Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowIn one of my bookkeeping sessions I was told that I could view the interrelationship between revenue accounts/categories and the corresponding expense accounts/categories by using classes. I have followed the "how-to" articles and do not see how to do this the way I am envisioning it working in a relatively smooth and seamless way which would be as follows:

1. Set up the classes to correspond to the desired accounts (NOTE: would be easier to just have account/category setup in the chart of accounts be able to indicate the relationship for an expense category/account to a given revenue/income account or at least indicate the class and/or tag).

2. For each transaction of a deposit and expense, indicate the class from the dropdown; this exists today. NOTE: It would be easier if the classes were part of the account/category set up to autofill this field.

3. Run a Profit/Loss report based on classes....the only one I see is a P&L by Tags, so it seems that classes will not give me this ability.

What the board has requested and I am trying to do is to show that if we took in a designated donation (we are a non-profit), we would like to see any expenses directly related to this income to know if we need to make adjustments/decisions if that segment has a negative balance. Ideally, this would also help in the determination of budget adjustments and projections.

Am I missing something in QBO Advanced on how to do this? Any help is greatly appreciated!

Thank you!

Paul

Solved! Go to Solution.

I appreciate you for laying out the details of your concern, @lewandpd.

I'll help you see the data you need about the interrelationship between the revenue and the corresponding expenses to seamlessly manage your business in QuickBooks Online.

We can run a Class Quick Report to get clearer insights into your income and expenses based on classes. Here's how:

Also, we have a Profit and Loss by Class report to see your income, expenses, and net income by class. I'll show you how to do it.

You'll want to review these great resources to help you modify your reports based on the information you need as well as how to save its current customization settings:

Keep me posted if you still have questions or QBO-related concerns. I'll be around for you.

Thank you, Carneil_C. Right now I have not entered any transactions with class assignments and so I am guessing that is why I am not seeing an available report for P&L by Class listed in the Business Overview section, correct?

Next question: I have 3 main categories/accounts for our non-profit: 1. Child Sponsorships, 2. Ministry Support and 3. Mission Trips. Each has their own revenue and expense categories/subcategories. For the report, I would need to just have the 3 classes and not split them by income and expense classes...correct? (That way they would pull in anything will an income into one of our 3 revenue classes (as listed above), and the same with the expenses. Would happen to have a sample report to attach for me to look at?

Thank you.

Paul

Hi Carneil. Not sure if you got my reply to your excellent response asking if I only need classes say for my three main areas of Child Sponsorship, Ministry Support and Mission Trip. Then I would tag both revenue and expense with the same class (when they are related), and the report of P&L by Class would do the grouping along with calculating the Net Income for each of these classes...is that correct? If so, do you have a sample report that you could attach?

Thank you.

Paul

Hi there, @lewandpd.

I'm here to assist you with your query about running reports by class in QuickBooks Online.

The Profit and Loss by Class report will show in the Business Overview section if you have turned on the Class Tracking feature. Since you're a non-profit organization, the Profit and Loss by Class report will show as Statement of Activity by Class report.

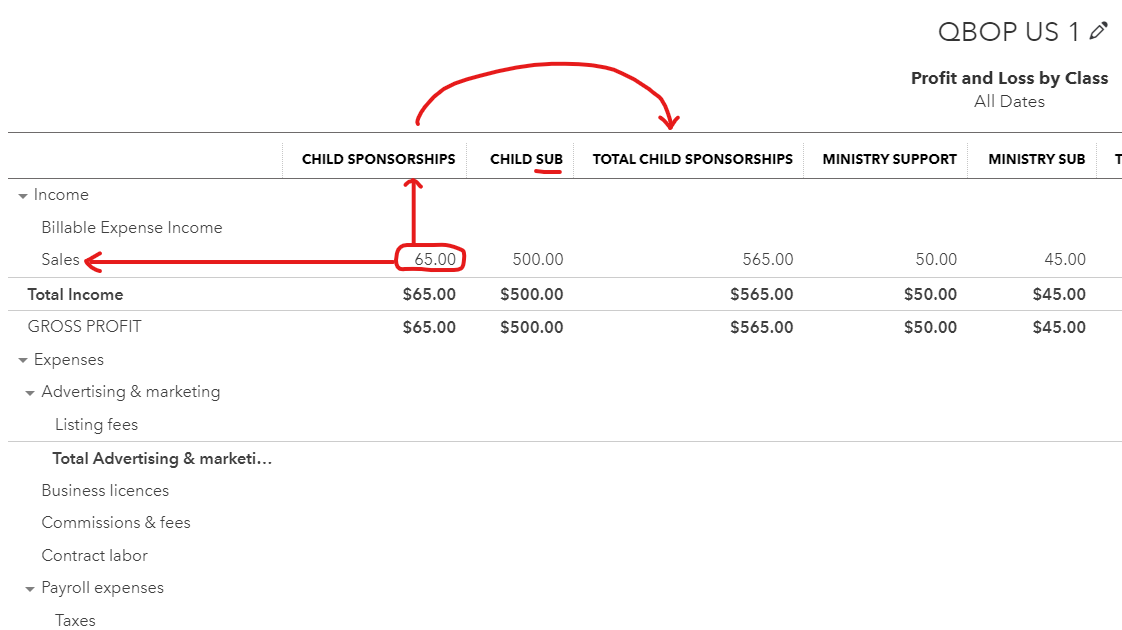

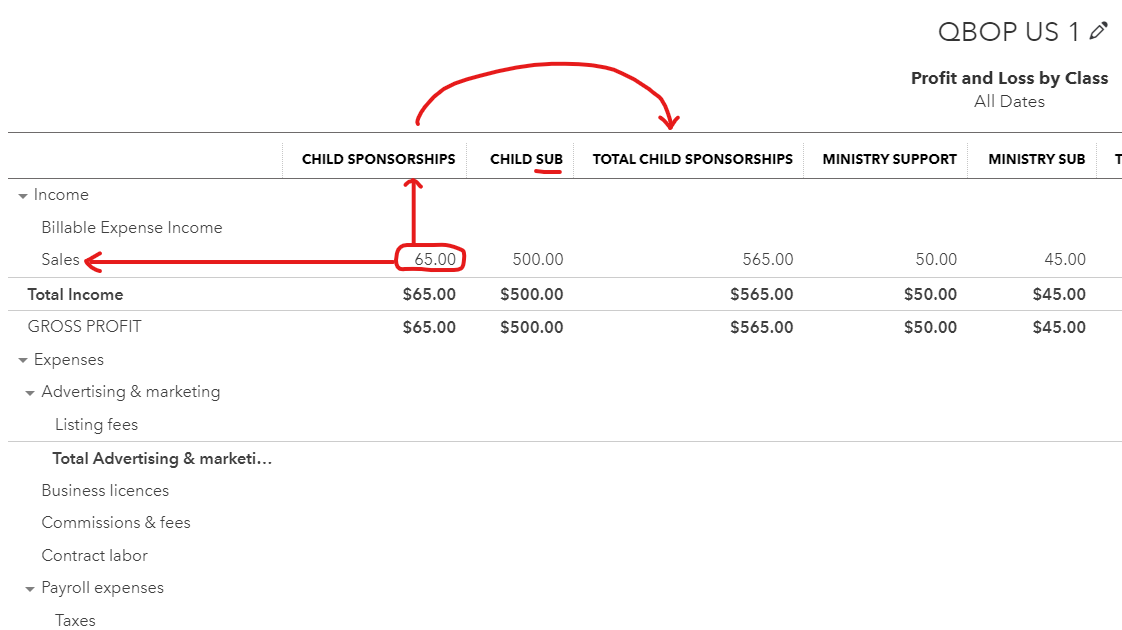

If you assign transactions to each different class, they will show in your Profit and Loss by Class report in different columns. This way your transactions will be segregated into different classes and sub-classes. Below is a sample Profit and Loss by Class report that shows your three classes with sub-classes.

If you want to split them into income and expense, you'll need to set up an account for each of them through the Chart of Accounts. This way, you can categorize the transactions with classes to their specific revenue and expense classes.

For example, the image above with the three different classes with sub-classes has a transaction categorized as a Sales revenue account type. This means you recorded your line item in your transaction in the Sales revenue account type and classified as Child Sponsorships class type. However, if you want to add an expense transaction, you'll need to create a new Expense transaction assigned to an expense account type and a class assigned.

Furthermore, you can also learn how to customize your reports in QuickBooks Online to personalize your reports by your preferred data.

If you need additional help with class tracking and running a report in QuickBooks Online, please feel free to leave a reply. I'm always here to assist you.

Thank you, MarkAngeloG, for your reply and examples. If I want my specific accounts/subaccount expenses to show up in the SAME column, e.g., Child Sponsorships, then I would add the Class "Child Sponsorships" to the transactions that were directly related to the "Child Sponsorships" revenue...correct?

Also, what would it take to get a "class" field assigned to a particular account/category to make auto-population of that field in a given transaction line to happen? I would also want this to happen in the "Rules" as well. Is there a way to do this using "custom fields"?

FYI...I do have the classes enabled, however, the report of P&L by Classes does NOT show up in the list. Please see the additional attached screenshot.

Thank you.

Paul

I appreciate you for following up with additional questions regarding using classes for revenue and related expenses in QuickBooks Online (QBO), @lewandpd.

Upon carefully reading the thread, I see that your company is a non-profit organization which is why the P&L by Class report doesn't show up under the business overview. The name of the reports changes when your company type is set up as nonprofit. In your case, you can run the Statement of Activity by Class report.

Moreover, it seems that you want to show your subaccount in the same column as the Child Sponsorship class which is not feasible in QuickBooks. It's important to note that when running a Profit and Loss by Class report, classes are linked to the detailed portion (line item) of transactions, not the categories or subaccounts. This is to identify the amount of income for each category.

For the 'Rules', are you referring to the bank rules in QuickBooks that you want to assign classes to? What does it have to do with the custom field? Please know that we don't have the option to add custom fields for bank rules. To learn more about it, check out this article: Set up bank rules to categorize online banking transactions in QuickBooks Online.

Additionally, if there's something you want to add that is not available within your profit and loss report, you can also export it to Excel. From there, you can personalize your data further manually.

If you have additional questions about using classes and running P&L by Class report in QuickBooks, just hit the reply button below. The Community team is always around to answer them for you.

Hi Nicole,

Thank you for your response; that certainly explains why the P&L by Classes is not showing; I would prefer that there was one as I like for grouping better than the Statement of Activity by Class which is more detail than I would like at times.

My statement in regard to the Import of data/rules is that it would make it a lot more automated to be able to have the ability to assign a class in the chart of accounts such that no manual selection from a dropdown would be needed; for me this is a cumbersome step as most of our donations come thru a 3rd party interface (REACH).

How do I get these enhancement ideas put forth for the QBO development group to consider them?

Thank you.

Paul

Thanks for joining this thread, Paul. We're glad to have you send your thoughts directly to our Product Engineers.

To send your feedback about our product, we'll have you submit it to our team using your QBO account. Doing so would help them improve our software for the benefit of the users.

Here's how:

Moreover, I'm adding this article to help you personalize your reports in QBO: Customize reports in QuickBooks Online.

Feel free to post again here in the Community if you have more QuickBooks-related concerns. Have a great day.

Thank you, Ivan, for your helpful information as well as all the others in prior posts!. With an additional Bookkeeper session I believe I have enough information to proceed.

As a first time Community user I am not sure how to mark this question as SOLVED...any help would be appreciated!

It's good to hear that my colleague's previous response was helpful for you, @hopeforchildrenministriesinc.

Marking a response from another user or agent's response as solved is generally available if you're the author of the original post. However, if you're joining a thread and want to mark a response as solved, you can follow these steps:

For future reference, let me add this article to learn about Fund Accounting for non-profits and how to track funds in QuickBooks Online (QBO): Fund Accounting for non-profits in QuickBooks Online.

We'll always be here in the Community should you need further assistance running Profit and Loss or other financial reports in QBO. We'll do our best to assist. Take care.

Thank you, AlverMarkT, for your response. I have attached a screenshot of what I see when I click on the 3 vertical dots and it does not include the Solved option. Can you please advise on how or where to see that option? I also tried looking around at my original post and did not see this option either when I clicked the 3 vertical dots although there was one option to "float this topic for current user" but I do not know what that means.

Thanks.

Paul

I appreciate you for coming back to the thread to ask for additional clarification about the option that you have on your end, hopeforchildrenministriesinc. I'll clarify how marking as Solved or Accept as Solution to the post in the Community works.

Please know that the Accept as Solution is only available if you're the author or the original poster of the page. Otherwise, you can only click the Cheer button to notify my colleague that you agree to the steps provided.

In case you need to see a table list that contains which reports are available for your version of QuickBooks, you can read this article: Reports included in your QuickBooks Online subscription.

Please add any details below if you need further assistance with the financial reports. I'll be around to help you.

I appreciate you for laying out the details of your concern, @lewandpd.

I'll help you see the data you need about the interrelationship between the revenue and the corresponding expenses to seamlessly manage your business in QuickBooks Online.

We can run a Class Quick Report to get clearer insights into your income and expenses based on classes. Here's how:

Also, we have a Profit and Loss by Class report to see your income, expenses, and net income by class. I'll show you how to do it.

You'll want to review these great resources to help you modify your reports based on the information you need as well as how to save its current customization settings:

Keep me posted if you still have questions or QBO-related concerns. I'll be around for you.

Thank you, Carneil_C. Right now I have not entered any transactions with class assignments and so I am guessing that is why I am not seeing an available report for P&L by Class listed in the Business Overview section, correct?

Next question: I have 3 main categories/accounts for our non-profit: 1. Child Sponsorships, 2. Ministry Support and 3. Mission Trips. Each has their own revenue and expense categories/subcategories. For the report, I would need to just have the 3 classes and not split them by income and expense classes...correct? (That way they would pull in anything will an income into one of our 3 revenue classes (as listed above), and the same with the expenses. Would happen to have a sample report to attach for me to look at?

Thank you.

Paul

Hi Carneil. Not sure if you got my reply to your excellent response asking if I only need classes say for my three main areas of Child Sponsorship, Ministry Support and Mission Trip. Then I would tag both revenue and expense with the same class (when they are related), and the report of P&L by Class would do the grouping along with calculating the Net Income for each of these classes...is that correct? If so, do you have a sample report that you could attach?

Thank you.

Paul

Hi there, @lewandpd.

I'm here to assist you with your query about running reports by class in QuickBooks Online.

The Profit and Loss by Class report will show in the Business Overview section if you have turned on the Class Tracking feature. Since you're a non-profit organization, the Profit and Loss by Class report will show as Statement of Activity by Class report.

If you assign transactions to each different class, they will show in your Profit and Loss by Class report in different columns. This way your transactions will be segregated into different classes and sub-classes. Below is a sample Profit and Loss by Class report that shows your three classes with sub-classes.

If you want to split them into income and expense, you'll need to set up an account for each of them through the Chart of Accounts. This way, you can categorize the transactions with classes to their specific revenue and expense classes.

For example, the image above with the three different classes with sub-classes has a transaction categorized as a Sales revenue account type. This means you recorded your line item in your transaction in the Sales revenue account type and classified as Child Sponsorships class type. However, if you want to add an expense transaction, you'll need to create a new Expense transaction assigned to an expense account type and a class assigned.

Furthermore, you can also learn how to customize your reports in QuickBooks Online to personalize your reports by your preferred data.

If you need additional help with class tracking and running a report in QuickBooks Online, please feel free to leave a reply. I'm always here to assist you.

Thank you, MarkAngeloG, for your reply and examples. If I want my specific accounts/subaccount expenses to show up in the SAME column, e.g., Child Sponsorships, then I would add the Class "Child Sponsorships" to the transactions that were directly related to the "Child Sponsorships" revenue...correct?

Also, what would it take to get a "class" field assigned to a particular account/category to make auto-population of that field in a given transaction line to happen? I would also want this to happen in the "Rules" as well. Is there a way to do this using "custom fields"?

FYI...I do have the classes enabled, however, the report of P&L by Classes does NOT show up in the list. Please see the additional attached screenshot.

Thank you.

Paul

I appreciate you for following up with additional questions regarding using classes for revenue and related expenses in QuickBooks Online (QBO), @lewandpd.

Upon carefully reading the thread, I see that your company is a non-profit organization which is why the P&L by Class report doesn't show up under the business overview. The name of the reports changes when your company type is set up as nonprofit. In your case, you can run the Statement of Activity by Class report.

Moreover, it seems that you want to show your subaccount in the same column as the Child Sponsorship class which is not feasible in QuickBooks. It's important to note that when running a Profit and Loss by Class report, classes are linked to the detailed portion (line item) of transactions, not the categories or subaccounts. This is to identify the amount of income for each category.

For the 'Rules', are you referring to the bank rules in QuickBooks that you want to assign classes to? What does it have to do with the custom field? Please know that we don't have the option to add custom fields for bank rules. To learn more about it, check out this article: Set up bank rules to categorize online banking transactions in QuickBooks Online.

Additionally, if there's something you want to add that is not available within your profit and loss report, you can also export it to Excel. From there, you can personalize your data further manually.

If you have additional questions about using classes and running P&L by Class report in QuickBooks, just hit the reply button below. The Community team is always around to answer them for you.

Hi Nicole,

Thank you for your response; that certainly explains why the P&L by Classes is not showing; I would prefer that there was one as I like for grouping better than the Statement of Activity by Class which is more detail than I would like at times.

My statement in regard to the Import of data/rules is that it would make it a lot more automated to be able to have the ability to assign a class in the chart of accounts such that no manual selection from a dropdown would be needed; for me this is a cumbersome step as most of our donations come thru a 3rd party interface (REACH).

How do I get these enhancement ideas put forth for the QBO development group to consider them?

Thank you.

Paul

Thanks for joining this thread, Paul. We're glad to have you send your thoughts directly to our Product Engineers.

To send your feedback about our product, we'll have you submit it to our team using your QBO account. Doing so would help them improve our software for the benefit of the users.

Here's how:

Moreover, I'm adding this article to help you personalize your reports in QBO: Customize reports in QuickBooks Online.

Feel free to post again here in the Community if you have more QuickBooks-related concerns. Have a great day.

Thank you, Ivan, for your helpful information as well as all the others in prior posts!. With an additional Bookkeeper session I believe I have enough information to proceed.

As a first time Community user I am not sure how to mark this question as SOLVED...any help would be appreciated!

It's good to hear that my colleague's previous response was helpful for you, @hopeforchildrenministriesinc.

Marking a response from another user or agent's response as solved is generally available if you're the author of the original post. However, if you're joining a thread and want to mark a response as solved, you can follow these steps:

For future reference, let me add this article to learn about Fund Accounting for non-profits and how to track funds in QuickBooks Online (QBO): Fund Accounting for non-profits in QuickBooks Online.

We'll always be here in the Community should you need further assistance running Profit and Loss or other financial reports in QBO. We'll do our best to assist. Take care.

Thank you, AlverMarkT, for your response. I have attached a screenshot of what I see when I click on the 3 vertical dots and it does not include the Solved option. Can you please advise on how or where to see that option? I also tried looking around at my original post and did not see this option either when I clicked the 3 vertical dots although there was one option to "float this topic for current user" but I do not know what that means.

Thanks.

Paul

I appreciate you for coming back to the thread to ask for additional clarification about the option that you have on your end, hopeforchildrenministriesinc. I'll clarify how marking as Solved or Accept as Solution to the post in the Community works.

Please know that the Accept as Solution is only available if you're the author or the original poster of the page. Otherwise, you can only click the Cheer button to notify my colleague that you agree to the steps provided.

In case you need to see a table list that contains which reports are available for your version of QuickBooks, you can read this article: Reports included in your QuickBooks Online subscription.

Please add any details below if you need further assistance with the financial reports. I'll be around to help you.

Thank you! I have now set it to be SOLVED. I logged in as another user when I was working on a different issue, and when I logged out and back in I was able to see the button!

Paul

Hello there, lewandpd.

I appreciate you for coming back to the thread and sharing an update about your concern. I'm glad that you're now able to set the post to be SOLVED.

Please know that you're always welcome to add a comment below if you still have concerns about managing reports with classes in QBO. I'm always around to help.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here