Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I'll be here to help you record you expenses that are already paid, office124.

If the bank you're using in paying the bills is connected to QBO, you can add them directly from your Banking page. They'll show as expenses in your bank's register. You can also manually enter them as either a Check or Expense.

We can use a Check as an example:

Let me know if there's anything else that you need help with.

If the bills are being paid through the bank, would the CHECK feature work, since no check is being sent to pay the bill?

For example, I know every month my Internet bill will be a certain amount and charged to my Debit card on a certain date. Do I create the Expense - Payee, Category, Description, Amount, Date, etc, - for that future charge and it will MATCH in the bank feed when it finally posts? Thanks

Good day to you, rh57.

Both the check and expense report a transaction as an expense and a payment simultaneously.

You can create an expense to record the bill you've paid through your bank. QuickBooks will automatically match this payment on your bank feeds.

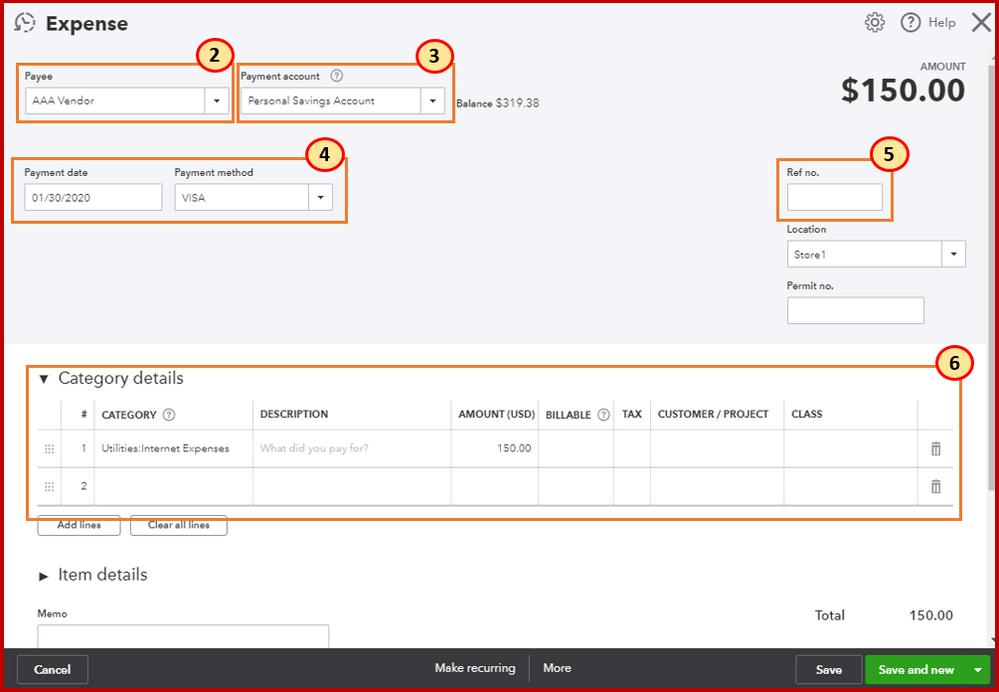

Let me show you how:

After that, go to the Banking page and match those expenses. The screenshot below will show you how it's done.

I've also added the Download, match, and categorize your bank transactions link for additional information. It includes a quick video tutorial and detailed steps to guide you with the process.

Learn more about this by going through this article, What is the difference between bills, checks, and expenses? for more details.

Don't hesitate to leave a comment below if there's anything else you need with QuickBooks. I'm always right here to answer your questions.

Have a great day ahead!

These are payments that are put on the bank debit card so no bill has ever been created. I'm wondering if I need to create a bill for each of these transactions or can I just enter the vendor name and add it

Perhaps I didn't word my question correctly. We order supplies and materials online and pay directly with out bank card. When this shows in the bank, do I have to go into QB's and create a bill and then create a payment or do I just make sure it is showing the correct vendor and category or can I just accept it??

Good Afternoon, @fidlady1.

Let's get some insight into which route you should take for your business. To clarify, you can do it ether way you'd like. It's solely based on how you'd like to run your business in QuickBooks Online. My colleague @MaryLandT did give you the correct information on how to match transactions if you decide to go that direction. Below is a guide that can be very helpful for the future.

If you have any other concerns, feel free to let me know. Have a wonderful weekend.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here