Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowFor Quickbooks Desktop/Enterprise - I'm trying to figure out which expenses have not been paid by our clients. When we enter an expense (check, credit card entry) we bill it to a client. These expenses then show up on their invoices with entered time, which get payments applied to them. I need a report that shows me all the expenses that have not been paid. I don't want to just see the unpaid invoices. Because right now I do not care about unpaid services/time. I want to see the unpaid expenses so we can collect. Our problem is that we have a high balance on one of our expense accounts, which should essentially be $0 since we pay it, an then we get reimbursed.

You can pull up the Unbilled Costs by Job report, BOM. This will show you the expenses that aren't billed/paid by the clients.

I'll guide you how:

You can also customize the report depending on the information you want to see.

If there's anything else that you need to know, feel free to get back to this thread.

Go to reports, then Job, Time & Mileage. Select the report "unbilled costs by job". This will show all the costs marked as billable the have not been pulled into an invoice.

I don't need ones that haven't been pulled into an invoice, I need ones that are on an invoice but haven't been paid yet

Thanks for your response, but this report shows me costs that haven't been invoiced. Which is not exactly what I'm looking for. I'm looking to see which costs, that have been billed, but haven't been paid.

Let's get the report you need, @BOM.

Here's how:

That's all there is to it! Please post again if you have any other questions, we're always happy to help. Have a great weekend!

This gives me open invoices, not unpaid costs. Yes, the costs are on the invoices, but I want to see, specifically, which costs have not been paid.

Hello, @BOM.

You may run an Unpaid Bills Detail report.

Here’s how to run Unpaid Bills Detail:

If you have other questions, leave a comment below. Have a great day.

Thank you. But maybe I'm not explaining this correctly. We already paid the bills, from the firm's account. So, for example, we pay the courthouse $6 for a clerk filing fee, and we bill it to a client. It then gets put on their invoices as a reimbursable expense. How do I create a report that shows me reimbursable expenses that have yet to be reimbursed to the firm by clients?

Welcome back to the Intuit Community, @BOM.

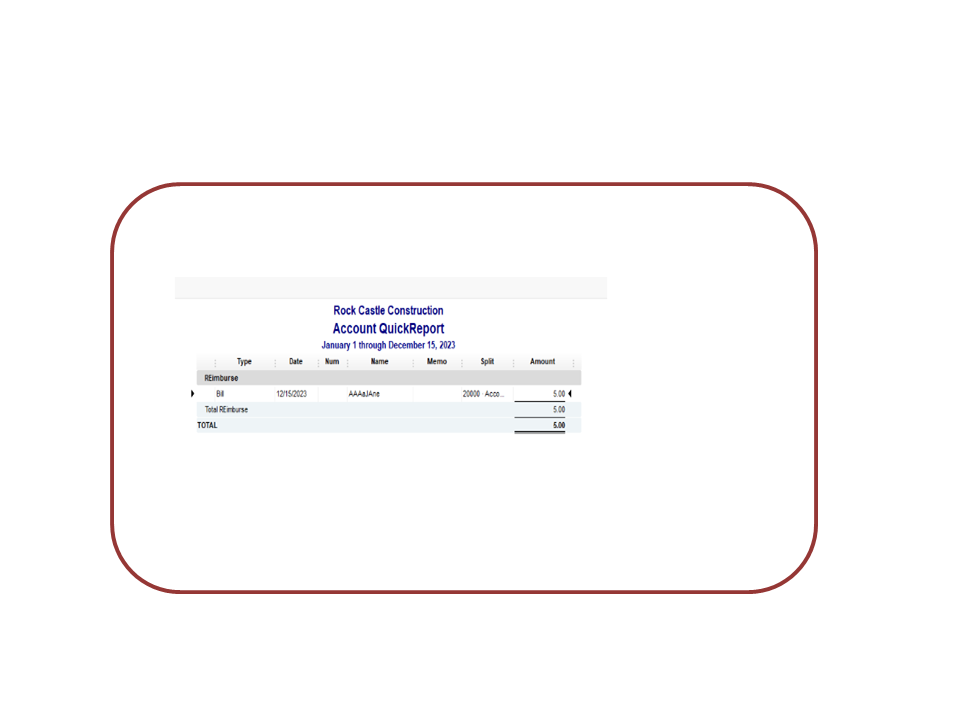

Thanks for adding more details about your concern. Based on the information, you’ll have to open two quick reports to view the reimbursable expenses.

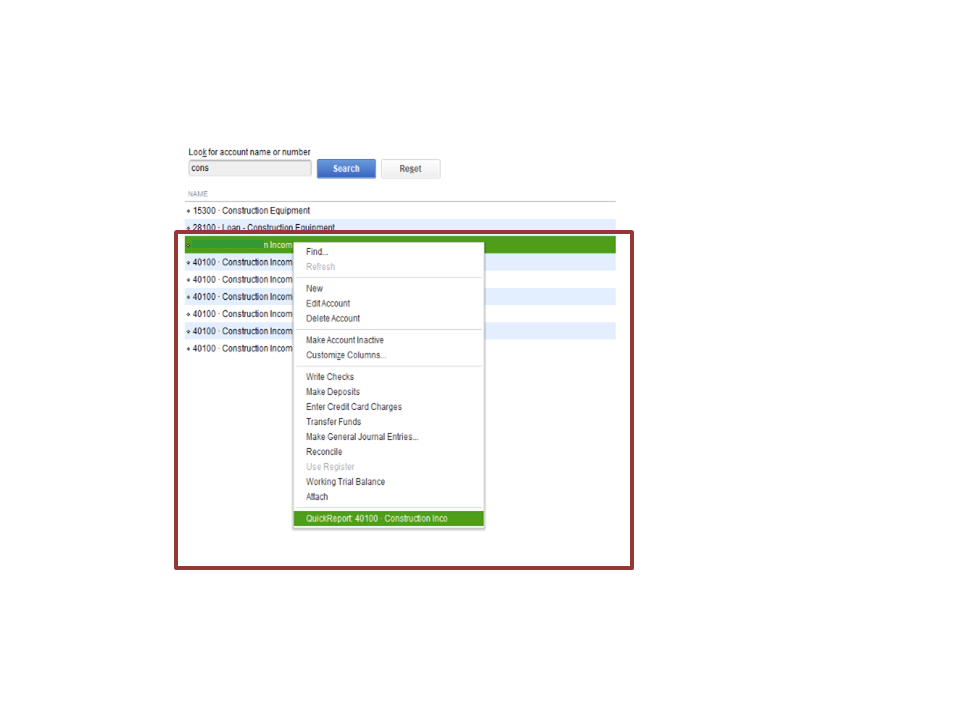

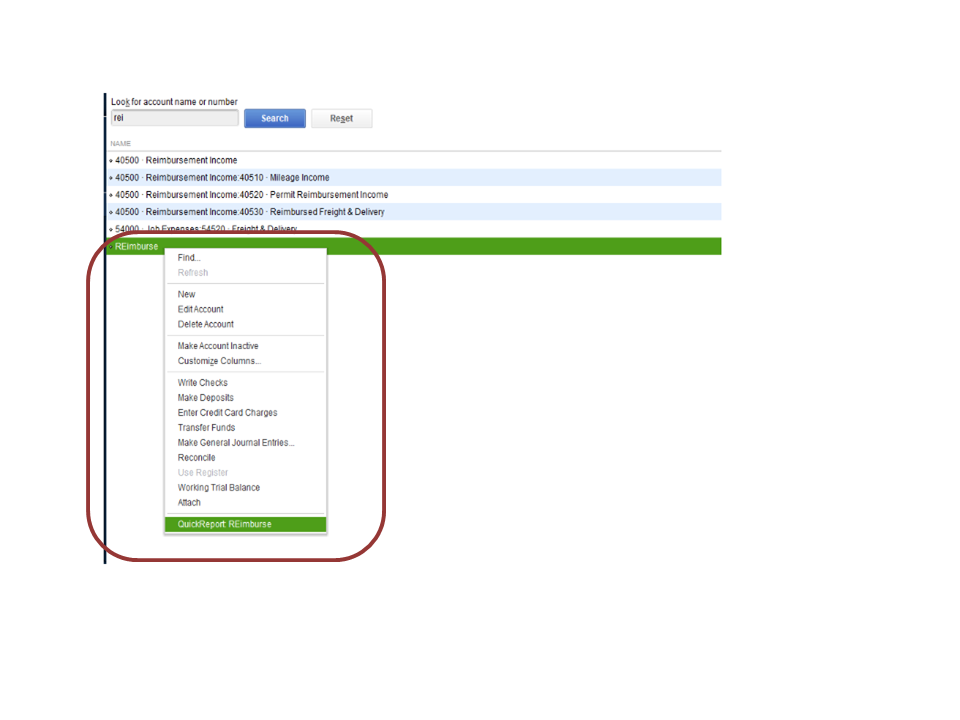

To accomplish it, open the income and expense account associated with the transaction. Here’s how:

To view the income:

For the expense:

For future reference, let me share with an article that provides an overview of how to tailor the data as well as add more brand to the report: Customize reports in QuickBooks Desktop.

Stay in touch if you have any other concerns or questions. I’ll be right here to answer them for you. Have a great rest of the day.

You can double click on the expense account then total by customer. Customize the report to add the paid status field and select paid status and toggle to open. The problem with this report is that if an invoice is only partially paid, the payment is applied proportionately to all line items on the invoice. If you are using billing costs, a balance in your expense account would indicate that the cost was never billed.

You should consider using items for your reimbursable costs. For instance, set up an item for postage. Costs that are related to customers and are reimbursable should not show up on your P&L statement. There are an asset account that is usually called Work In Progress or Reimbursable Customer Costs.

When you enter an expense or bill, you use the item tab and not the expense tab. The customer name is included on the item line and marked billable. When you invoice, you pull these costs into the invoice and this reduces the asset balance.

You can then run a report on the items and customize the report by totaling by customer and paid status to find out what costs are still due.

BOM, I feel your frustration.... this should be an EASY report for Quickbooks but i found the exact solution for you. I myself have the same issue, and for whatever reason people I explain this to, just like you did in your various posts, I guess dont understand the purpose of this report. We need a report to show BILLS or INVOICES we have paid but have NOT BEEN REIMBURSED yet by a customer in the form of a bill they have been given or even not billed for yet - in the reports below you WILL NEED to bill the customers in order for this to work. We simply want to know what we have spent on behalf of a customer and have not been paid back yet. So, it would be nice to see a report from QB with all this built into 1 report already formatted.

To many of us this really should be called an "out of pocket report"

here are the reports you need. I had to run 2 reports and combine an ACCRUAL report and a CASH BASIS report. The cash basis report will show ONLY PAYMENTS YOU MADE against that customer. The ACCRUAL report will shown all expenses billed. By comparing the 2 and subtracting the cash payment amount from the accrual amount will give you the total, or the "out of pocket expenses" to this point until the customer pays you. The 2 reports will list every invoice item so you can go down the list and compare. It is easier to export to excel into 2 separate spreadsheets so you can sort by date. *** please note my QB kept crashing right after each export so i had to keep reloading and starting the report process over again. But at least the reports had been exported to excel by then. I just had to remember which report i was using. **** 2nd note.... in my case, as a contractor, i had an issue with a client trying to pay bills behind my back directly to vendors and subs. I invoiced the customer, the customer wanted to pay direct and in 1 case was able to. So in my reports there was 1 invoice i had invoiced to the customer that had already been paid to that vendor/sub. That amount was still in my reports below in the accrual report so i had to remove that amount or line from that report to get an accurate amount of payments i made to what was actually invoiced.

I am using QB Desktop Premier Contractor 2020.

Go to "Reports" tab and in the various report lines there should be an option in one of those sections for "Job Cost Detail", at least there is in the contractor edition. Your industry version is probably similar. You can also find this report by doing the following: in the ribbon at the top of QB, select "Reports" then select "Report Center". In the "Report Center" select the "Memorized" tab inside Report Center. In the Memorized tab section I had the option for "Contractor" which you might have a different category for your version of QB, then in the Contractor list select "Job Cost Detail"

Run the report. It will give more detail then you need. 1st step is to choose your time period in the drop down box. I chose "all". Then below that you will see Accrual or Cash. Dont do this yet. Right now you probably have other projects in the list. You want to filter out only that 1 project. My version to the right side of Accrual or Cash has a "hide filters" area. To the right of that shows the filters pre-populated by QB. In the "Name" section click the blue link that says "all customers/jobs". When you click on that it will bring up another box with the "name" category selected in the options box and to it's right will be another drop down box where you can then choose only that specific customer or project. Choose the specific customer you want then select OK. The report will then run just that customer. Now, and only now do you want to run BOTH ACCRUAL AND CASH BASIS reports. after running each report, export each report to excel so you have copies to compare against. The cash basis report will be what you are specifically asking for in your posts, all your expenses paid to this point and the accrual report will be everything you billed so far. subtract the 2 and you will get how much you are "out of pocket" for that customer until they pay you.

BOM, I feel your frustration.... this should be an EASY report for Quickbooks but i found the exact solution for you. I myself have the same issue, and for whatever reason people I explain this to, just like you did in your various posts, I guess dont understand the purpose of this report. We need a report to show BILLS or INVOICES we have paid but have NOT BEEN REIMBURSED yet by a customer in the form of a bill they have been given or even not billed for yet - in the reports below you WILL NEED to bill the customers in order for this to work. We simply want to know what we have spent on behalf of a customer and have not been paid back yet. So, it would be nice to see a report from QB with all this built into 1 report already formatted.

To many of us this really should be called an "out of pocket report"

here are the reports you need. I had to run 2 reports and combine an ACCRUAL report and a CASH BASIS report. The cash basis report will show ONLY PAYMENTS YOU MADE against that customer. The ACCRUAL report will shown all expenses billed. By comparing the 2 and subtracting the cash payment amount from the accrual amount will give you the total, or the "out of pocket expenses" to this point until the customer pays you. The 2 reports will list every invoice item so you can go down the list and compare. It is easier to export to excel into 2 separate spreadsheets so you can sort by date. *** please note my QB kept crashing right after each export so i had to keep reloading and starting the report process over again. But at least the reports had been exported to excel by then. I just had to remember which report i was using. **** 2nd note.... in my case, as a contractor, i had an issue with a client trying to pay bills behind my back directly to vendors and subs. I invoiced the customer, the customer wanted to pay direct and in 1 case was able to. So in my reports there was 1 invoice i had invoiced to the customer that had already been paid to that vendor/sub. That amount was still in my reports below in the accrual report so i had to remove that amount or line from that report to get an accurate amount of payments i made to what was actually invoiced.

I am using QB Desktop Premier Contractor 2020.

Go to "Reports" tab and in the various report lines there should be an option in one of those sections for "Job Cost Detail", at least there is in the contractor edition. Your industry version is probably similar. You can also find this report by doing the following: in the ribbon at the top of QB, select "Reports" then select "Report Center". In the "Report Center" select the "Memorized" tab inside Report Center. In the Memorized tab section I had the option for "Contractor" which you might have a different category for your version of QB, then in the Contractor list select "Job Cost Detail"

Run the report. It will give more detail then you need. 1st step is to choose your time period in the drop down box. I chose "all". Then below that you will see Accrual or Cash. Dont do this yet. Right now you probably have other projects in the list. You want to filter out only that 1 project. My version to the right side of Accrual or Cash has a "hide filters" area. To the right of that shows the filters pre-populated by QB. In the "Name" section click the blue link that says "all customers/jobs". When you click on that it will bring up another box with the "name" category selected in the options box and to it's right will be another drop down box where you can then choose only that specific customer or project. Choose the specific customer you want then select OK. The report will then run just that customer. Now, and only now do you want to run BOTH ACCRUAL AND CASH BASIS reports. after running each report, export each report to excel so you have copies to compare against. The cash basis report will be what you are specifically asking for in your posts, all your expenses paid to this point and the accrual report will be everything you billed so far. subtract the 2 and you will get how much you are "out of pocket" for that customer until they pay you.

Hello

Is there a report that lists unbilled client expenses that were paid for and now I want to see if they have been billed to the client?

Yes, there is a report in QuickBooks Desktop that can help you view the details of unbilled client expenses that were paid for by the company, 126116.

We can run Unbilled Costs by Job report that can help you track unbilled client expenses and customize it according to your preferences. Here's how:

From there, you have the option to customize the report based on the specific information you want to view.

Moreover, you can memorize reports in QBDT if you wish to save the same customization settings to be available for future use.

Keep me posted if you have any follow-up questions about running reports. I'm always here to ensure you'll be assisted timely. Take care, and have a good one!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here