want to proceed to Step 3 to fix your company file and network issues.

If your previous bank reconciliation report shows as blank or the cleared transactions shows up as unclear, see this article for the solutions: Resolve common issues on Previous Reconciliation report.

You’re always welcome to reach out to me again with any questions you may have. I'll be more than happy to help.