Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I'll help you process a refund to your customers in QuickBooks Payments, @pturzo.

The best way to pay back your customers is by reversing the transaction in your QuickBooks Payments account. Let me show you how:

In addition, you can easily search for your transactions by date, amount, and last 4 digits of the customer's credit card number.

Please also take note that QuickBooks Payments allows you to process the refund within six months from the date of the sale. After this period, you can provide a refund using cash or check to your customers.

You can also print a receipt of your transaction and manually send to it your customers. Here's how:

The Community always has your back, so please let me know if you have other questions. Have a great weekend, and stay safe.

Thank you ReymondO

Weird thing is, when I go to my QuickBooks Payments account and search for his 3 transactions, the 2 credit card transactions show up but not the 3rd transaction where he used Quickbooks Payments-bank. However, if I go to Activity and Reports and search all deposits, all 3 transactions show up. So it's not allowing me to reverse his ACH payment.

Is there another way to do this refund? If I go to the payment that I'm trying to refund in Quickbooks Online and click on "transaction processed", a bank transfer receipt pops up. There is an option to print or refund. If I hit refund, will that work to refund him the money? Or, is this just how to handle refunding the invoice within Quickbooks Online and it doesn't actually refund the money?

Yes, there is, @pturzo.

Recording a refund to your customer will actually return their payments. Allow me to share some steps on how to achieve this in your QuickBooks Online (QBO) account:

You can read the Refund a credit card payment or ACH payment for a paid invoice section in this article for more information: Void or refund customer payments in QuickBooks Online.

I'm also this resource that can guide you on how to link your customer deposit to an invoice.

Let me know if you have other questions about refunds in QBO. I’ll be around ready to assist you. Take care, and stay well.

Thank you JasroV.

I feel like I need to explain exactly what happened.

I invoiced a customer in September. The customer made 2 payments towards the invoice but never paid the full amount. He made 2 payments via quickbooks payments-credit card and 1 payment via quickbooks payments-bank.

He changed his mind about the purchase this week and wants a refund. I was able to refund the 2 credit card payments but not the ACH payment. I just now mailed him a check because I couldn't figure out how to reverse the ACH payment online. Now, I'm really not sure how to record all this in quickbooks online. It seems there are so many different ways to do one thing. It's very confusing.

Thanks for getting back to this thread and providing additional details about your concern, @pturzo.

You can record a refund to your customer using Check or Expense if they made a prepayment for an order but canceled it before receiving the goods or services. Doing this will reduce your bank's balance and offsets the customer's prepayment.

Let me show you how:

Step 1: Record the refund for your customer

Step 2: Link the refund to the customer's credit.

In addition, you can run the Transactions List by Customer report in QuickBooks Online. This will show you the list of income and expense transactions grouped by customers. Just go to Reports and open the Transactions List by Customer report.

Please know that our doors are always open to help you with any QuickBooks-related concern. Take care and enjoy the day!

Thank you so much! All that makes sense. What do I do with the original invoice now?

It shows as if we still have an outstanding partially paid invoice.

Also, was it not possible to reverse his ACH payment? When someone pays via Quickbooks payments-bank but changes their mind, is the only way to refund them by sending them an actual check?

Thank you so much!

Let me add some insights about the ACH payment, pturzo.

You need to choose another refund method, like actual check or cash since you're unable to refund an ACH payment.

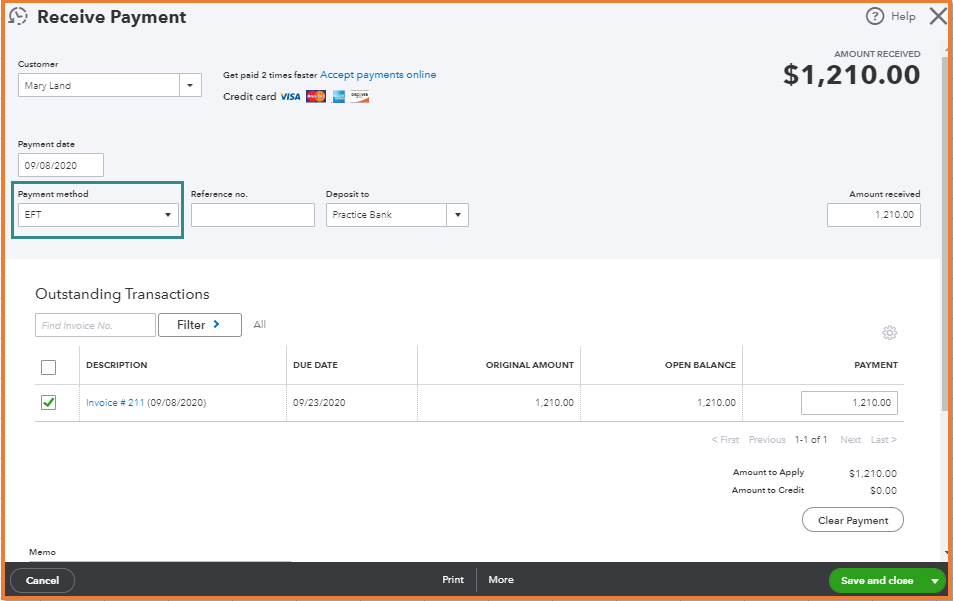

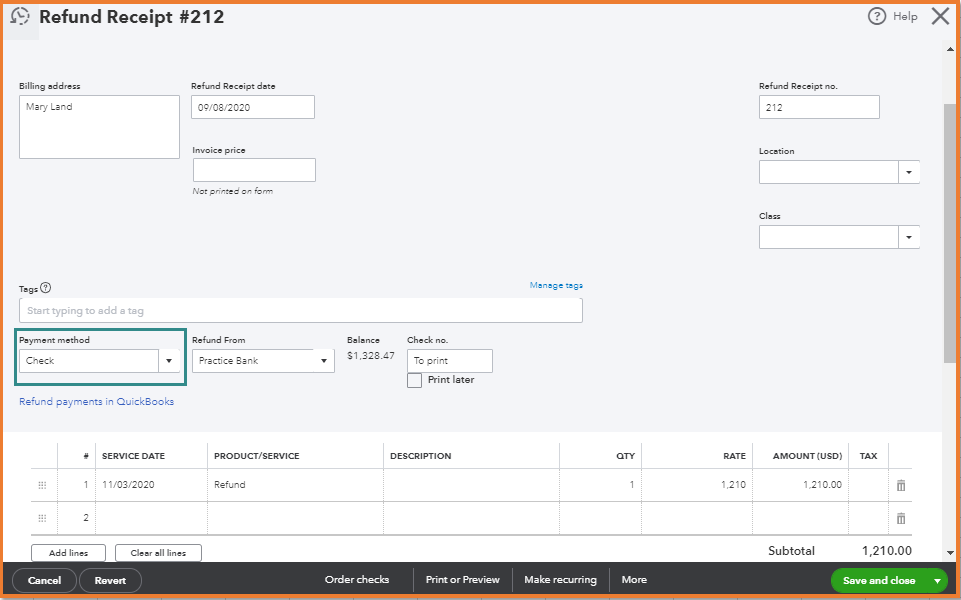

To zero out the balance, you can record the ACH payment. Then, use the Refund receipt function to enter the actual check you've paid to the customer. Let me show you how:

Once done, you can record the refund. Here's how:

You can visit again this link for more details about the process: Void or refund customer payments in QuickBooks Online.

Let me know if you need anything else concerning the customer refund. I'm always around to help you.

Thank you MaryLandT.

I already refunded them the 2 credit card payments they made via Quickbooks Payments-card for $200 and $500 and I mailed them a physical check for $750 to cover the ACH payment. I did a refund receipt for the check I mailed. I did not make a refund receipt for the credit card refunds yet. Should I do that as one transaction for $700 ($500 + $200)?

Going by your instructions:

I don't have an "eft" option in the Payment method pull down. Is that the same as e-check?

The fact that this was paid and refunded in 3 different transactions is making this more confusing for me.

I'm not understanding how to link all 3 refunds I made to the invoice. Not sure what the reference number would be either. Is that the number that was given when I generated the refund receipt for $750?

Sorry that this is not making complete sense to me. I really appreciate all your help.

I'm here to help you with the refund process, pturzo.

The steps provided by @MaryLandT can be performed in QuickBooks Online (QBO). That's the reason why you're not seeing the EFT option.

The Electronic Fund Transfer (EFT) is somewhat the same as an e-check. This is the money from one bank account to another, either within a single financial institution or across multiple institutions.

When processing a refund, you can do that as one transaction for $700. For you to correctly process the refund, you can follow the process provided by my colleague in QBO.

For your reference, you can read this article for more information: Categorize And Match Online Bank Transactions In QuickBooks Online.

Keep me posted on the process. I'll be right here to help you anytime.

I have been going in circles trying to figure out how to give a partial ACH refund from QBO. I see so many articles for refunding the whole transaction, but not a partial amount. I tried going to QuickBooks Payments and searching for transactions, which I can find, but when I go to refund e-check, the transaction won't show up in search results. Why is it so hard to refund pat of an invoice payment from my customer?

Let me help you with processing a partial refund in QuickBooks Payments, cbenson_1.

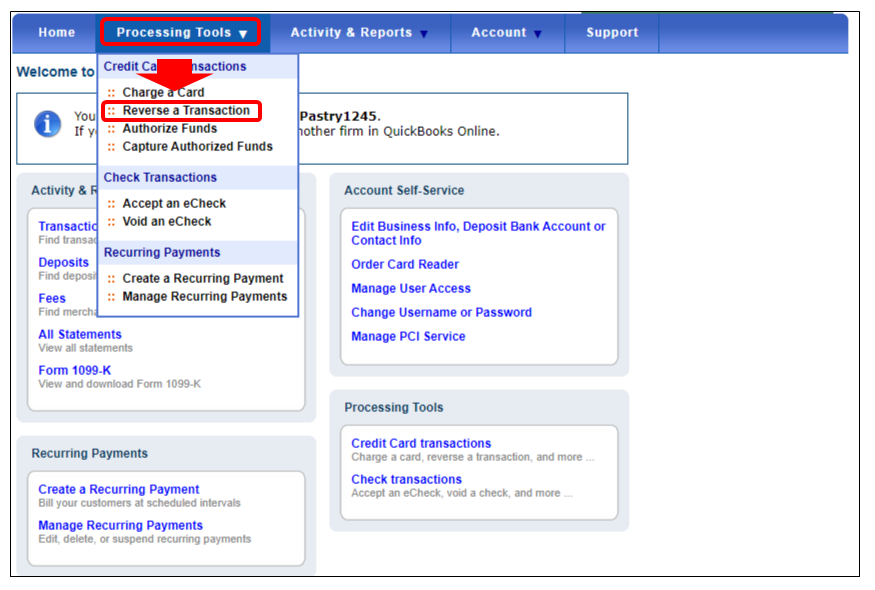

We have two ways to issue a partial refund in QuickBooks Payments. First, we can process a refund by selecting the Reverse a Transaction option in the Processing Tools drop-down. Once you reach Step 6, you'll be prompted to process a full refund. Just make sure to select Cancel and after that, you can enter a different amount. Here's how:

The second one is to create a partial refund/credit. just follow the steps below:

Here's an article you can refer to for more details about voiding or refunding transactions in QuickBooks Payments. Moreover, you may incur a fee depending on your pricing plan and transaction type when processing a refund. For further details, check out this article: Understand fees for refunds or void transactions.

Feel free to browse this link here if you need help with other tasks in QuickBooks Payments. It'll route you to our general payroll topics with articles.

Drop a comment below if you have follow-up questions or concerns about processing customer payments. I'm more than happy to assist you. Take care and have a wonderful day ahead.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here