Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Thank you for reaching out to the Quickbooks Community, M1Jones1. Could you verify if the payment is linked to the invoice? If not, the invoice would have an open balance, but the customer balance would be $0. The reason being, the payment would still offset the invoice in the account receivable for the customer. Another thing I would check is to make sure there aren't two payments. You can run the Transaction List by Customer report to view this. Here's how:

Also, I've attached a couple of articles here for the detailed steps of recording invoice payments:

I will be looking forward to your response. Simply respond below. The Community and I will be here to help you. Until then, take care.

Thank you. I followed those steps to verify the deposit is linked to the invoice, but it seems I'm still missing something.

When I double click the invoice, the payment status shows as paid, and below it indicates "1 payment made ($100)". When I click on the "1 payment made" link, it takes me to a "receive payment" screen. In the Outstanding Transactions field, the correct invoice is checked.

Scrolling down to the Credits section, nothing is checked. I can see that the $100 deposit is there (though unchecked), but in the Original Payment column it shows $80, and next in the Open Balance column it shows $20 (numbers fictionalized for ease of understanding).

What does any of this mean?

Let's ensure to deposit the invoice payments amount, @M1Jones1.

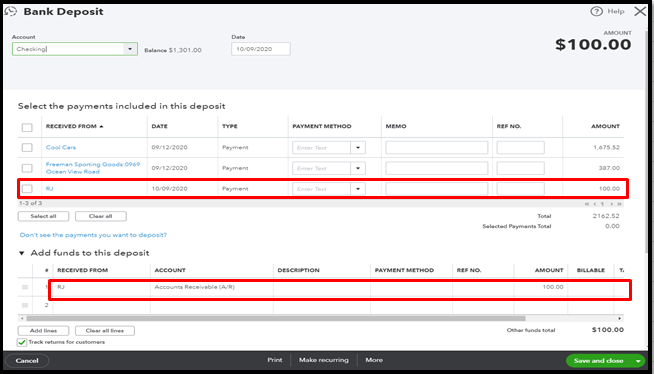

If you created a bank deposit and added the said amount to Accounts Receivable (A/R), then your customer will have a negative balance. This entails an overpayment.

If this is the case, let's open the deposit amount linked to the paid invoice. Here's how:

With regards to the $80 amount on the Original Amount column, this could be the money entered on the Add funds to this deposit column (A/R). Thus, leaving only $20 on the Open Balance column.

If you want to link the deposit to an invoice, please take note of the following:

Then, you can follow the steps in this article: How to link a deposit to an invoice.

You'll want to pull up the Invoices and Received Payments report to keep track of all your invoices and the payments that go with them. Simply go to the Reports menu, and then choose the said report from the Who owes you section.

You can count on me if you have more questions about managing your invoices in QuickBooks Online. Keep safe,@M1Jones1.

i cant seem to get this fixed. i show an invoice as paid, under same customer payment for the invoice amount and then a overdue negative deposit for the invoice amount. How can i fix this? i cant find any information anywhere

Nice to have you joined this thread, @vikingboatfiberglas.

A possible reason for this is that the invoice payment was not applied to an invoice. To get around this issue, you’ll want to link the payment to the invoice. Let me guide you how in your QuickBooks Online (QBO) account.

Here’s how:

Let me also share with you this article that you can read for your future reference:

Know that I’m always around to help whenever you have other questions or concerns in managing your invoices or with your account. It’s always my pleasure to help you. Have a good one and more success in your business!

Afternoon,

Piggybacking off the above questions.

Our client paid back on June 15th, 2021. The account shows as updeposited funds. If I deposit the funds, the client isn't getting charged again, correct? As in, they have already paid and the money left their acount when they paid last year, but we just didn't deposit it correctly from quickbooks. Is this accurate? Thank you for your assistance!

Just want to make sure they won't randomly see money pulled from their bank account nearly a year after the work was completed, and that when they paid, the money was already taken from their account.

Thanks for joining us here in the thread, @Antique-inc.

Yes, you're right. Once you move money from the Undeposited funds, It'll not charge your customer again. If you're unsure how to proceed, consult your accountant for assistance. This way, they can provide you with other options to do it.

Additionally, I've got you these articles to help you in the future:

Please know you that you are always welcome to post here in the Community if you need help with your QuickBooks-related concerns. Rest assured, I'll be here to assist you once again. Keep safe and stay hydrated!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here