Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Good morning, following issues talking through the help chat, I am writing for an issue concerning the chart of accounts import.

I am currently subscribed to Quickbooks online for two companies I manage.

Pursuant to an acquisition I must now use my parent company’s CoA for reporting purposes.

I have to bulk import the CoA as I have approximately 4000 accounts in the new CoA, thus manual input is not an option (although I know I may have to manually input balance sheet opening amounts).

I have formatted the new CoA in excel to what I presume should be Quickbook format and have it ready to be imported.

Once I bulk import, the old CoA should be erased so that it won’t appear on any reports. However I don’t want to lose my historical data just in case I need something in the future.

Also, before adopting the new COA I have to be absolutely sure that the format I have ready in excel will work.

How do you think I can achieve these results?

What could be the correct workflow to achieve my results (besides from opening two new accounts and closing the old ones)?

1. checking my new CoA will be accepted by Quickbooks before bulk importing

2. bulk importing new CoA over the old CoA so that no old account will crop up in my subsequent reports

3. not losing old data (accounts+account values) in case I may need it for any future issue

Let me know if someone can help me out

Kind regards

Paolo

Solved! Go to Solution.

Thanks for coming back to the Community, 123145827583957.

I appreciate adding more details about your concern, especially the screenshot. It gives me a clearer view of how the chart of accounts is set up in your company.

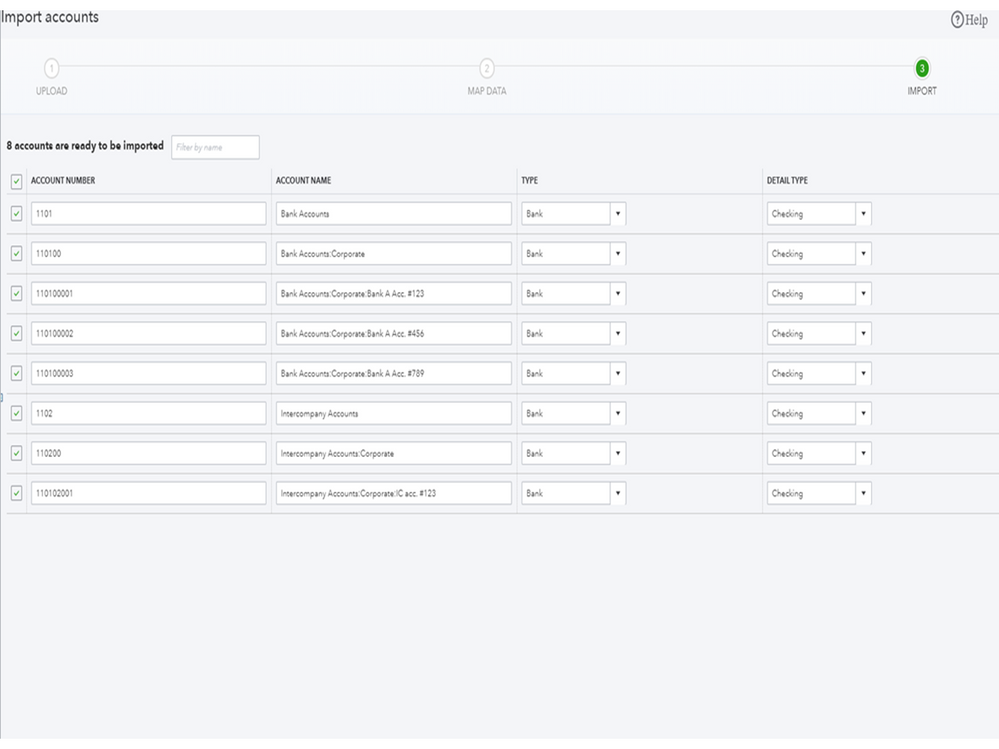

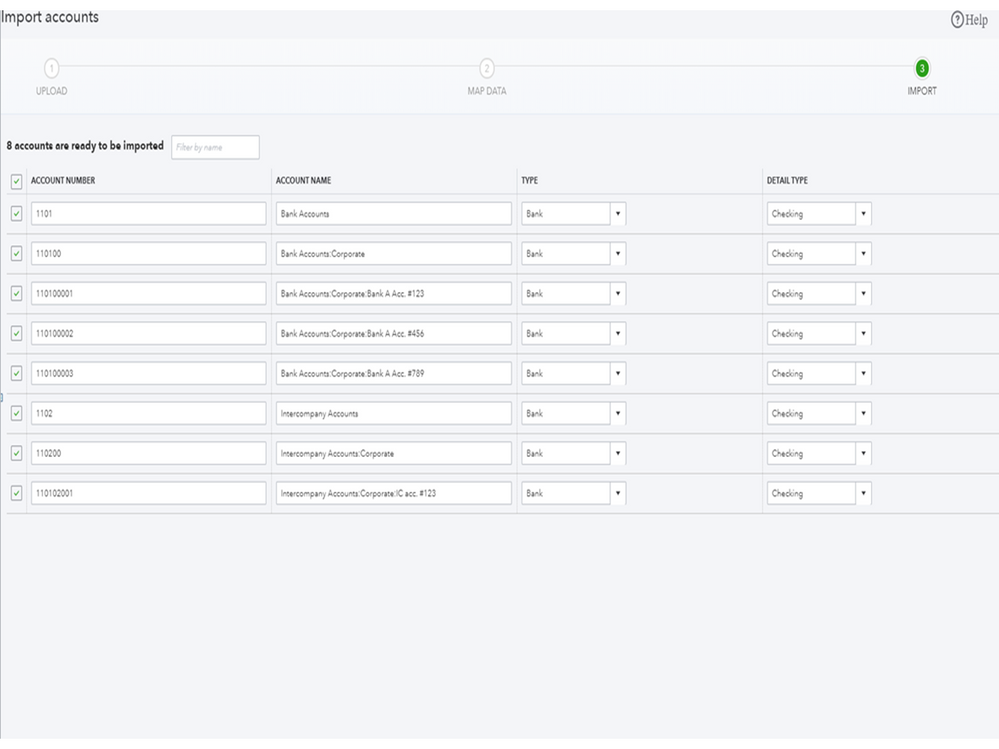

Yes, the chart of account format created should work. I imported it, and the new information is already in my register.

Here’s how:

In QBO, you’ll have to manually inactive each account. Also, you can only import the Account number, Account Name, Type, and Detail Type except for the opening balance. That's why you'll have to enter the amounts on the register.

To seamlessly transfer your chart account to the new company, I recommend following the suggestion shared by @MadelynC. For more insights into the process, check out the Import your chart of accounts to QuickBooks Online guide.

I’m also adding a link to help you efficiently organize your transactions. These resources outline the complete steps on how to inactivate the online banking feature and instructions to classify downloaded entries.

Please let me know if I can be of further assistance. I’ll jump right back in to help and make sure you’re taken care of. Enjoy the rest of the day.

Hello @Paolo_S,

I appreciate you for providing detailed information and screenshots. Let me help you fix the issue with the sub-accounts.

Missing information from the imported sub-accounts can be an issue related to the web pages. We can use a private browser to open your account and see if they show up correctly.

It doesn't use the cache, which stores data and creates browser-related issues. Use these keyboard shortcuts depending on the browser you're using:

If you can view the accounts in the drop-down menu, let's switch back to the regular browser and clear its cache. It helps to restore the default setup of the browser.

In case private browsing doesn't work, use other supported web engine to get the best and most secure experience with the program.

If all else fails, I suggest using the Get a callback or Start a chat feature from the Help menu. One of our QuickBooks Support Team can securely access your account and resolve your issues timely.

Here's how:

For more information, as well as how to add opening balances for accounts, I recommend the following article: Import your chart of accounts to QuickBooks Online.

You're always welcome to post any questions you have in this space related to your imported accounts. I'll be happy to help you some more. Have a good day.

Look no further, I’m here to ensure you can achieve them all, @Paolo.

I’d be glad to share information on how to replace old accounts in QuickBooks Online.

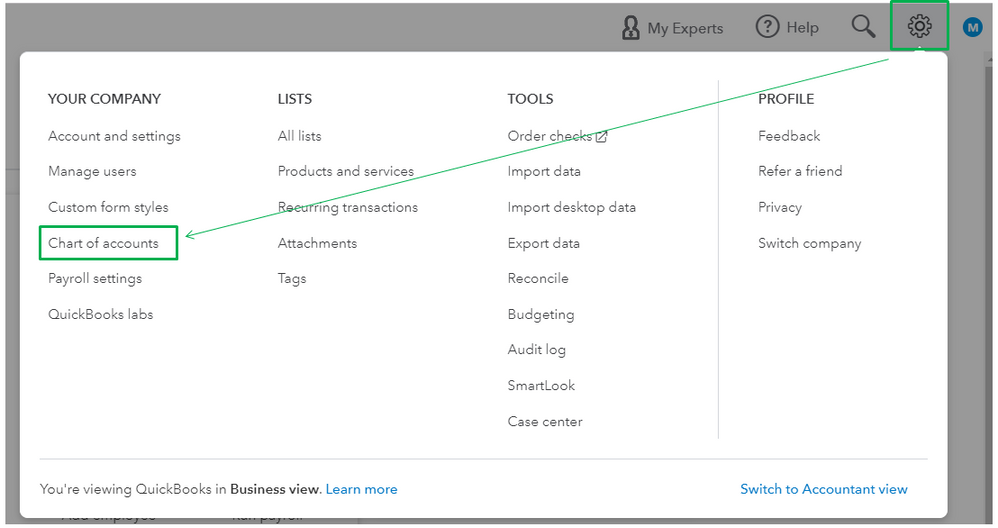

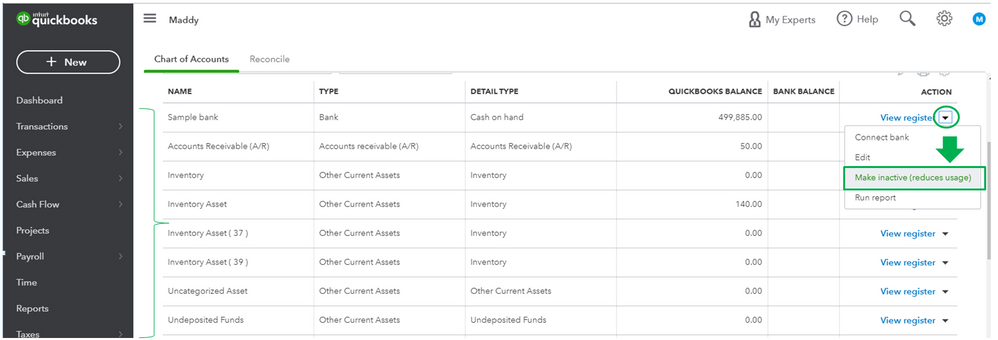

QuickBooks uses your Chart of accounts to organize all your accounting. If you want to remove the old ones, you can make them inactive. This basically deletes it. QuickBooks hides inactive accounts from lists and menus but keeps past transactions on your reports.

Here’s how:

Here’s an article on how to delete and restore an account for more detailed information. This provides directions to access the accounts if you need them for any future concerns.

When it comes to importing accounts, you’ll want to format it using a spreadsheet in Excel, Google Sheets, or a CSV file so you can import it to QuickBooks. Let me show you the steps:

I have here a sample spreadsheet for your reference. You can also use this article for complete steps to successfully import them.

By following these instructions, you can have your new Chart of Accounts without losing the old data. Let me know if you have questions or account concerns. I’ll be here to help you further. Take care.

Madlyn, thank you so much for your help it was greatly appreciated.

I was wondering whether I could follow up and ask you some more details.

a) I am attaching a sample of the new CoA and was wondering if in your opinion it is going to work (the issue is with the numbering, but having used sub-accounts as you suggested, I believe it should).

b) is there a way to "bulk" make the old CoA accounts inactive or do I have to manually select "make inactive" through the gear menu for each old account ?

c) is there a way to add opening balances to the new CoA accounts via Excel or do I have to edit each new account through the gear icon?

d) in order to get the old accounts out of the way I was thinking of exporting the old CoA (ca. 400 accounts), numbering each account with a very long number (that way they will not overlap with the new CoA numbering), reimporting the old CoA and only then making the Old Accounts inactive, does this make sense ?

Thanks again for your input, I can't express how helpful this is!

Regards

Paolo

Thanks for coming back to the Community, 123145827583957.

I appreciate adding more details about your concern, especially the screenshot. It gives me a clearer view of how the chart of accounts is set up in your company.

Yes, the chart of account format created should work. I imported it, and the new information is already in my register.

Here’s how:

In QBO, you’ll have to manually inactive each account. Also, you can only import the Account number, Account Name, Type, and Detail Type except for the opening balance. That's why you'll have to enter the amounts on the register.

To seamlessly transfer your chart account to the new company, I recommend following the suggestion shared by @MadelynC. For more insights into the process, check out the Import your chart of accounts to QuickBooks Online guide.

I’m also adding a link to help you efficiently organize your transactions. These resources outline the complete steps on how to inactivate the online banking feature and instructions to classify downloaded entries.

Please let me know if I can be of further assistance. I’ll jump right back in to help and make sure you’re taken care of. Enjoy the rest of the day.

Good morning,

I've begun importing my new Chart of Accounts via Excel and it works likes a breeze.

However, I've stumbled across an issue I am hoping you can help me with; I've attached screen shots to help with my explanation.

Once I've imported the accounts and sub accounts via excel (see "chart of accounts organization" section of attached document for the CoA account/sub account organisation), my CoA looks exactly like it should with parent and sub accounts perfectly aligned (see "Chart of accounts" section of attached document).

Next, I need to give my accounts an opening balance, so I go view register-->edit account and I access the edit mask (see "Account Edit" section of attached document).

When the account I need to edit is a sub account, I was expecting the corresponding parent to be already included in the "parent account" box, whereas it is empty and highlighted in red (again see "Account Edit" section of attached document) which means I have to manually enter the corresponding parent.

I have over 4.000 sub accounts to enter, and this could really get messy, however it gets even worse when I cannot find the correct parent in the drop-down parent category list (see "sub account" section of attached document).

Obviously, the account edit mask will not let me save and exit without me having indicated the correct parent account so I am definitely stuck!

Let me give you an example:

Ultimate Parent: 1101 Bank Accounts

First Level Sub account of Parent: 110100: Corporate

Second Level Sub account of Parent: [removed]: Bank of America #5175

I was expecting to be able to assign "1101 Corporate" as the parent of "110100 Corporate" and "110100 Corporate" as the parent of "[removed]: Bank of America #5175", however I can't find these accounts as possible parents in the drop-down menu of the "parent account" in the account edit mask.

Is there some kind of option which has to be flagged, is it simply not doable or can you suggest a workaround?

Thanks in advance

Paolo

Hello @Paolo_S,

I appreciate you for providing detailed information and screenshots. Let me help you fix the issue with the sub-accounts.

Missing information from the imported sub-accounts can be an issue related to the web pages. We can use a private browser to open your account and see if they show up correctly.

It doesn't use the cache, which stores data and creates browser-related issues. Use these keyboard shortcuts depending on the browser you're using:

If you can view the accounts in the drop-down menu, let's switch back to the regular browser and clear its cache. It helps to restore the default setup of the browser.

In case private browsing doesn't work, use other supported web engine to get the best and most secure experience with the program.

If all else fails, I suggest using the Get a callback or Start a chat feature from the Help menu. One of our QuickBooks Support Team can securely access your account and resolve your issues timely.

Here's how:

For more information, as well as how to add opening balances for accounts, I recommend the following article: Import your chart of accounts to QuickBooks Online.

You're always welcome to post any questions you have in this space related to your imported accounts. I'll be happy to help you some more. Have a good day.

Pursuant to yet another useful reply by the QB support team (kudos), I am going forward with the new Chart of Accounts set-up.

When setting beginning balances for the new accounts. I can't seem to enter my end of year values as beginning value for the following accounts, and was wondering why and how to go about doing so:

1. Fixed Assets

2. Accumulated Depreciation

3. Retained Earnings

Thanks in advance!

Paolo

Joining the thread to help with your recent question about entering opening balances, 123145827583957.

Can you tell us what happens when you tried to enter amount or the balances? You can actually create a journal entry to record the opening balances for the accounts that you mentioned.

Here's how:

Let me share these articles with you that can serve as your guide:

Don't hesitate to add another reply below if you have follow-up questions.

Hi JenoP, thanks for your reply.

Basically all accounts allow me to enter an opening balance, except: fixed assets, depreciation and retained earnings (and obviously linked bank accounts, which work with the online feed) and was wondering if this was normal and if these accounts were running correctly.

No problem in making a journal entry, I just found it bizarre that only these accounts work differently and was thinking maybe I'd set them up wrong

Thanks

Paolo

Hello there, @Paolo_S.

Importing the data within the Accounts is unavailable. Although, you can manually setup the Opening balance or the Original Cost of the account after you've imported them. Or you can check out our integrated application that will help you simplify the process. I'd be glad to show you the steps.

Here's how:

Once done, create a Journal Entry transaction to track those previous data linked with the bank accounts.

If you're still not able to enter the opening balance even after performing the steps that we've shared in this thread. I'd recommend contacting our Customer Care Team. They have the tools to perform screen share and help you with the process, you may also want to let your accountant join you when speaking to out representative to ensure your books are setup correctly.

Also, you may consider checking this page that contains integrated applications for importing transactions: QuickBooks Apps Center.

I've included this article for your future task when your ready to assess your business financials: Reconcile an account in QuickBooks Online.

You're always welcome to tag my name in the comment section below if you have other questions. I'd be happy to lend a helping hand. Take care.

Thanks for your kind reply.

The problem persists because when I do not have the possibility of entering a beginning balance (no beginning balance filed in edit mask) when I select a fixed asset account. I added a screenshot of what I get when I enter the "edit" mask.

This happens to all fixed asset "Type" accounts when anything except for "accumulated....." is selected in the "Detail Type" (i.e. land, buildings, vehicles, etc.)

This also happens with the retained earnings account (I am starting new in Quickbooks as from 1.1.21 but obviously have an initial retained earnings amount to enter spilling over from previous years): no initial balance field in the account edit mask.

Thanks

Paolo

Thanks for providing a screenshot, 123145827583957. I want to make sure this is taken care of.

Since the problem persists, I recommend reaching out to our Customer Care Support team. That way, they can take a look into your account in a private one-on-one setting and determine the reason as to what's preventing you from entering a beginning balance.

Here are the steps on how to reach out to us:

The Community is always here to help.

Good morning, pursuant a one-on-one session, my problem persists. I have two companies, two accounts, one Chart of Accounts which is the same for both companies. I have imported the same exact data for both companies, import was flawless, data is correctly formatted as per specs: company 1's CoA works perfectly, company 2's CoA does not.

Company 1: in account edit mask I see correct parent of subaccounts; parent account can be modified on the basis of drop-down list

Company 1: in account edit mask I cannot see correct parent of subaccounts (despite "subaccont" having been recognized as it has been automatically ticked); parent account cannot be modified as drop-down list is empty.

I have already emptied cache, history, etc.: a complete mystery

I need to get company 2's CoA running quickly.

Since Company 1 and Company 2 have the same CoA, product list, customers and vendors, I was thinking of "cloning" Company 1 QB Account and renaming it "Company 2". Can this be done ? If yes, how ?

Thanks in advance

Hi 123145827583957!

We're unable to clone a QuickBooks Online account. If you need a new account for "Company 2" with the same data from "Company 1", you'll need to set up a new account. Then, manually import the data from Company 1 to the new one.

Please note that we can only move lists such as vendors, customers, inventory, and chart of accounts to the new company. Check this link for the detailed steps: Create or add another company file to QuickBooks Online.

Leave a comment again if you need anything else. Take care!

Has this not yet been resolved? I have the same problem. I cannot adjust the beginning balance for Fixed Assets, Depreciation etc. This is quite annoying as I cannot really start using my QB without setting these balances first.

Thanks for joining this thread, Bart57. You got me here to help you with adjusting your beginning balance in QuickBooks Online.

To adjust the beginning balance for Fixed Assets and Depreciation, I would suggest creating a JE.

Also, I highly suggest consulting your accountant for guidance on which account receives the debit and credit side of the transaction. This is to ensure the accuracy of your books.

Please tag me in a comment if you have any other questions.

Hello, I am reviewing this thread and others because I need to simplify my CoA in QuickBooks Online. For the most part, I need to eliminate a number of subaccounts (such as A/R & A/P subaccounts and some subaccounts of expense accounts) that represent an unnecessary level of detail in the CoA. And besides, the detail is instead recorded through the use of classes and subclasses.

I do need the parent accounts to retain all the data, and very importantly, I need to maintain the correct class reporting for each transaction. (We are a nonprofit, and I use the classes and subclasses to correlate each transaction to a specific line-item in our grant budgets. It works like a charm when reporting time rolls around.)

You said that "QuickBooks hides inactive accounts from lists and menus but keeps past transactions on your reports." This is good news, and it sounds to me like I can simply inactivate the unneeded subaccounts, and the data in those inactive accounts will still show up correctly in reports in the still-active parent accounts. Is this true?

And equally importantly, will reports based on classes, such as Statement of Activity by Class, continue to show the data in the correct classes or subclasses?

Thank you for your assistance.

Rick

Hi Rick!

I’m glad you found this thread and happy to know that the Class tracking feature works best for your records! I'll share insights about inactivating accounts and their effects on your reports, so you will be guided accordingly.

Inactivating sub-accounts you don’t need is the best way to tidy up your Chart of Accounts. And yes, it’s true that their transactions or the amounts they accrue will still show up in your reports, but not in the parent, but in the accounts themselves.

The accumulated expenses for Advertising sub still show up in the P&L.

One more thing. Before you inactivate a balance sheet account, make sure it has no balance because QuickBooks will make an adjusting entry if you inactivate it with a balance. Therefore, if you still have open bills that accumulate in sub-A/Ps, you'll want to manage them first. Check out this article for more details: Make an account inactive on your chart of accounts in QuickBooks Online.

This information should help you manage your books and transactions. Just let me know if you need more assistance. I'll be around to lend a hand.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here