Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI have checks that were written in the last 2 previous years that have never cleared. They continue to show up as uncleared transactions on my reconciliation reports. What is the best way to remove them from the system since the checks are no longer valid?

Hello, AK2487.

Thank you for reaching out to us here in the Community. I'm here to provide some information about the uncleared transaction on your reconciliation report.

Ensure these transactions are relevant yet uncleared, you'll have to wait until it'll get cleared from the bank. However, if it's a duplicate, you can delete it in the bank register. Here's how:

In addition, I've added this article that you can check about how to import web connect in QuickBooks Desktop.

I'm all ears if you have other questions about bank transactions in QuickBooks. Take care!

H have the same issue but my client ha over 5000 uncleared transactions. They are marked with an "R" on the register. How do I clean this up quickly?

Hi there, lexylu.

I'd be glad to help you clean up uncleared transactions in QuickBooks Desktop (QBDT).

But before doing so, let's make sure to secure a backup copy of your company file. This way, you'll be able to restore it anytime you want to undo the process.

To start, simply open the transaction and select the Delete option. Alternatively, you can use the keyboard shortcut CTRL + D to automatically delete an entry.

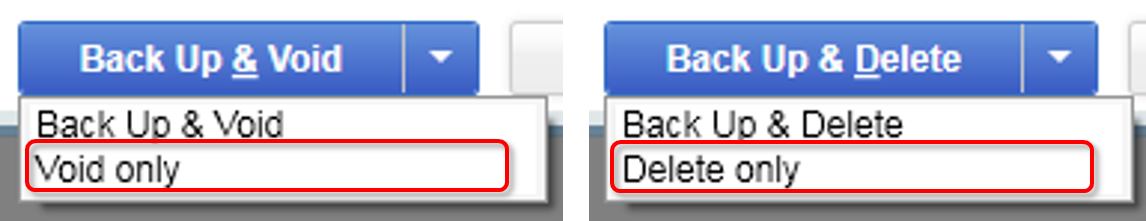

Another option is to have the Admin or External Accountant user log in and delete the transactions in bulk.

Here's how:

Lastly, you can visit the Desktop Apps website and find a suitable deleter application. Simply enter the keyword "deleter" in the search field provided.

If you have any additional questions about un-cleared transactions, I'm always here to help. You are welcome to reply below or post again. Have a good one!

My apologies. I am using quickbooks online - qbo

Thanks for getting back to us, @lexylu.

Let me help you remove these uncleared transactions in QuickBooks Online (QBO).

If the transactions are automatically downloaded from the bank, you can proceed with the steps I previously mentioned. However, if you manually entered the transactions into QuickBooks, you'll have to delete them manually as well.

Here's how:

To learn more about this process, read this article: Exclude expenses from downloaded bank transactions.

Lastly, I recommend visiting this Community article: Reconcile Workflow. It contains in-depth details about starting, fixing any differences, and completing the reconciliation process.

Please let me know how it goes or if you have other concerns. I'll be around to help some more. Take care.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here