Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

CYBER MONDAY SALE 70% OFF QuickBooks for 3 months* Ends 12/5

Buy nowThanks for getting back, sb123

Allow me to provide clarifications about the 1099 Transaction Detail Report in QuickBooks Online (QBO).

Cash basis for 1099 Transaction Detail Report includes all the bills that have already been paid and you can customize the report period you want to show on the report.

You may want to check other available 1099 reports for vendors and vendor payments in QBO: Create a 1099 report for vendors and vendor payments.

Stay in touch with me if you have any other questions about QuickBooks reports. I'm always here to answer them for you.

ABSOLUTELY! Not being able to pull a report that simply shows a 1099 vendor and the total they were paid YTD is ridiculous in this day and age. Quicken has far more versatility for reports that total out but quicken does not integrate with other systems much so I am working with QuickBooks Online.

Hi there, lglassman.

Thank you for posting in the Community. I'd be happy to help get this taken care of today.

Currently, you have two options to run the year-to-date report for vendor payments in QuickBooks Online based on what period you need. Let me share what my colleague IntuitLeleth posted.

Run a report of all the payments you made last year to your 1099 vendors:

Run a report of all the payments you made this year:

I've also included this article for additional reference: Create a 1099 report for vendors and vendor payments.

If you need to reach out for more help, I suggest calling our phone support. The phone support agents will be able to assist you in getting this resolved.

Here's how:

These resources should help to get you back on track.

Drop me a comment below if you have any other questions about creating the year-to-date report for vendor payments in QuickBooks Online. I'll be happy to help you further.

It is absolutely ridiculous that this software which is supposed to help businesses cannot provide this absolutely necessary report. One might think that Intuit has no idea how its software is supposed to help not hinder. This is not something that I should have to go onto a forum to find. Correct 1099s should be a one click item.

Hello there, @csdoty.

I like you to know that your voice matters to us. I can see the importance of having the ability to pull up a report that contains all the details that you need for 1099 vendors for your business.

I'll do my part and personally submit this feedback to our developers, so they can assess your preference and put it under consideration. For now, to get the YTD information of your vendors, I recommend following the workaround presented by other users above.

To stay in the loop with our recent news, product updates and road-maps, you can check out our QuickBooks Online Blog.

The Community got you covered if you have any other concerns. Just visit us here, and we'll make sure you're taken care of. Have a good day!

Got laid off 10 days ago (I was running a temp of 103 and am currently waiting to be tested for covid-19) and my local unemployment office is requesting a YTD 1099 before they can process my paperwork that makes me eligible for the new federally funded unemployment benefits. Thank you.

Hey there, @doaldkidd.

I hope everything turns out ok with your testing. My thoughts are with you.

To clarify, are you an independent contractor or listed as an employee for a business? Typically 1099s are only released to independent contractors, whereas an employee would receive a W2. You can see the difference between W2 employee and 100 contactors for more details.

Additionally, you can see a Payroll Summary by Employee Report to gather the details on gross pay, total hours worked, total taxes withheld, and employer taxes and contributions. I've included the steps below to access this report.

1. Open the Reports menu.

2. In the search box, type Employee and choose Payroll Summary by Employee.

3. In the Employee drop-down menu, pick your name. Include the Hour and Rate, then click Run Report.

4. Then you'll see all the information needed listed in the report.

I'm also including a couple of handy articles to further explain 1099s in QuickBooks Online.

Please let me know if you have further questions or concerns. I'll be here for you every step of the way. Wishing you the best. Take care!

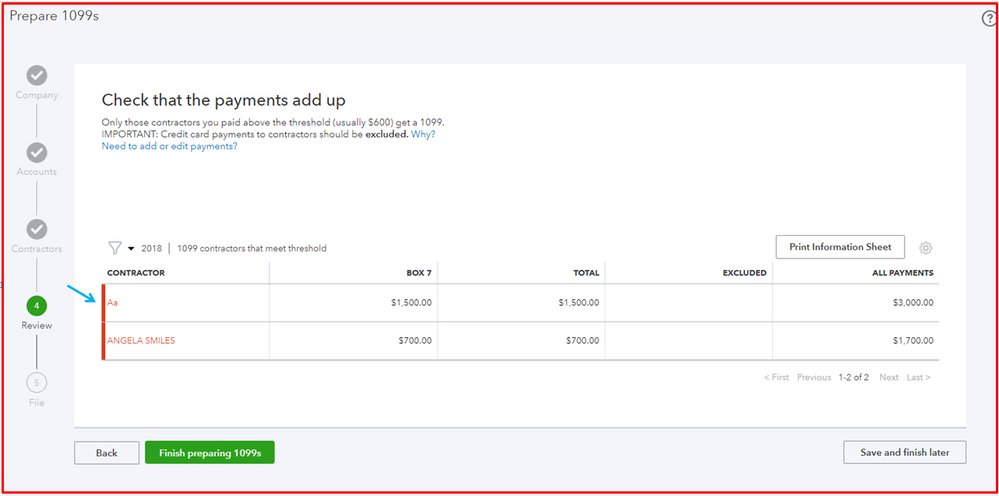

QB Online prepare 1099's. Got a list of 1099 vendors for 2020 but there is no amount for each vendor

QB Online - When will there be amounts for each vendor for 2020 1099's?

Hello there, PollyH.

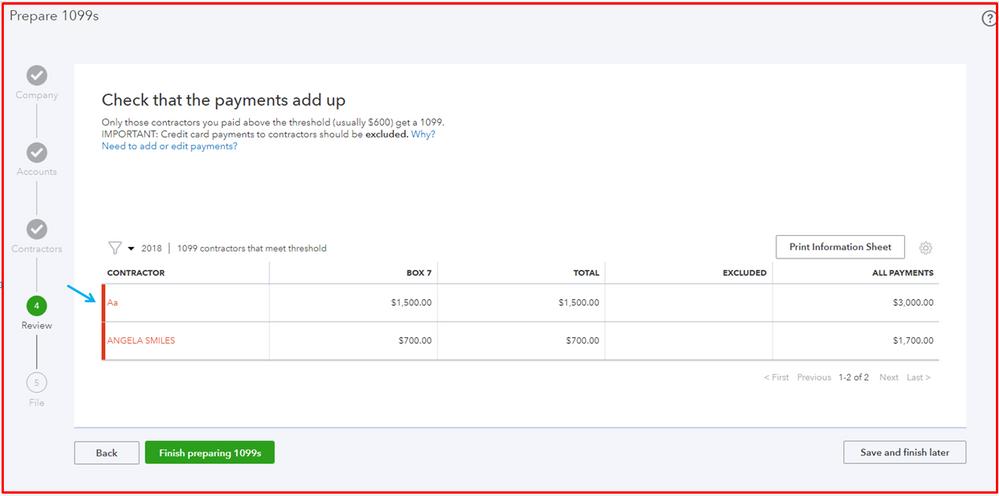

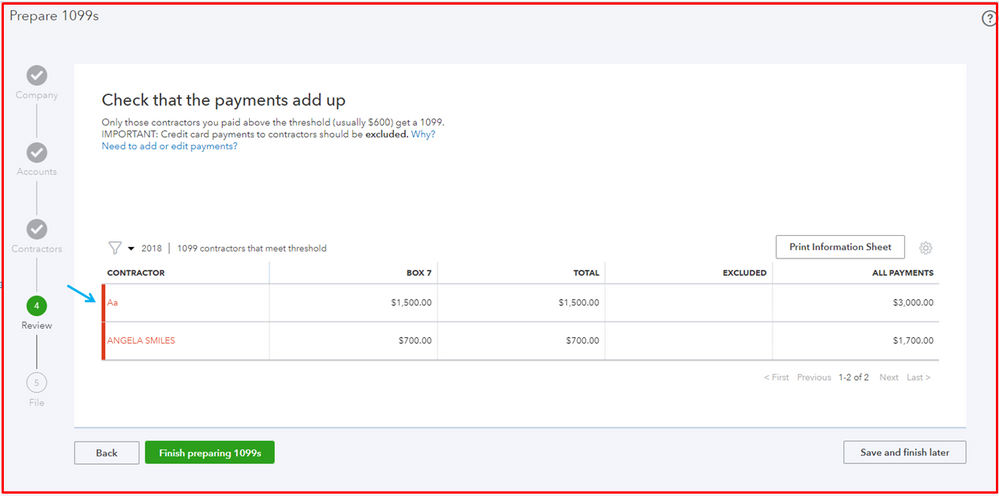

We can go ahead and check the account mapping for vendor payments in the 1099 Wizard. Also, let's ensure that transactions are named to contractors too. Let me walk you through:

Also, you can check the troubleshooting for 1099s. Also, you may want to check out this article to know more about preparing and filing 1099s: Prepare and file Federal 1099s using QuickBooks Online.

If you have other questions or need further help with 1099 in QuickBooks Online, please let me know by commenting below. I'll be around to help you. Take care and stay safe.

When I get to "review your contractors' info I get a list of 1099 vendors with Name, address, tax ID email, action. But there is no amount for each of the vendors. I know there are some who are over 600.

Thank you,

Polly Hoffman

It's nice to see you here in the Community, PollyH.

When preparing 1009s, make sure that whatever expense account is on those contractor's checks, you have that same expense account mapped to Box 7 on the 1099 setup screen.

Here's how:

To know more about this process, here's an article for your reference: Create and file 1099s using QuickBooks Online. On the same link, you'll find the steps on how to E-file your 1099s as well as a guide on how to check the filing status.

If you need to file both the 1099-NEC and the 1099-MISC, you'll need to create a new expense account and transfer all the expenses for that Contractor from the old expense account to the new one in the purpose of mapping in 1099 NEC. This write-up will provide you more details about this: How to modify your chart of accounts for your 1099-MISC and 1099-NEC filing.

Please let me know how it goes or if you ran into a different situation by leaving a reply below. I'm here to keep helping. Have a great rest of your day!

What if there is no 1099 from the drop down menu?

Let me provide the steps so you can see 1099 from the drop-down menu you're referring to, bettyjo2.

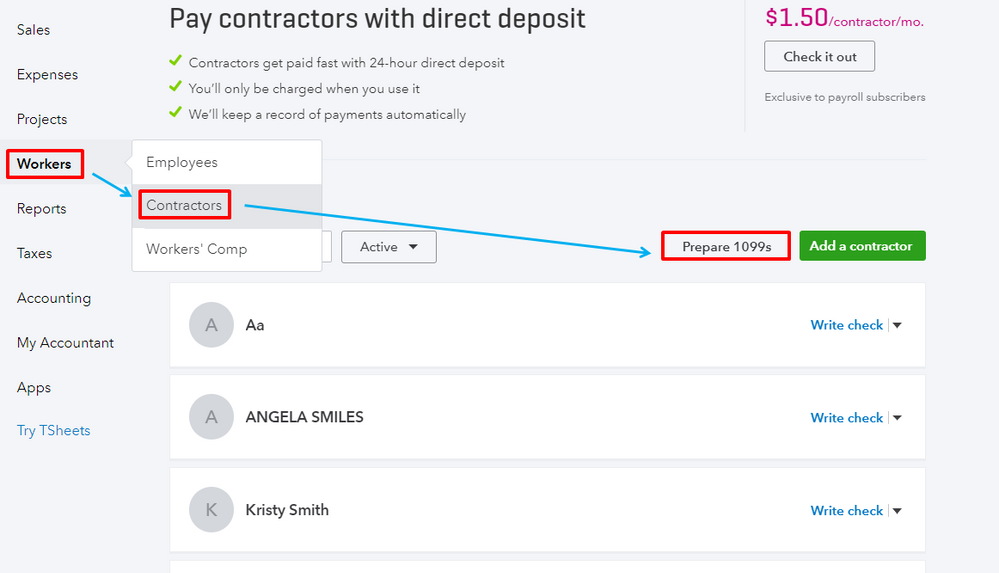

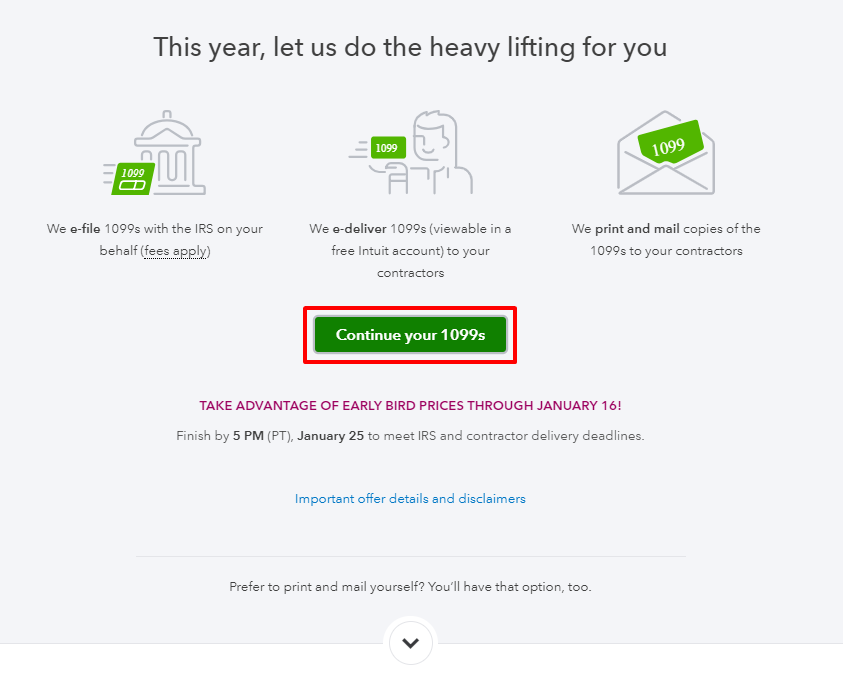

In QuickBooks Online, you simply click the Prepare 1099s button when processing the form. You can follow the steps provided by my colleague on how to generate 1099s for your vendors.

If you're using QuickBooks Desktop where you can see the drop-down menu for 1099, make sure to create a backup copy of your company file.

During the backup process, you need to select Yes when asks if you want to print or file 1099s. If you say no, the system will ask you to create a backup again.

After running the backup, here are the steps on how to generate the form:

You might also want to check out these articles to know more about the newly revised form:

Please let me know if there's anything else you need in QuickBooks. I'll be around whenever you need help.

We have far too many vendors to go through the list and check each box. There has to be a better way!!! I am so extremely disappointed with QuickBooks Online I could just scream. The desktop version was soooo much better. Why change what isn't broken?

This is rediculous! We should be able to click a button to get the report! Not weed out all the other venders. This literally takes too long to do! Just give us the option to do a date range in the 1099 section that we can optionally print! Please! I absolutely hate this version of QB simply because of this very tiny thing. Had I known this was missing I would have looked much harder for different options before going with QB. If the price keeps going up, I just may have to do that anyhow.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here