Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Solved! Go to Solution.

Hi there, @rcmat.

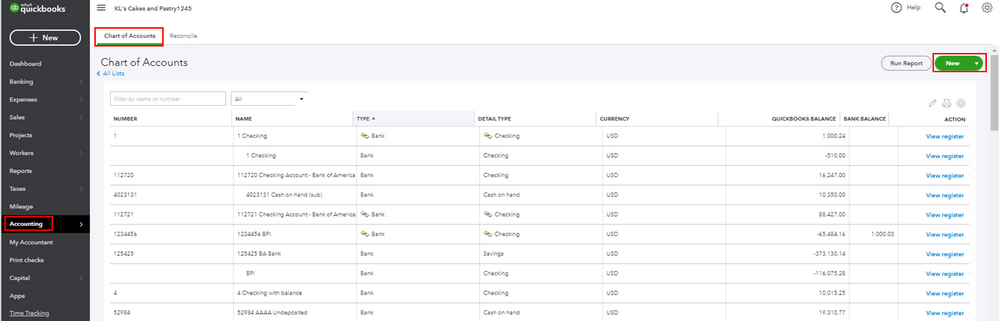

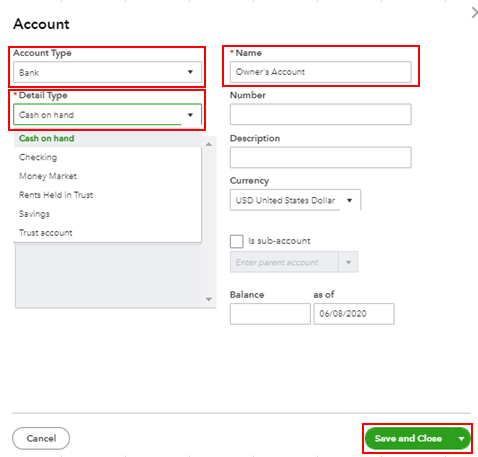

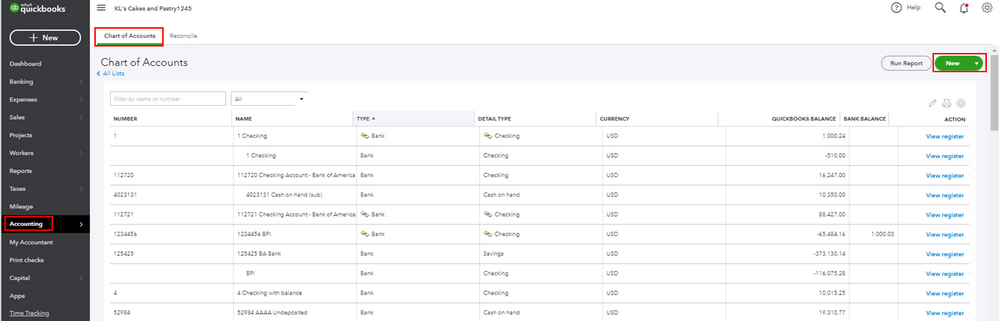

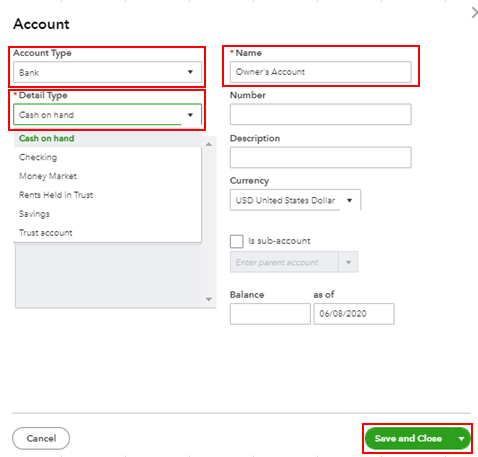

You'll want to add the owner's bank account in the Chart of Accounts so you can select it when creating an expense transaction. Let me guide you through the steps.

Here's an article you can read for more details: How to create a new parent account or subaccount.

Once done, you'll have to select the owner's bank account in the Payment account drop-down.

You might also want to check out this article to learn how to pay for business expenses with personal funds: Record business expenses you made with personal funds.

Please let me know if you need clarification about this, or there's anything else I can do for you. I'll be standing by for your response. Have a great day and stay safe.

Hi there, @rcmat.

You'll want to add the owner's bank account in the Chart of Accounts so you can select it when creating an expense transaction. Let me guide you through the steps.

Here's an article you can read for more details: How to create a new parent account or subaccount.

Once done, you'll have to select the owner's bank account in the Payment account drop-down.

You might also want to check out this article to learn how to pay for business expenses with personal funds: Record business expenses you made with personal funds.

Please let me know if you need clarification about this, or there's anything else I can do for you. I'll be standing by for your response. Have a great day and stay safe.

Thank you, Mark_R. That works, and I no longer have to use the "undeposited funds" account as the source of the owner-paid expense.

Thank you, Mark_R. I no longer have to use "undeposited funds" as the source of personal funds used to pay for an expense.

I appreciate you getting back to us, @rcmat.

I'm happy to know that I was able to resolve your concern about paying expenses with owner funds in QuickBooks Online.

As always, feel free to visit our QuickBooks Community help website if you need tips and related articles in the future.

Please know that the Community team and I are always here to help with any QuickBooks concern you may have. Thanks for coming to the Community, wishing you continued success.

I was wondering if you add a personal credit or bank account to use for business expenses paid with personal funds does that create a necessity to reconcile the account, which is undesirable since the account being added is not in fact a business credit or bank account? What is the alternative when manually adding these types of expenses - to use the uncategorized asset option? TIA

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here