Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowWhat about for checks or direct deposits received from specific insurance companies or government payors on behalf of patients/beneficiaries... the QBO user (a Single Member LLC medical provider) clicks on the "Receive Payment" within he specific customer invoice (while selecting either Check or Direct Deposit which usually goes to A/R), is there a way to attributes that payment to an A/R account that is created called Blue Cross Insurance Claim Account or Medicare Claim Account? I'm not sure how to properly properly account for the transaction or whether it can even be done, but I hope someone from QBO can advise (step by step) what the correct way is. Also, what if a medical provider bills $90 per service, the patient pays a $10 copay and the insurance pays $78.53. Because the contract rate is $88.53, how do you clear the remaining $1.47 so that you can satisfy/show the invoice as paid?

Solved! Go to Solution.

You can create new a/r accounts, but for some reason QBO will not allow you to use them --obviously a disconnect here during development

QB is really not designed for medical billing, medical billing software would be a good investment long term

The write off between billed and approved should to be handled by a credit memo, create a non inventory item which posts to a sales income discount account, and use that on a credit memo. In receive payments, apply the credit memo to the invoice and receive the payment

QB operates on the customer level, the concept of multiple customers (patient, primary ins, secondary ins) paying one invoice is hard to track. QB does not care who pays a part of an invoice, but for medical billing you need to know who paid what when and for who, and you can not track that in QBO. Class or location can not be used for payments, nor can an item..

You can create new a/r accounts, but for some reason QBO will not allow you to use them --obviously a disconnect here during development

QB is really not designed for medical billing, medical billing software would be a good investment long term

The write off between billed and approved should to be handled by a credit memo, create a non inventory item which posts to a sales income discount account, and use that on a credit memo. In receive payments, apply the credit memo to the invoice and receive the payment

QB operates on the customer level, the concept of multiple customers (patient, primary ins, secondary ins) paying one invoice is hard to track. QB does not care who pays a part of an invoice, but for medical billing you need to know who paid what when and for who, and you can not track that in QBO. Class or location can not be used for payments, nor can an item..

Hi Lindsey,

Did you figure out how to track insurance claim payments? I am having the same issue.

Hi there, allisontax,

I'm here to help track the insurance claim payments in QuickBooks Online.

You need to create an account to help categorize this entry. I suggest consulting this with your accountant to know what specific type of account to set up.

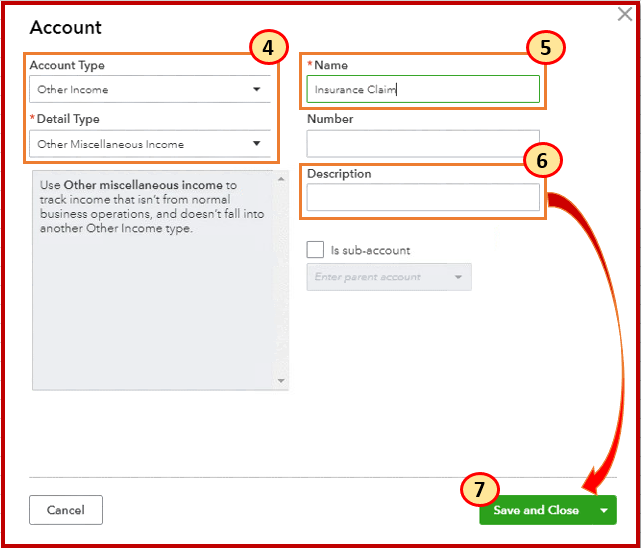

Create a new account

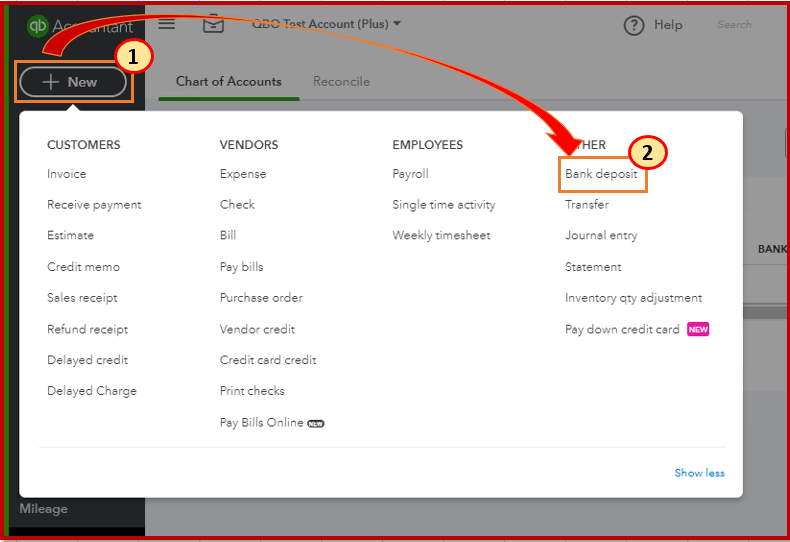

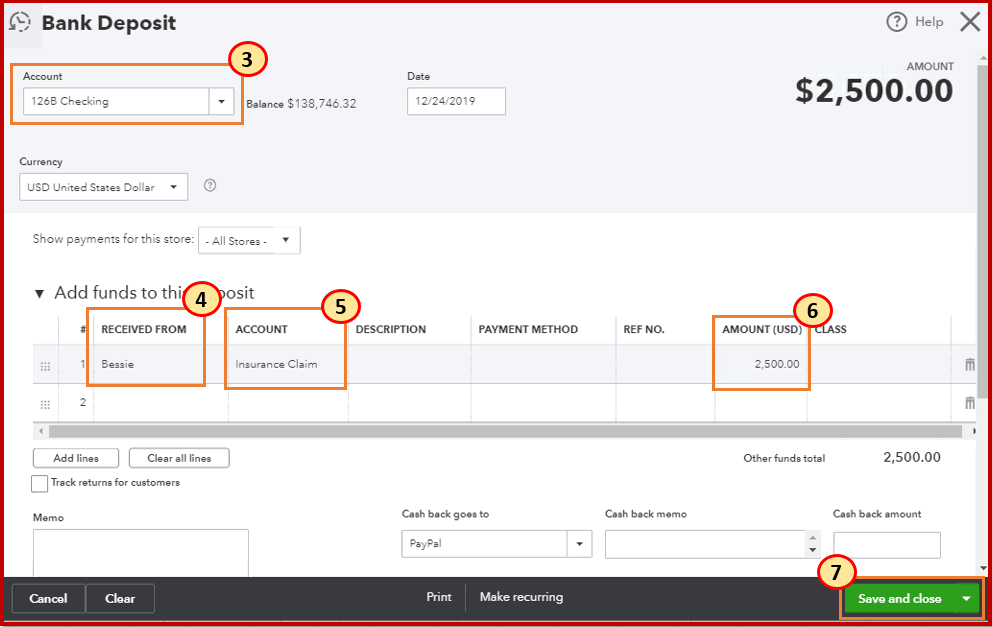

Once done, make a bank deposit and categorize it under the account created above. Here's how:

You can refer to the record and make bank deposits to learn more about the process.

Let me know if you have follow-up questions, and I'll get back with the information you need.

I had the same issue and decided to setup the patients as a sub-customers of the insurance company and select the option to Bill with parent. It works like a charm!

Here is the screen-shot under customer setup:

Oh that's smart, I like that! Well done!

What was the end result/recommendation to write off the amount over the contracted allowable amount in the online version? Can you apply a write off simultaneously when recording the insurance payment?

I like the sub-customer idea, if they are your clients. If a provider has someone outside the office doing the bookkeeping with QBO, I'm not sure this method would work....HIPAA and all. Any other thoughts of how to accomplish this?

Hi there, @Dspeedy.

Thank you for reaching out to the Community. We can use class tracking to help you track the insurance payment in QuickBooks.

Although, you can associate it to a customer or sub-customer. Just make sure your Class Tracking feature is turned on for the Class column to show up.

On the other hand, class and location tracking monitors income, expenses, and reports for different segments or locations of the business.

Please see these support articles for more details:

Leave a comment below if you need anything else, I’m always ready to help. Have a good one!

Yeah... totally shouldn’t be inputting client data in QB. They refuse to issue a BAA. Get practice management software and do it right.

Hi Mary,

Quick question... will this allow identify (track & generate a report) who paid a particular of an invoice and when?

Thanks for the input!

- Henry

Hi @HJ-Nesca,

I'll handle this query for you.

The steps provided by my peer @MaryLandT above is for insurance claim payments. As for your concern, I'd like to point you to the post made by Rustler above. In case you missed it, the option to track who paid what portion of an invoice, and also when, is unavailable at this time.

I suggest you consult your bookkeeper or accountant on how it's best to proceed with your earlier query. It's so you can ensure your books stay accurate.

You may also keep an eye on this page: The QuickBooks Blog. It lists all of QBO's new features, as well as improvements each month. It also comes with a short description for each, so you'll become familiar with them in no time.

Direct other questions you may have in the comments below. I'll be sure to get back to you.

I setup all the insurance carriers as the primary customers and I have 1 "patient" called NONE that I am using to track patient payments. Because of HIPAA you cannot individually identify patients and treatment charges in QB or QBO and I do not do this.

But, my method allows me to track Accounts Receivable by Insurance carrier. I am currently posting Co-pays as discounts for now, until I find a better way.

Elias

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here